Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

This is a formal IRS document that outlines the details of a property foreclosure.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

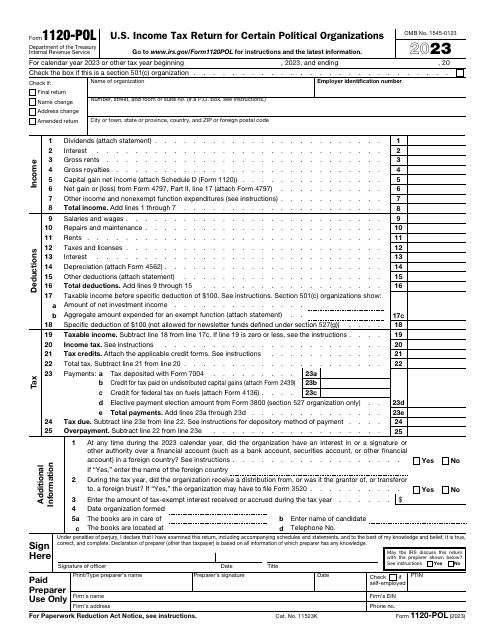

Use this form to inform the Internal Revenue Service (IRS) about the taxable income of your political organization, as well as about your tax liability according to Section 527.

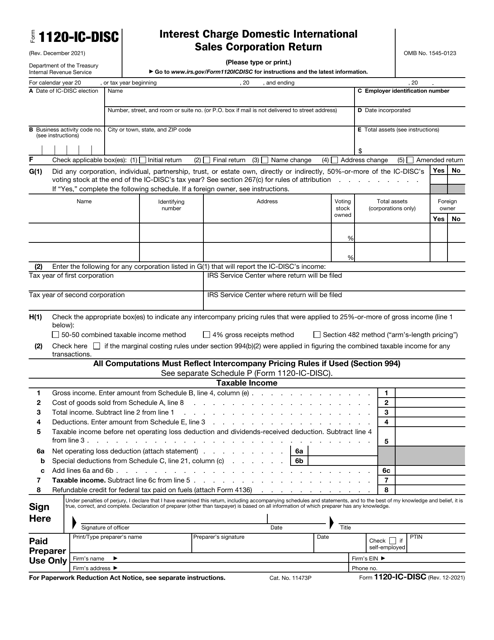

This form is also called the IC-DISC tax return. It is a form used by corporations as an information return reported to the Internal Revenue Service (IRS). A list of available Schedules is presented in the form description.

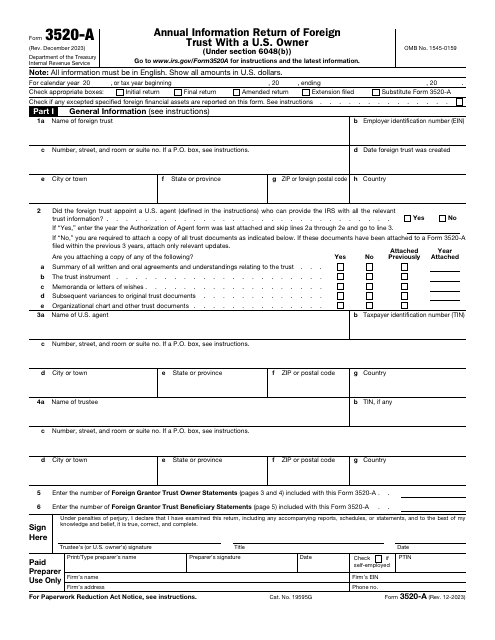

This document is submitted to the Internal Revenue Service (IRS) annually by foreign trusts with a U.S. owner to inform the IRS about the trust, its American beneficiaries, and any U.S. trust owner.

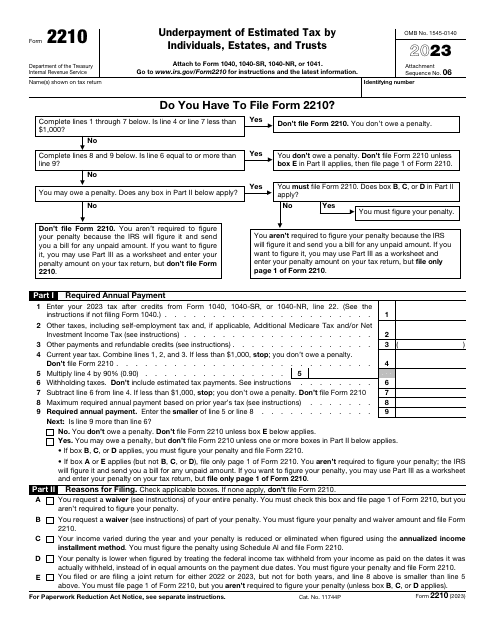

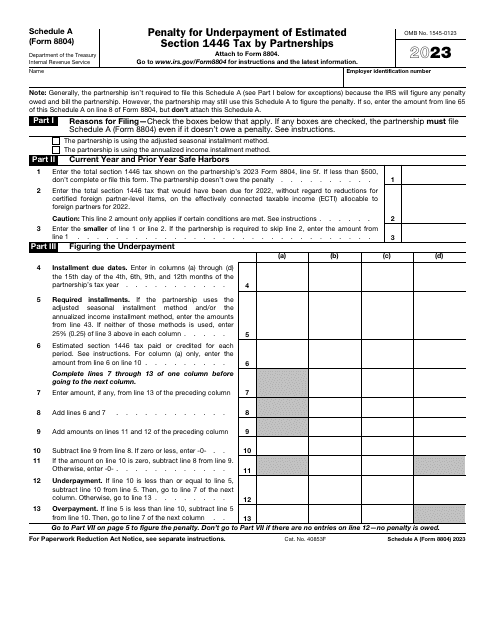

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

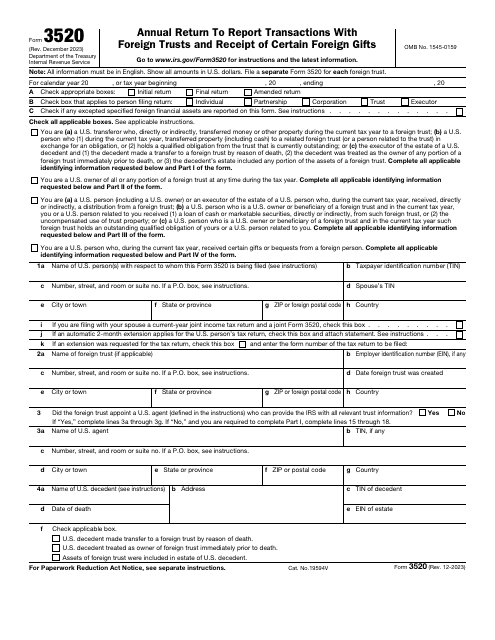

This form is a formal statement used by people and entities obliged to tell the fiscal authorities about the transactions they have had with foreign trusts throughout the year.

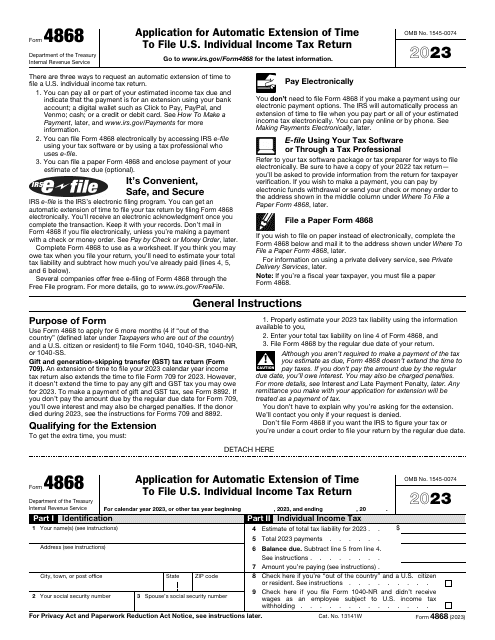

This is an IRS form that needs to be filled out to request an automatic extension to submit income tax return forms.

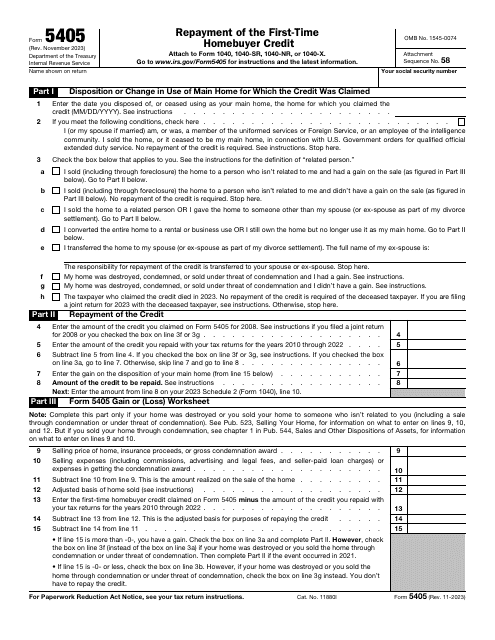

This is a fiscal instrument used by taxpayers who are responsible for computing and repaying the credit they used to purchase residential property in the past.

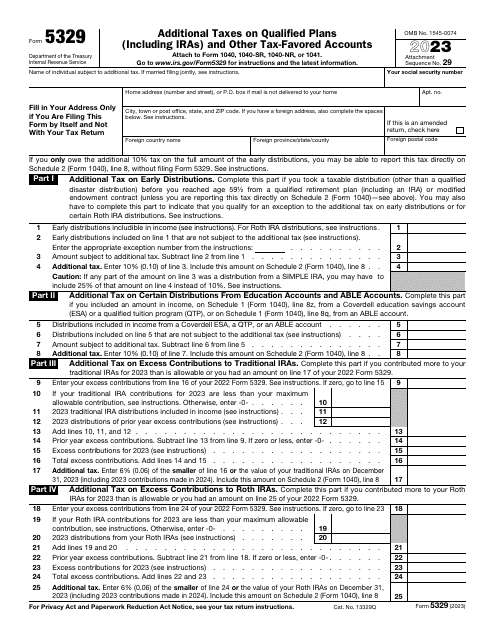

This is a fiscal document individual taxpayers need to prepare and file to demonstrate whether they need to pay the government penalties on education savings plans or retirement plans as well as a percentage of distributions they got throughout the tax year.

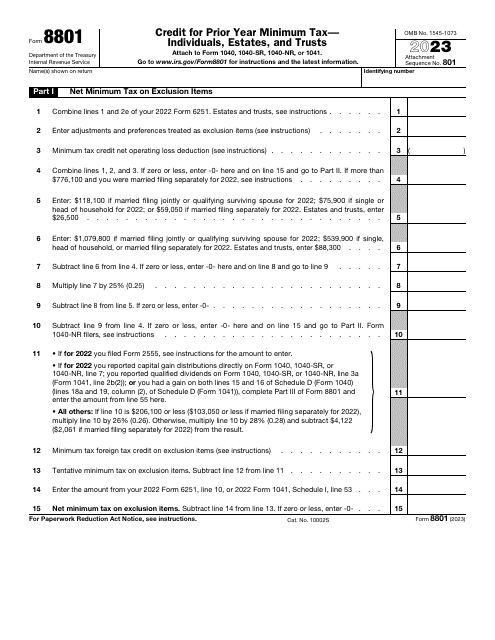

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

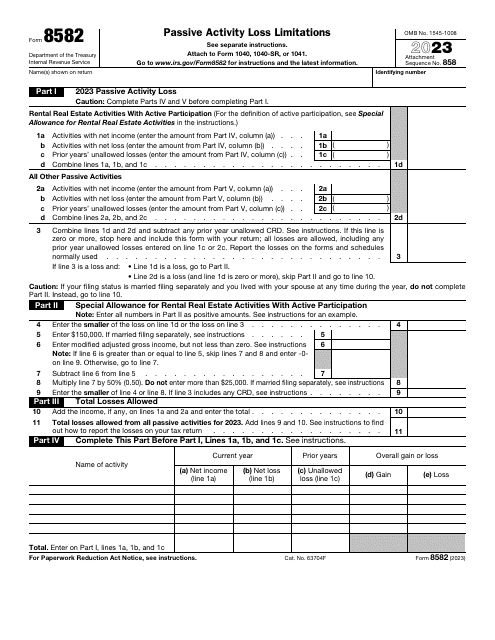

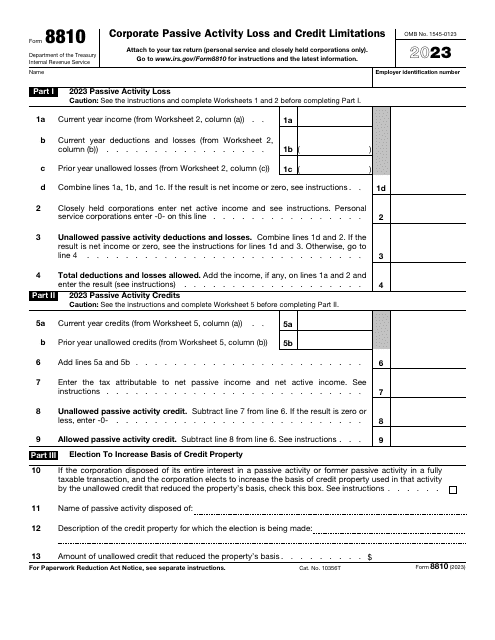

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

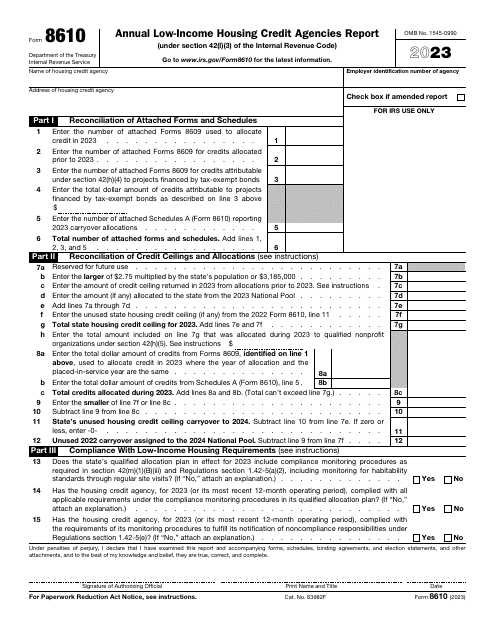

This is a formal IRS statement a housing credit agency is supposed to complete to inform the fiscal authorities about the total amount of housing credits their entity has allocated during the twelve months outlined in the form.