Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

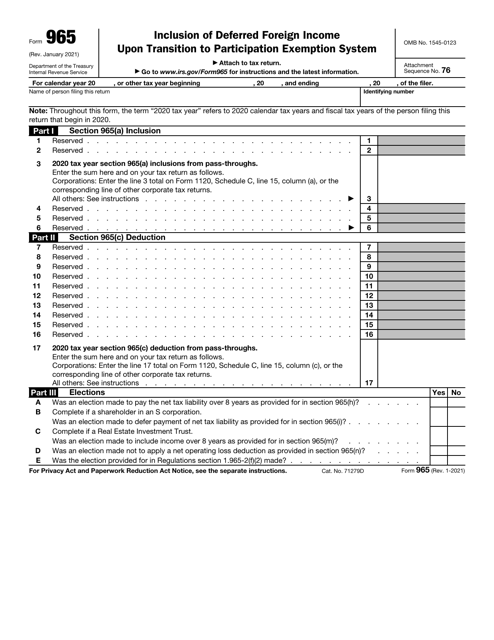

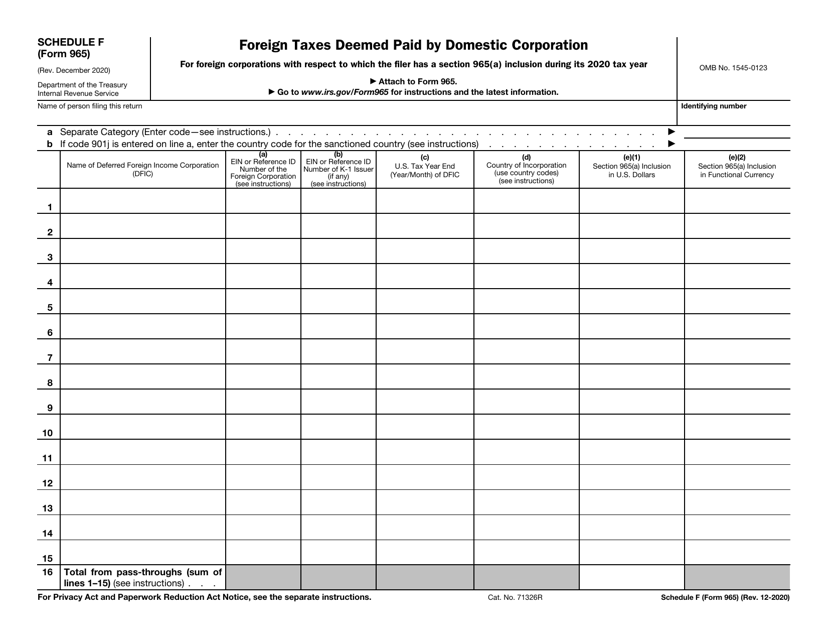

Documents:

4644

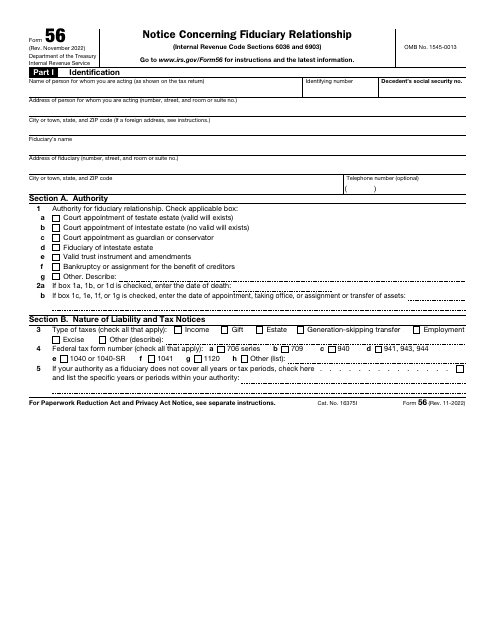

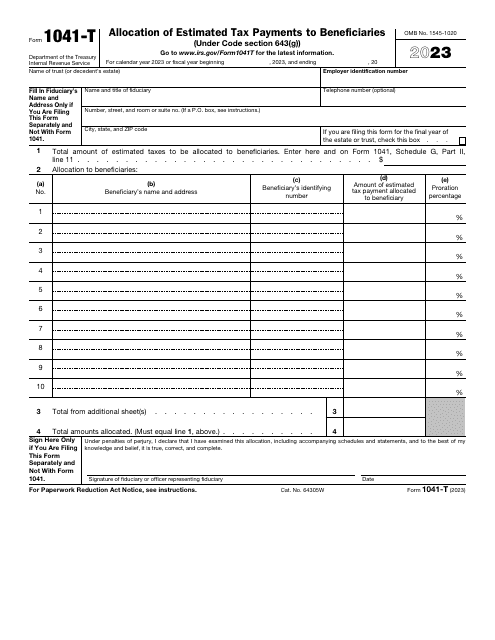

This is a fiscal statement prepared by a person or organization to tell the government about the fiduciary arrangement that was formed with them serving as a fiduciary.

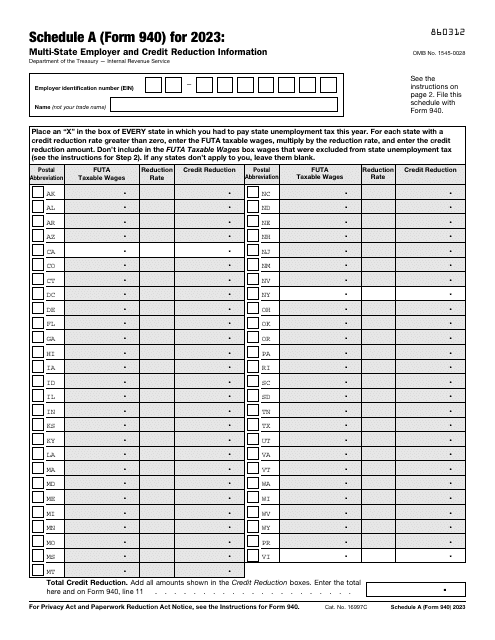

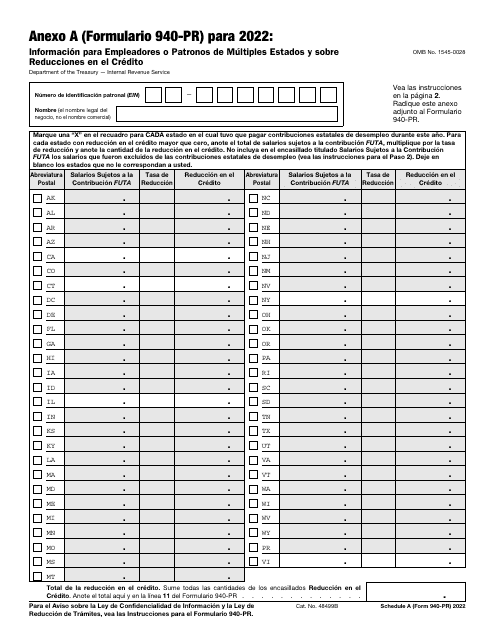

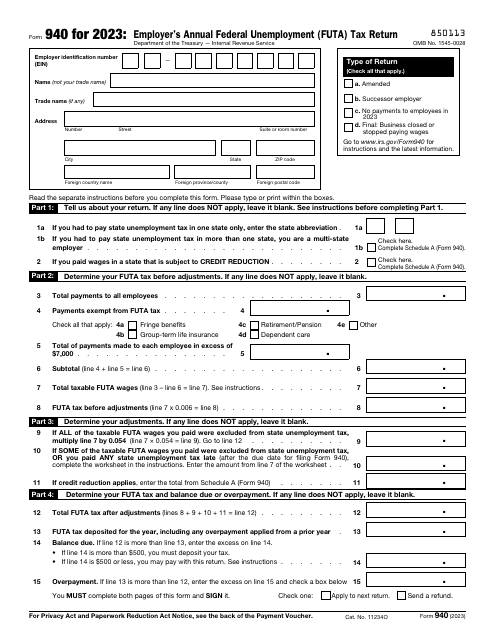

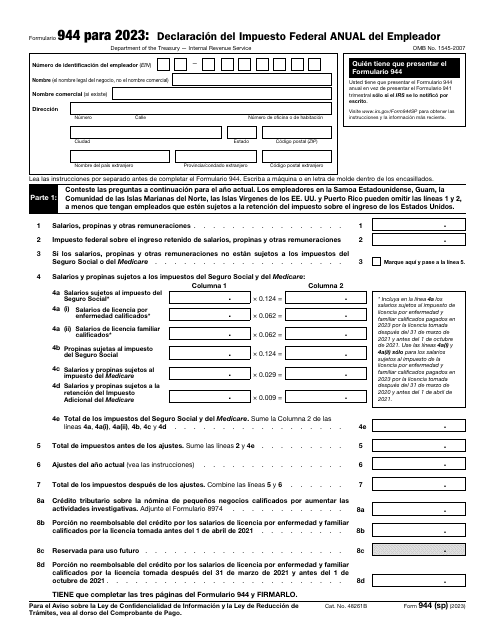

This is a supplementary form used by a taxpayer to figure out their annual federal unemployment tax.

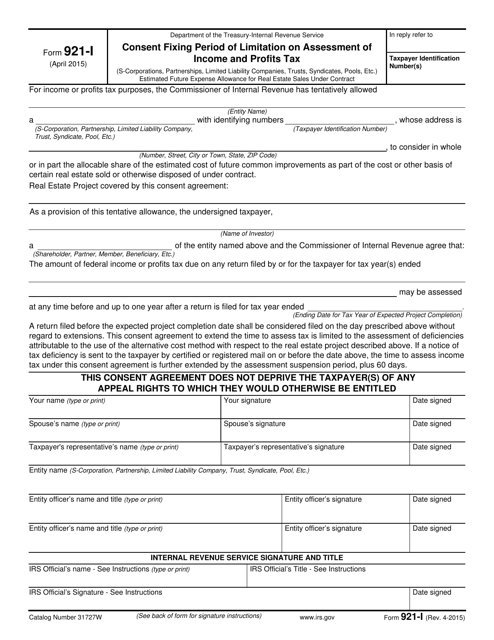

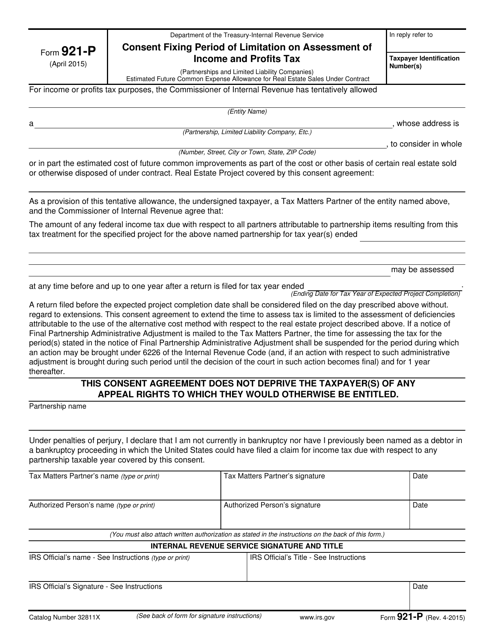

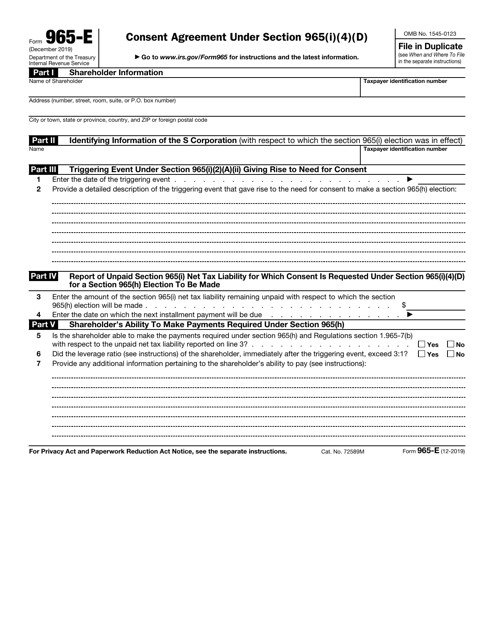

This form is used for entering into a consent agreement under Section 965(I)(4)(D) of the Internal Revenue Code.

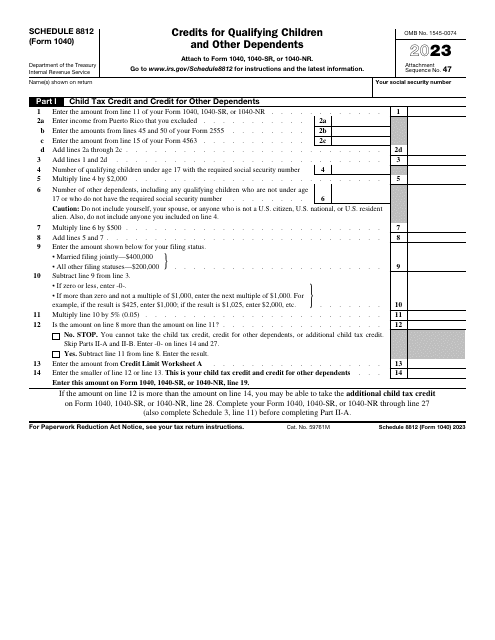

This is a fiscal statement created to let taxpayers with children make the most of the tax benefits they qualify for via extra tax credit.

This is a formal instrument prepared and filed by an organization that wants the fiscal authorities to confirm its exemption from the obligation to pay income tax on a federal level.

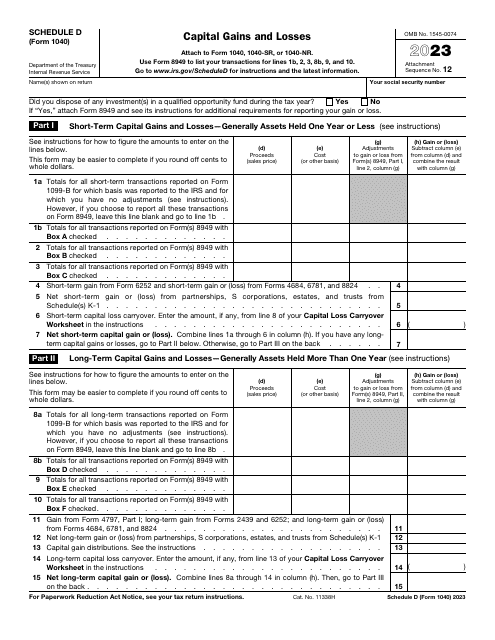

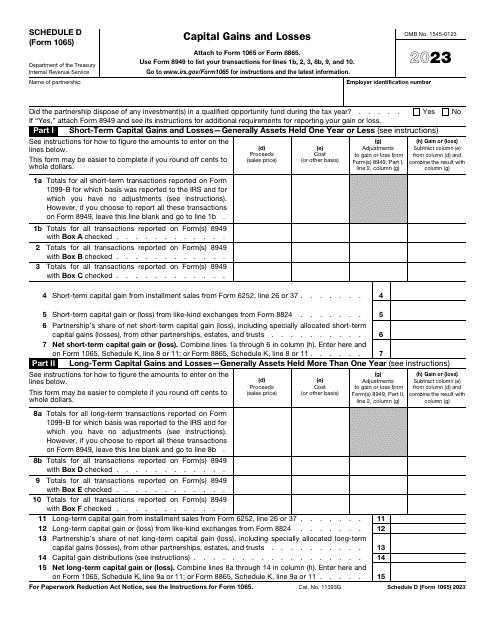

This is a supplementary document taxpayers have to attach to their tax return to outline capital gains and losses that were the result of property sales.

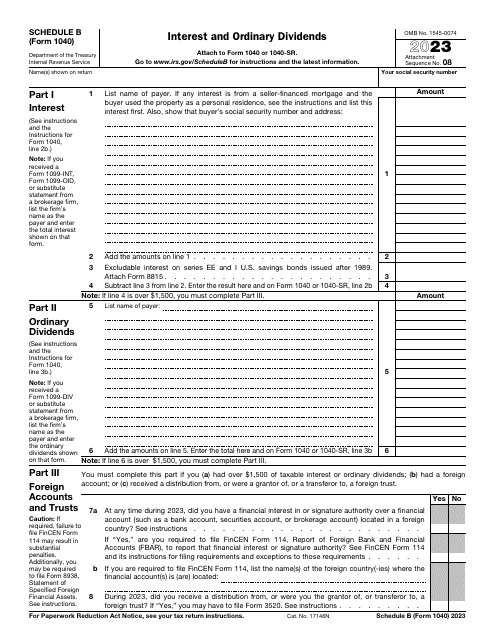

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

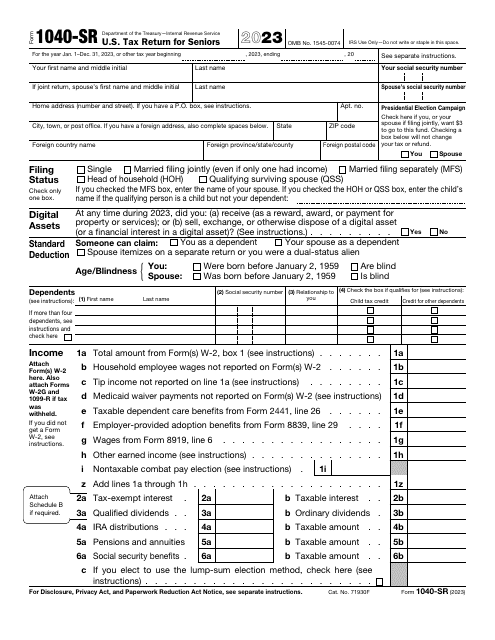

The purpose of this IRS application is to make the process of filing a federal income tax return easier for seniors - the document features larger print, but contains the standard deduction charts.

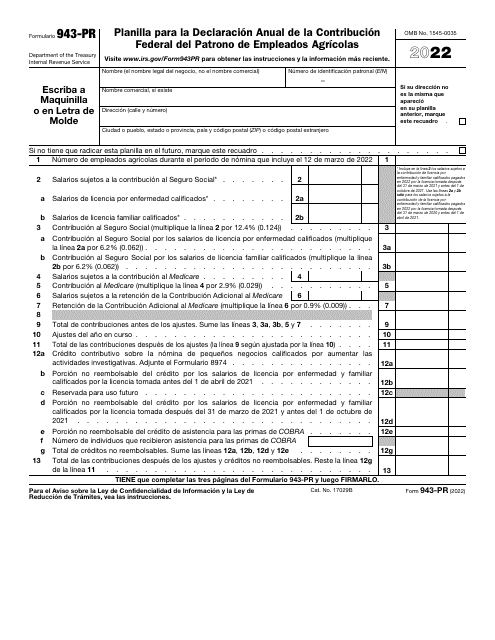

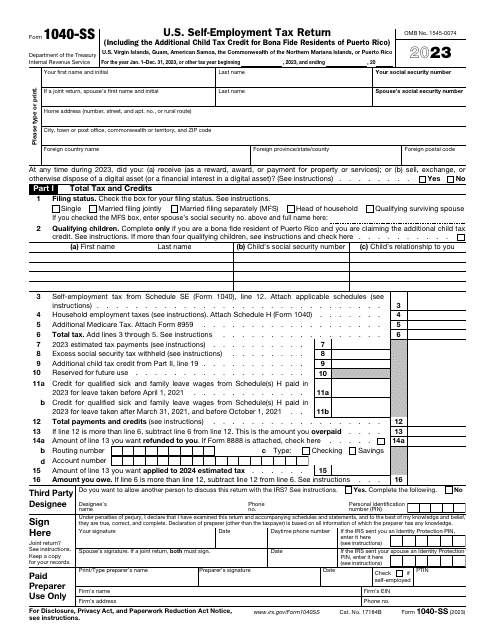

Use this document only if you are a resident of the United States Virgin Islands (USVI), Commonwealth of Puerto Rico, Commonwealth of the Northern Mariana Islands (CNMI), Guam, and American Samoa and wish to report your self-employment net earnings to the United States.