Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

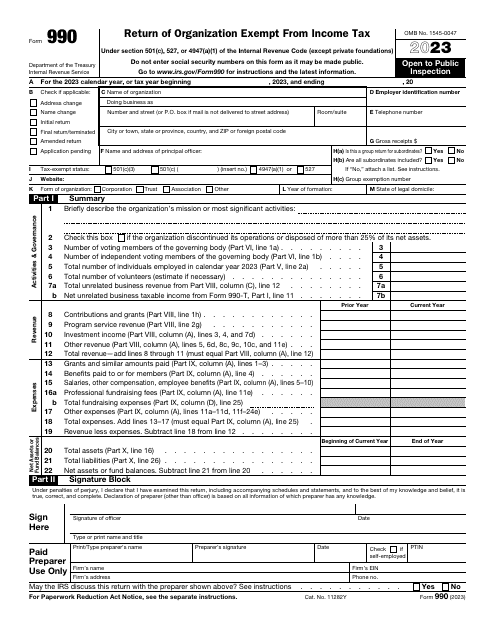

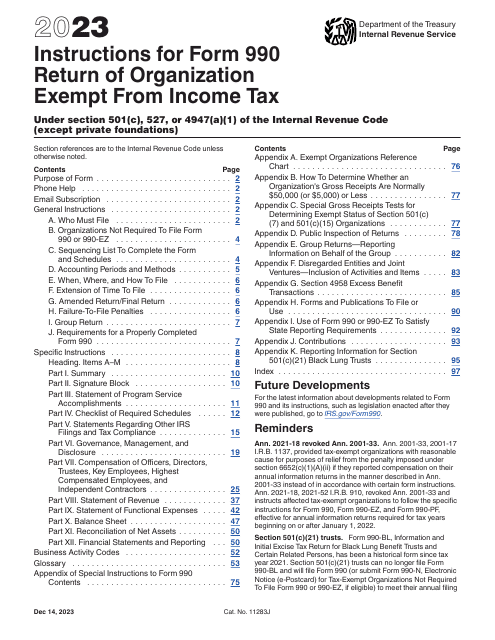

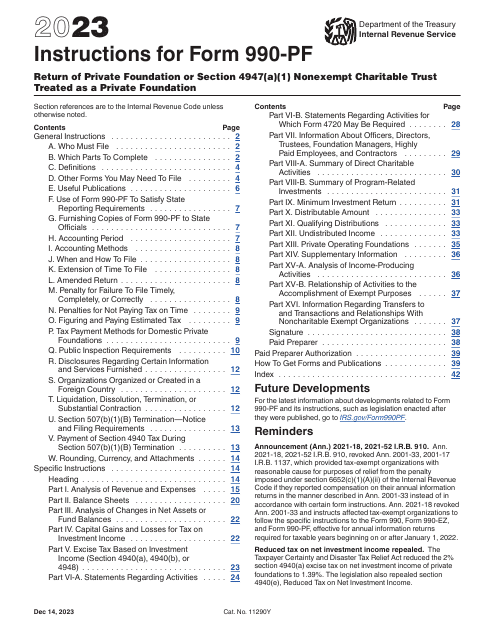

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

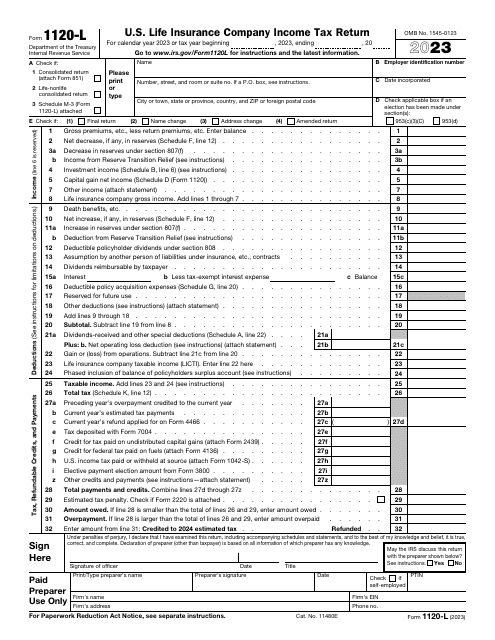

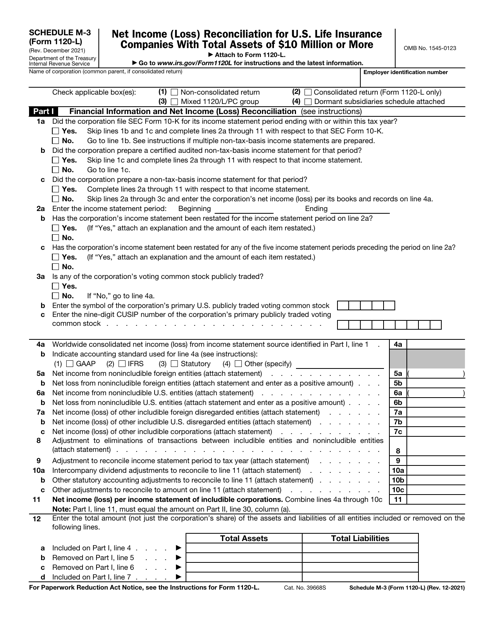

File this form if you are the owner of a domestic life insurance company to report to the IRS on your income, deductions, and credits for the tax year, and to figure your income tax liability.

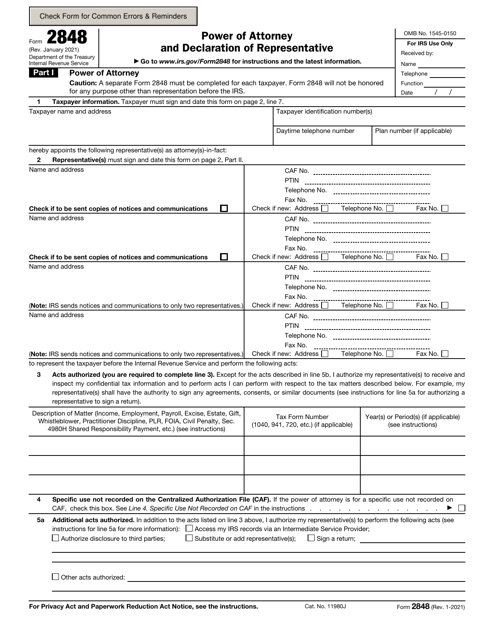

This is a formal statement used by a taxpayer to entrust their representative to perform specific actions in their name.

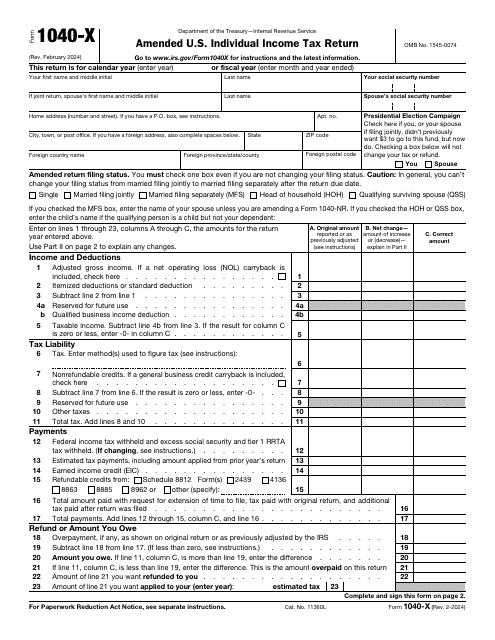

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

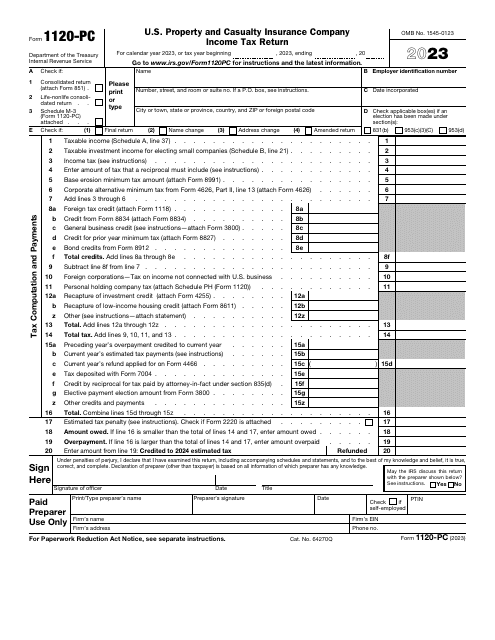

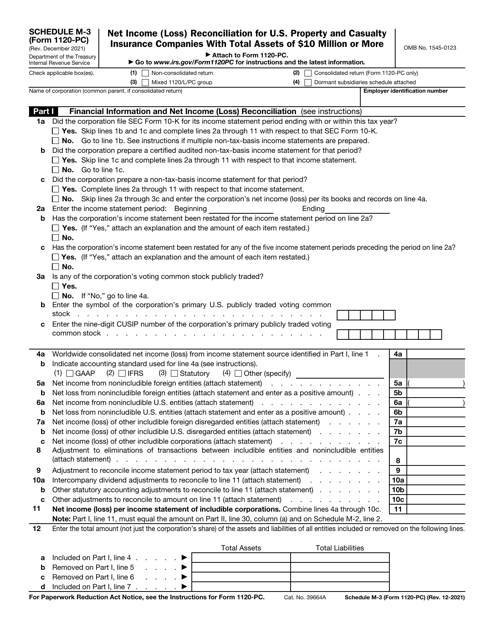

This form is filed by non-life insurance companies wishing to inform the Internal Revenue Service (IRS) of their income, deductions, and credits, as well as to figure their income tax liability.

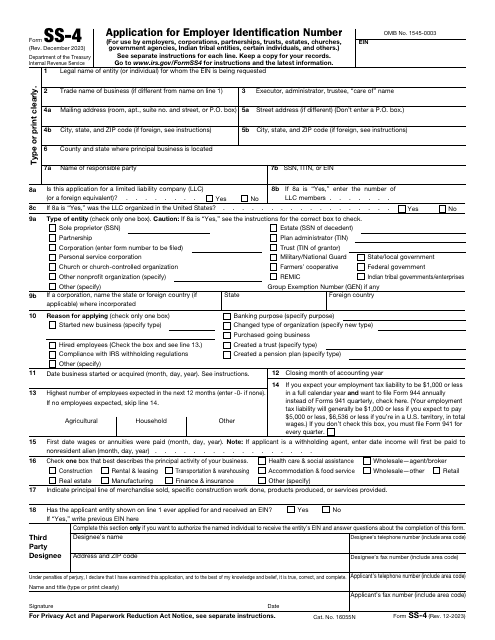

This is a fiscal document used by taxpayers - from sole proprietors to corporations - to ask tax organizations for a unique identification number.

This document provides information about the Taxpayer Advocate Service, a resource available to help individuals with their tax-related issues.

This document provides information about the Taxpayer Advocate Service, a resource available to help taxpayers with their tax-related issues and concerns.

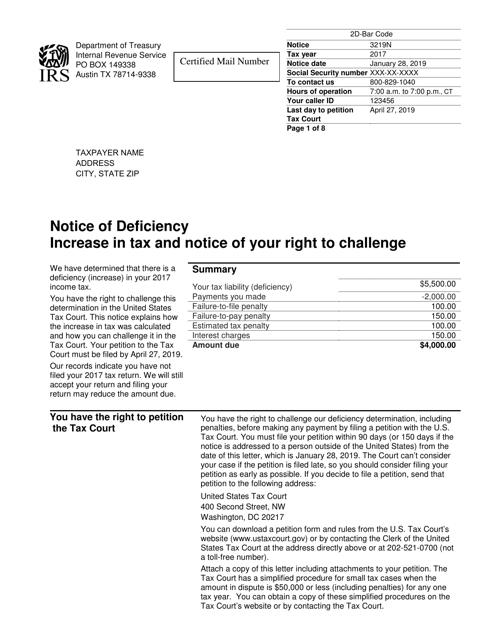

This document is a Notice of Deficiency from the Internal Revenue Service (IRS). It is sent to taxpayers who have underreported their income or have other tax liabilities. The notice provides information about the proposed changes to the tax return and the options available to the taxpayer to respond.

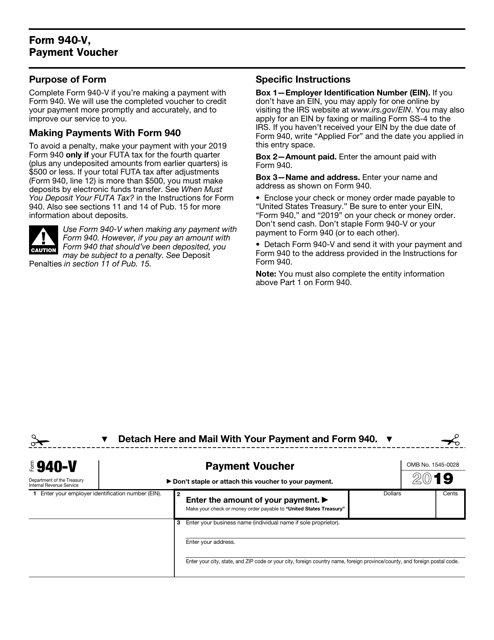

This form is used for submitting payment to the IRS for your Form 940 tax return.

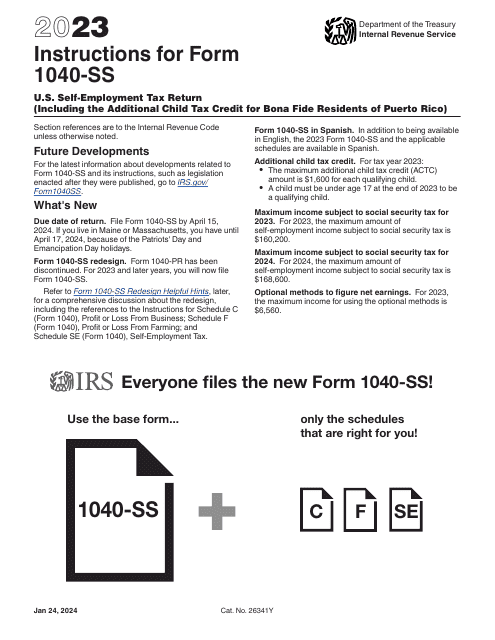

This document provides instructions for filling out IRS Form 1040 and 1040-SR. It guides you through the process of reporting your income, deductions, and credits to calculate your tax liability.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

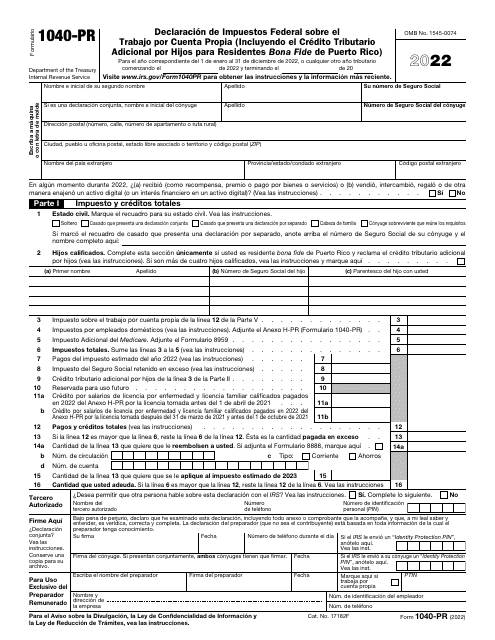

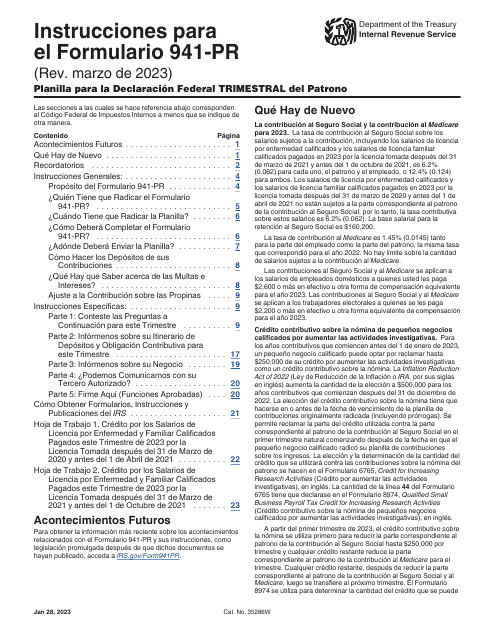

This document is used for making payment in Puerto Rico and is in Spanish.

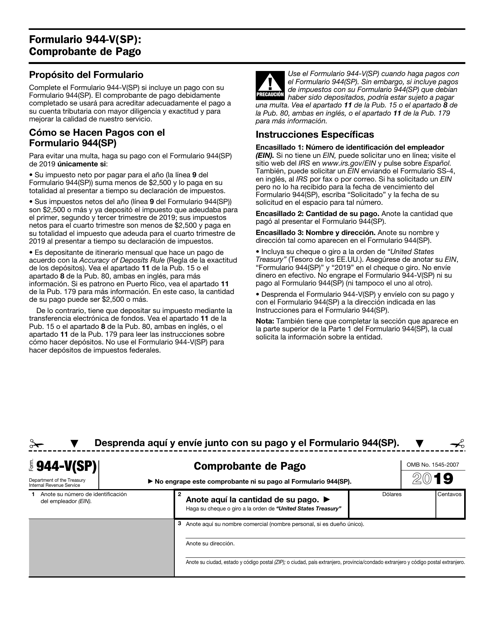

This type of document is a Spanish version of the IRS Form 944-V Payment Voucher. It is used by Spanish-speaking individuals or businesses to make payment arrangements with the IRS.

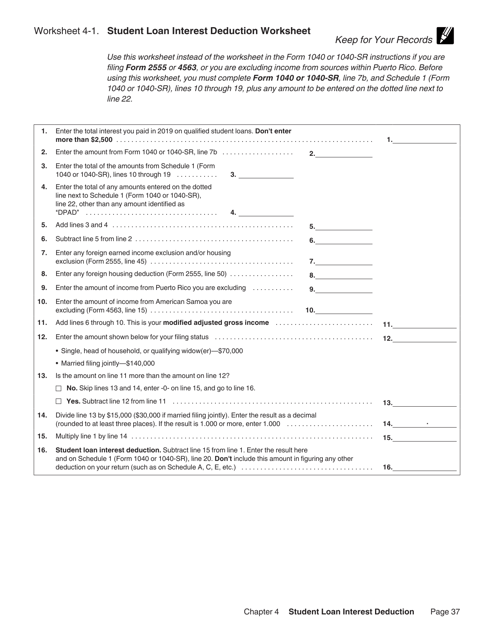

This document is a worksheet that helps you calculate the amount of student loan interest you can deduct from your taxes. It is explained in Publication 970, which provides information on tax benefits for education expenses.