Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

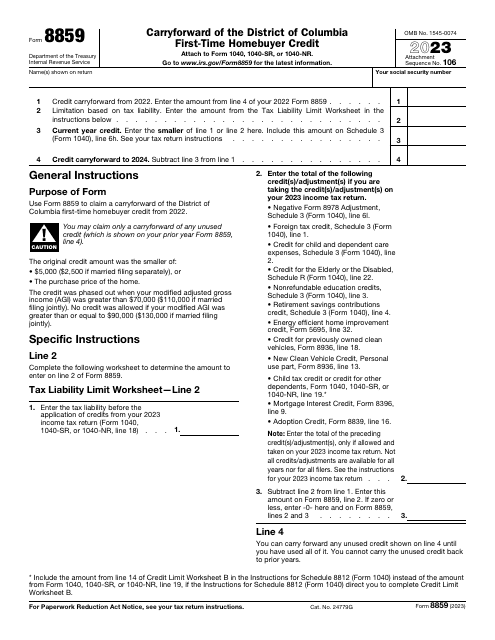

This is a fiscal document residents of the District of Columbia are permitted to complete in order to claim a carryforward credit they will be able to use in the future.

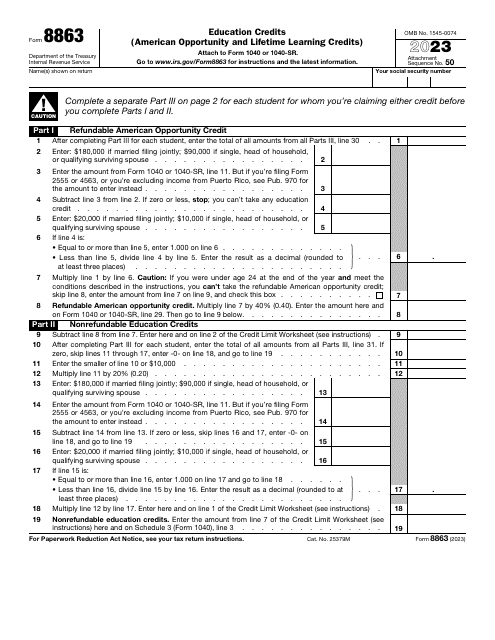

Fill in this form to claim one of the Internal Revenue Service (IRS) educational tax credits. It will provide a dollar-for-dollar reduction in the amount of tax owed at the end of the reporting year for the expenses incurred to attend educational institutions that participate in the student aid programs.

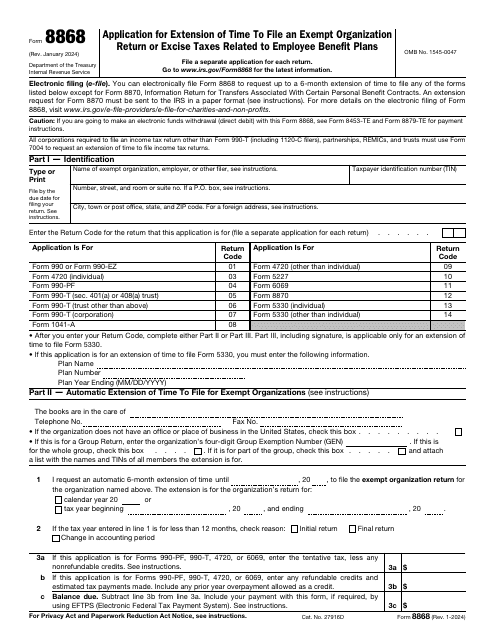

This is a formal IRS form that exempt organizations have to use to inform the fiscal authorities about late filing of a return.

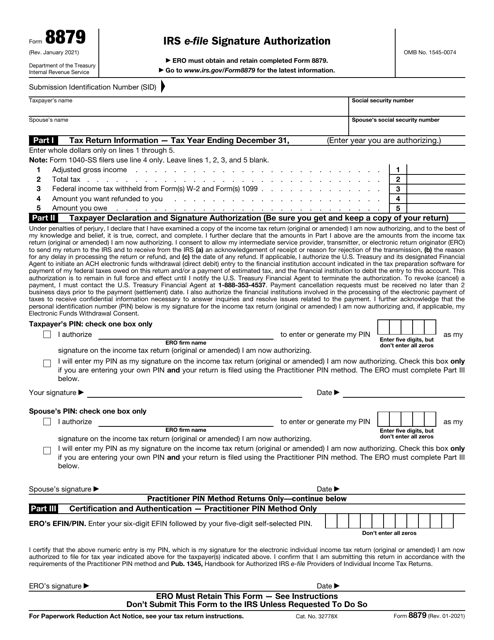

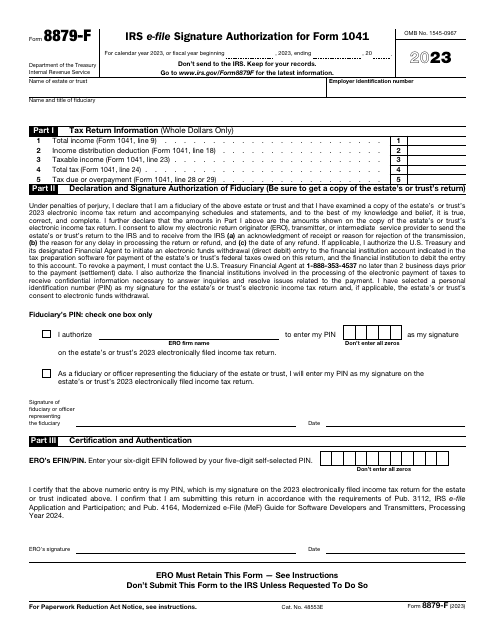

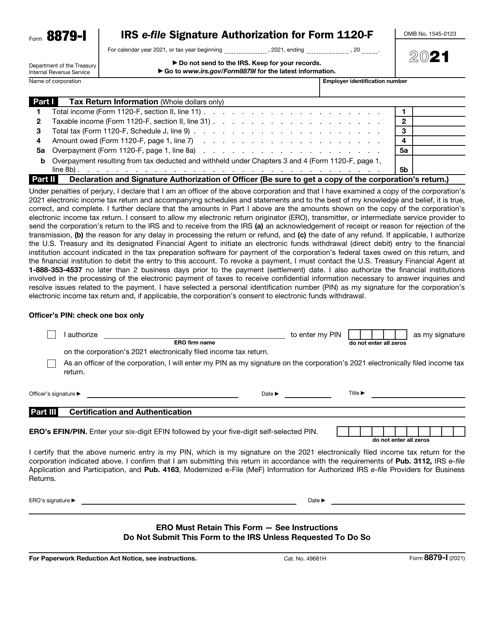

This is an IRS form that allows taxpayers to authorize an electronic return originator to use their e-signature while filing tax returns on behalf of their client.

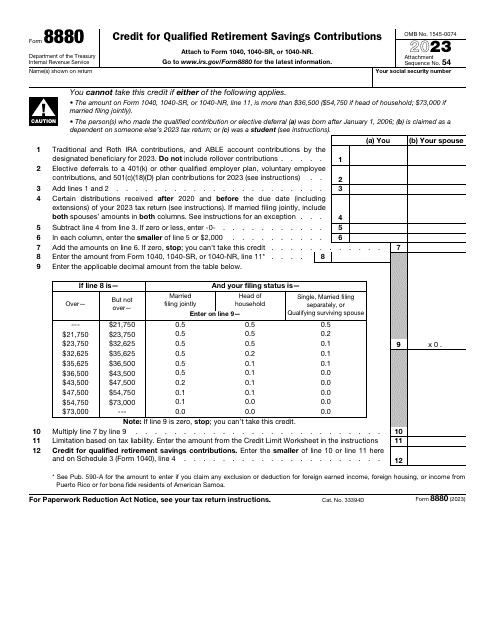

This is a formal instrument that allows individuals to express their intention to receive a saver's credit after contributing money to their retirement savings plans.

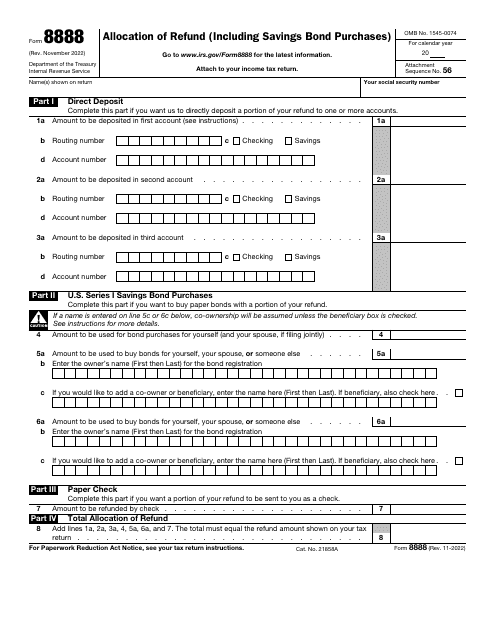

This is an IRS form filled out and submitted by a taxpayer that chooses to spread their tax refund across several accounts.

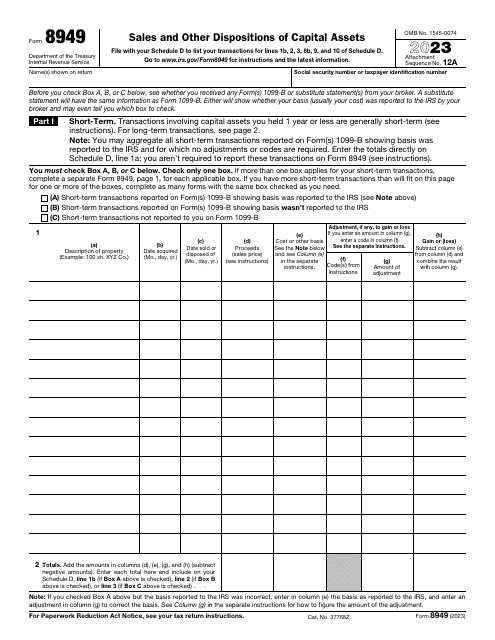

This is a legal document used to report exchanges and sales of capital assets, both long- and short-term capital gains and losses, to the IRS.

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

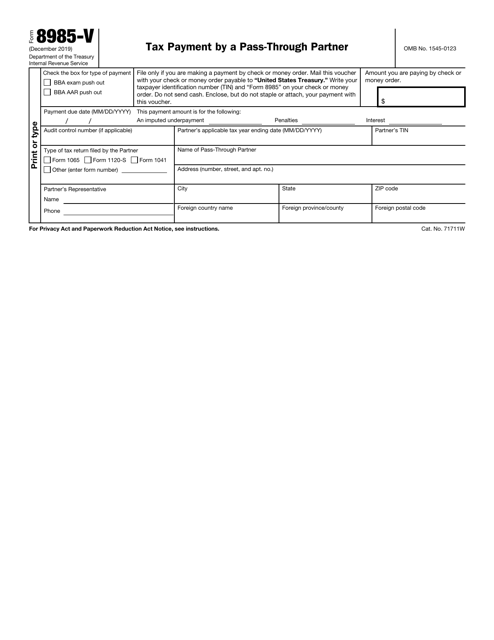

This Form is used for making tax payments by a pass-through partner to the IRS.

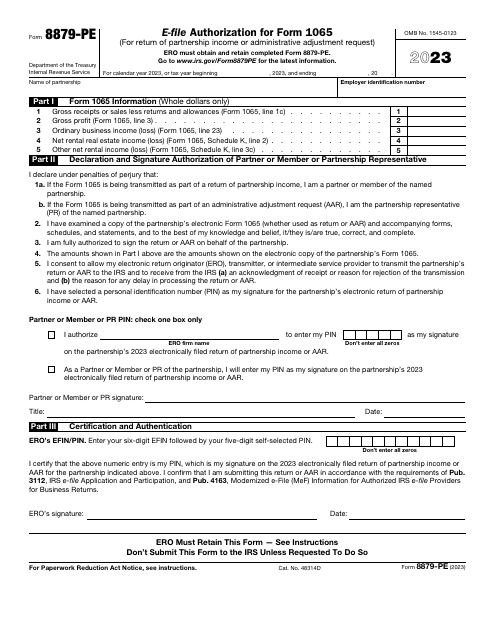

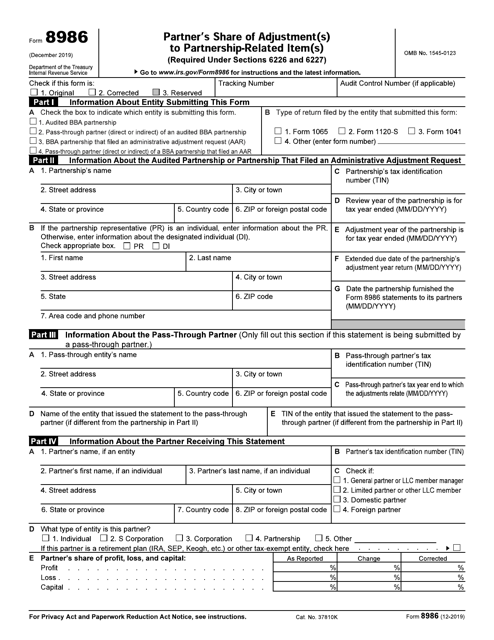

This Form is used for reporting transmittal and partnership adjustment tracking information required under Sections 6226 and 6227 of the IRS code.

This Form is used for reporting a partner's share of adjustments or items related to a partnership. It is required by sections 6226 and 6227 of the Internal Revenue Code.

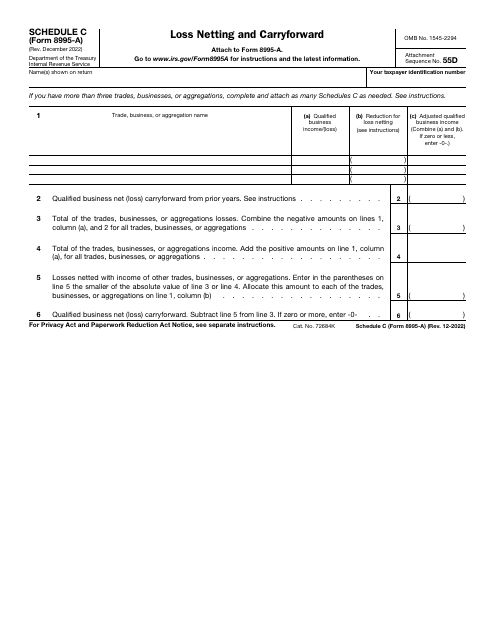

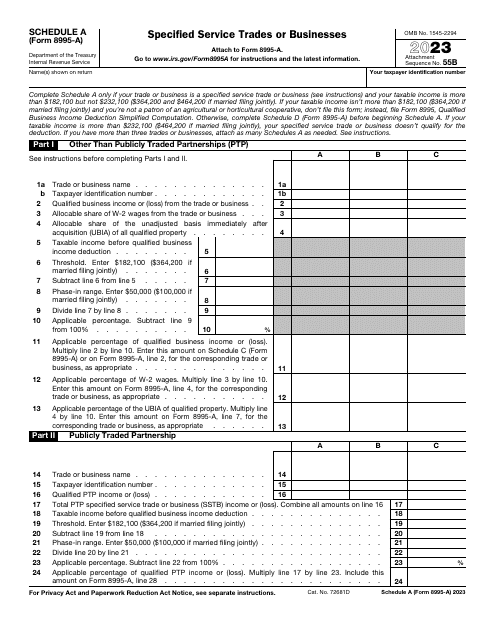

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

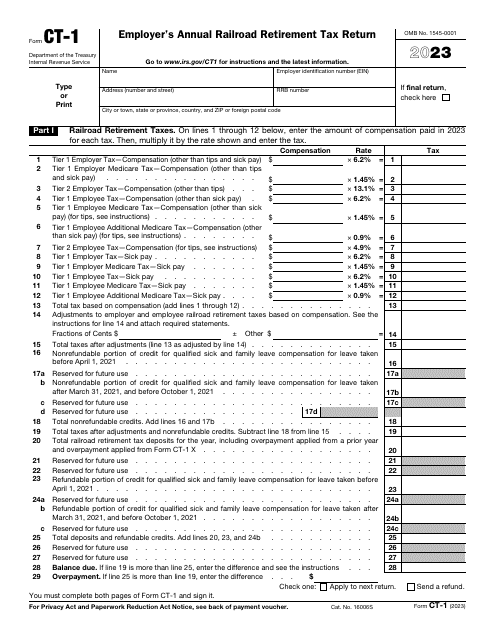

This is a fiscal form railroad industry employers are supposed to fill out in order to report the compensation they paid to their employees if that compensation is taxed in accordance with the Railroad Retirement Tax Act.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

File this document with the Social Security Administration (SSA) if you are a payer or employer who needs to transmit a paper Copy A of forms W-2 (AS), W-2 (CM), W-2 (GU), and W-2 (VI) to the above-mentioned organization.

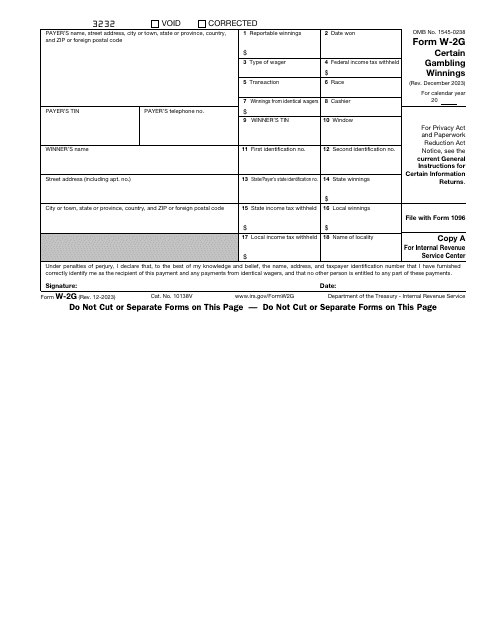

This is a formal report filed by gambling facilities to outline the winnings of their clients and certify they deducted taxes from the sum of money won.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.