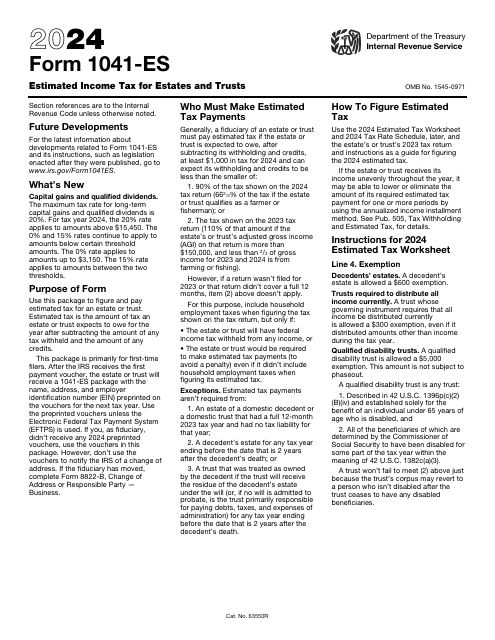

Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

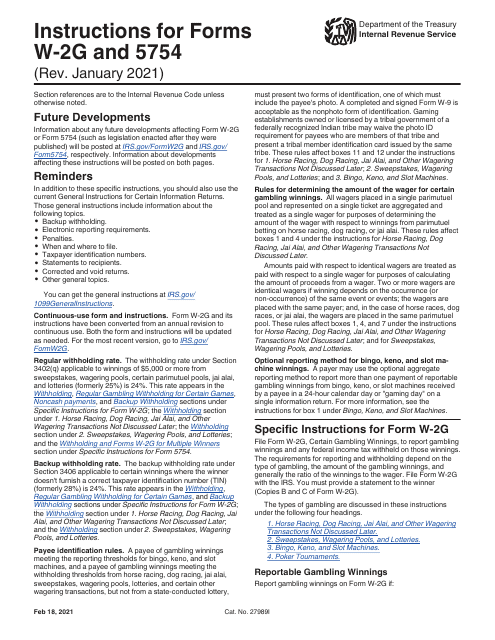

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

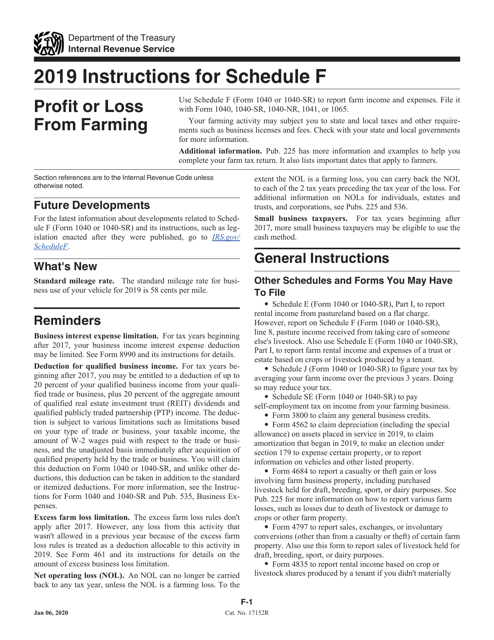

This document is used for reporting profit or loss from farming activities on your income tax return. It provides instructions on how to complete Schedule F, which is the section of IRS Form 1040 or 1040-SR specifically for reporting farm income and expenses.

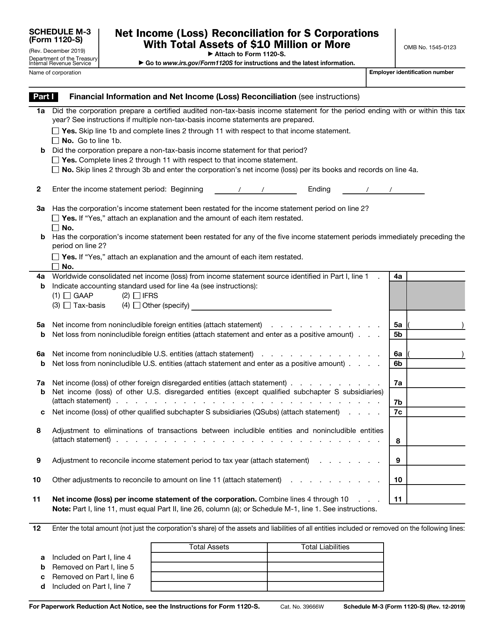

This Form is used for S corporations with total assets of $10 million or more to reconcile net income (loss) for tax purposes. It provides instructions for completing IRS Form 1120-S Schedule M-3.

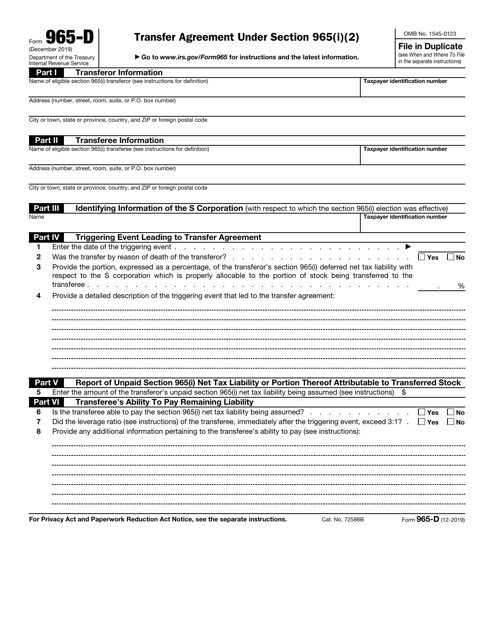

This form is used for transferring assets under Section 965(I)(2) of the IRS Code.

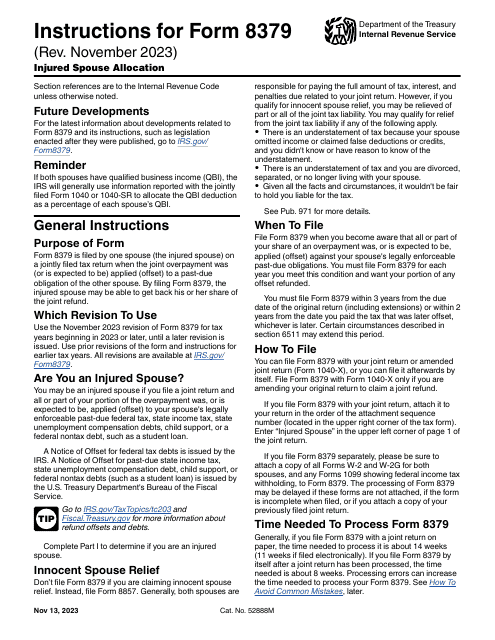

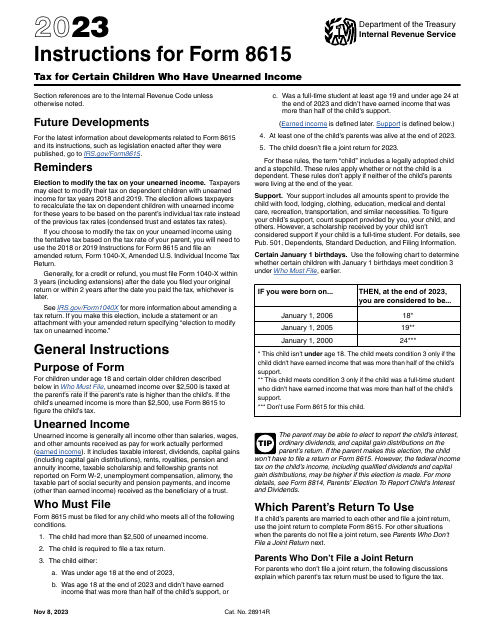

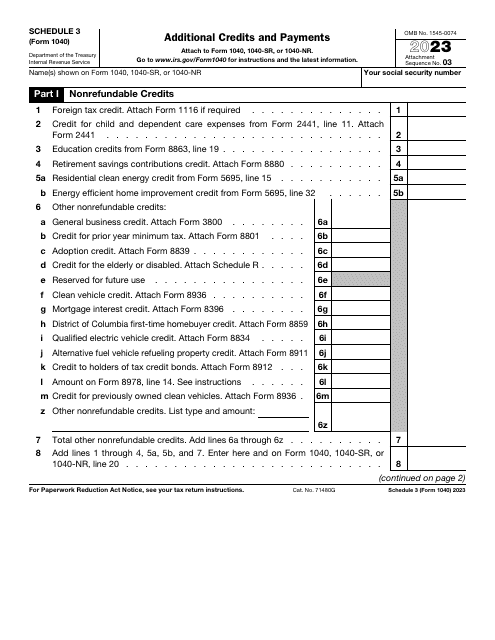

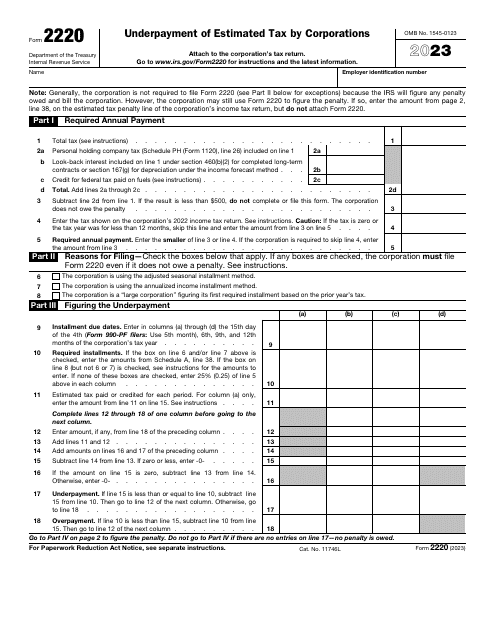

This is a fiscal form that elaborates on payments and credits that may let an individual lower the taxes they would otherwise have to pay in full or add to the amount of tax refund they are claiming.

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

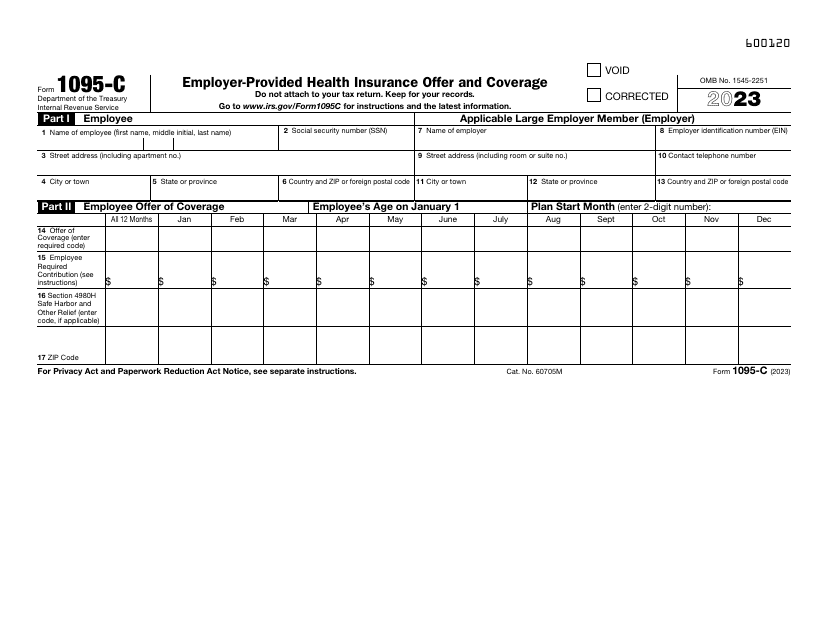

This form is filed by employers with 50 or more full-time employees in order to provide information about their enrollment in health coverage required under sections 6055 and 6056 of the Internal Revenue Code.

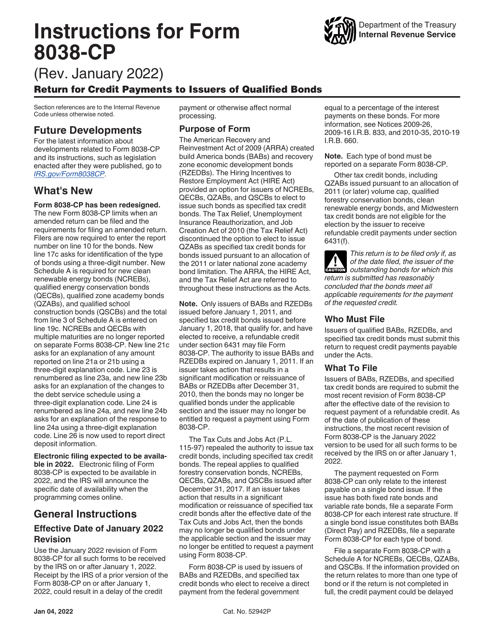

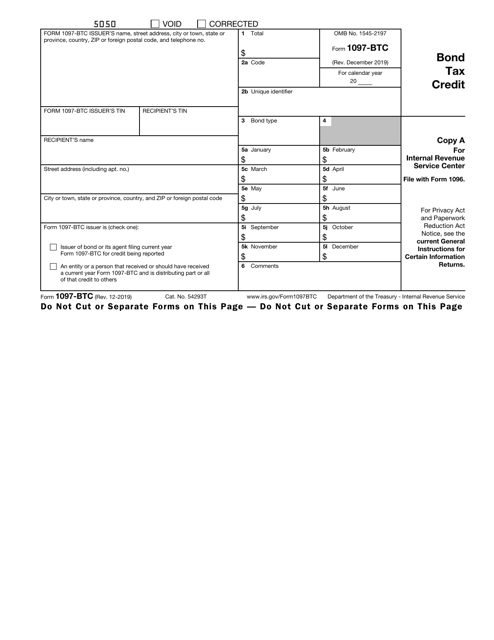

This is a formal IRS document prepared by tax credit bond issuers and taxpayers that distribute the credit in question.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

This Form is used for net income (loss) reconciliation for S corporations with total assets of $10 million or more.

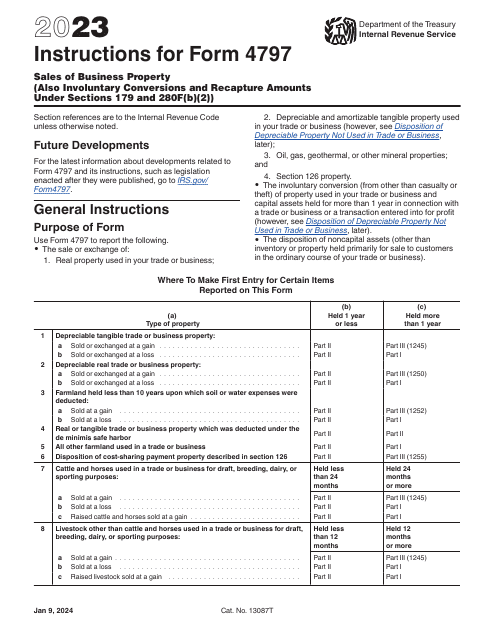

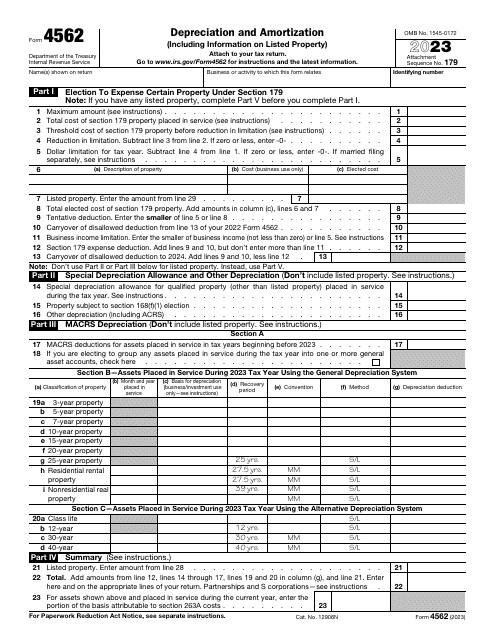

This is a formal document prepared by business owners whose intention is to ask for tax deductions due to depreciation of assets they used to carry out business operations and amortization of this property.

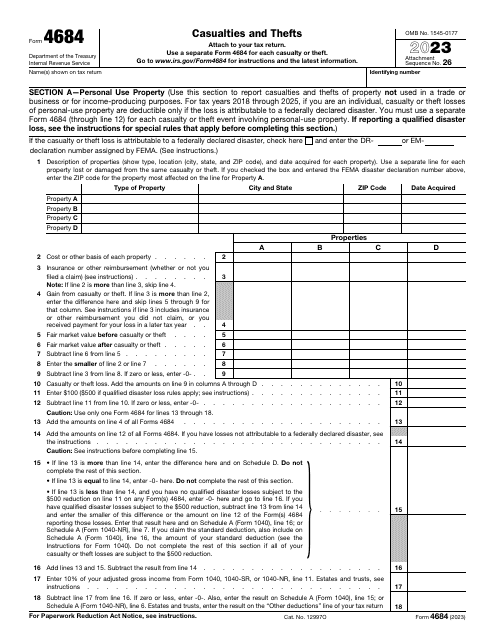

This is a formal statement prepared by a taxpayer who wants to confirm their right to receive a tax deduction upon property damage or loss they sustained if the reason for it was a casualty or theft.

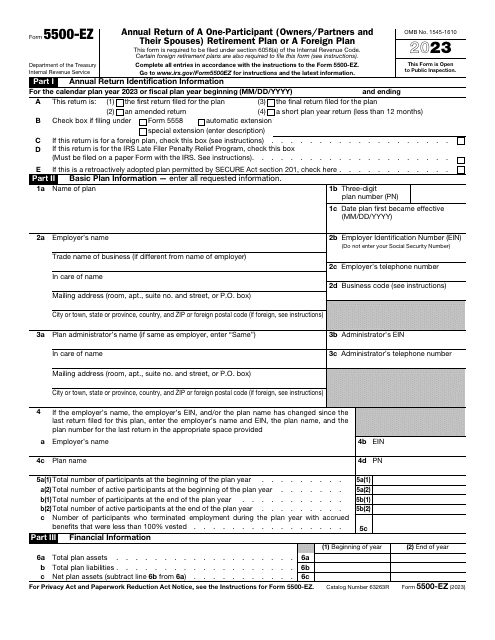

This form should be filled out by one-participant plans and by foreign plans. You are not required to file the form with attachments or schedules. File this form for an annual return if you do not file it electronically on a related Form 5500-SF.