Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

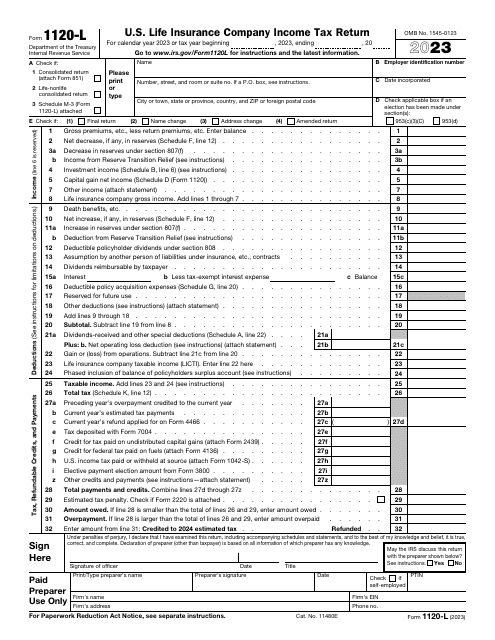

File this form if you are the owner of a domestic life insurance company to report to the IRS on your income, deductions, and credits for the tax year, and to figure your income tax liability.

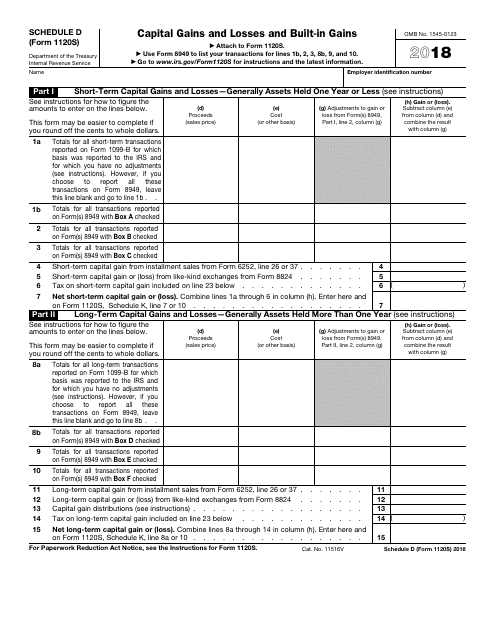

This document provides a schedule for reporting capital gains and losses, as well as built-in gains, on IRS Form 1120S. It is used by S corporations to report these financial transactions to the IRS.

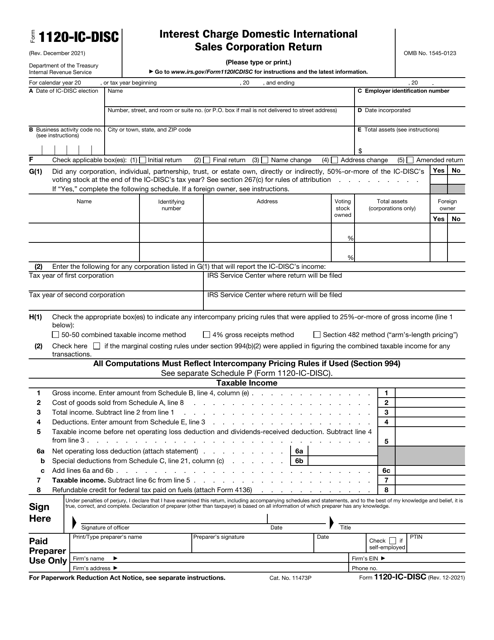

This form is also called the IC-DISC tax return. It is a form used by corporations as an information return reported to the Internal Revenue Service (IRS). A list of available Schedules is presented in the form description.

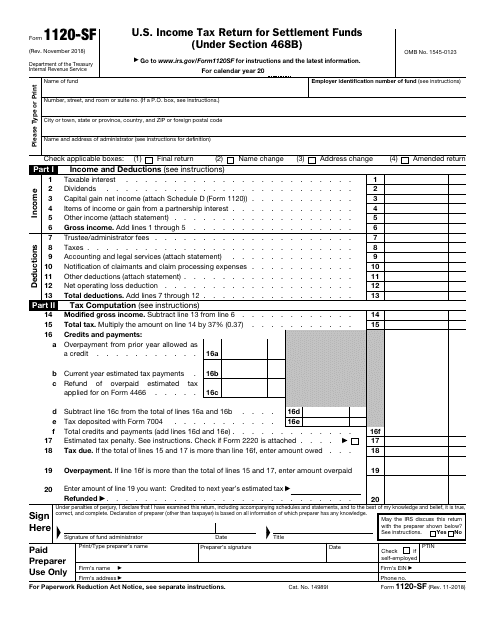

This form is also known as the Qualified Settlement Fund Tax Return and is filed by Section 468B designated and qualified settlement funds, in order to report their transfers, income, deductions, distributions, and to determine their income tax liability.

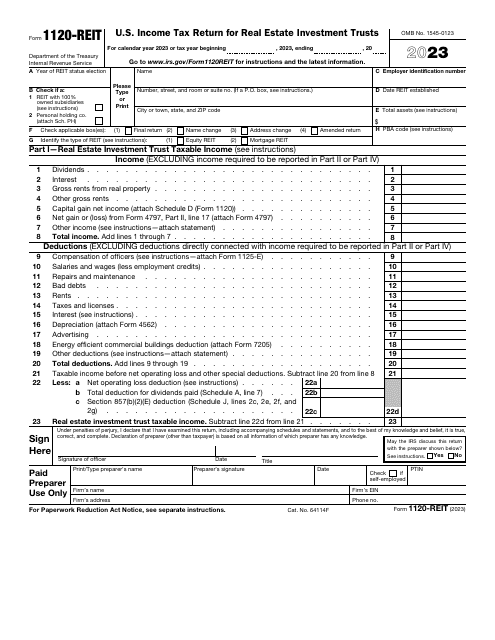

File this form if you are a corporation, trust, or an association electing to be treated as Real Estate Investment Trusts (REITs) in order to report your income, deductions, credits, penalties, as well as your income tax liability.

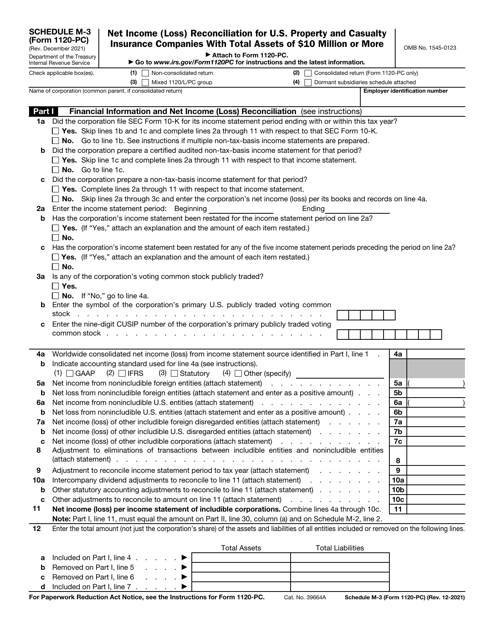

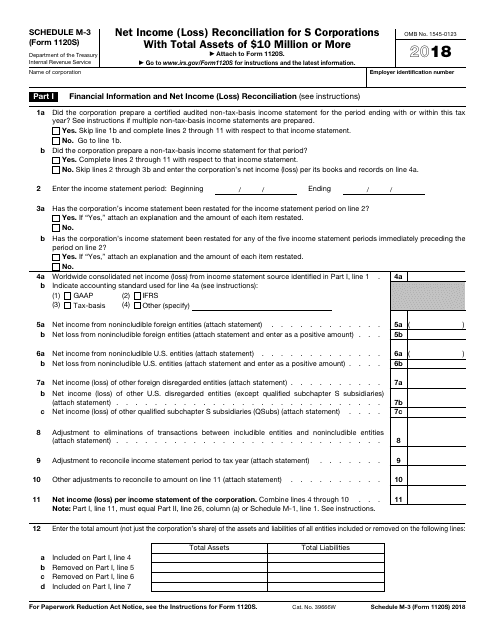

This Form is used for reconciling the net income (loss) of S corporations with total assets of $10 million or more on Schedule M-3.

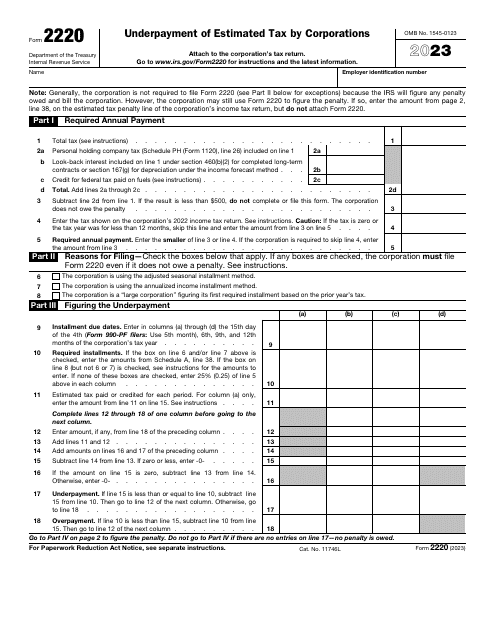

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

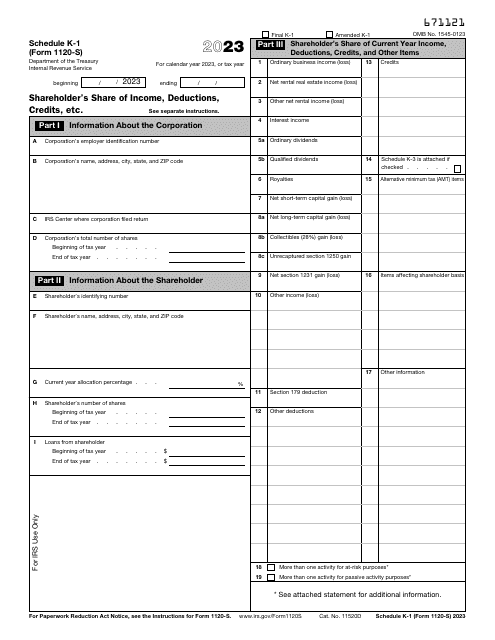

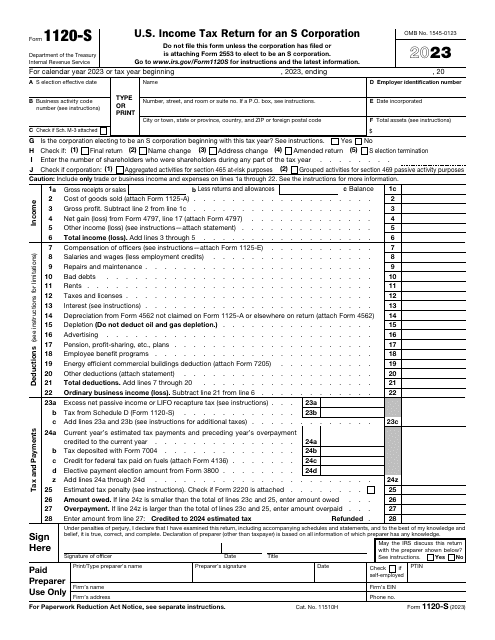

This form is used for reporting income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. The information is sent to the Internal Revenue Service (IRS).

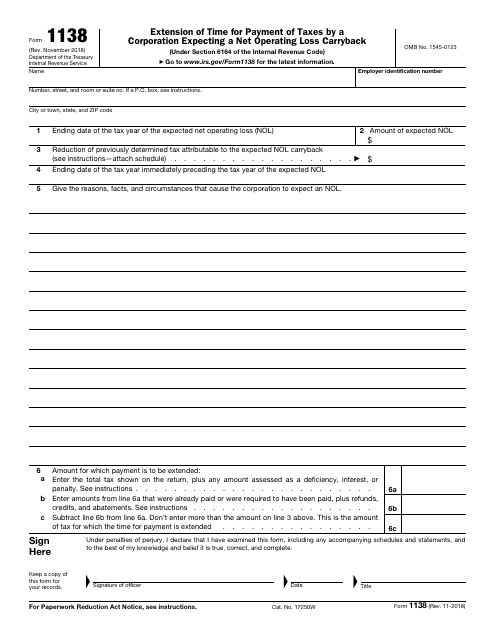

This form is used for corporations expecting a net operating loss carryback to request an extension of time to pay their taxes.

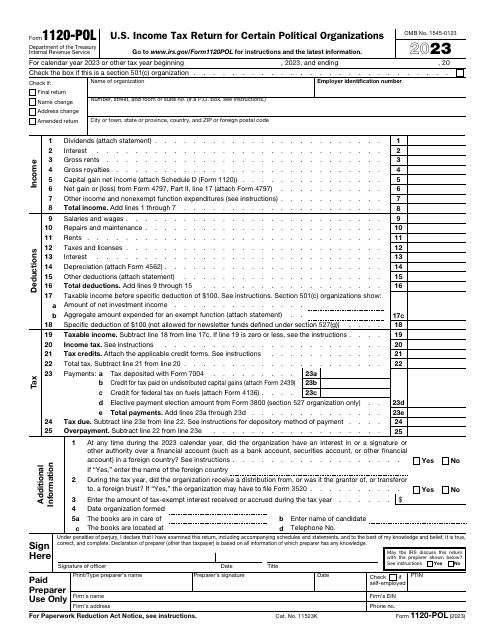

Use this form to inform the Internal Revenue Service (IRS) about the taxable income of your political organization, as well as about your tax liability according to Section 527.

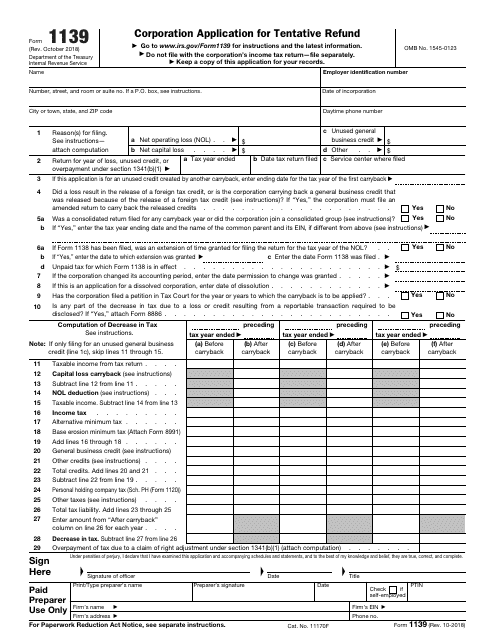

This form is used for corporations to seek a tentative refund of overpaid taxes from the Internal Revenue Service (IRS).

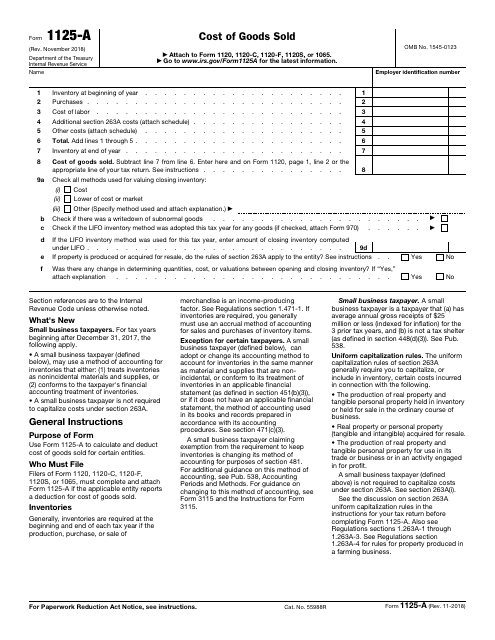

This document is used to calculate and deduct the cost of goods sold for certain entities.

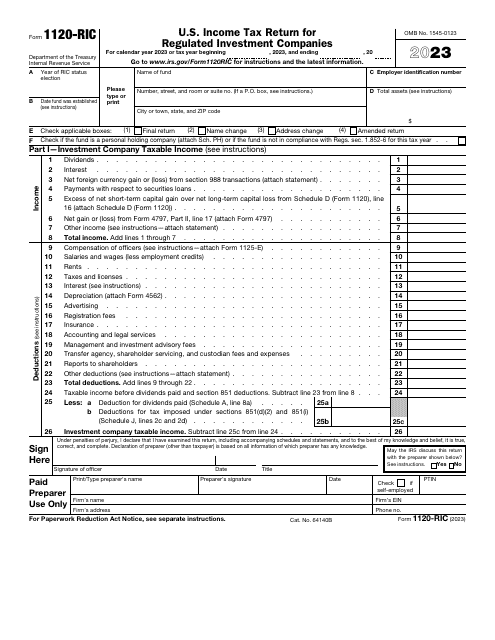

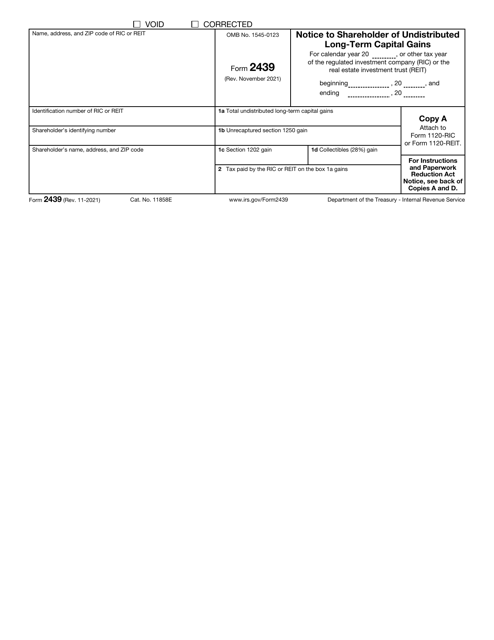

This is a fiscal form used by regulated investment companies to inform the government about their revenue over the course of the tax year, describe their losses and gains, claim tax deductions and credits, and compute their tax liability correctly.

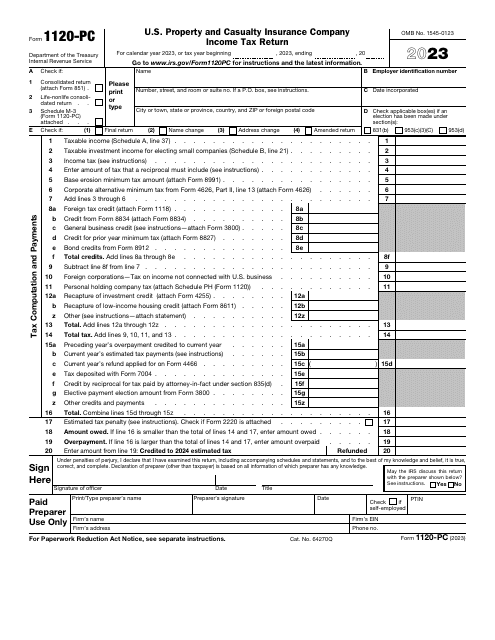

This form is filed by non-life insurance companies wishing to inform the Internal Revenue Service (IRS) of their income, deductions, and credits, as well as to figure their income tax liability.

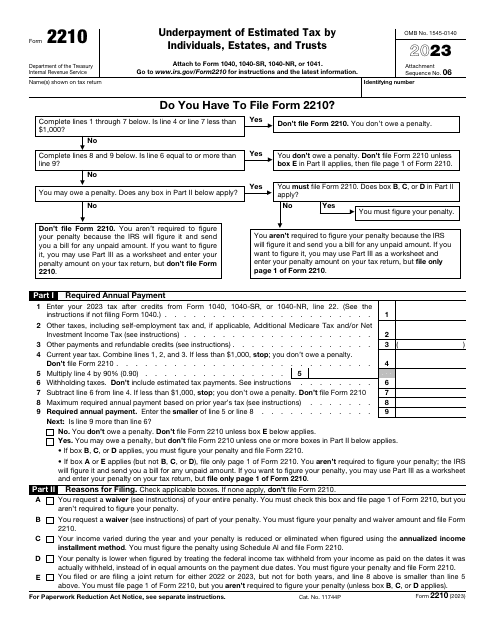

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.

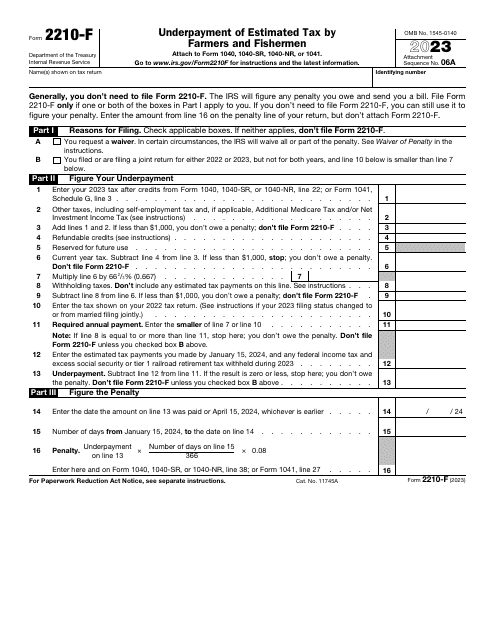

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

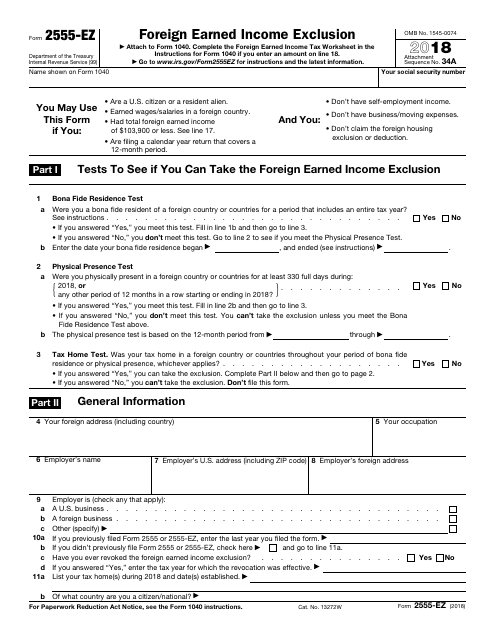

This document is used for claiming the Foreign Earned Income Exclusion on your taxes.

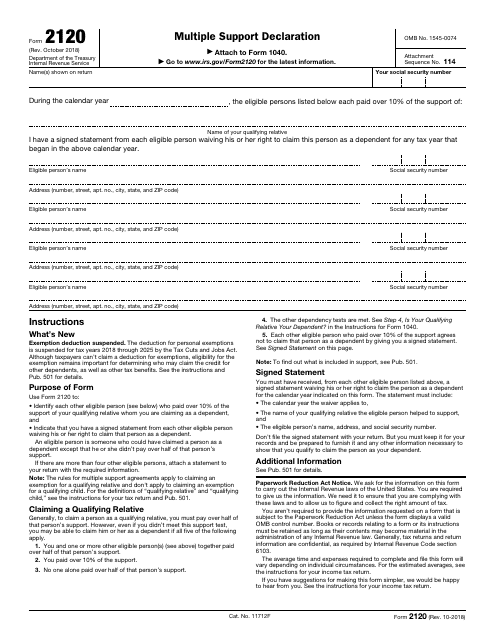

This form is used for declaring multiple individuals who provide support for a dependent. It is used by taxpayers to determine who can claim the dependency exemption for a qualifying person.

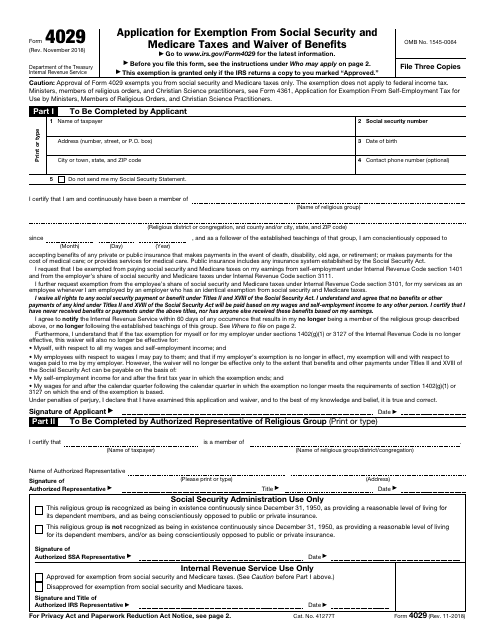

This Form is used for applying for exemption from Social Security and Medicare taxes and waiving benefits.

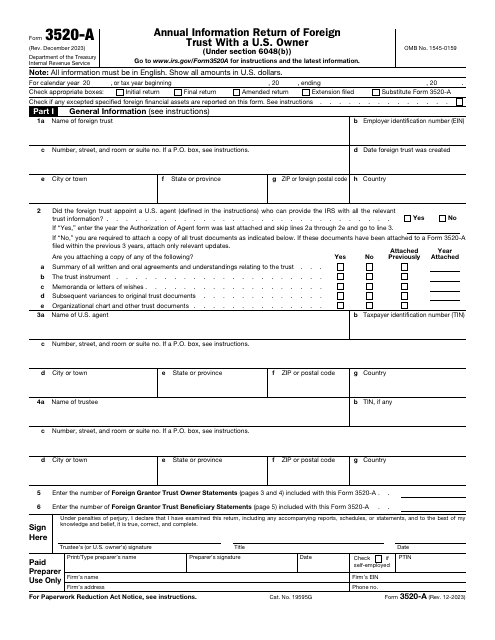

This document is submitted to the Internal Revenue Service (IRS) annually by foreign trusts with a U.S. owner to inform the IRS about the trust, its American beneficiaries, and any U.S. trust owner.

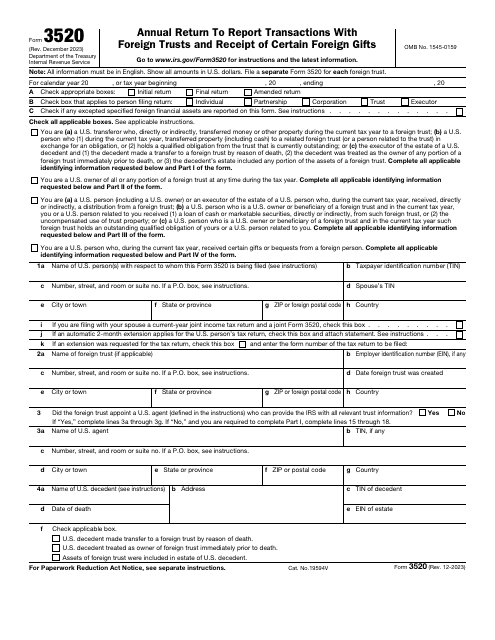

This form is a formal statement used by people and entities obliged to tell the fiscal authorities about the transactions they have had with foreign trusts throughout the year.

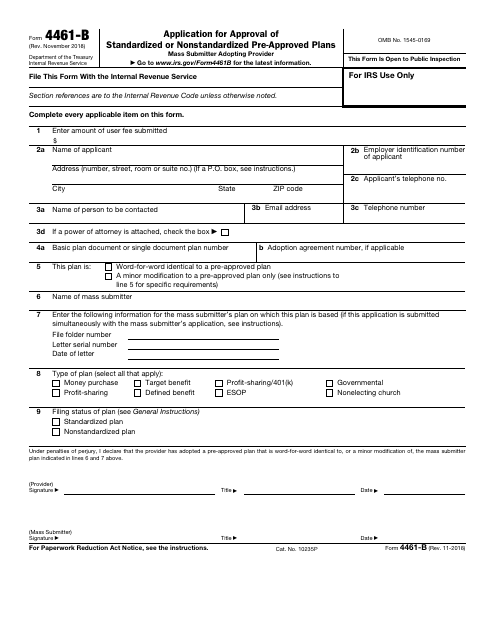

This Form is used for applying for approval of standardized or nonstandardized pre-approved retirement plans with the IRS.