Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

This is a fiscal form used by taxpayers that need to inform the tax organs about the financial profit they generated through transactions with real estate.

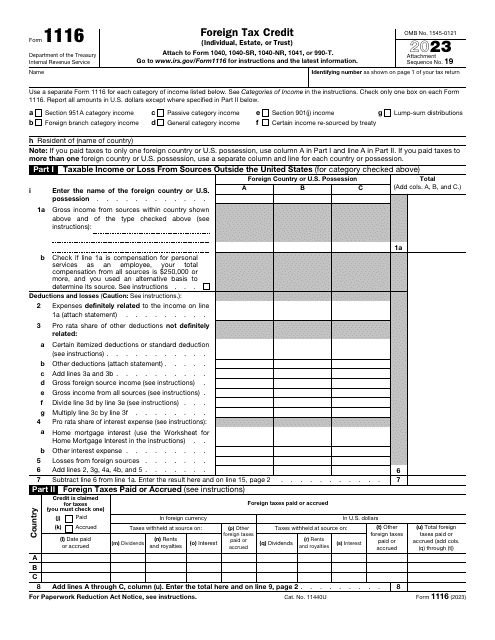

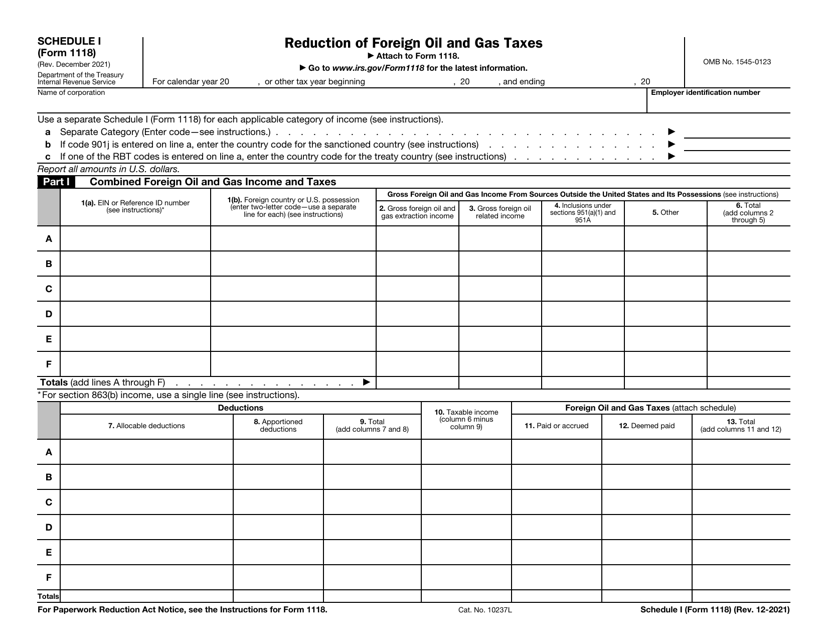

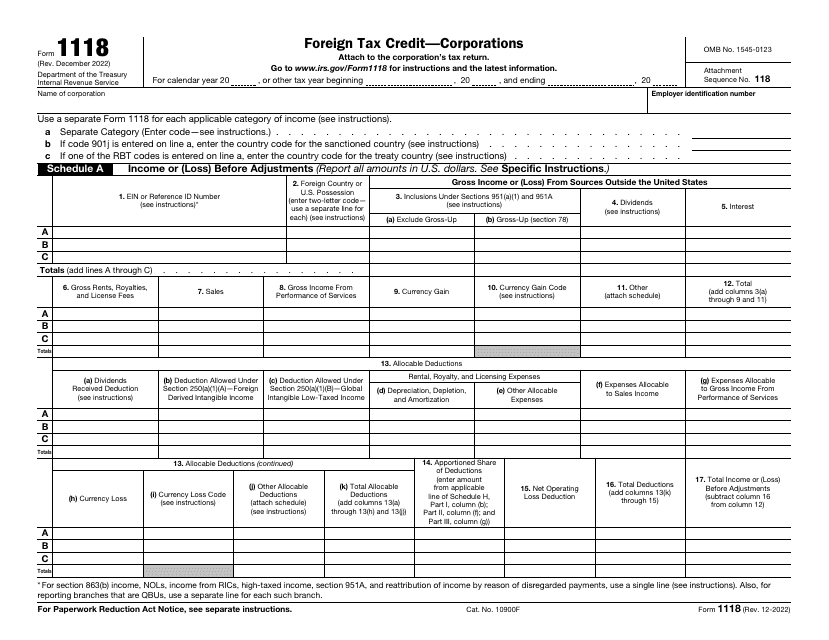

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.

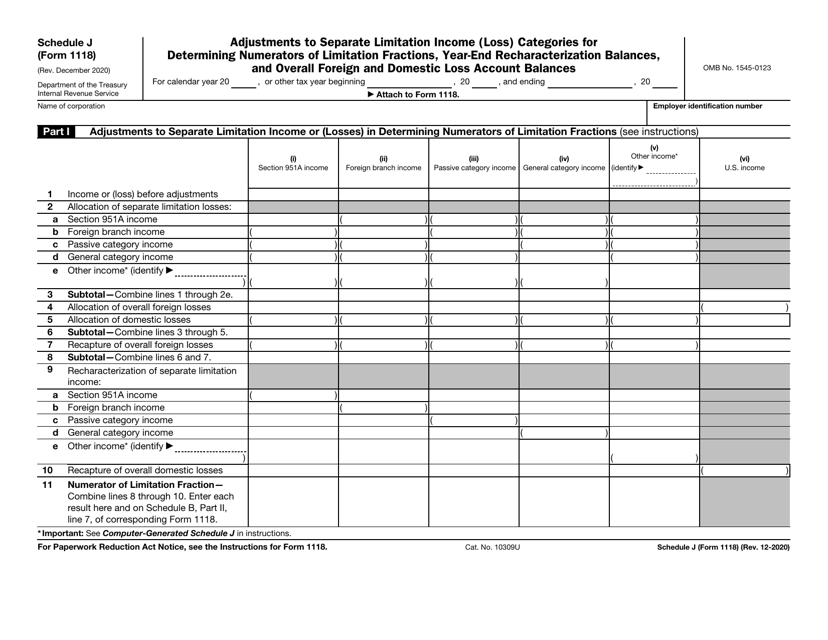

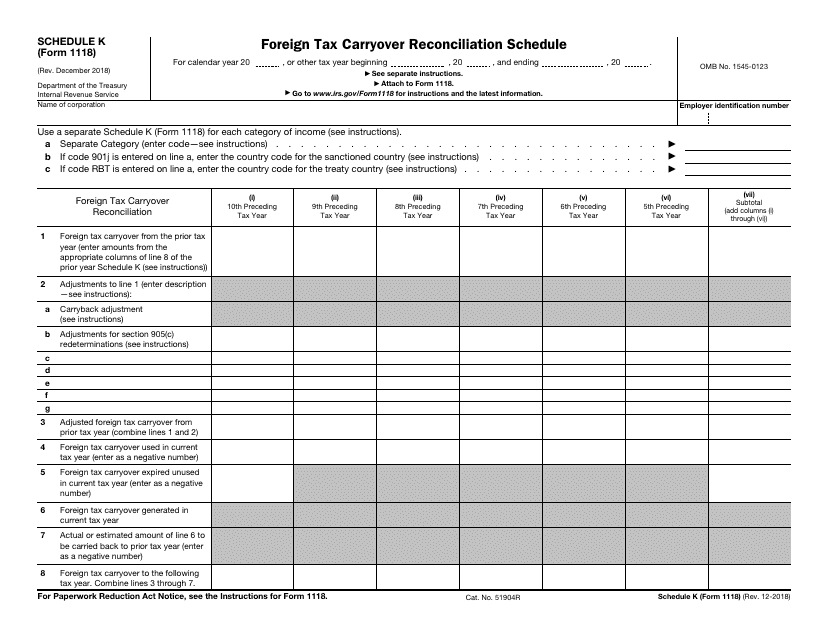

This Form is used for reconciling foreign tax carryovers on Schedule K. It is related to foreign taxes paid or accrued.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

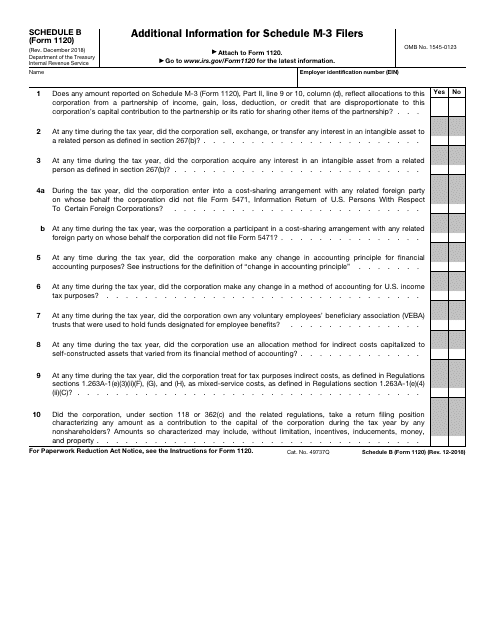

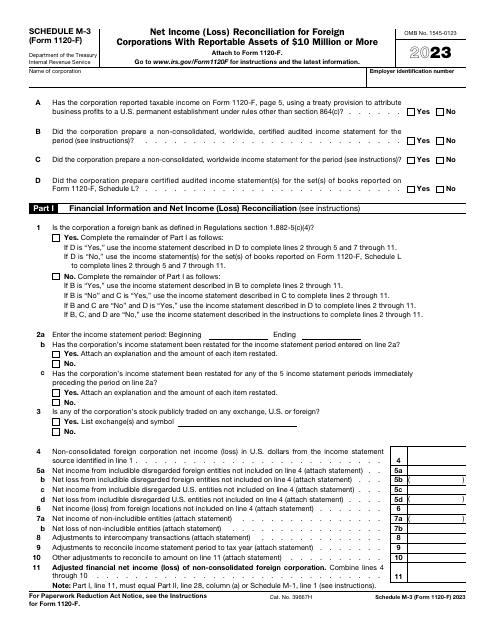

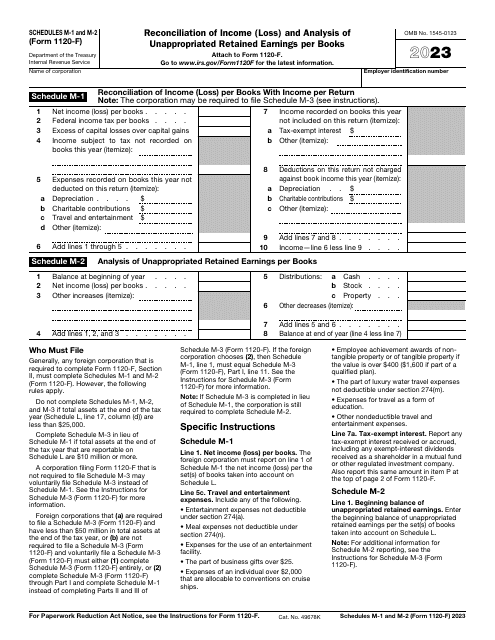

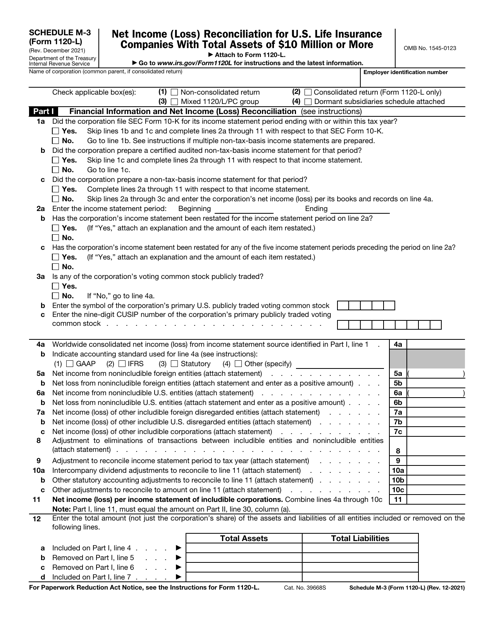

This form is used for providing additional information to Schedule M-3 filers who are filing IRS Form 1120.

This Form is used for providing consent and creating a plan for allocation of income and deductions among companies in a controlled group. It helps with the apportionment of taxes for multiple companies.

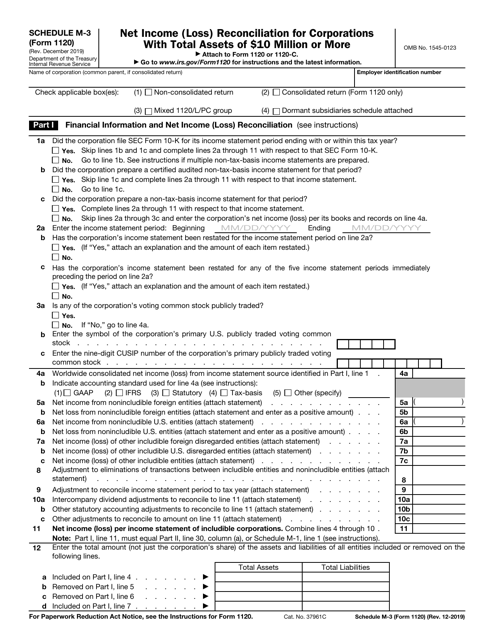

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

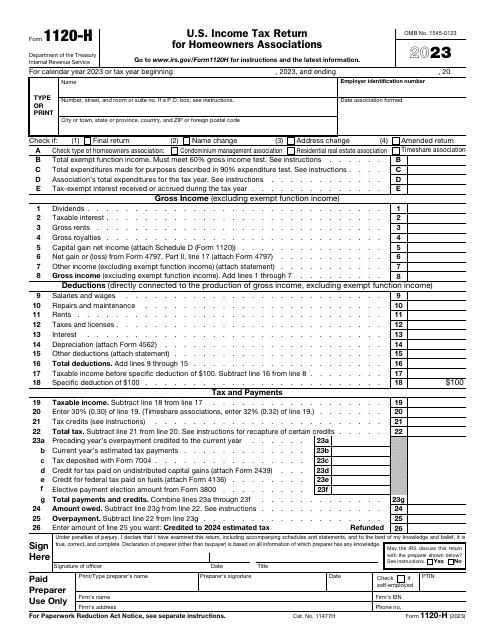

Fill out this form if you represent a homeowner's association in order to make use of certain tax benefits. That means, that the association can exclude the Exempt Function Income from its gross income.

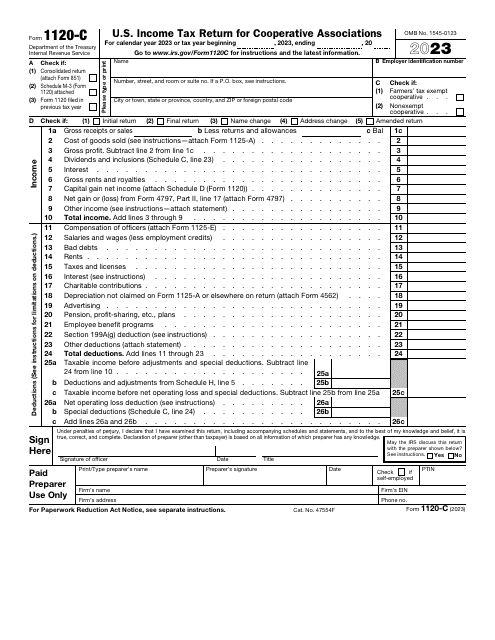

Use this form if you are a corporation that operates on a cooperative basis, to report your information (such as income, gains, losses, deductions, and credits) to the Internal Revenue Service (IRS), and to figure your income tax liability.

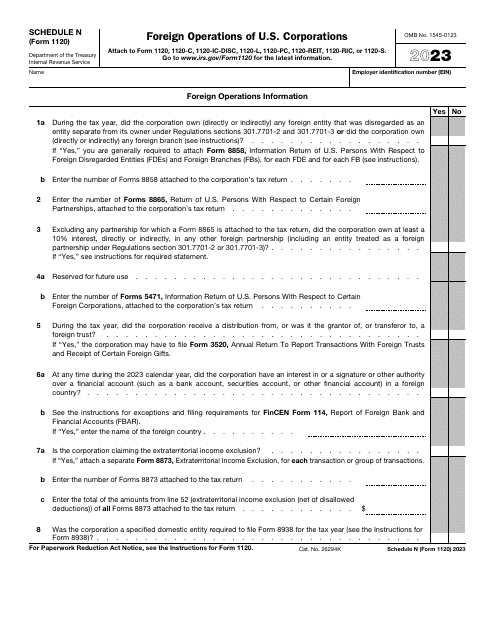

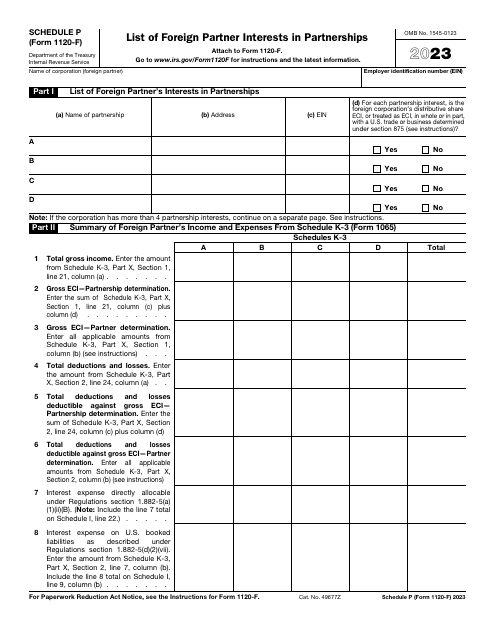

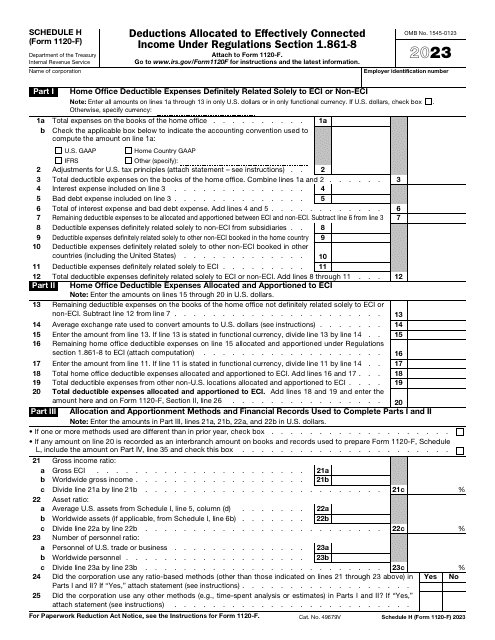

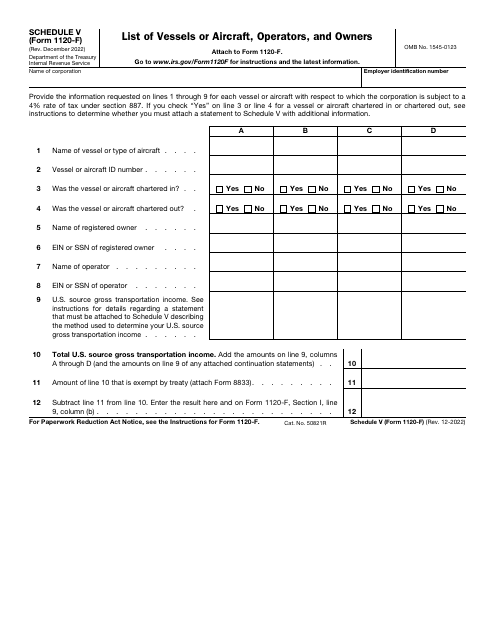

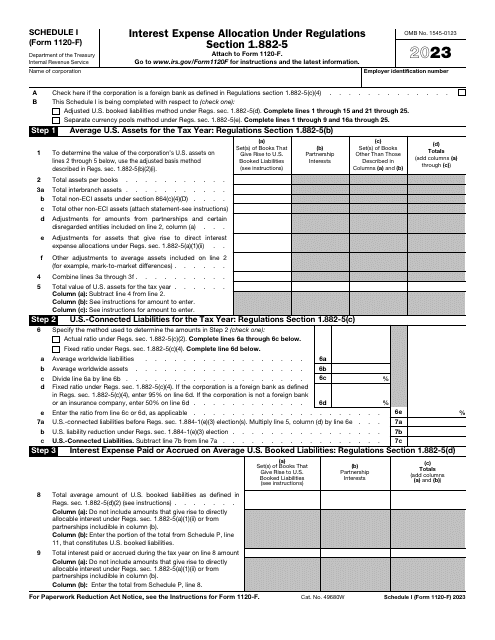

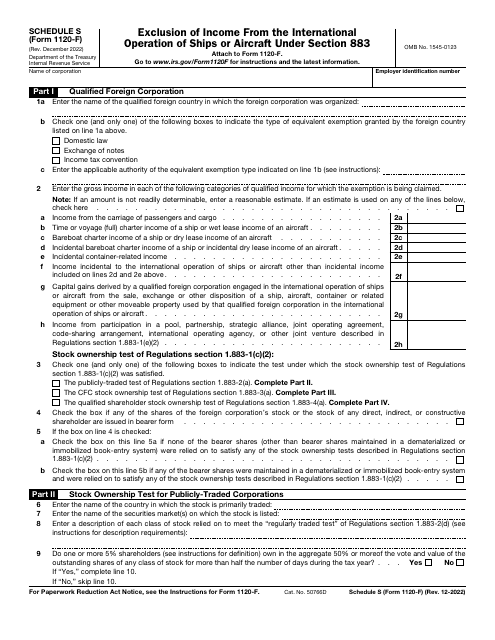

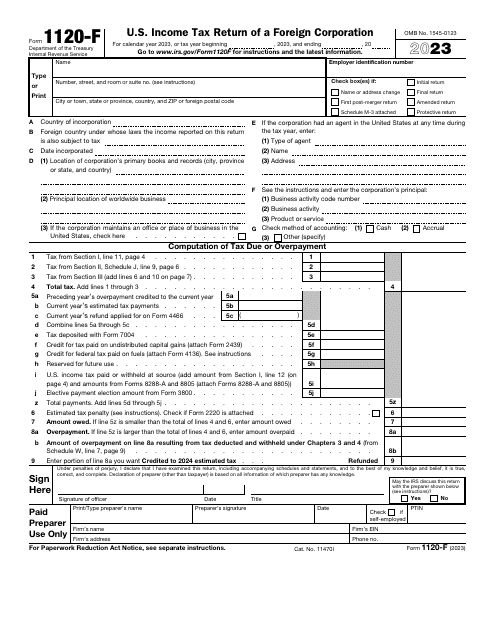

File this form if you are a foreign corporation and maintain an office within the United States in order to report your income, deductions, and credits to the Internal Revenue Service (IRS), as well as to figure your U.S. income tax liability.

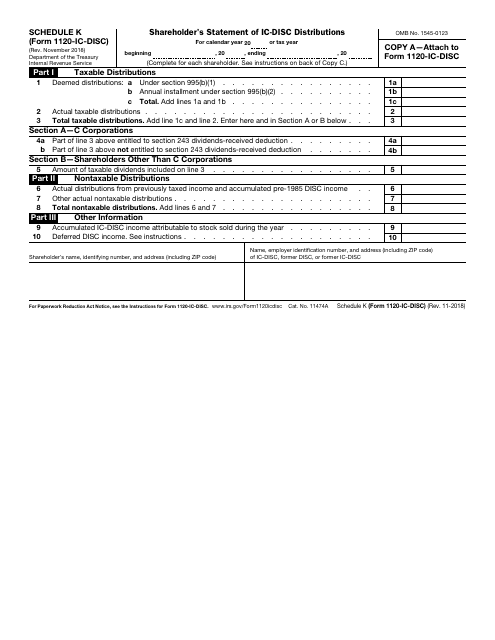

This document is used for reporting IC-DISC distributions made to shareholders.

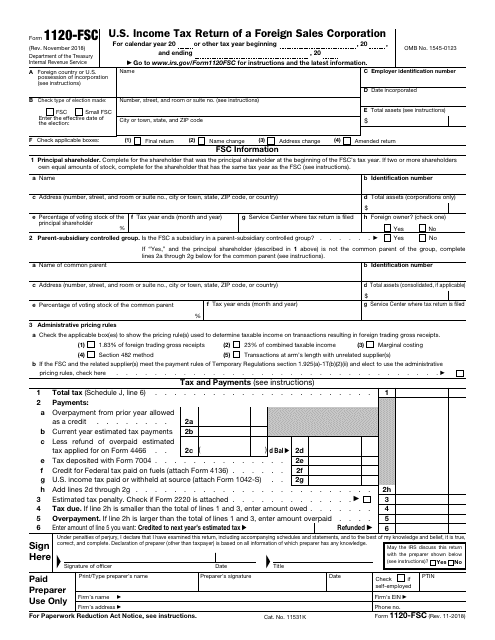

This is a fiscal document filled out by entities that export goods produced in the United States to inform tax organizations about the income they generated during the year, the deductions they qualify for, and the tax they are supposed to pay.