Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

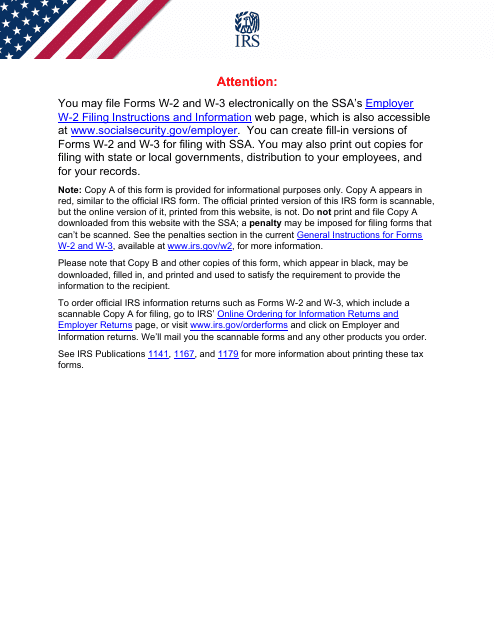

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

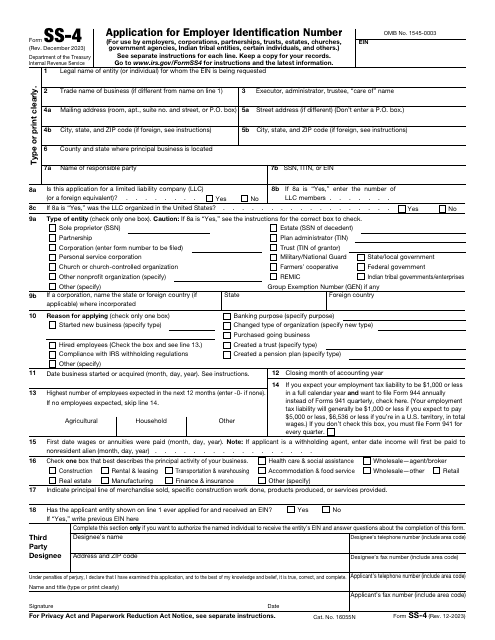

This is a fiscal document used by taxpayers - from sole proprietors to corporations - to ask tax organizations for a unique identification number.

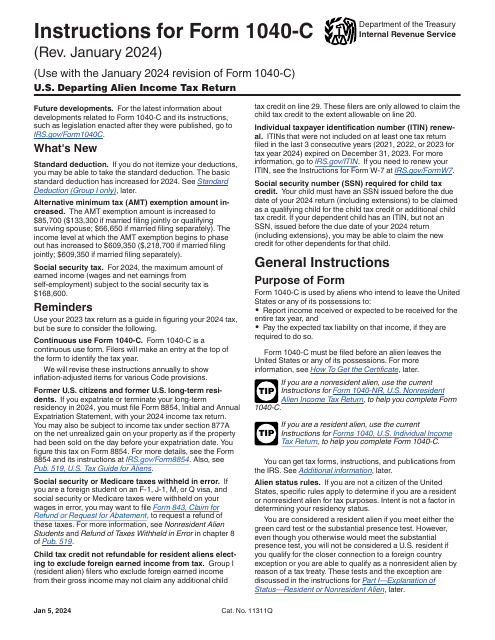

Use this form to report the income you received or expect to receive for the tax year and to pay the expected tax on that income (only if you are required to do so).

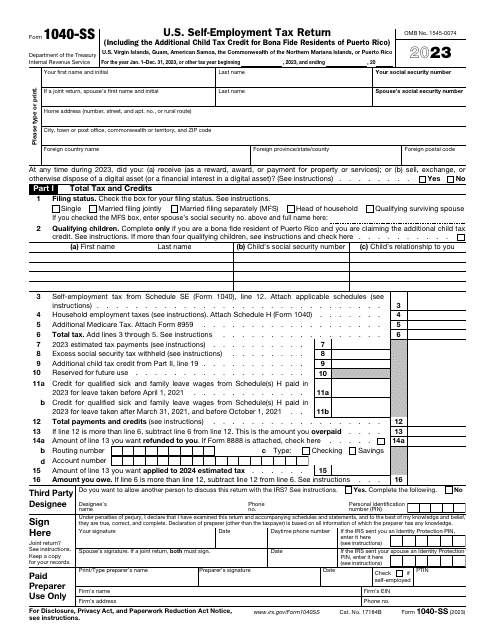

Use this document only if you are a resident of the United States Virgin Islands (USVI), Commonwealth of Puerto Rico, Commonwealth of the Northern Mariana Islands (CNMI), Guam, and American Samoa and wish to report your self-employment net earnings to the United States.