Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

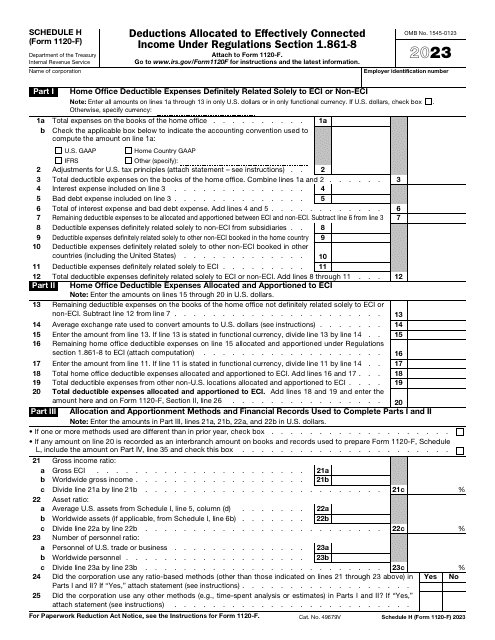

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

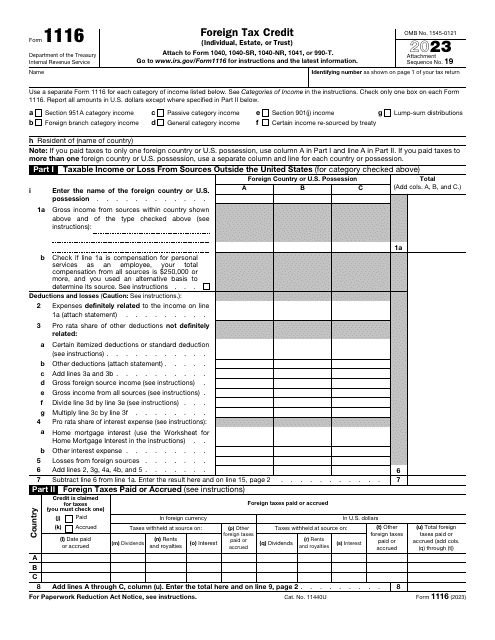

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.

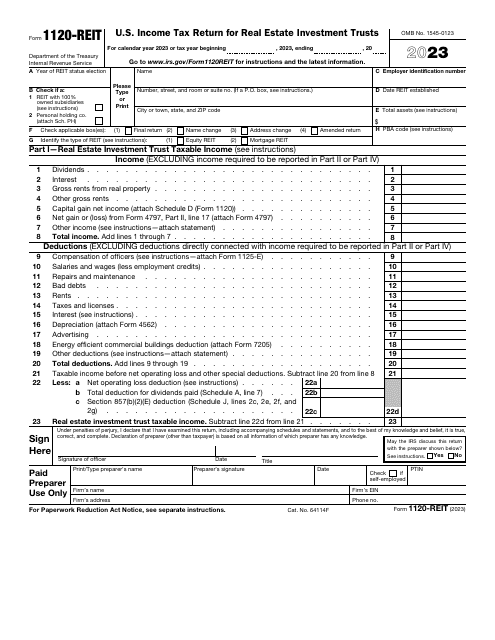

File this form if you are a corporation, trust, or an association electing to be treated as Real Estate Investment Trusts (REITs) in order to report your income, deductions, credits, penalties, as well as your income tax liability.

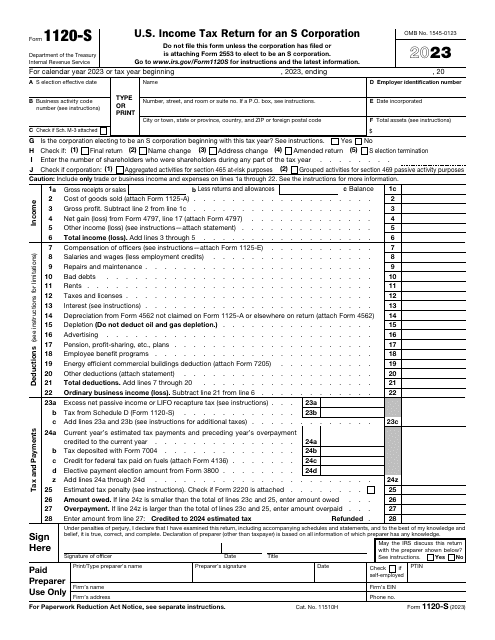

This form is used for reporting income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. The information is sent to the Internal Revenue Service (IRS).

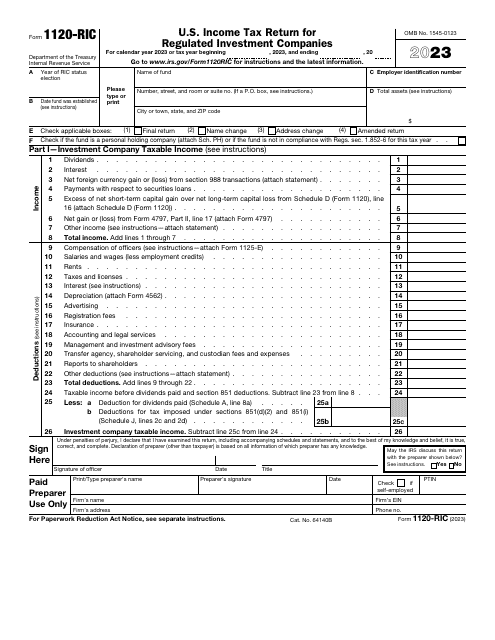

This is a fiscal form used by regulated investment companies to inform the government about their revenue over the course of the tax year, describe their losses and gains, claim tax deductions and credits, and compute their tax liability correctly.

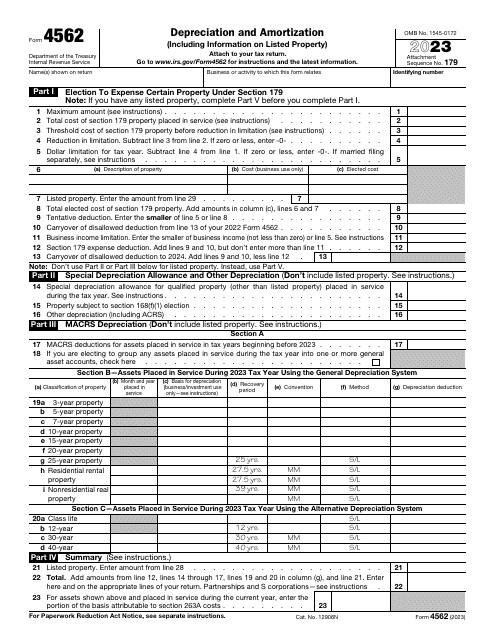

This is a formal document prepared by business owners whose intention is to ask for tax deductions due to depreciation of assets they used to carry out business operations and amortization of this property.

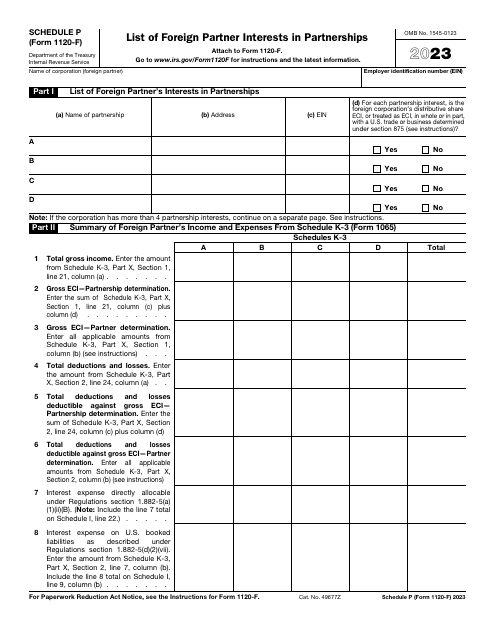

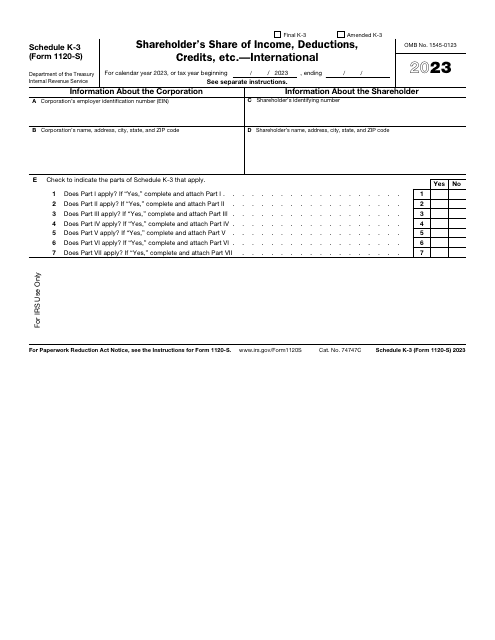

This is a fiscal form filled out by S corporations to inform the tax authorities about their international operations that are subject to tax.

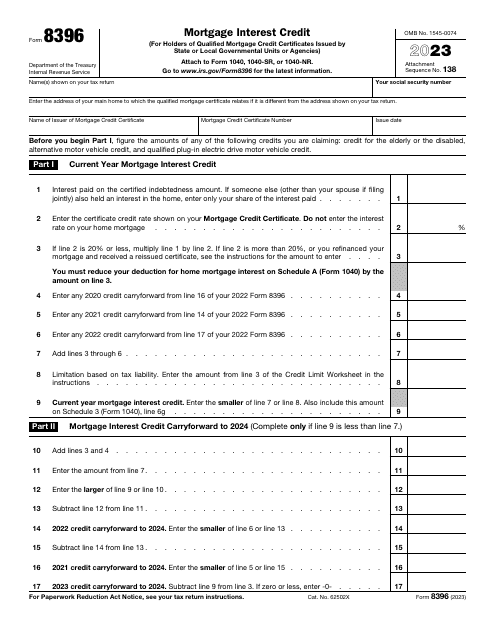

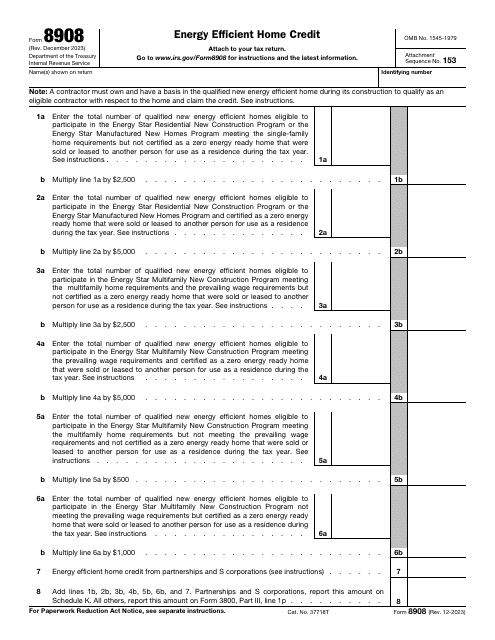

This is a formal document filled out by taxpayers in order to compute the amount of mortgage interest credit over the course of the year and report the information to fiscal authorities.

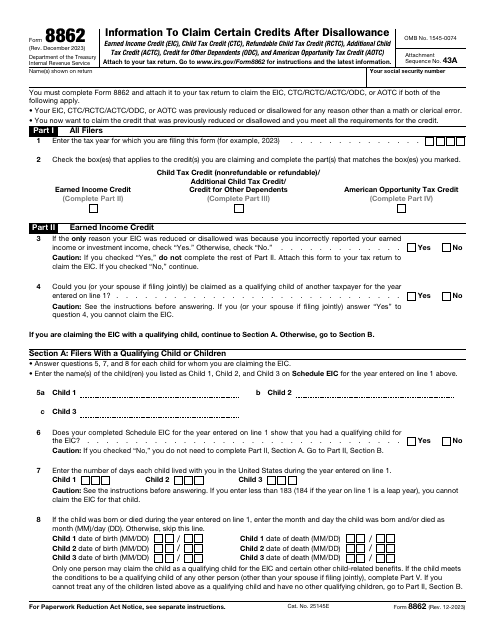

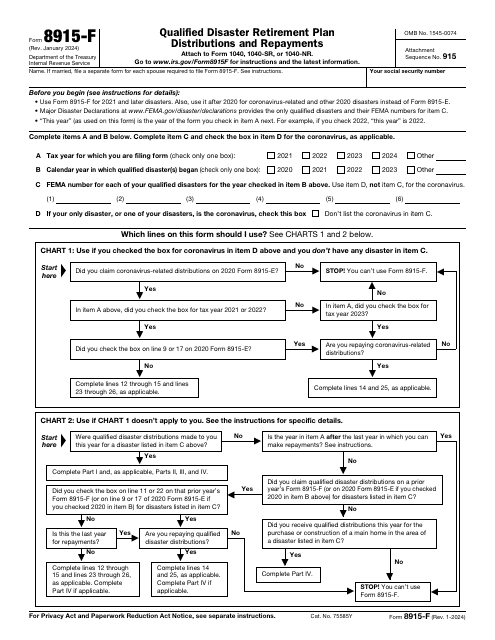

This is a fiscal form used by taxpayers to request the payment of a tax credit that was disallowed in the past.

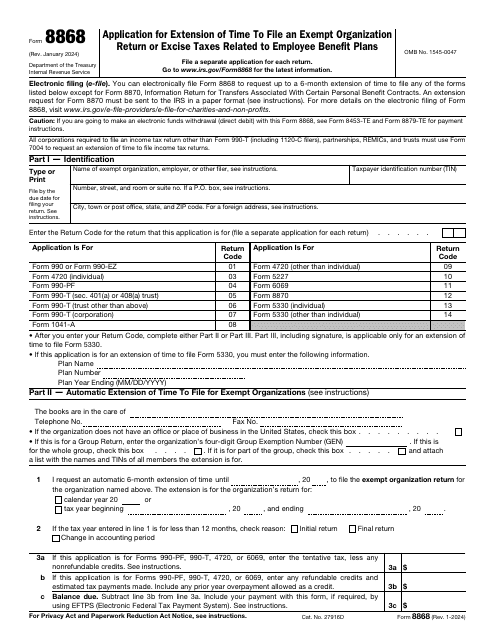

This is a formal IRS form that exempt organizations have to use to inform the fiscal authorities about late filing of a return.

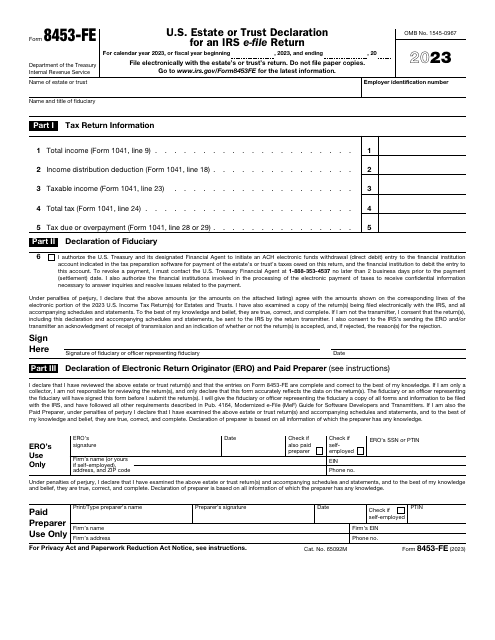

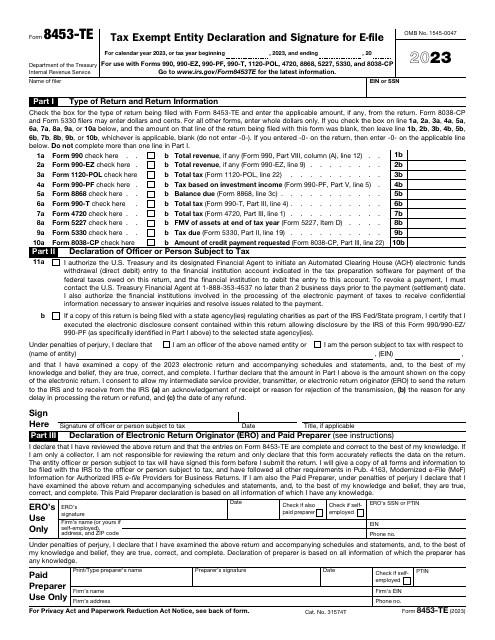

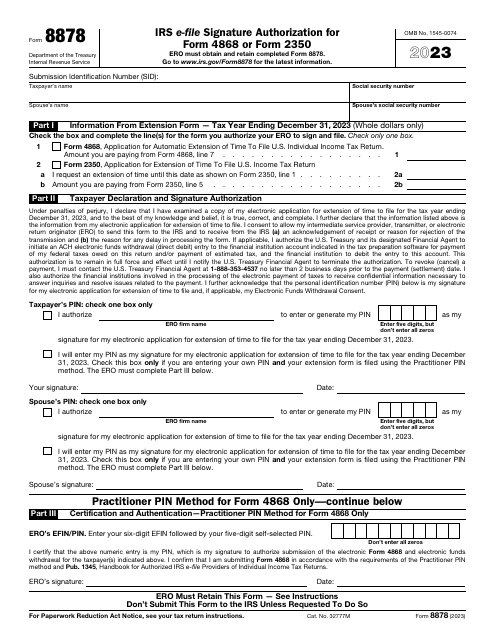

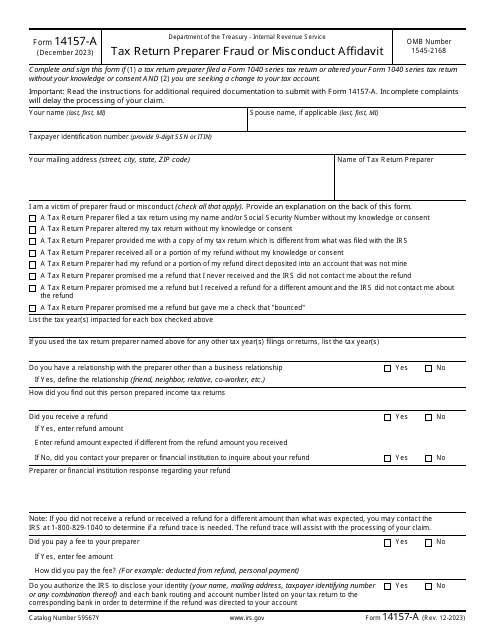

This is a form designed for taxpayers that want to grant an electronic return originator the right to use a unique identification number when filing tax documentation on behalf of the person that hired them.

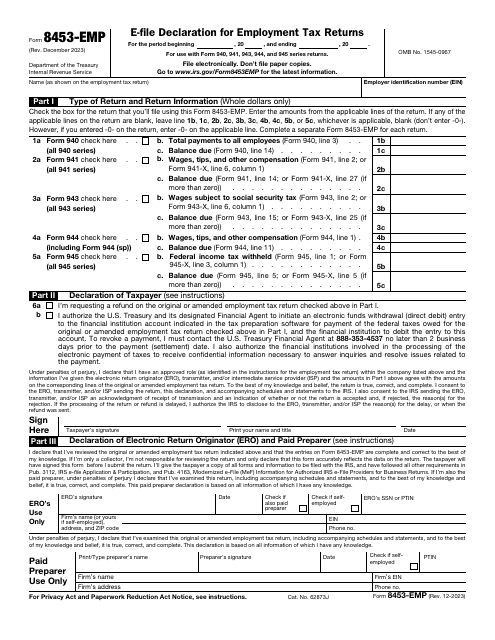

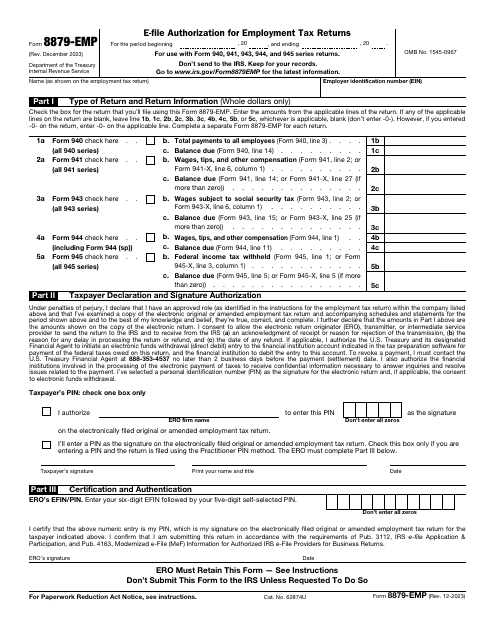

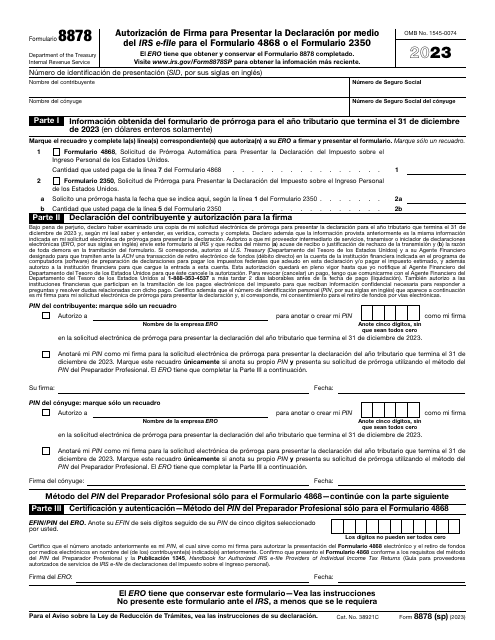

This is a supplementary form taxpayers may sign if they want to confirm their willingness to utilize a personal identification number that will allow them to provide an electronic signature when certifying employment tax returns or asking for a filing extension.