Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

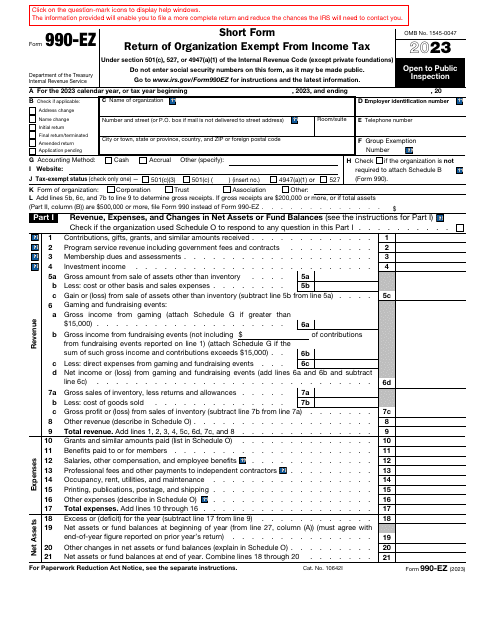

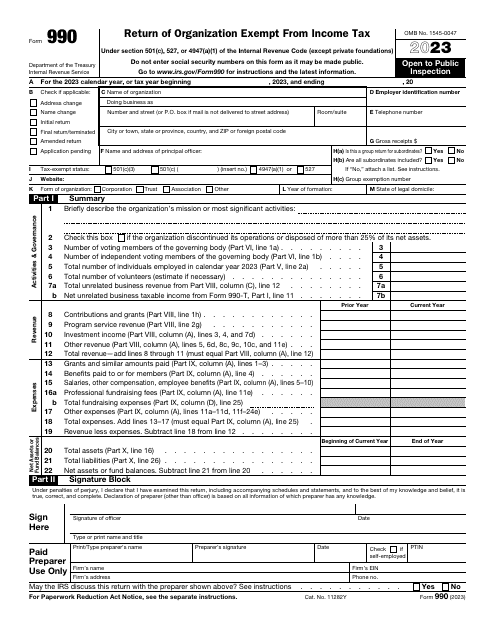

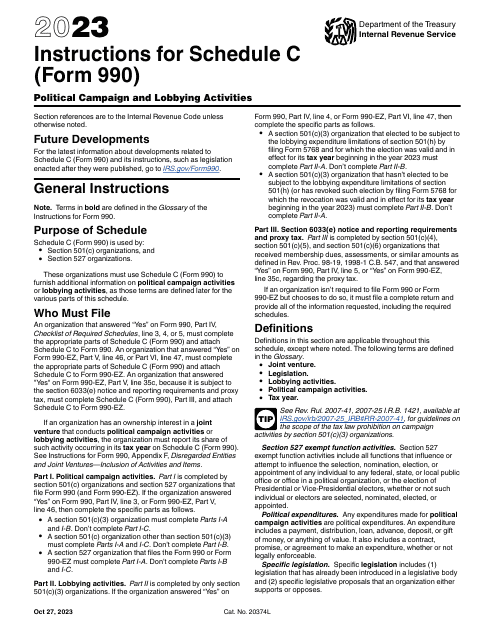

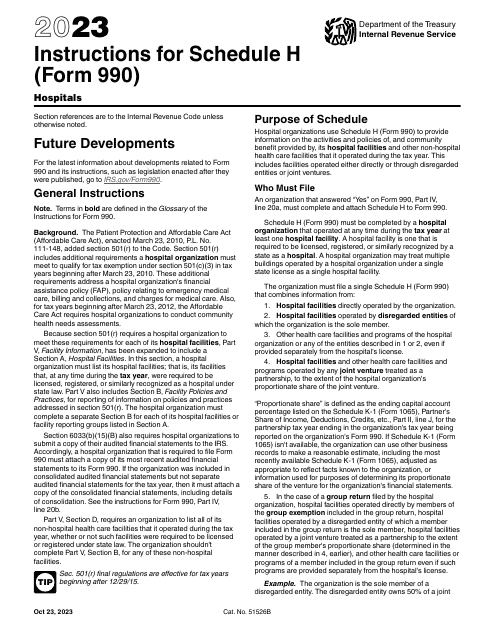

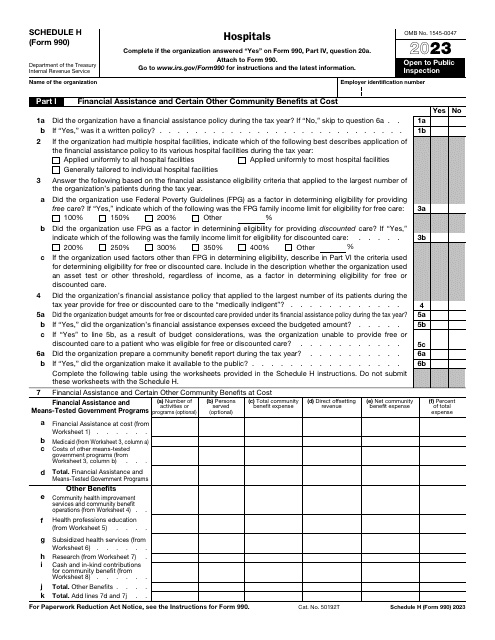

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.

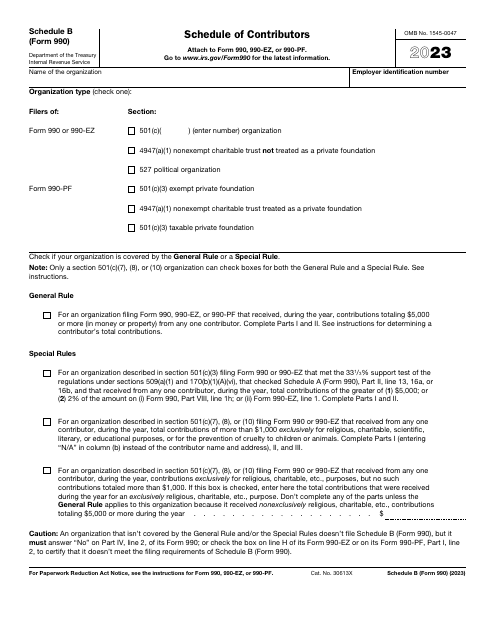

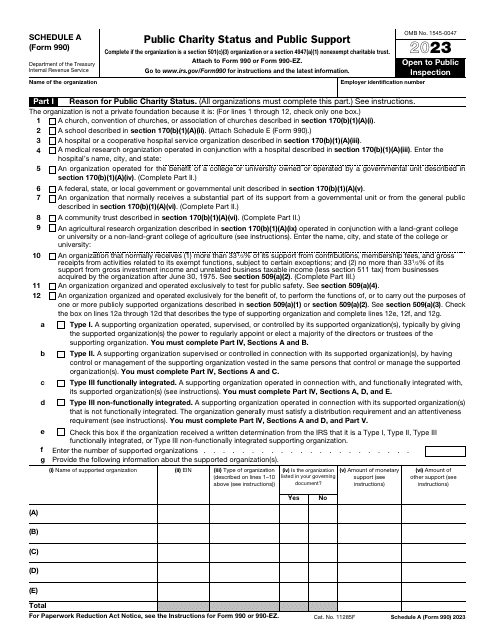

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

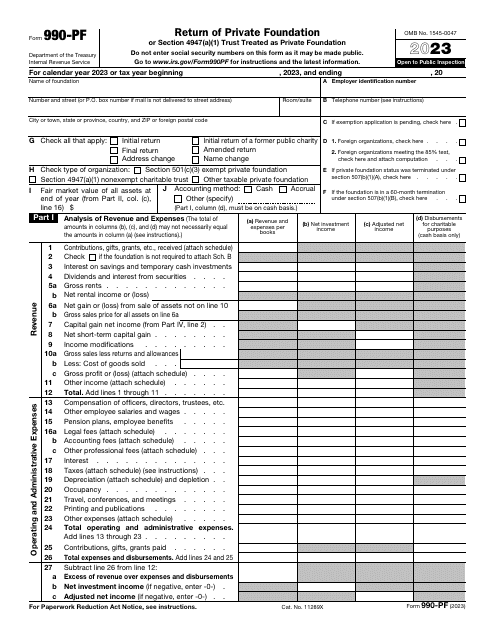

This form, also known as the private foundation tax return, can also substitute Form 1041, if a trust has no taxable income. Use this form to calculate the tax on the income from an investment and to report charitable activities and distributions.

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

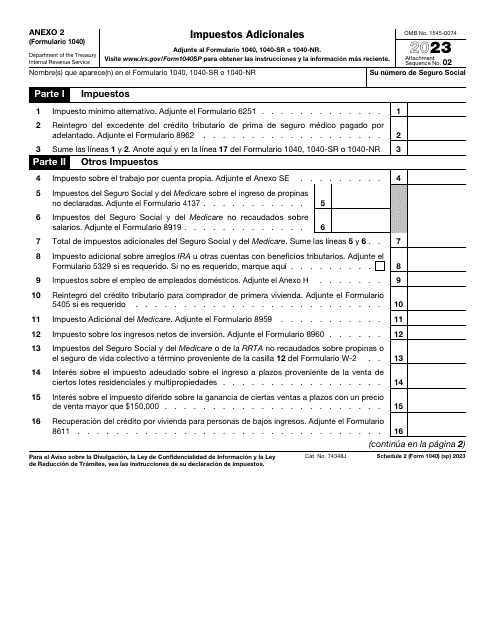

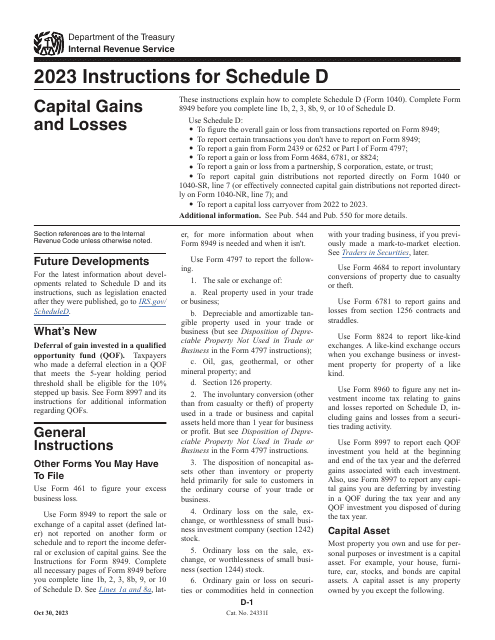

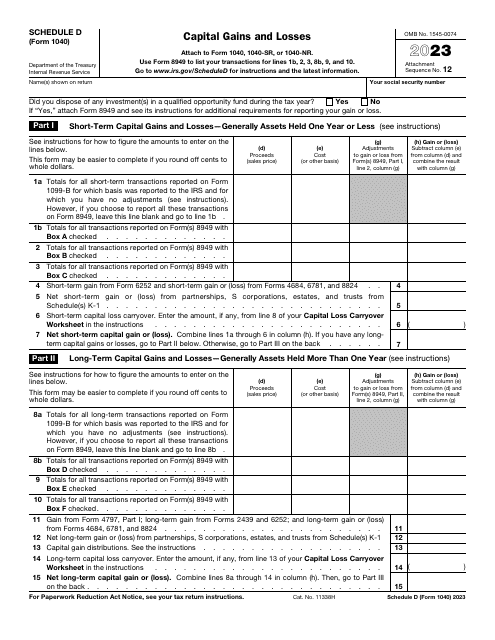

This is a supplementary document taxpayers have to attach to their tax return to outline capital gains and losses that were the result of property sales.

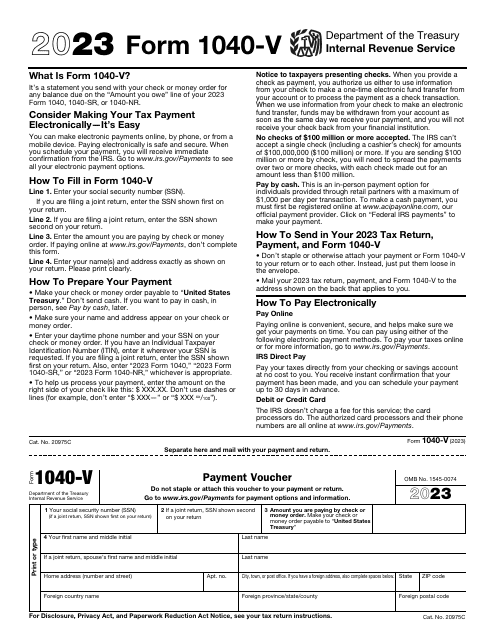

This is a supplementary document completed by taxpayers that chose to fulfill their financial obligations to fiscal organizations with the help of a check or money order.