Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

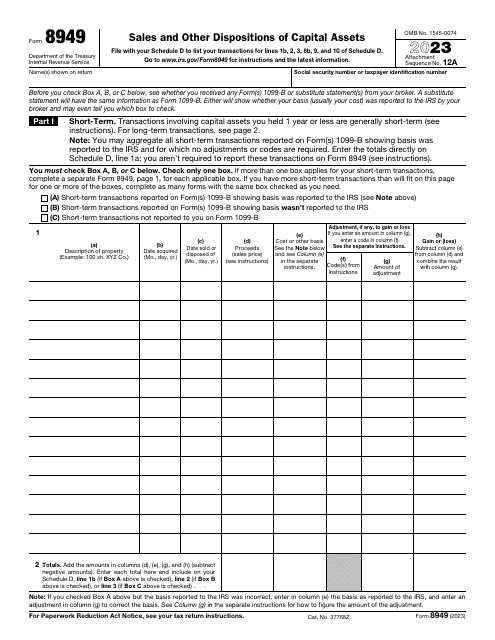

This is a legal document used to report exchanges and sales of capital assets, both long- and short-term capital gains and losses, to the IRS.

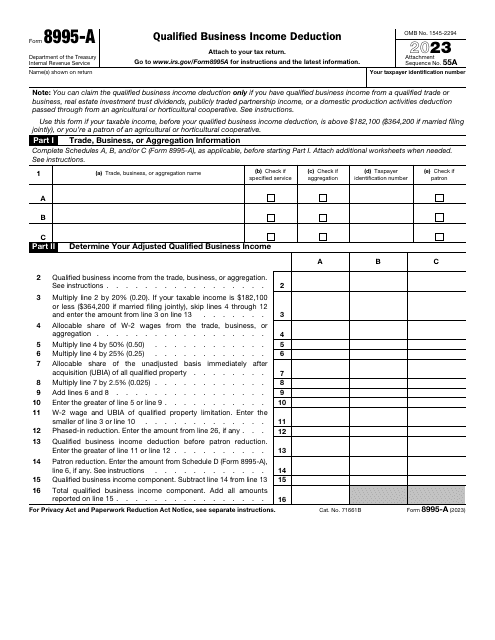

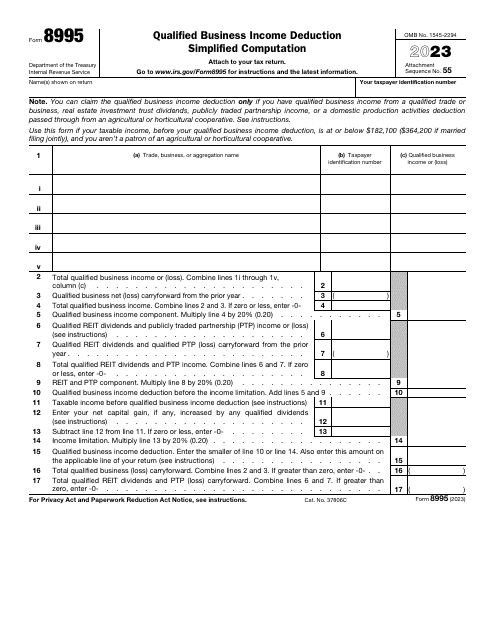

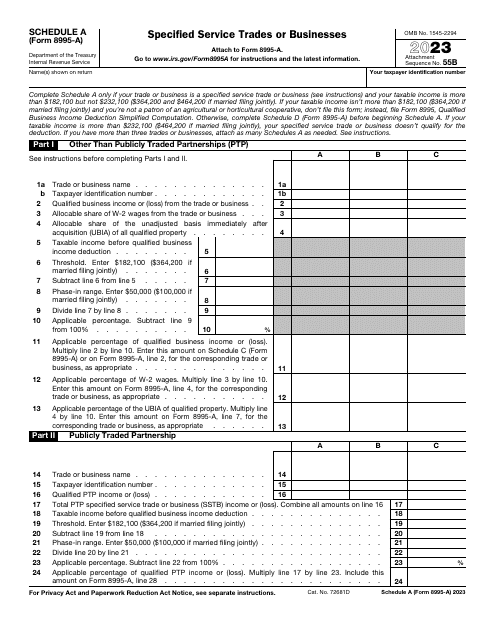

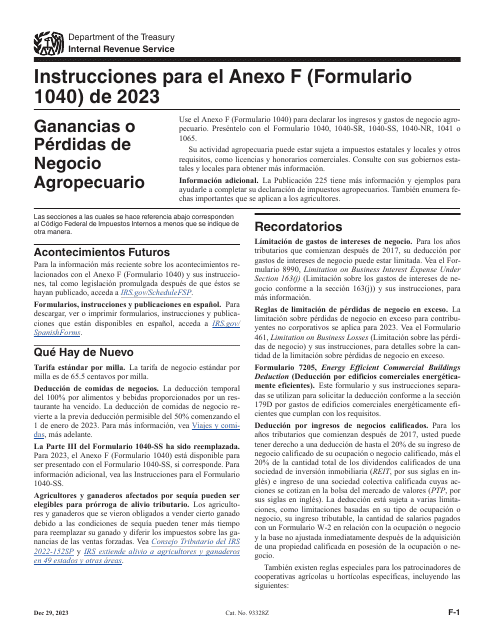

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

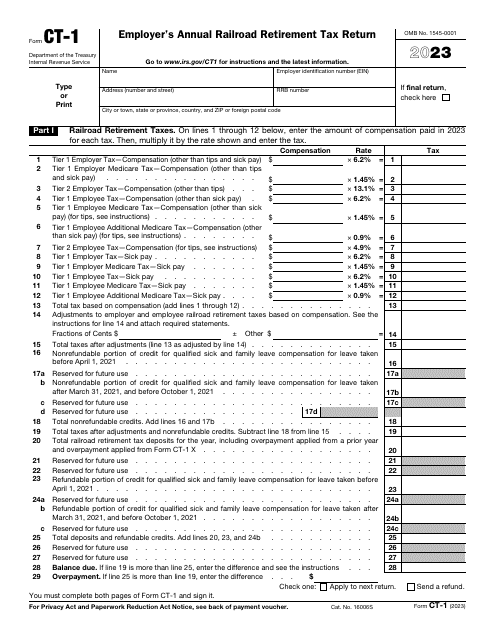

This is a fiscal form railroad industry employers are supposed to fill out in order to report the compensation they paid to their employees if that compensation is taxed in accordance with the Railroad Retirement Tax Act.

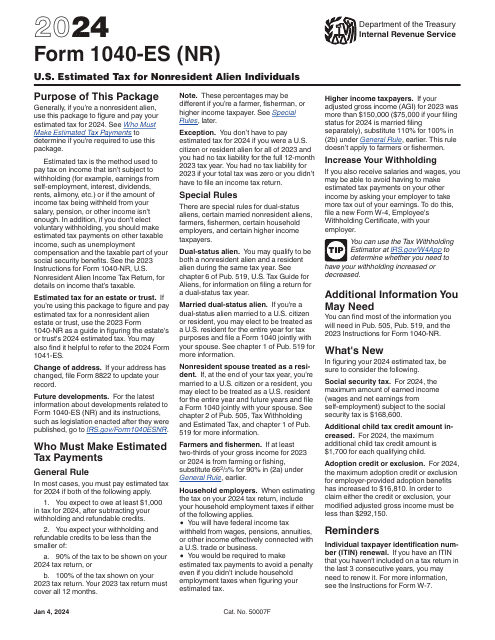

This is a form used to calculate and pay estimated tax on income by nonresident aliens that isn't subject to IRS withholding.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

This is a formal IRS document completed to outline the discount received on particular debt instruments.

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.