Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

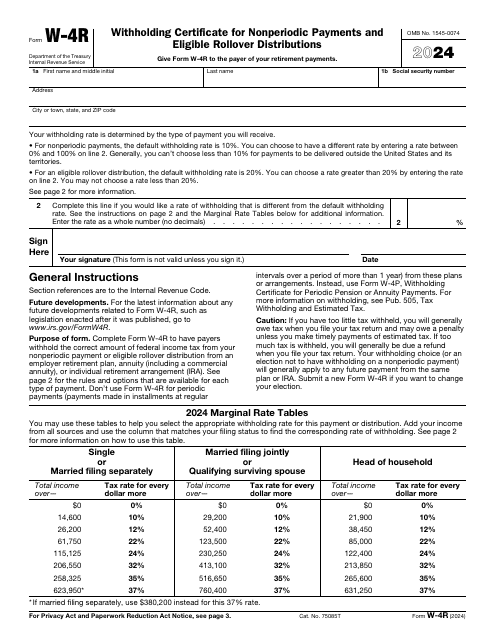

Form W-4R Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions, 2024

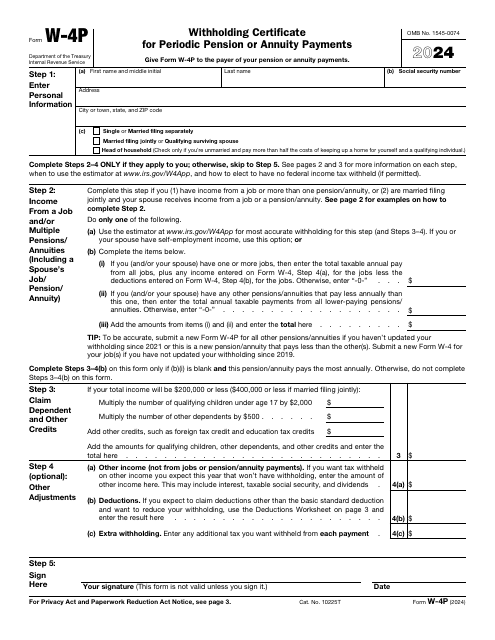

This is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

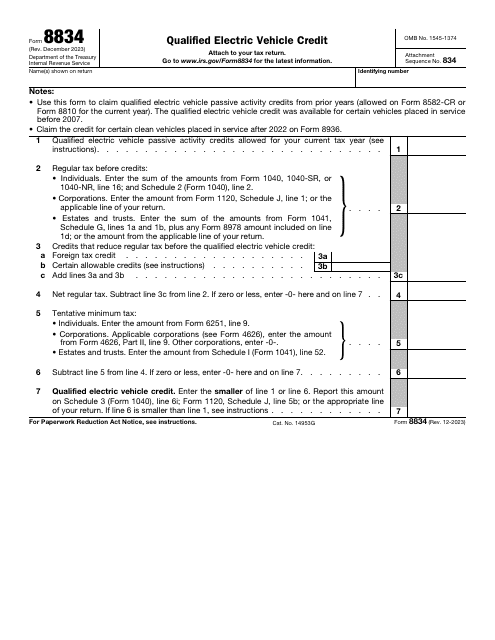

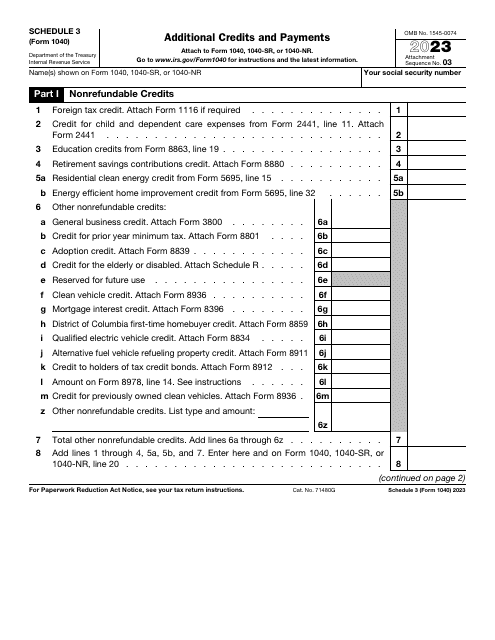

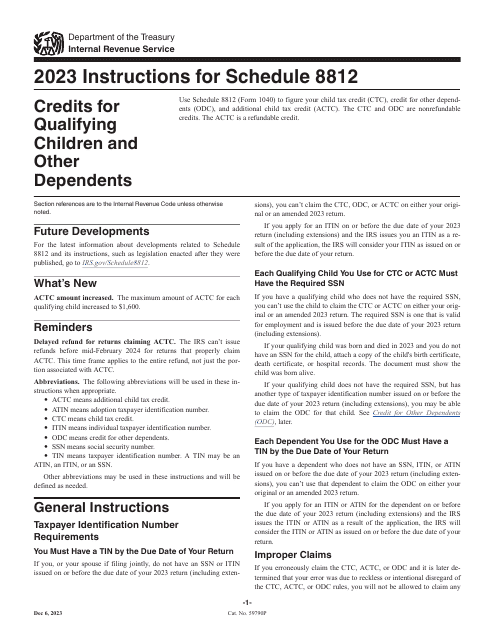

This is a fiscal form that elaborates on payments and credits that may let an individual lower the taxes they would otherwise have to pay in full or add to the amount of tax refund they are claiming.

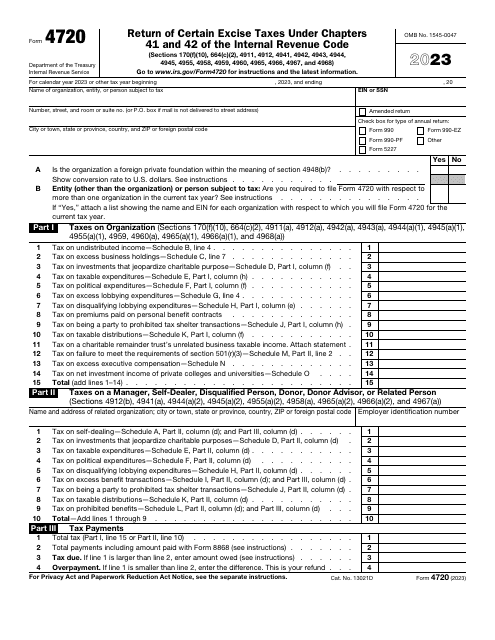

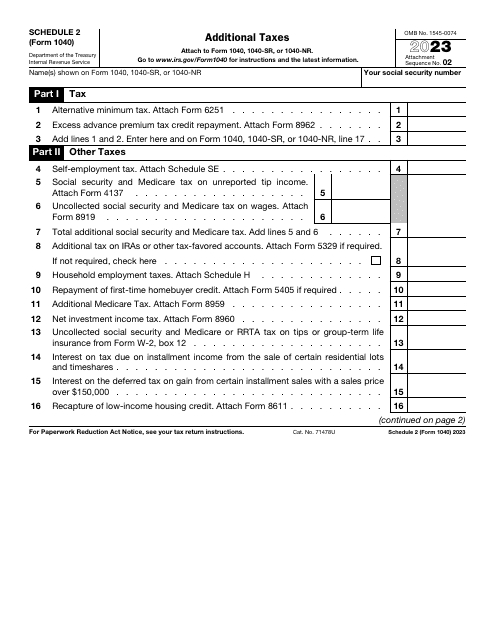

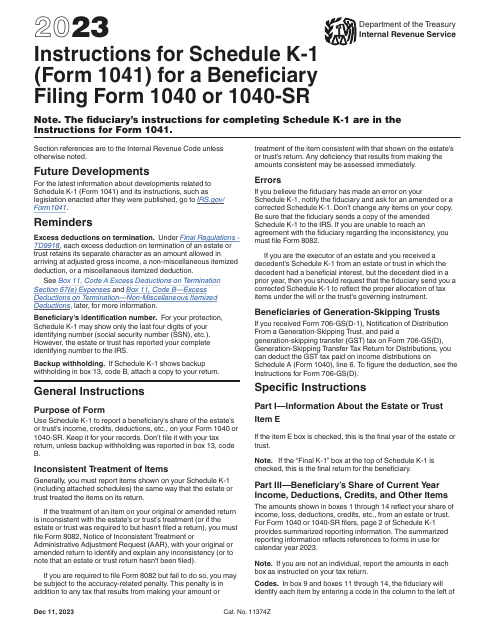

This is a supplementary document designed to allow taxpayers to list taxes they do not outline on the main income statement they are supposed to file annually.

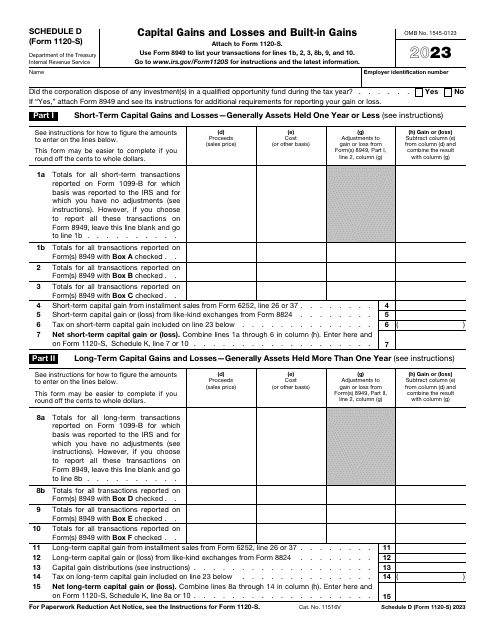

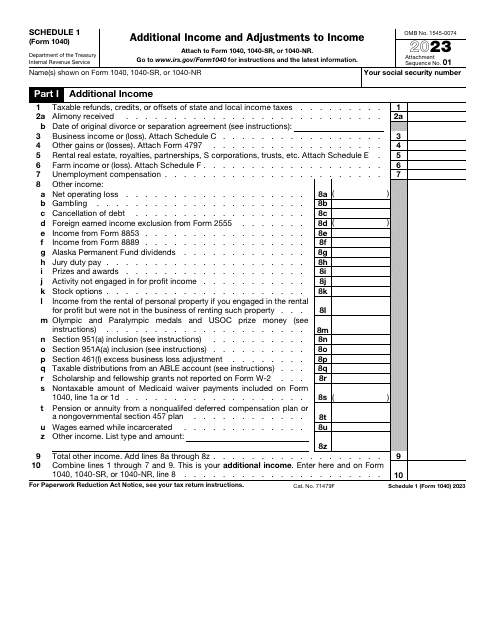

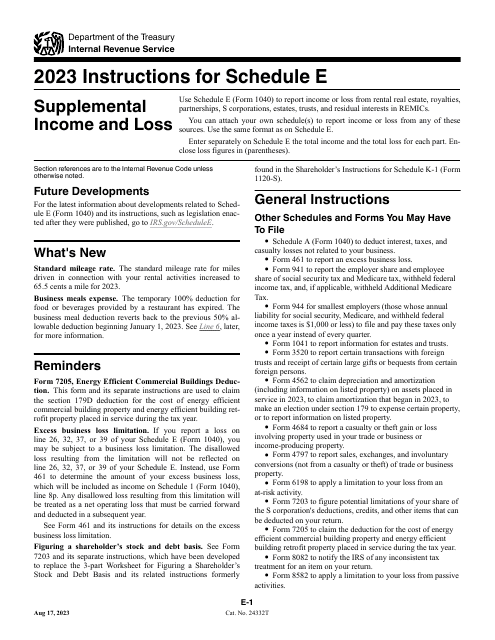

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

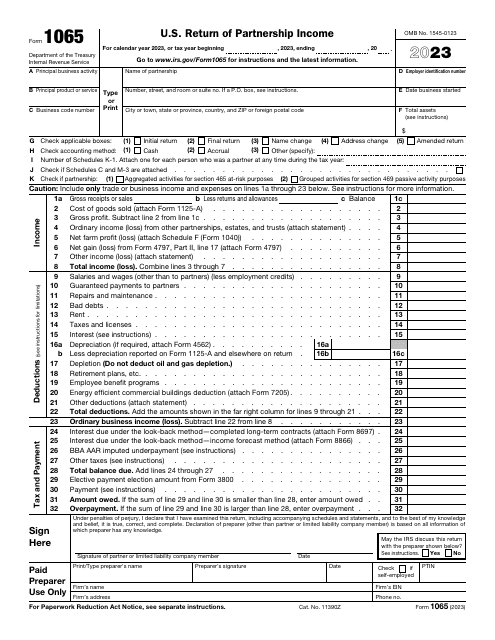

Use this form to report information on deductions, credits, and income relevant to the operation of a partnership to the Internal Revenue Service (IRS).

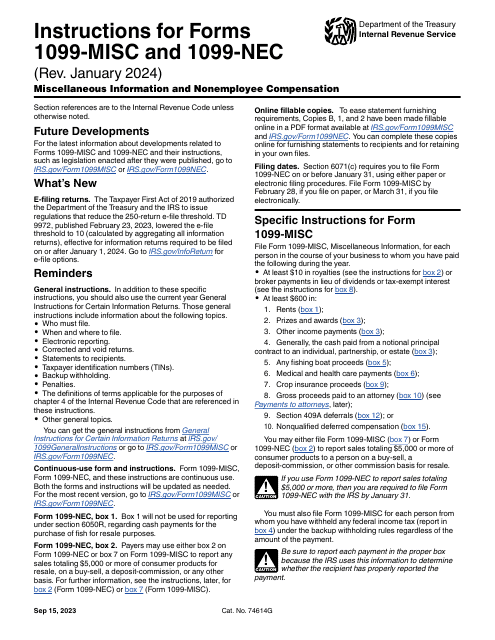

This is a fiscal IRS document business entities have to use to report compensation they have paid to individuals and companies they do not consider their employees.

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.