Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

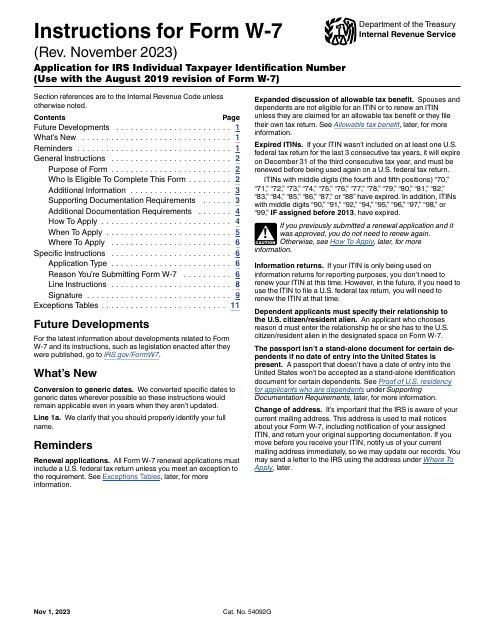

These are the IRS-issued Instructions for the IRS Form W-7, Application for IRS Individual Taxpayer Identification Number - also known as the individual tax identification number application.

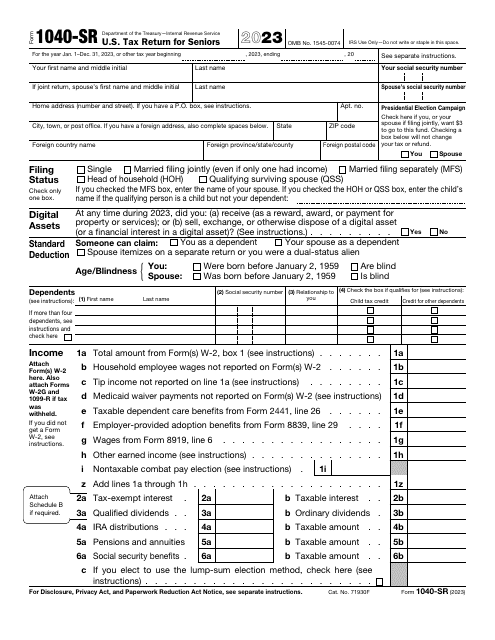

The purpose of this IRS application is to make the process of filing a federal income tax return easier for seniors - the document features larger print, but contains the standard deduction charts.

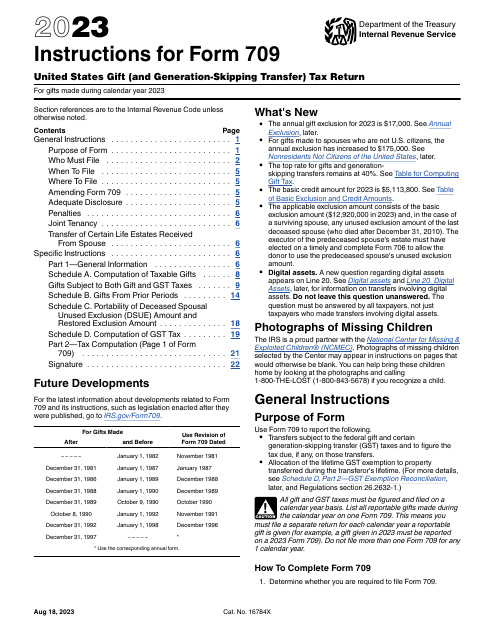

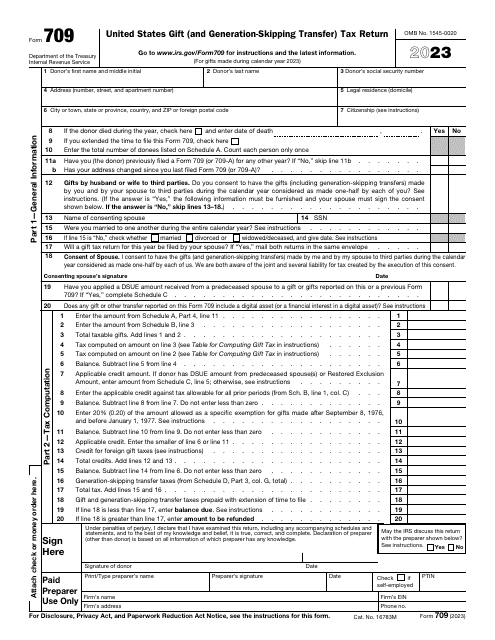

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return, 2023

Instructions for IRS Form 4506-B Request for a Copy of Exempt Organization IRS Application or Letter

This is a formal document used by taxpayers to outline asset transfers that are considered gifts and are subject to tax.

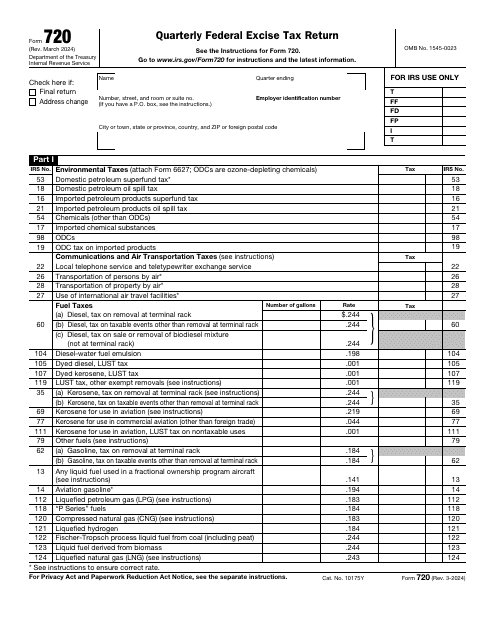

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

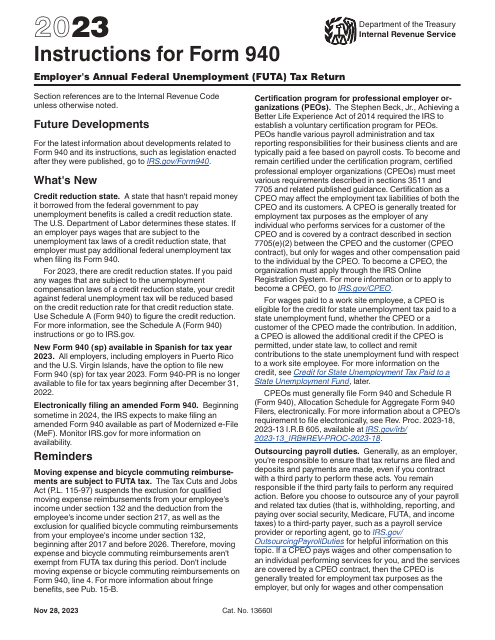

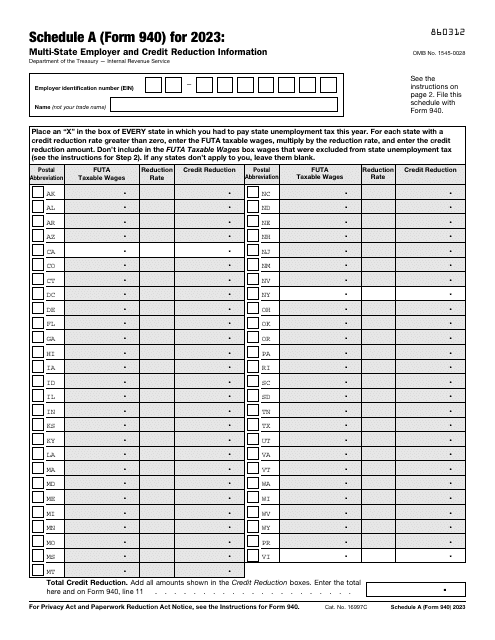

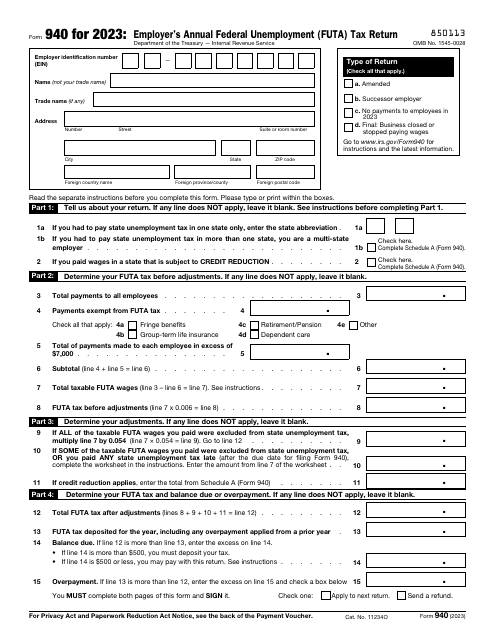

This is a supplementary form used by a taxpayer to figure out their annual federal unemployment tax.

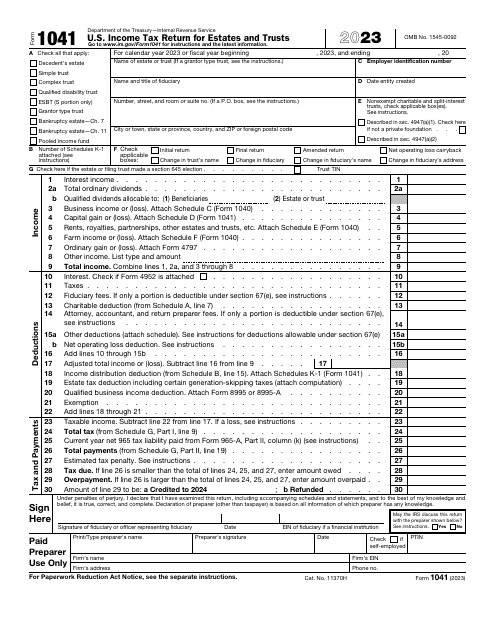

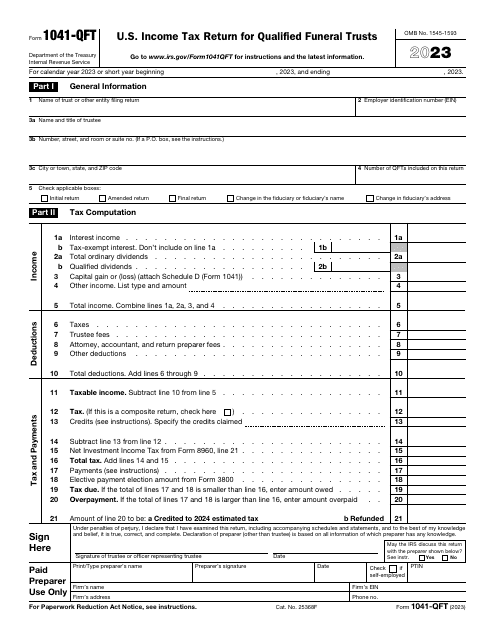

File this document, also known as the Estates and Trusts Tax Return, as an income tax return to the Internal Revenue Service (IRS) if you are a fiduciary of a bankruptcy estate, domestic decedent's estate, or a trust.

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

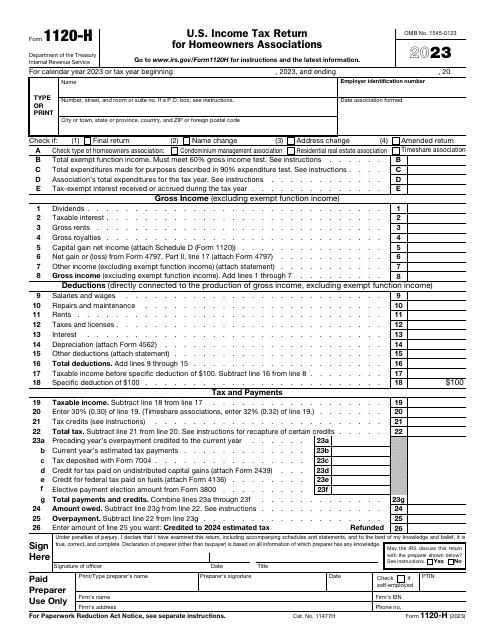

Fill out this form if you represent a homeowner's association in order to make use of certain tax benefits. That means, that the association can exclude the Exempt Function Income from its gross income.

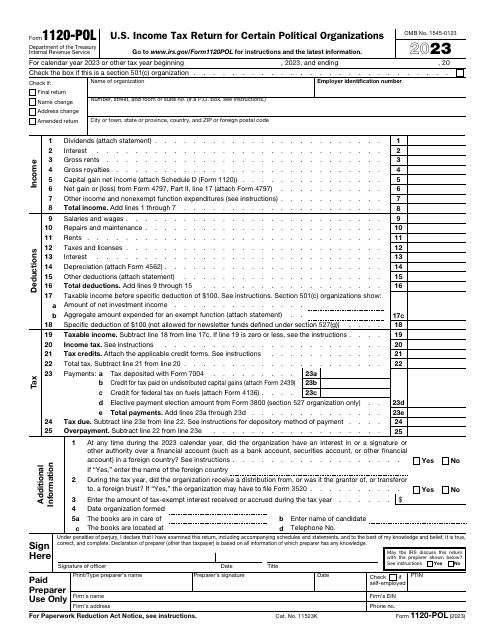

Use this form to inform the Internal Revenue Service (IRS) about the taxable income of your political organization, as well as about your tax liability according to Section 527.

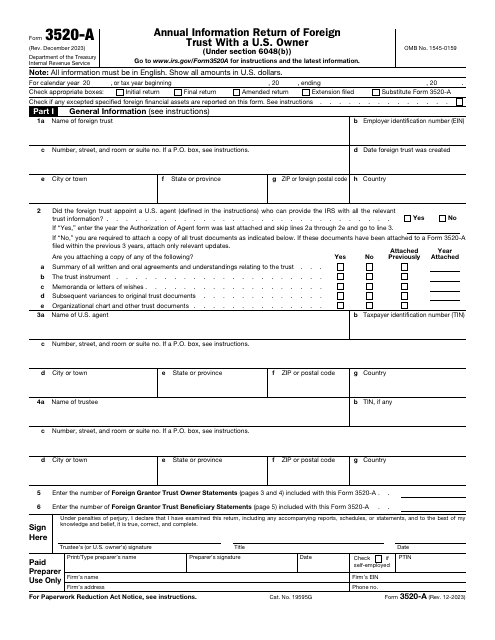

This document is submitted to the Internal Revenue Service (IRS) annually by foreign trusts with a U.S. owner to inform the IRS about the trust, its American beneficiaries, and any U.S. trust owner.

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

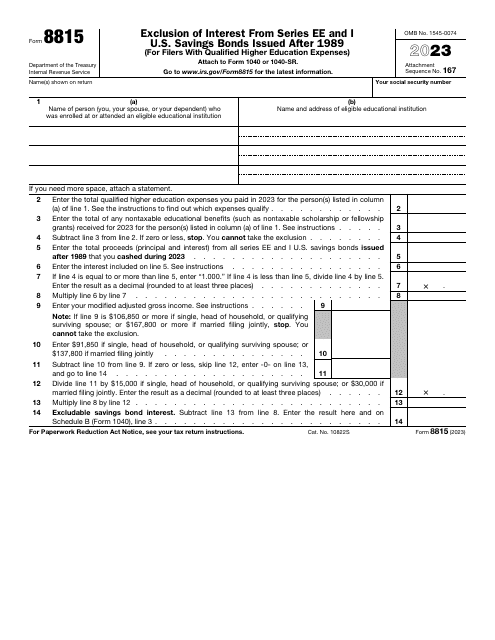

This is a fiscal document used by individual taxpayers to exclude the specific bond interest from their income.