This version of the form is not currently in use and is provided for reference only. Download this version of

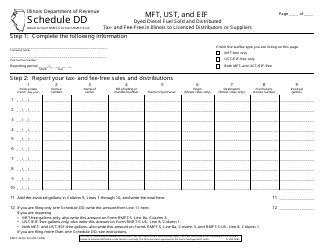

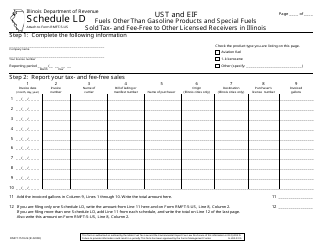

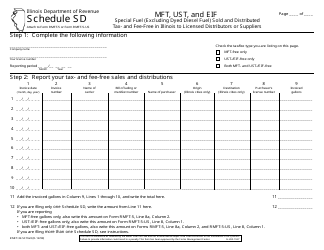

Instructions for Form RMFT-32 Schedule D

for the current year.

Instructions for Form RMFT-32 Schedule D Mft, Ust, and Eif Gasoline Products Sold and Distributed Tax- and Fee-Free in Illinois to Licensed Distributors and Receivers - Illinois

This document contains official instructions for Form RMFT-32 Schedule D, Mft, Ust, and Eif Licensed Distributors and Receivers - a form released and collected by the Illinois Department of Revenue.

FAQ

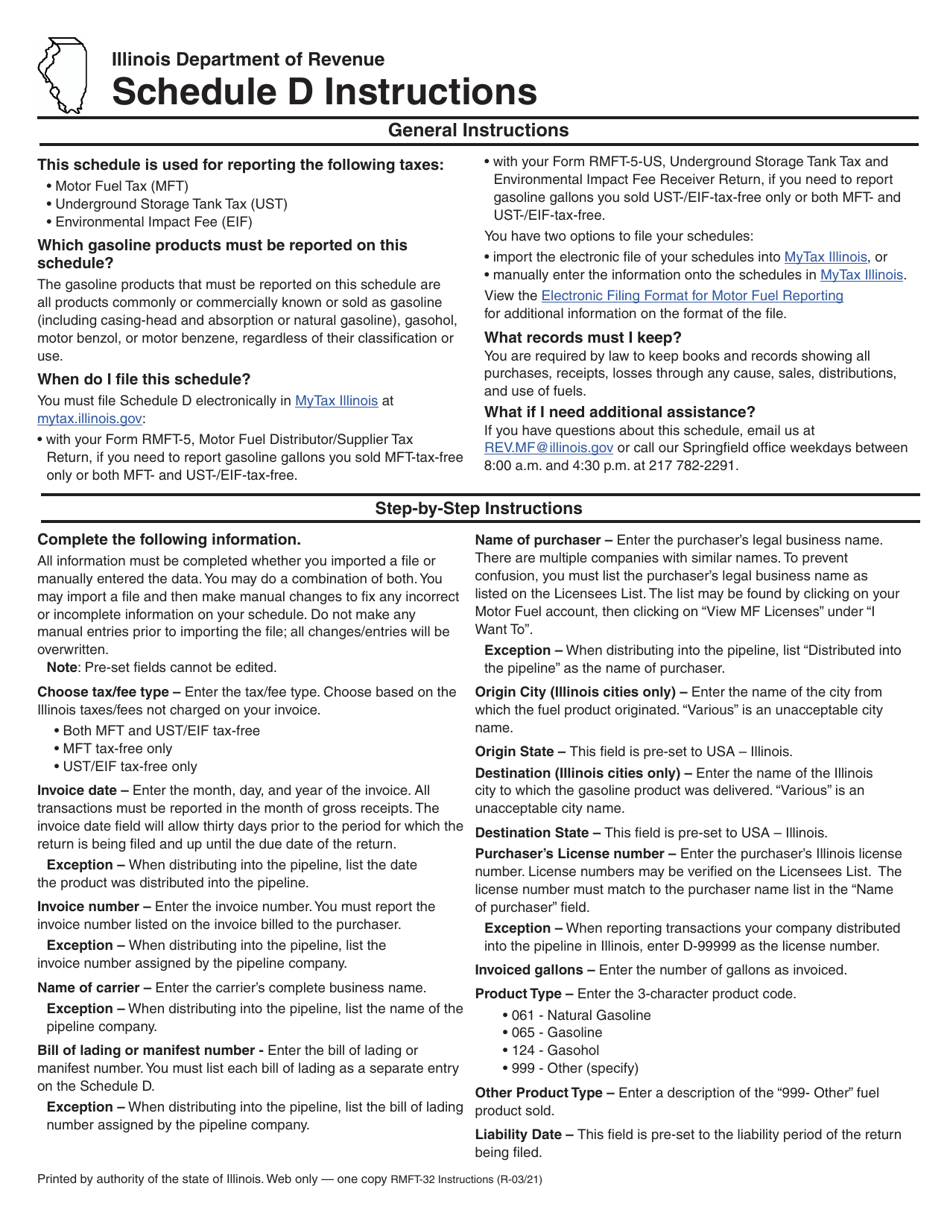

Q: What is Form RMFT-32?

A: Form RMFT-32 is a schedule that needs to be filled out for reporting the sale and distribution of tax- and fee-free gasoline products in Illinois.

Q: Who should fill out Form RMFT-32?

A: Licensed distributors and receivers who sell and distribute tax- and fee-free gasoline products in Illinois should fill out Form RMFT-32.

Q: What information is required on Form RMFT-32?

A: Form RMFT-32 requires information such as the name and address of the distributor or receiver, the date of sale, the quantity of gasoline products sold, the tax-and fee-free status of the products, and more.

Q: Is there a deadline for filing Form RMFT-32?

A: Yes, Form RMFT-32 must be filed on a monthly basis, and the deadline for filing is the 20th of the following month.

Q: Are there any penalties for late filing of Form RMFT-32?

A: Yes, there are penalties for late filing of Form RMFT-32, including monetary penalties and potential suspension or revocation of licenses.

Instruction Details:

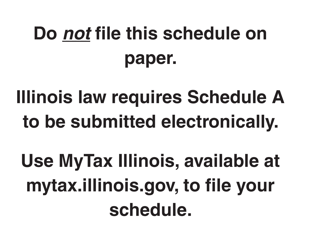

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.