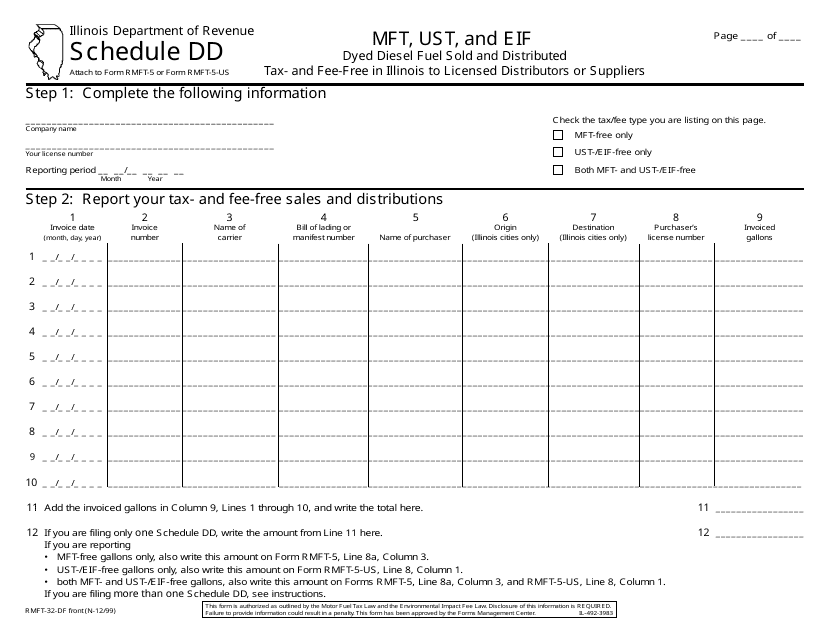

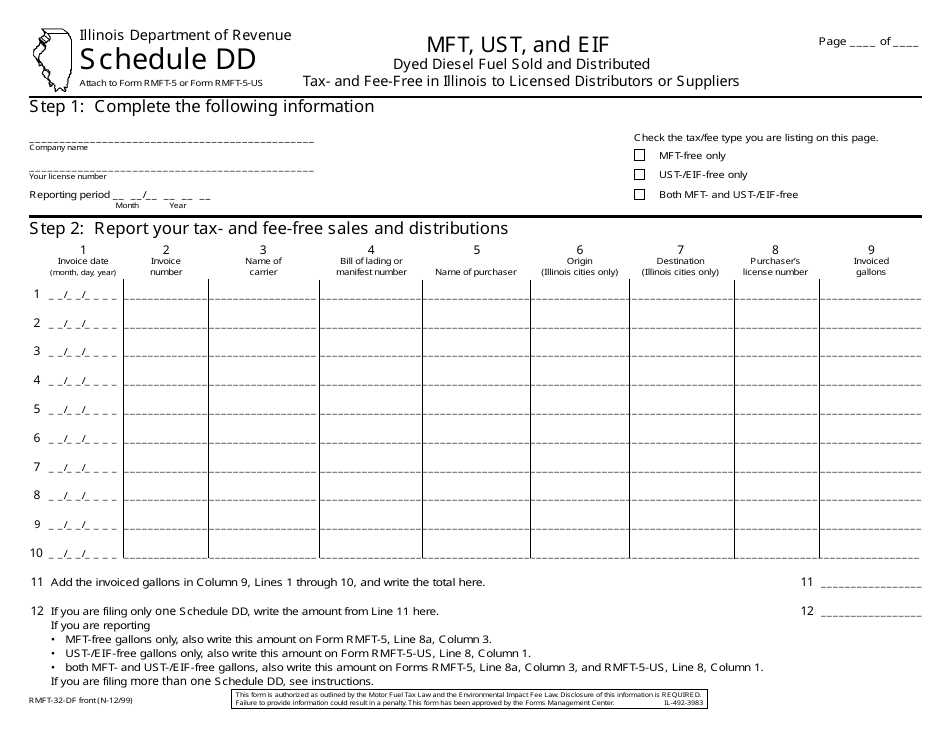

Form RMFT-32-DF Schedule DD Mft, Ust, and Eif Dyed Diesel Fuel Sold and Distributed Tax- and Fee-Free in Illinois to Licensed Distributors or Suppliers - Illinois

What Is Form RMFT-32-DF Schedule DD?

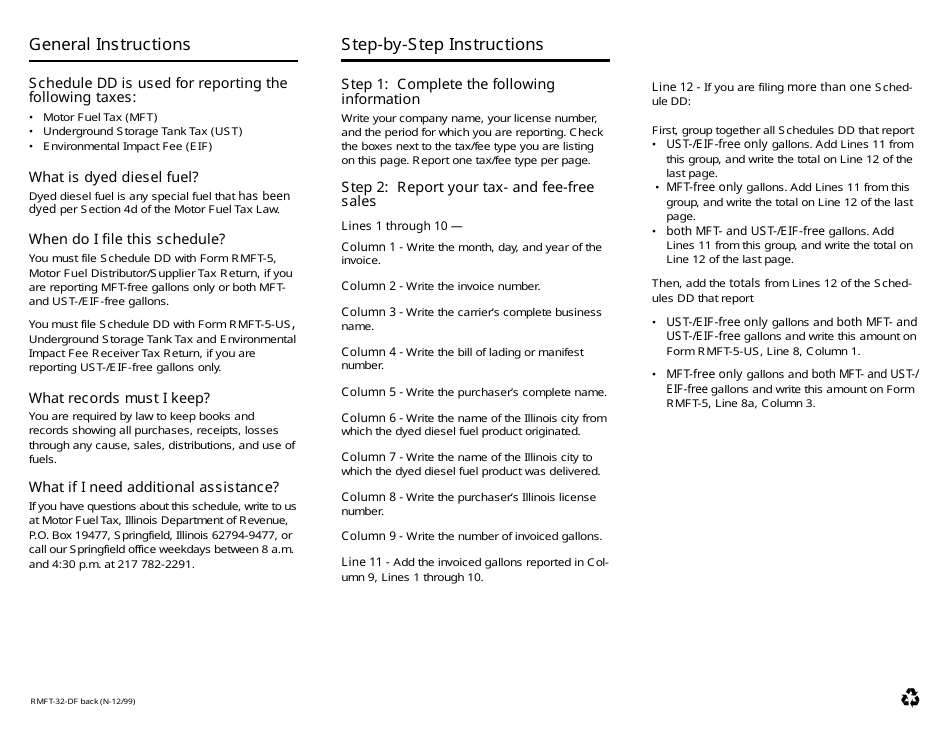

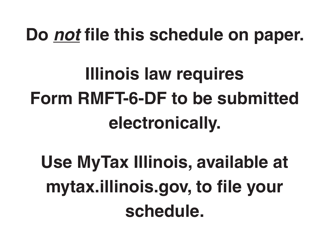

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RMFT-32-DF Schedule DD?

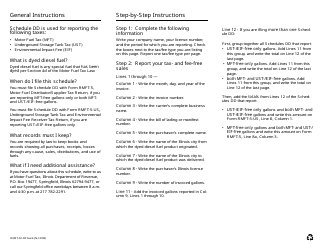

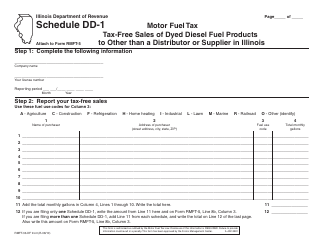

A: RMFT-32-DF Schedule DD is a reporting form used in Illinois to report the sale and distribution of tax- and fee-free dyed diesel fuel.

Q: Who needs to file RMFT-32-DF Schedule DD?

A: Licensed distributors or suppliers who sell and distribute tax- and fee-free dyed diesel fuel in Illinois need to file RMFT-32-DF Schedule DD.

Q: What kind of diesel fuel does RMFT-32-DF Schedule DD apply to?

A: RMFT-32-DF Schedule DD applies to dyed diesel fuel that is sold and distributed tax- and fee-free.

Q: Is RMFT-32-DF Schedule DD specific to Illinois?

A: Yes, RMFT-32-DF Schedule DD is specific to Illinois and is used to report dyed diesel fuel sales and distribution in the state.

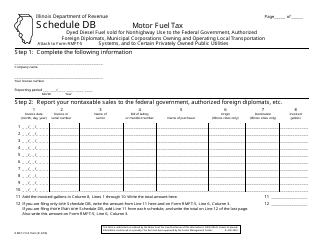

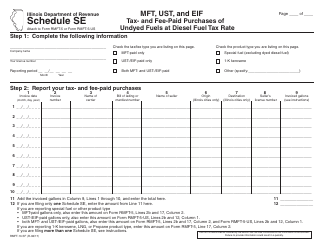

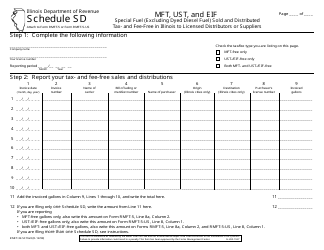

Q: What information is required to be reported on RMFT-32-DF Schedule DD?

A: RMFT-32-DF Schedule DD requires information on the quantity and destination of dyed diesel fuel sales and distribution, as well as other related information.

Q: What are the penalties for not filing RMFT-32-DF Schedule DD?

A: Failure to file RMFT-32-DF Schedule DD can result in penalties, including fines and potential legal action by the state government.

Form Details:

- Released on December 1, 1999;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-32-DF Schedule DD by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.