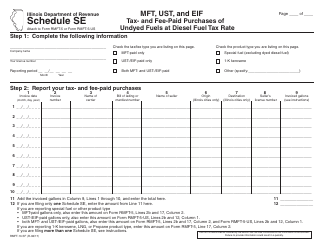

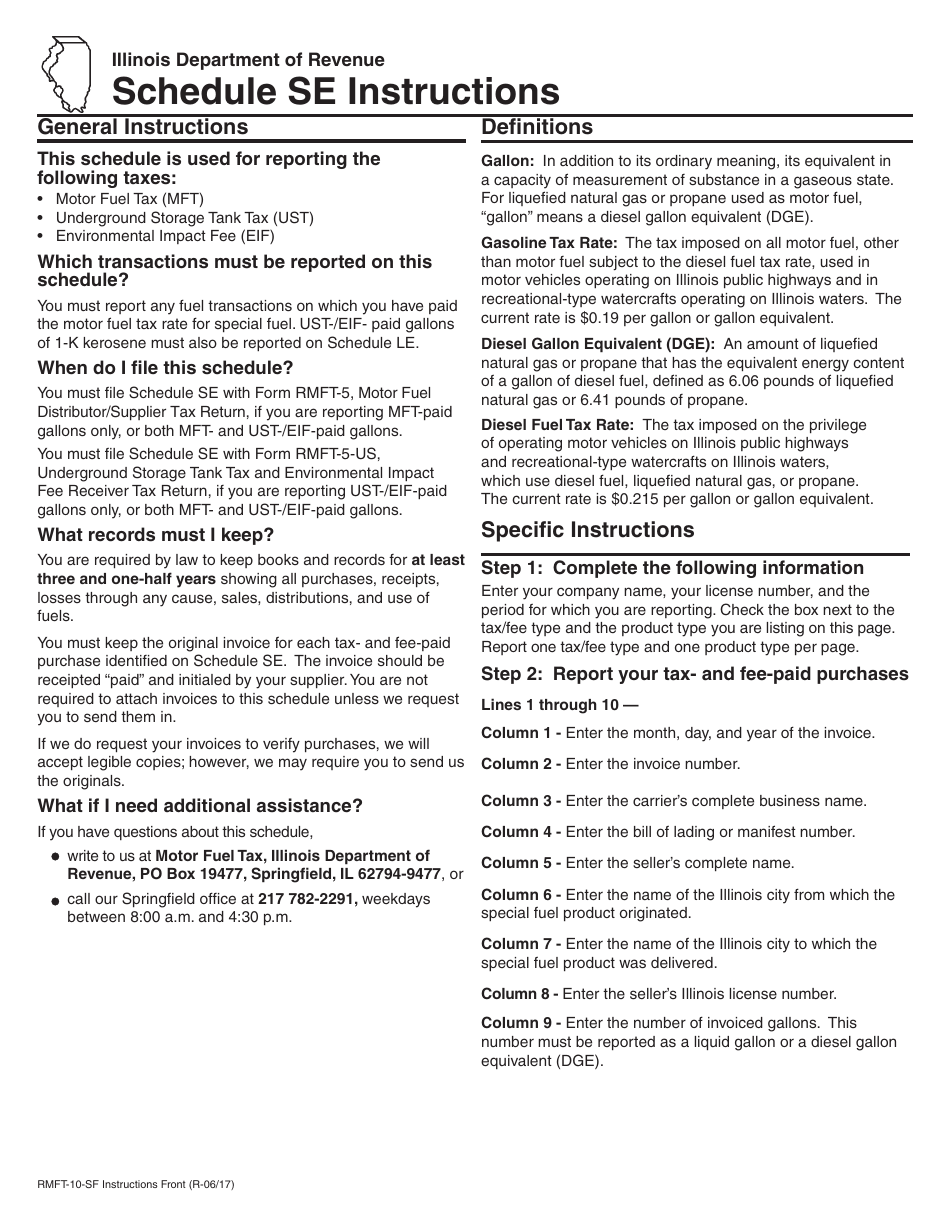

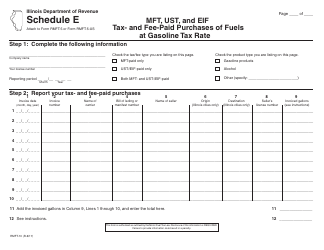

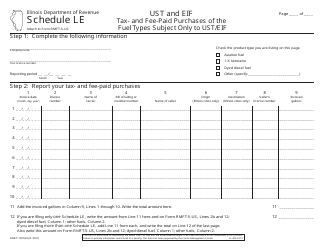

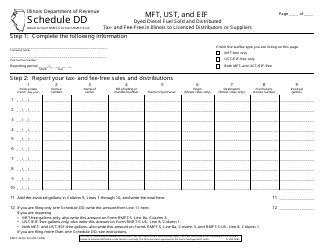

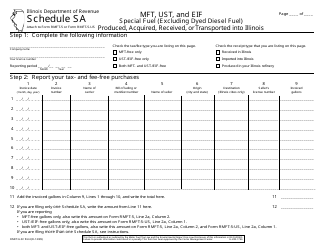

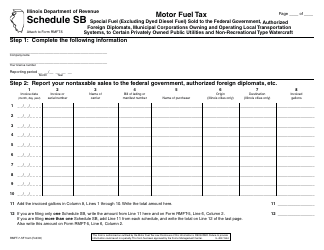

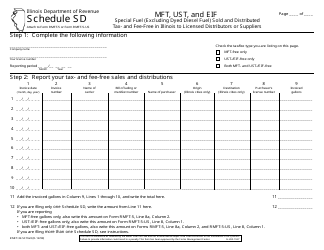

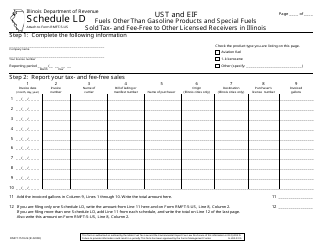

Instructions for Form RMFT-10-SF Schedule SE Mft, Ust, and Eif Tax- and Fee-Paid Purchases of Undyed Fuels at Diesel Fuel Tax Rate - Illinois

This document contains official instructions for Form RMFT-10-SF Schedule SE, Mft, Ust, and Eif Tax- and Fee-Paid Purchases of Undyed Fuels at Diesel Fuel Tax Rate - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form RMFT-10-SF Schedule SE is available for download through this link.

FAQ

Q: What is Form RMFT-10-SF?

A: Form RMFT-10-SF is a form used in Illinois to report tax- and fee-paid purchases of undyed fuels at the diesel fueltax rate.

Q: What is Schedule SE Mft, Ust, and Eif?

A: Schedule SE Mft, Ust, and Eif is a schedule that is part of Form RMFT-10-SF. It is used to provide detailed information about tax- and fee-paid purchases of undyed fuels at the diesel fuel tax rate.

Q: Who needs to file Form RMFT-10-SF?

A: Businesses or individuals who have made tax- and fee-paid purchases of undyed fuels at the diesel fuel tax rate in Illinois must file Form RMFT-10-SF.

Q: What information is required on Form RMFT-10-SF?

A: Form RMFT-10-SF requires you to provide details about the tax- and fee-paid purchases of undyed fuels, including the date of purchase, the supplier, the quantity purchased, and the amount of tax paid.

Q: When is the deadline to file Form RMFT-10-SF?

A: The deadline to file Form RMFT-10-SF is typically the last day of the month following the end of the reporting period. However, it is recommended to check the current year's instructions or consult with the Illinois Department of Revenue for the specific deadline.

Q: Are there any penalties for not filing Form RMFT-10-SF?

A: Yes, failure to file Form RMFT-10-SF or filing it late can result in penalties and interest charges.

Q: Do I need to keep a copy of Form RMFT-10-SF for my records?

A: Yes, it is recommended to keep a copy of Form RMFT-10-SF and any supporting documentation for your records in case of future audits or inquiries.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.