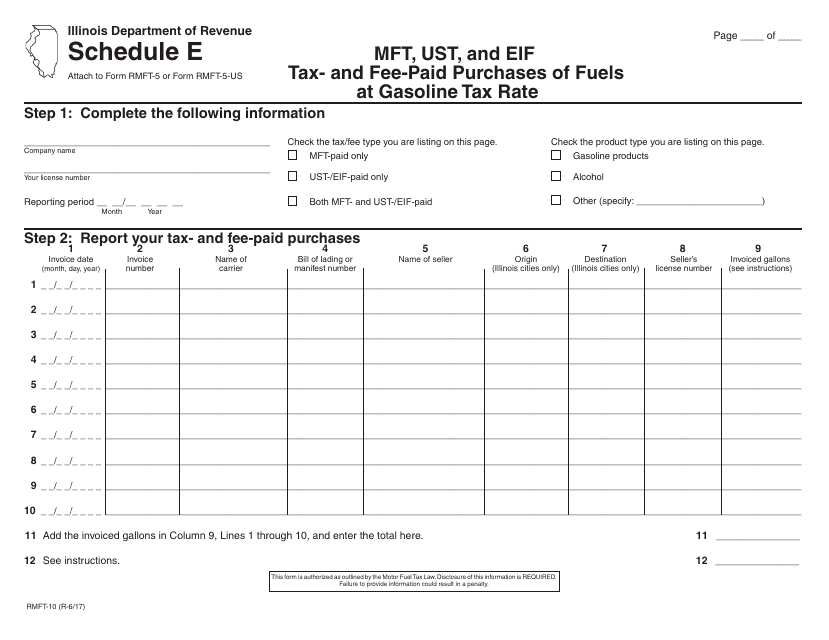

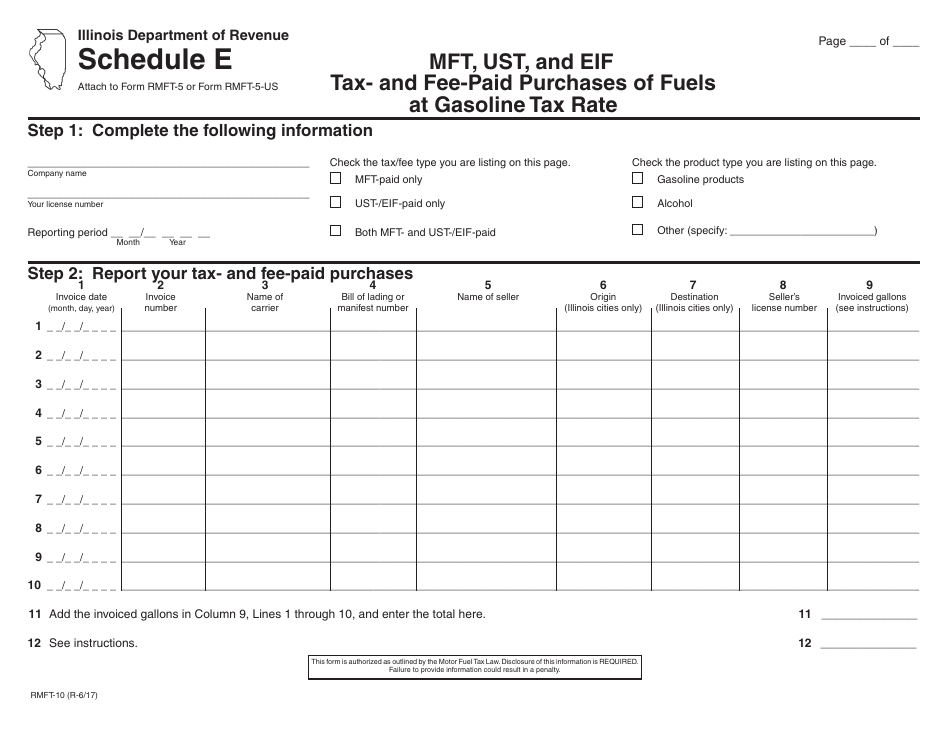

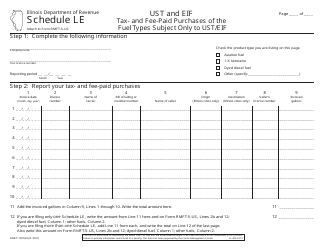

Form RMFT-10 Schedule E Mft, Ust, and Eif Tax- and Fee-Paid Purchases of Fuels at Gasoline Tax Rate - Illinois

What Is Form RMFT-10 Schedule E?

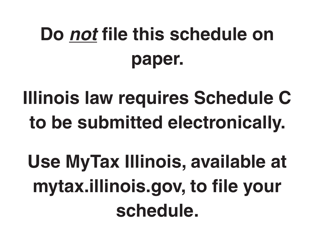

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

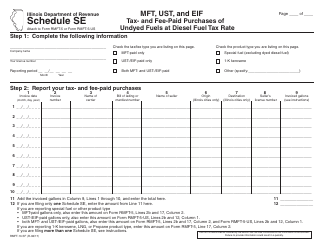

Q: What is Form RMFT-10 Schedule E?

A: Form RMFT-10 Schedule E is a tax form used in Illinois to report tax- and fee-paid purchases of fuels at the gasoline tax rate.

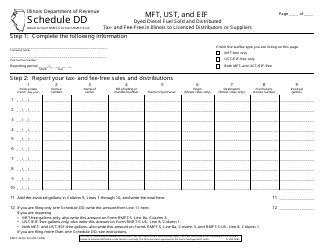

Q: What does Mft, Ust, and Eif stand for?

A: Mft stands for Motor Fuel Tax, Ust stands for Underground Storage Tank fee, and Eif stands for Environmental Impact Fee.

Q: Who needs to use Form RMFT-10 Schedule E?

A: This form is required for businesses and individuals who have made tax- and fee-paid purchases of fuels at the gasoline tax rate in Illinois.

Q: What information is required on Form RMFT-10 Schedule E?

A: The form requires you to provide details about the tax- and fee-paid purchases of fuels, including the type and quantity of fuel purchased.

Q: When is the deadline for filing Form RMFT-10 Schedule E?

A: The deadline for filing Form RMFT-10 Schedule E is the last day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form RMFT-10 Schedule E?

A: Yes, there are penalties for late filing, which may include interest charges and fines.

Q: Are there any exemptions or deductions available on Form RMFT-10 Schedule E?

A: Yes, there are certain exemptions and deductions available, depending on the nature of the purchase.

Q: Who should I contact if I have questions about Form RMFT-10 Schedule E?

A: If you have questions about Form RMFT-10 Schedule E, you should contact the Illinois Department of Revenue or consult a tax professional.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

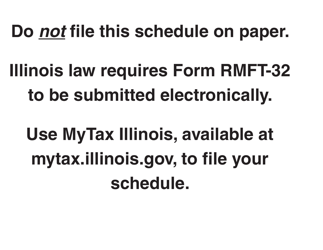

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-10 Schedule E by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.