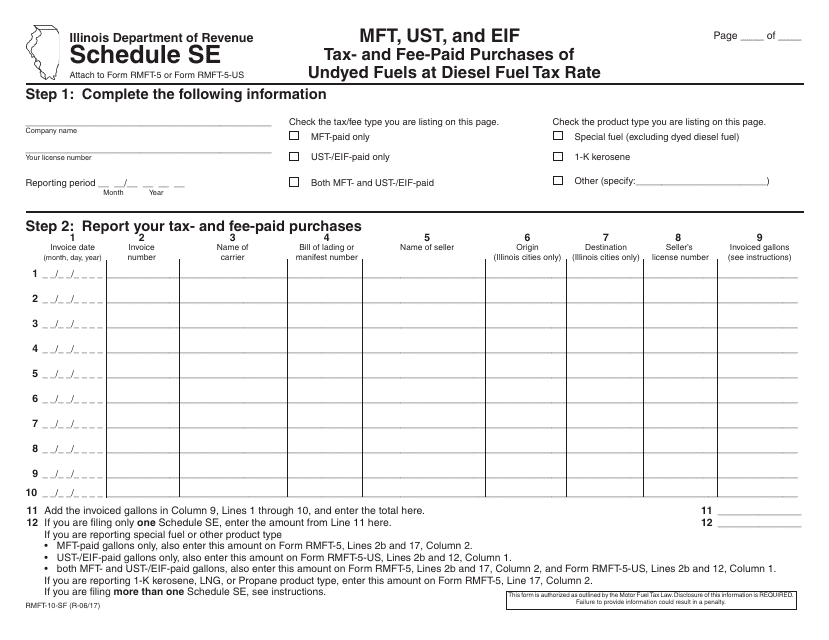

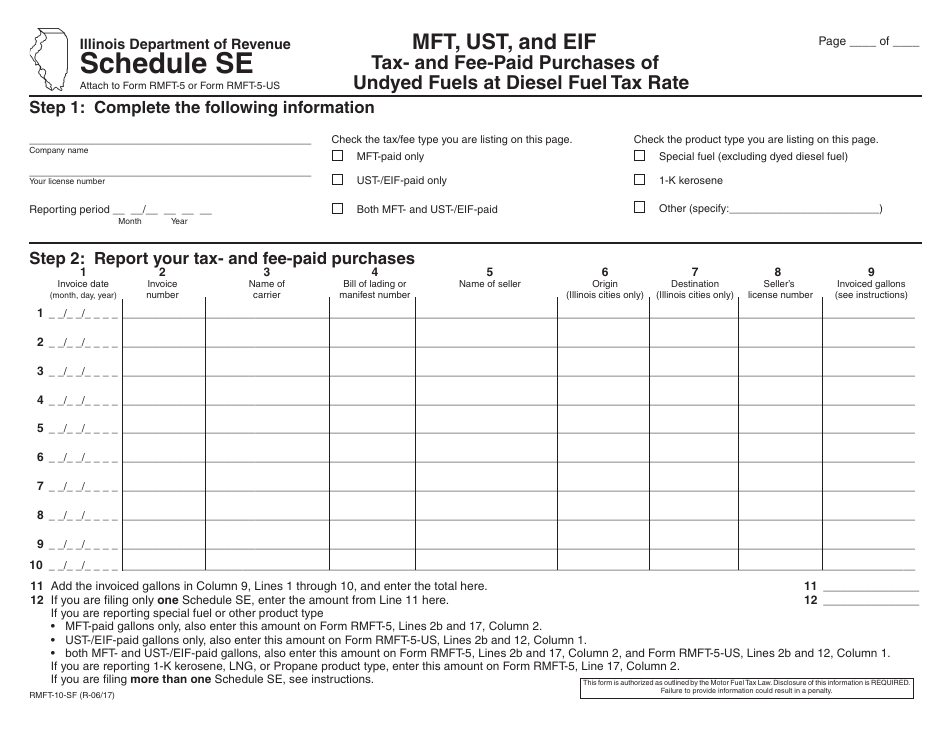

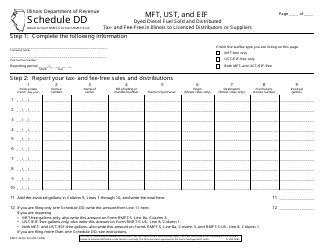

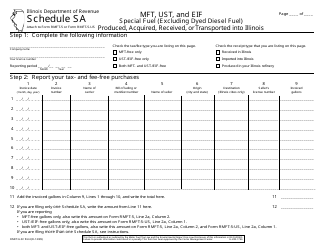

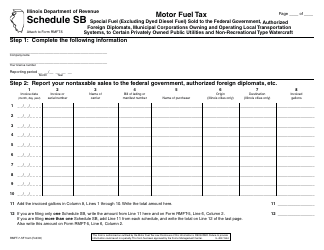

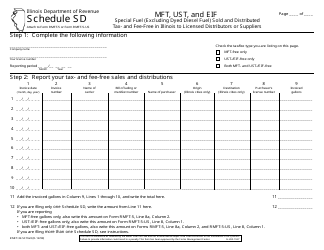

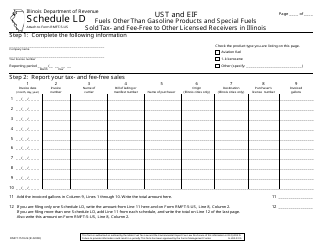

Form RMFT-10-SF Schedule SE Mft, Ust, and Eif Tax- and Fee-Paid Purchases of Undyed Fuels at Diesel Fuel Tax Rate - Illinois

What Is Form RMFT-10-SF Schedule SE?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RMFT-10-SF?

A: Form RMFT-10-SF is a tax form used in Illinois to report the purchases of undyed fuels at the diesel fuel tax rate.

Q: What does RMFT stand for?

A: RMFT stands for Revenue Making Fuel Tax.

Q: What is Schedule SE Mft, Ust, and Eif?

A: Schedule SE Mft, Ust, and Eif is a section of Form RMFT-10-SF that requires reporting of tax- and fee-paid purchases of undyed fuels.

Q: What are undyed fuels?

A: Undyed fuels are fuels that do not contain any coloring agents or dyes.

Q: What is the diesel fueltax rate in Illinois?

A: The diesel fuel tax rate in Illinois is the tax rate applied to the purchase of diesel fuel.

Q: Why do I need to report tax- and fee-paid purchases of undyed fuels?

A: Reporting these purchases helps the state track and collect appropriate taxes and fees related to fuel.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-10-SF Schedule SE by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.