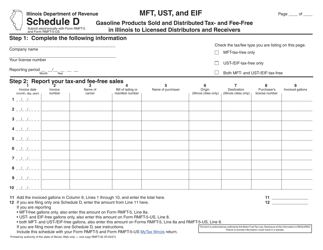

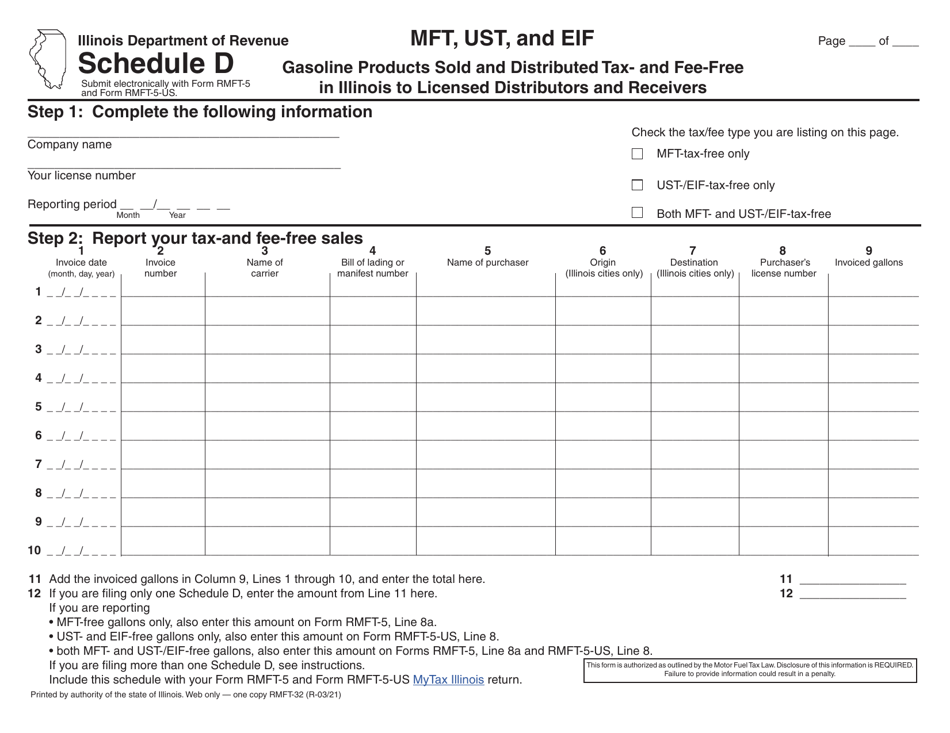

Schedule D Mft, Ust, and Eif Gasoline Products Sold and Distributed Tax- and Fee-Free in Illinois to Licensed Distributors and Receivers - Illinois

What Is Schedule D?

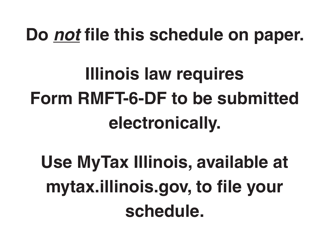

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule D?

A: Schedule D is a tax form used to report the sale and distribution of gasoline products in Illinois.

Q: What does Mft stand for?

A: Mft stands for motor fuel tax.

Q: What does Ust stand for?

A: Ust stands for underground storage tank.

Q: What does Eif stand for?

A: Eif stands for environmental impact fee.

Q: Who is eligible for tax- and fee-free gasoline products in Illinois?

A: Licensed distributors and receivers in Illinois are eligible for tax- and fee-free gasoline products.

Q: What is the purpose of Schedule D?

A: The purpose of Schedule D is to track and document tax- and fee-free gasoline products sold and distributed in Illinois.

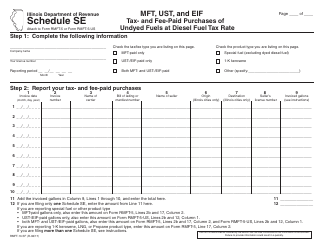

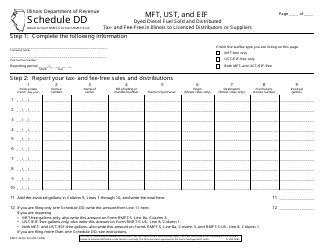

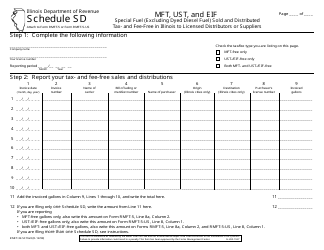

Q: How do I fill out Schedule D?

A: You need to provide detailed information about the quantity and type of gasoline products sold and distributed, along with the names of licensed distributors and receivers.

Q: Are tax- and fee-free gasoline products common in Illinois?

A: Yes, tax- and fee-free gasoline products are commonly distributed to licensed distributors and receivers in Illinois.

Q: What taxes and fees are exempted on the gasoline products in Illinois?

A: The motor fuel tax and environmental impact fee are exempted on the gasoline products sold and distributed in Illinois.

Q: Are other states offering tax- and fee-free gasoline products?

A: Each state may have its own regulations regarding taxes and fees on gasoline products, so it can vary from state to state.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule D by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.