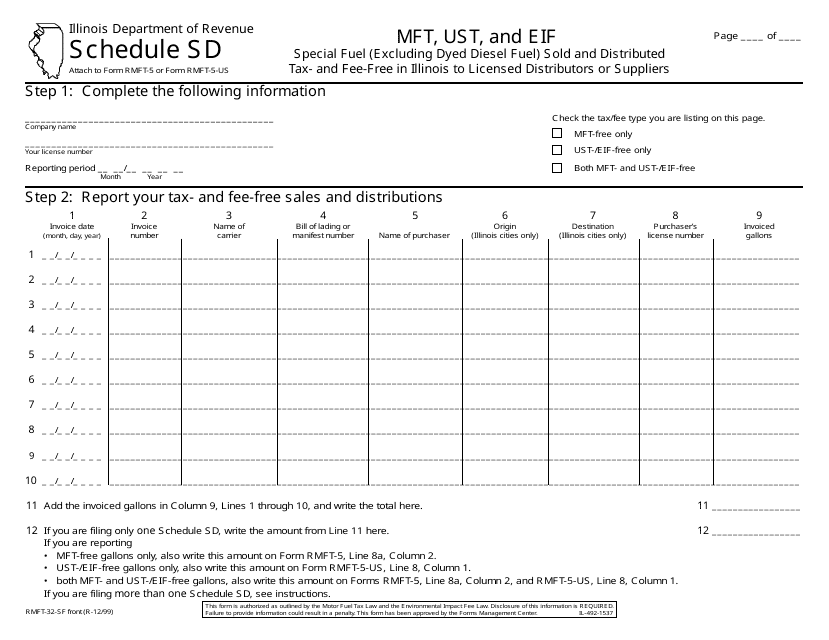

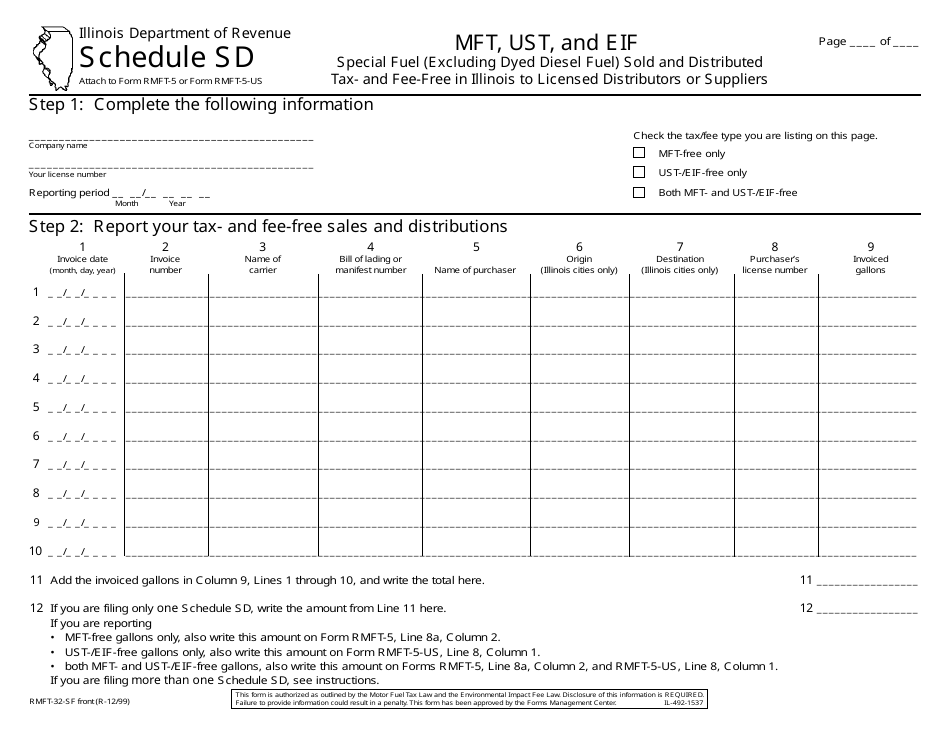

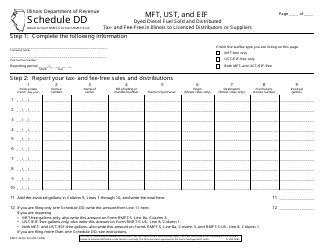

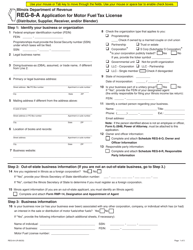

Form RMFT-32-SF Schedule SD Special Fuel (Excluding Dyed Diesel Fuel) Sold and Distributed Tax- and Fee-Free in Illinois to Licensed Distributors or Suppliers - Illinois

What Is Form RMFT-32-SF Schedule SD?

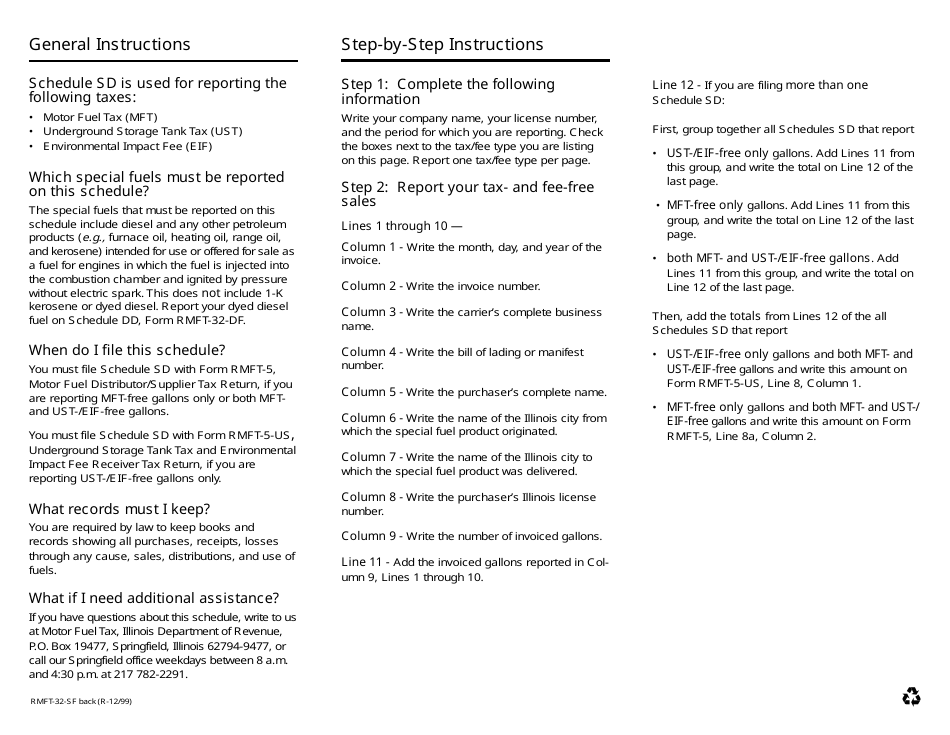

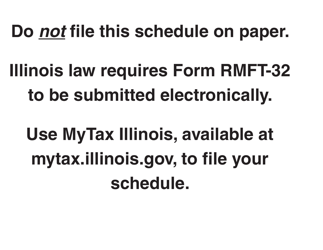

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RMFT-32-SF?

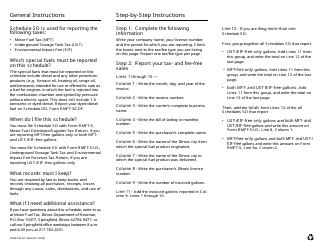

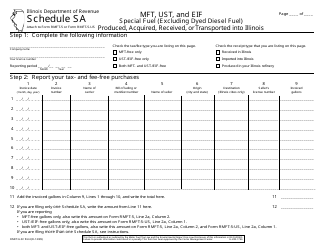

A: Form RMFT-32-SF is a schedule used in Illinois for reporting the sale and distribution of tax- and fee-free special fuel (excluding dyed diesel fuel) to licensed distributors or suppliers.

Q: Who is required to use Form RMFT-32-SF?

A: Any individual or business in Illinois who sells and distributes tax- and fee-free special fuel (excluding dyed diesel fuel) to licensed distributors or suppliers must use Form RMFT-32-SF.

Q: What does Form RMFT-32-SF report?

A: Form RMFT-32-SF reports the quantities and types of tax- and fee-free special fuel (excluding dyed diesel fuel) sold and distributed to licensed distributors or suppliers.

Q: What is special fuel?

A: Special fuel refers to any motor fuelother than gasoline, diesel fuel, or blended fuel.

Q: What is the purpose of reporting tax- and fee-free special fuel?

A: Reporting tax- and fee-free special fuel allows the state of Illinois to track the distribution of this fuel and ensure compliance with applicable laws and regulations.

Q: Is dyed diesel fuel included in Form RMFT-32-SF?

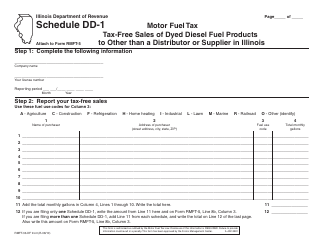

A: No, Form RMFT-32-SF is specifically for reporting tax- and fee-free special fuel excluding dyed diesel fuel. Dyed diesel fuel has its own separate reporting requirements.

Q: Are there any penalties for failing to file Form RMFT-32-SF?

A: Yes, failing to file Form RMFT-32-SF or filing it incorrectly can result in penalties and fines imposed by the Illinois Department of Revenue.

Form Details:

- Released on December 1, 1999;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-32-SF Schedule SD by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.