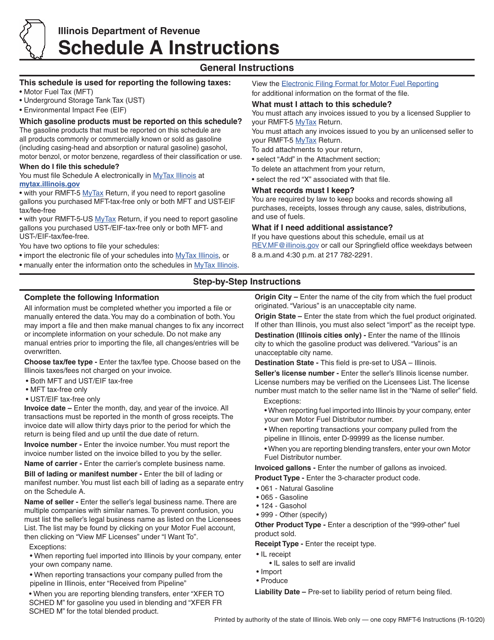

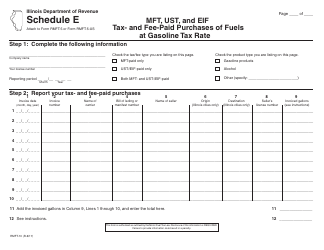

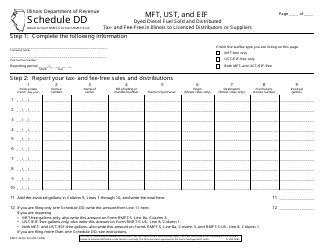

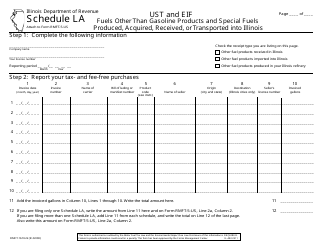

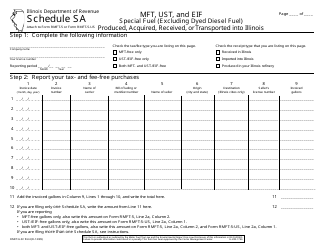

Instructions for Schedule A Mft, Ust, and Eif Gasoline Products Produced, Acquired, Received, or Transported Into Illinois - Illinois

This document contains official instructions for Schedule A , Mft, Ust, and Eif Gasoline Products Produced, Acquired, Received, or Transported Into Illinois - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Schedule A Mft, Ust, and Eif Gasoline Products Produced, Acquired, Received, or Transported Into Illinois?

A: Schedule A Mft, Ust, and Eif Gasoline Products Produced, Acquired, Received, or Transported Into Illinois is a document that provides instructions for reporting gasoline products produced, acquired, received, or transported into the state of Illinois.

Q: Who needs to file Schedule A Mft, Ust, and Eif Gasoline Products Produced, Acquired, Received, or Transported Into Illinois?

A: Any entity or individual involved in the production, acquisition, receipt, or transportation of gasoline products into Illinois needs to file this schedule.

Q: What information is required to be reported on Schedule A Mft, Ust, and Eif Gasoline Products Produced, Acquired, Received, or Transported Into Illinois?

A: The schedule requires you to report details such as the type of gasoline product, quantity, date of production or acquisition, storage details, and transportation information.

Q: Are there any penalties for not filing Schedule A Mft, Ust, and Eif Gasoline Products Produced, Acquired, Received, or Transported Into Illinois?

A: Yes, failure to file this schedule or providing false information may result in penalties, fines, or other legal consequences as determined by the Illinois Department of Revenue.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.