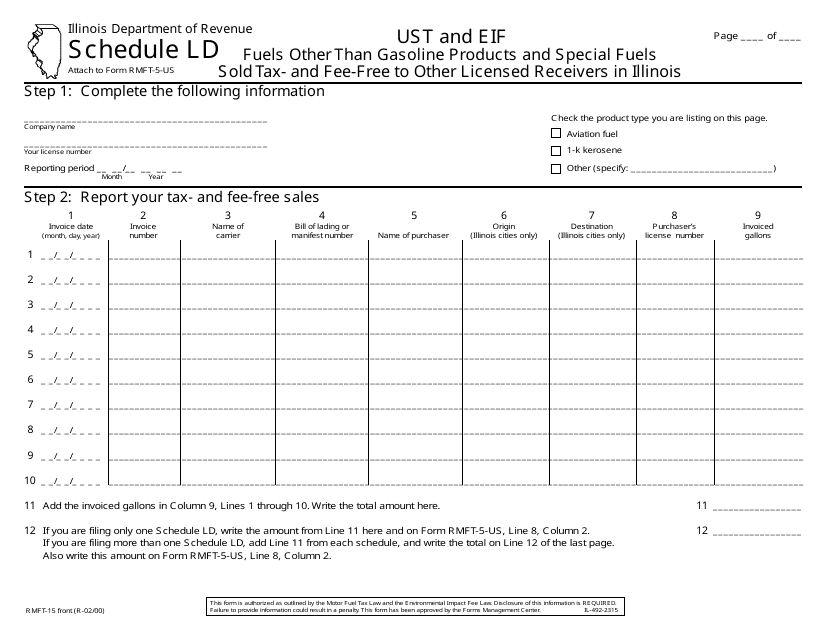

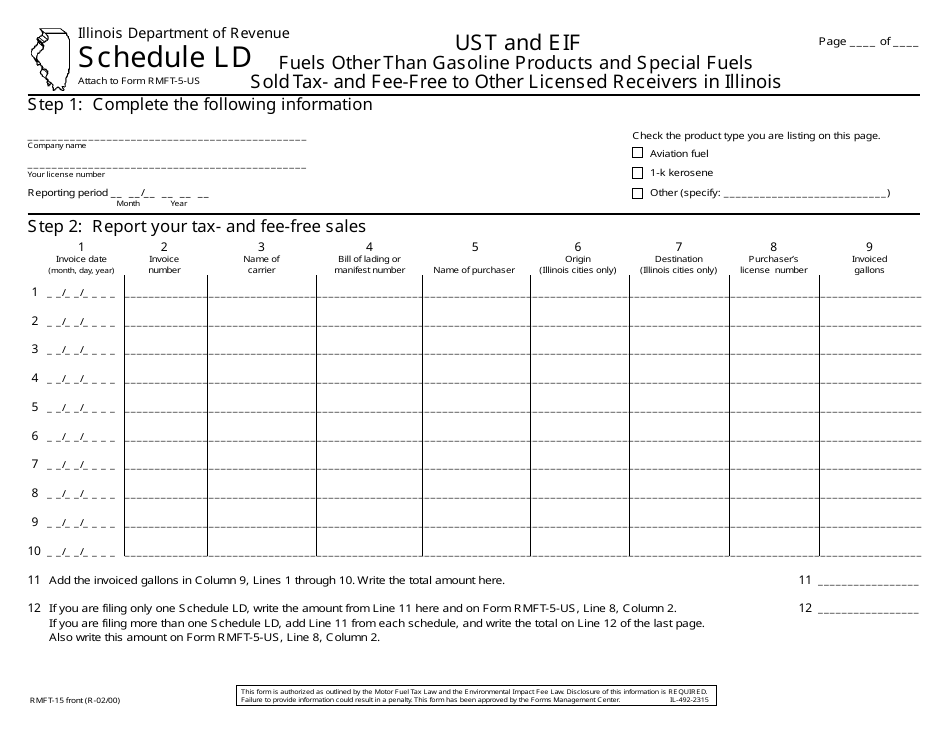

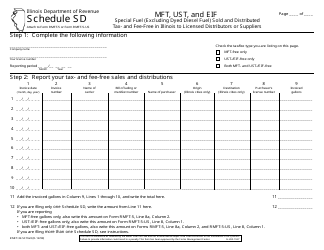

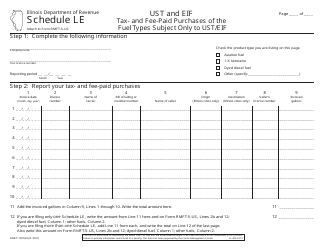

Form RMFT-15 Schedule LD Ust and Eif Fuels Other Than Gasoline Products and Special Fuels Sold Tax- and Fee-Free to Other Licensed Receivers in Illinois - Illinois

What Is Form RMFT-15 Schedule LD?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

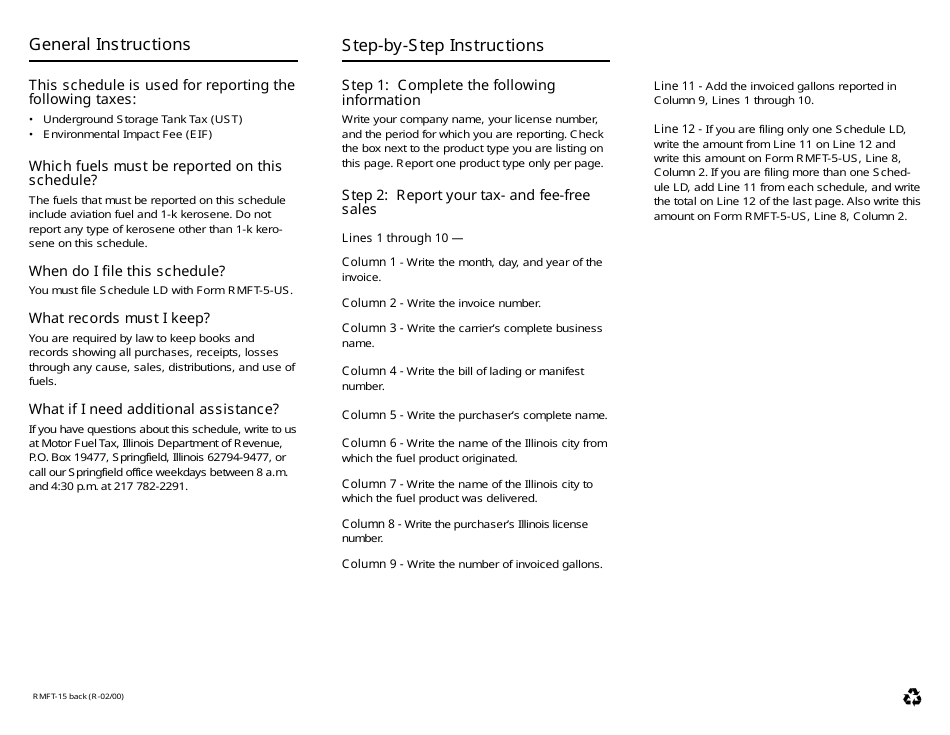

Q: What is the purpose of Form RMFT-15 Schedule LD?

A: The purpose of Form RMFT-15 Schedule LD is to report the sale of Ust and Eif Fuels other thangasoline products and special fuels that were sold tax- and fee-free to other licensed receivers in Illinois.

Q: Who is required to file Form RMFT-15 Schedule LD?

A: Individuals or entities who have sold Ust and Eif Fuels other than gasoline products and special fuels tax- and fee-free to other licensed receivers in Illinois are required to file Form RMFT-15 Schedule LD.

Q: What information is required to be reported on Form RMFT-15 Schedule LD?

A: Form RMFT-15 Schedule LD requires the reporting of the quantity and type of Ust and Eif Fuels other than gasoline products and special fuels that were sold tax- and fee-free to other licensed receivers in Illinois.

Q: Are there any specific instructions for completing Form RMFT-15 Schedule LD?

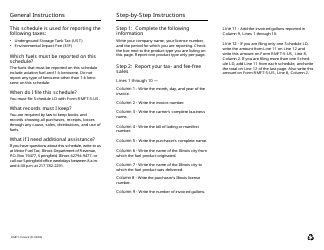

A: Yes, specific instructions for completing Form RMFT-15 Schedule LD can be found in the instructions provided by the Illinois Department of Revenue.

Form Details:

- Released on February 1, 2000;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-15 Schedule LD by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.