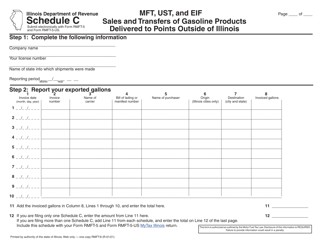

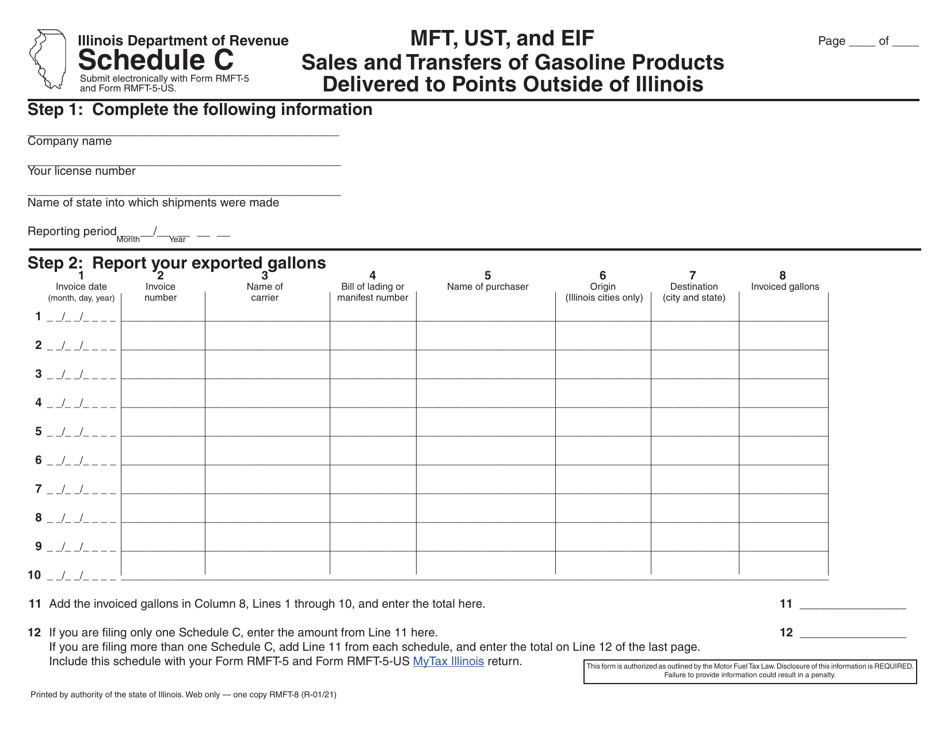

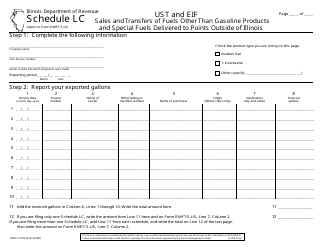

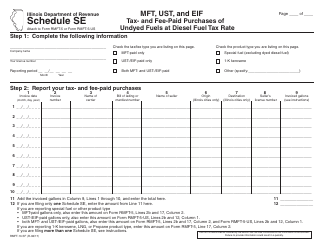

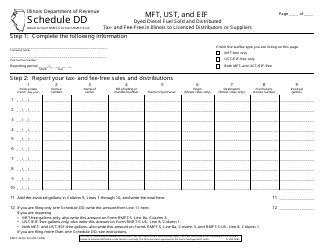

Form RMFT-8 Schedule C Mft, Ust, and Eif Sales and Transfers of Gasoline Products Delivered to Points Outside of Illinois - Illinois

What Is Form RMFT-8 Schedule C?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form RMFT-8 Schedule C?

A: Form RMFT-8 Schedule C is used to report sales and transfers of gasoline products delivered to points outside of Illinois.

Q: What are Mft, Ust, and Eif Sales and Transfers?

A: Mft stands for Motor Fuel Tax, Ust stands for Underground Storage Tank, and Eif stands for Environmental Impact Fee. Sales and transfers refer to the selling or transferring of gasoline products.

Q: Who needs to file form RMFT-8 Schedule C?

A: Anyone who sells or transfers gasoline products to points outside of Illinois needs to file form RMFT-8 Schedule C.

Q: What information is required on form RMFT-8 Schedule C?

A: The form requires information such as the seller's name and address, buyer's name and address, quantity of gasoline products sold or transferred, and the destination outside of Illinois.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-8 Schedule C by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.