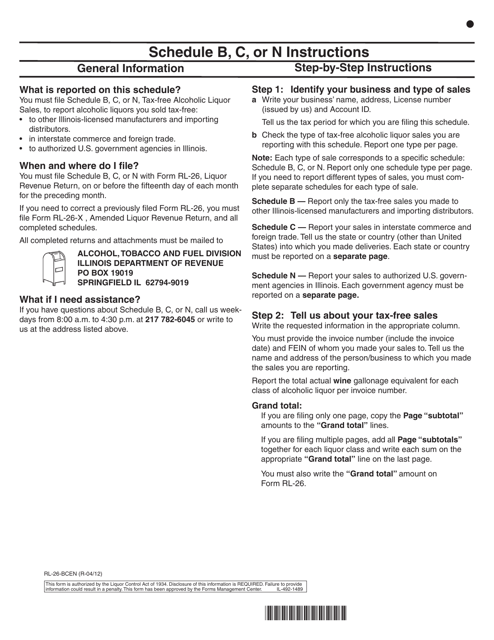

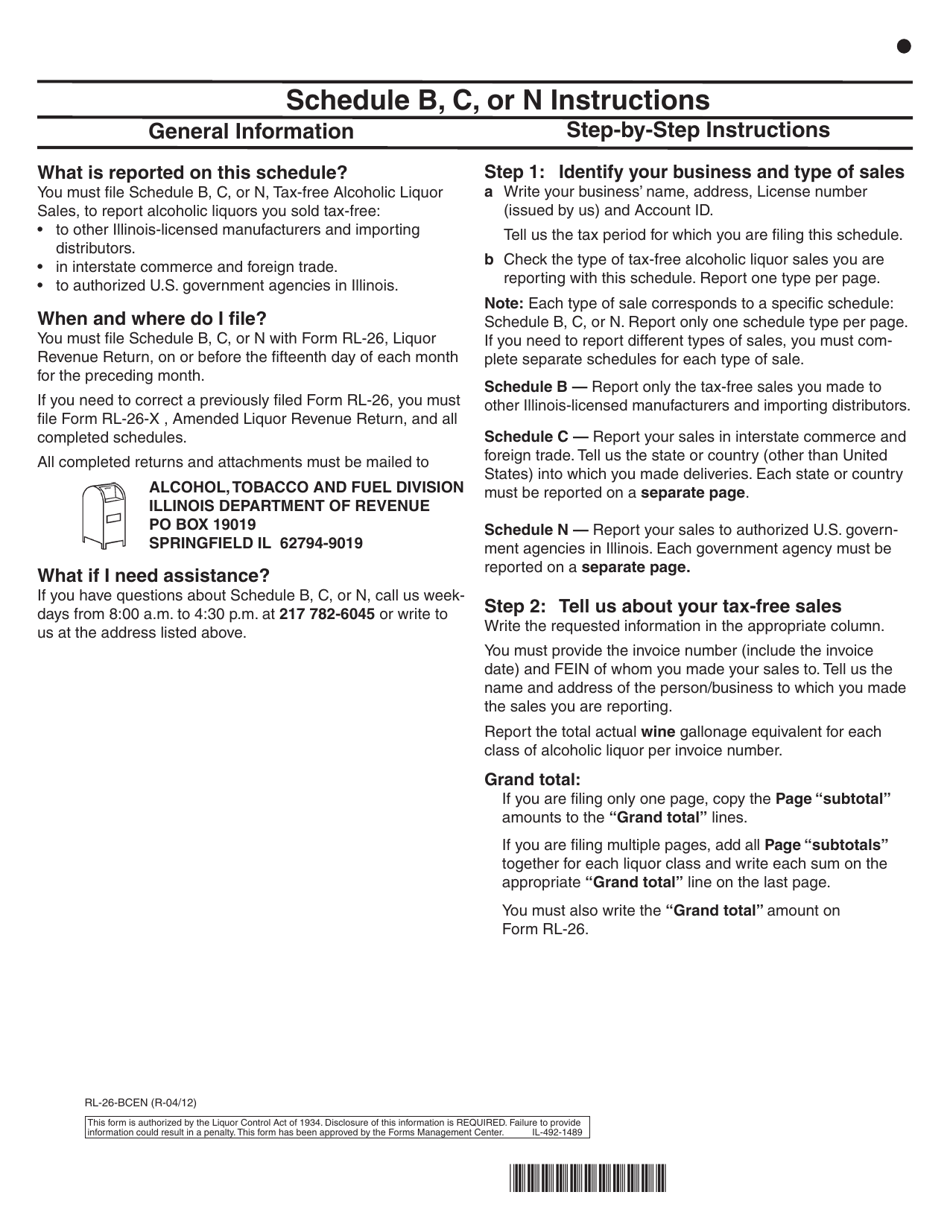

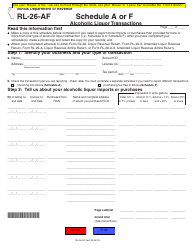

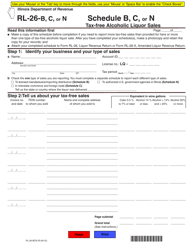

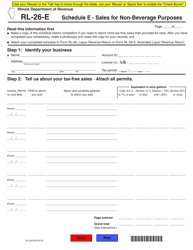

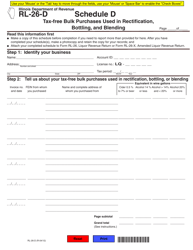

Instructions for Form RL-26-BCN Schedule B, C, N Tax-Free Alcoholic Liquor Sales - Illinois

This document contains official instructions for Schedule B , Schedule C , and Schedule N for Form RL-26-BCN . . These documents are released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form RL-26-BCN?

A: Form RL-26-BCN is a tax form used for reporting tax-free liquor sales in Illinois.

Q: What are Schedule B, C, and N?

A: Schedule B, C, and N are different sections of Form RL-26-BCN that require specific information for different types of tax-free liquor sales.

Q: What is a tax-free liquor sale?

A: A tax-free liquor sale refers to the sale of alcoholic beverages that are exempt from state or local taxes.

Q: What information is needed for Schedule B?

A: Schedule B requires reporting of tax-free liquor sales to Illinois purchasers.

Q: What information is needed for Schedule C?

A: Schedule C requires reporting of tax-free liquor sales to out-of-state purchasers.

Q: What information is needed for Schedule N?

A: Schedule N requires reporting of tax-free liquor sales to United States governmental agencies or instrumentalities.

Q: Why is it important to report tax-free liquor sales?

A: Reporting tax-free liquor sales is necessary for complying with tax laws and regulations in Illinois and ensuring proper documentation of sales.

Q: Are there any penalties for not reporting tax-free liquor sales?

A: Failure to report tax-free liquor sales accurately and timely may result in penalties, fines, or other legal consequences.

Q: Can I file Form RL-26-BCN electronically?

A: Yes, the Illinois Department of Revenue allows electronic filing of Form RL-26-BCN.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.