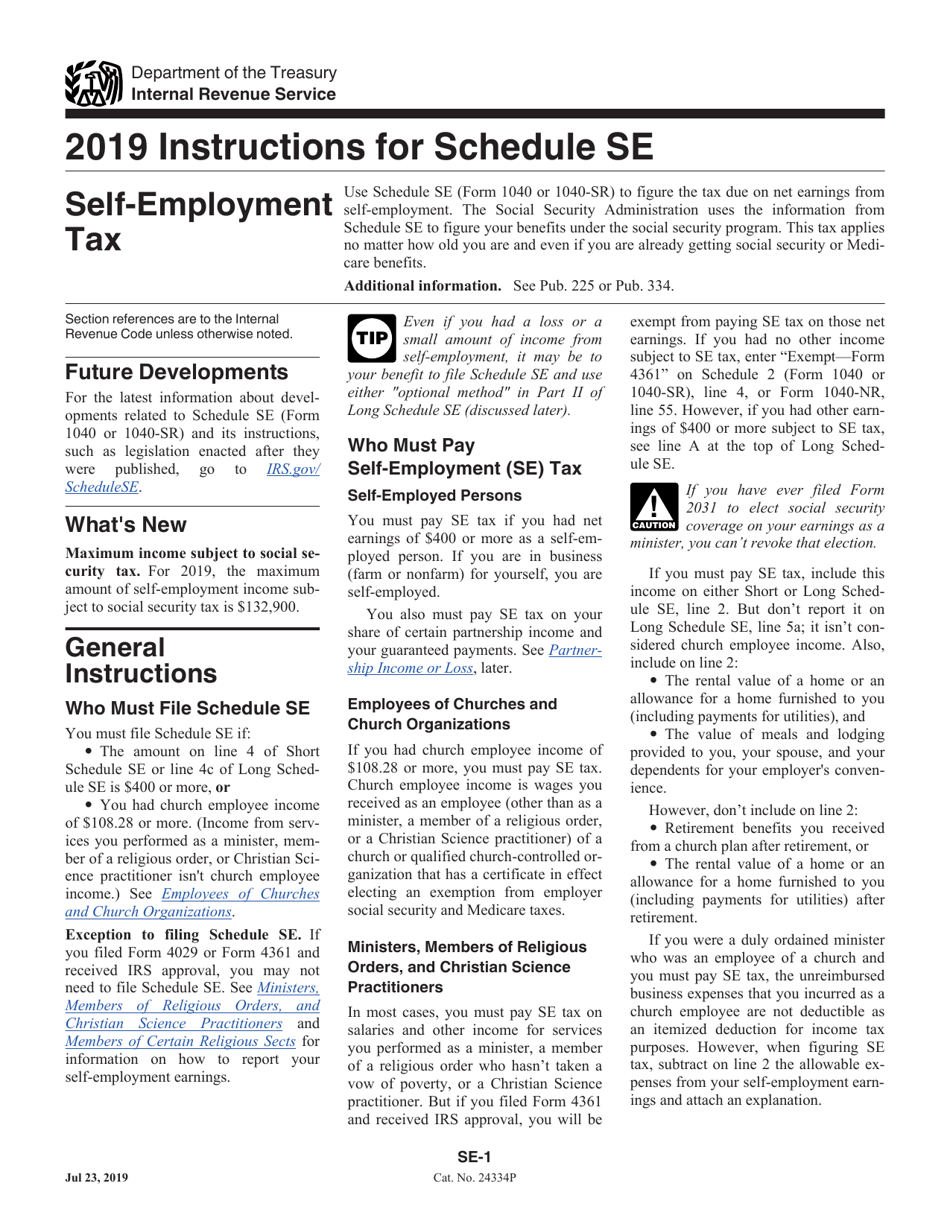

Instructions for IRS Form 1040, 1040-SR Schedule SE Self-employment Tax

This document contains official instructions for IRS Form 1040 Schedule SE and IRS Form 1040-SR Schedule SE . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 (1040-SR) Schedule SE is available for download through this link.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is the main tax form used by individuals to file their federal income tax return.

Q: What is IRS Form 1040-SR?

A: IRS Form 1040-SR is a simplified version of Form 1040 for seniors (age 65 or older) with larger font size and easy-to-understand format.

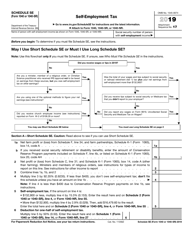

Q: What is Schedule SE?

A: Schedule SE is a form used to calculate and report self-employment taxes.

Q: Who needs to file Schedule SE?

A: Those who have income from self-employment, such as freelancers, contractors, and business owners, generally need to file Schedule SE.

Q: What is self-employment tax?

A: Self-employment tax is a tax that individuals who work for themselves must pay. It consists of both the employer and employee portions of Social Security and Medicare taxes.

Q: How do I calculate self-employment tax?

A: To calculate self-employment tax, you multiply your net self-employment income by the self-employment tax rate, which is currently 15.3%.

Q: Can I deduct self-employment tax?

A: Yes, you can deduct the employer portion of your self-employment tax as an adjustment to income on your Form 1040 or Form 1040-SR.

Q: Do I have to pay estimated taxes if I have self-employment income?

A: If you expect to owe at least $1,000 in taxes from your self-employment income, you may need to make estimated tax payments throughout the year to avoid penalties.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.