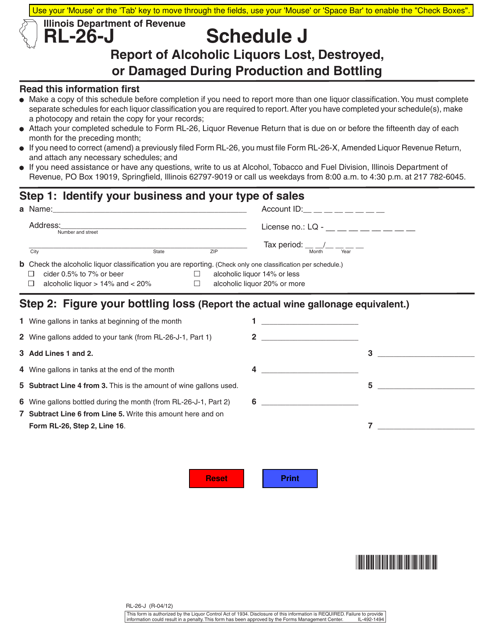

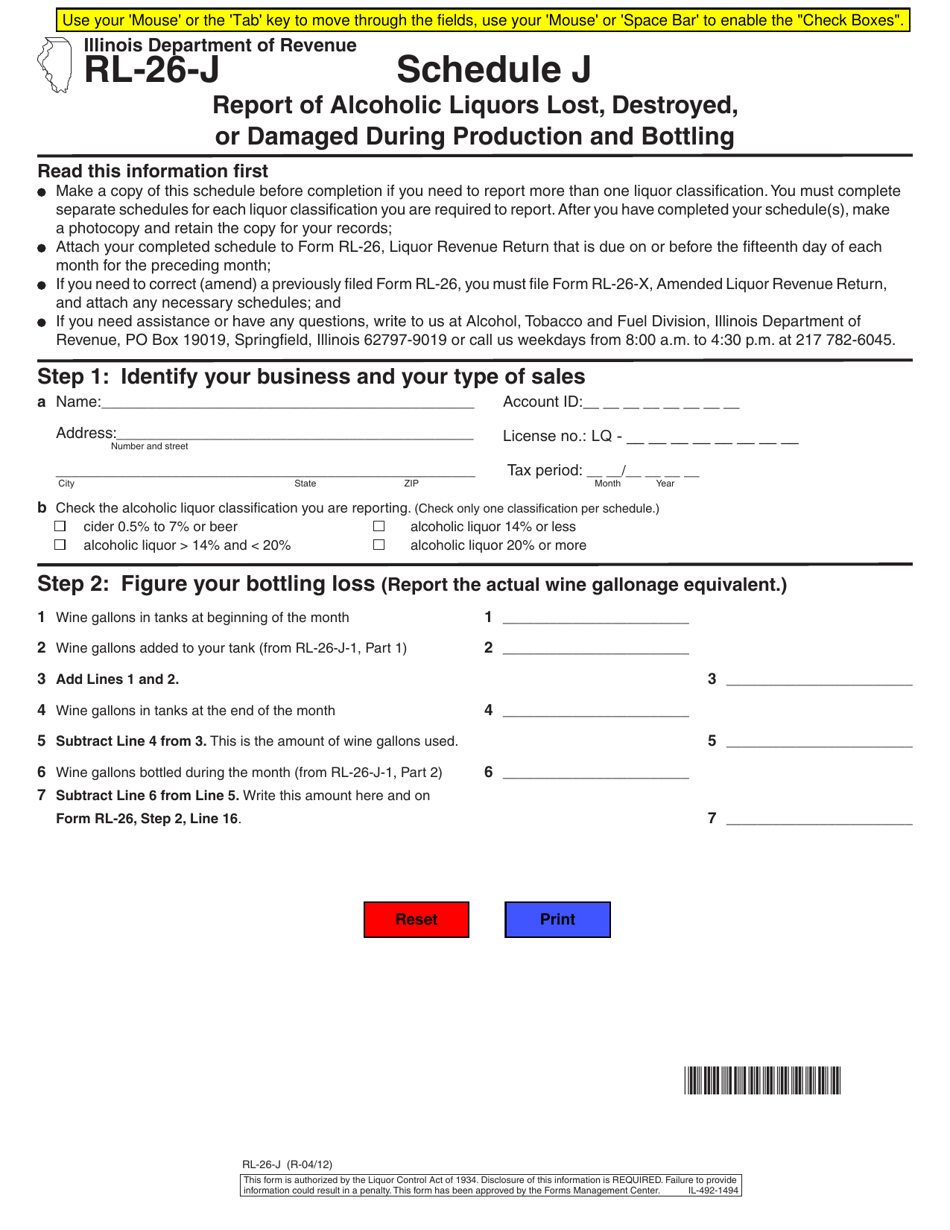

Form RL-26-J Schedule J Report of Alcoholic Liquors Lost, Destroyed, or Damaged During Production and Bottling - Illinois

What Is Form RL-26-J Schedule J?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RL-26-J Schedule J form?

A: The RL-26-J Schedule J form is a report used in Illinois to declare alcoholic liquors lost, destroyed, or damaged during production and bottling.

Q: Who needs to fill out the RL-26-J Schedule J form?

A: Producers and bottlers of alcoholic liquors in Illinois need to fill out the RL-26-J Schedule J form if any of their products are lost, destroyed, or damaged during the production process.

Q: When should the RL-26-J Schedule J form be filed?

A: The RL-26-J Schedule J form should be filed within 30 days after the loss, destruction, or damage occurs.

Q: Are there any penalties for not filing the RL-26-J Schedule J form?

A: Yes, failure to file the RL-26-J Schedule J form or filing it late may result in penalties and interest imposed by the Illinois Department of Revenue.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RL-26-J Schedule J by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.