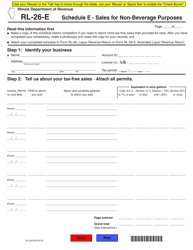

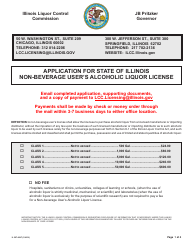

Instructions for Form RL-26-E Schedule E Sales for Non-beverage Purposes - Illinois

This document contains official instructions for Form RL-26-E Schedule E, Sales for Non-beverage Purposes - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form RL-26-E Schedule E is available for download through this link.

FAQ

Q: What is Form RL-26-E Schedule E?

A: Form RL-26-E Schedule E is a form used in Illinois to report sales for non-beverage purposes.

Q: Who needs to file Form RL-26-E Schedule E?

A: Any business or individual in Illinois that sells non-beverage items needs to file Form RL-26-E Schedule E.

Q: What are non-beverage sales?

A: Non-beverage sales refer to sales of items other thanalcoholic beverages.

Q: What information do I need to provide on Form RL-26-E Schedule E?

A: You need to provide information about your sales of non-beverage items, including the total sales amount.

Q: When is the deadline to file Form RL-26-E Schedule E?

A: Form RL-26-E Schedule E is due on the 15th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing, including a potential penalty of $500 per month.

Q: Do I need to attach any supporting documents with Form RL-26-E Schedule E?

A: No, you do not need to attach any supporting documents with Form RL-26-E Schedule E.

Q: What if I made no sales for non-beverage purposes during the reporting period?

A: If you made no sales for non-beverage purposes during the reporting period, you still need to file Form RL-26-E Schedule E and indicate zero sales.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.