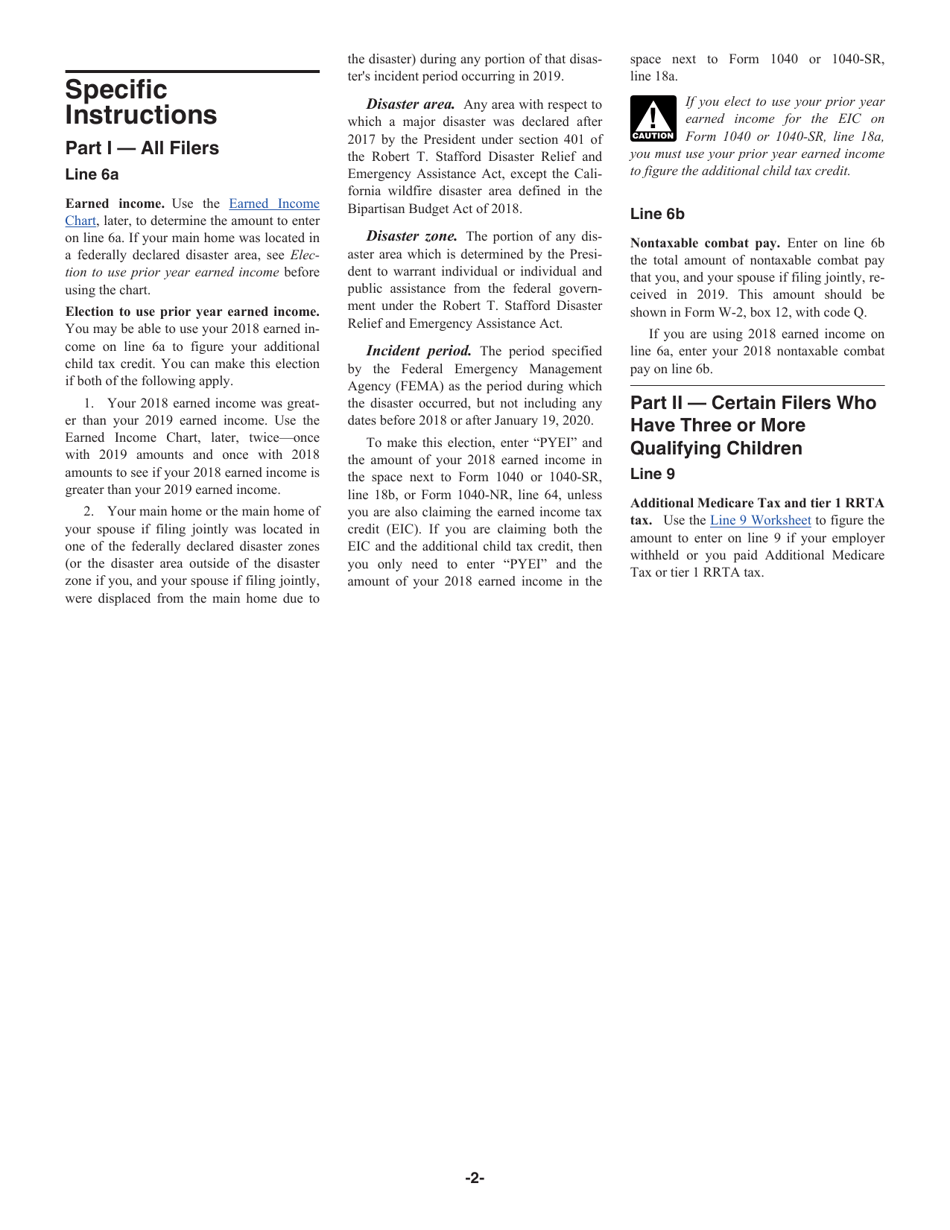

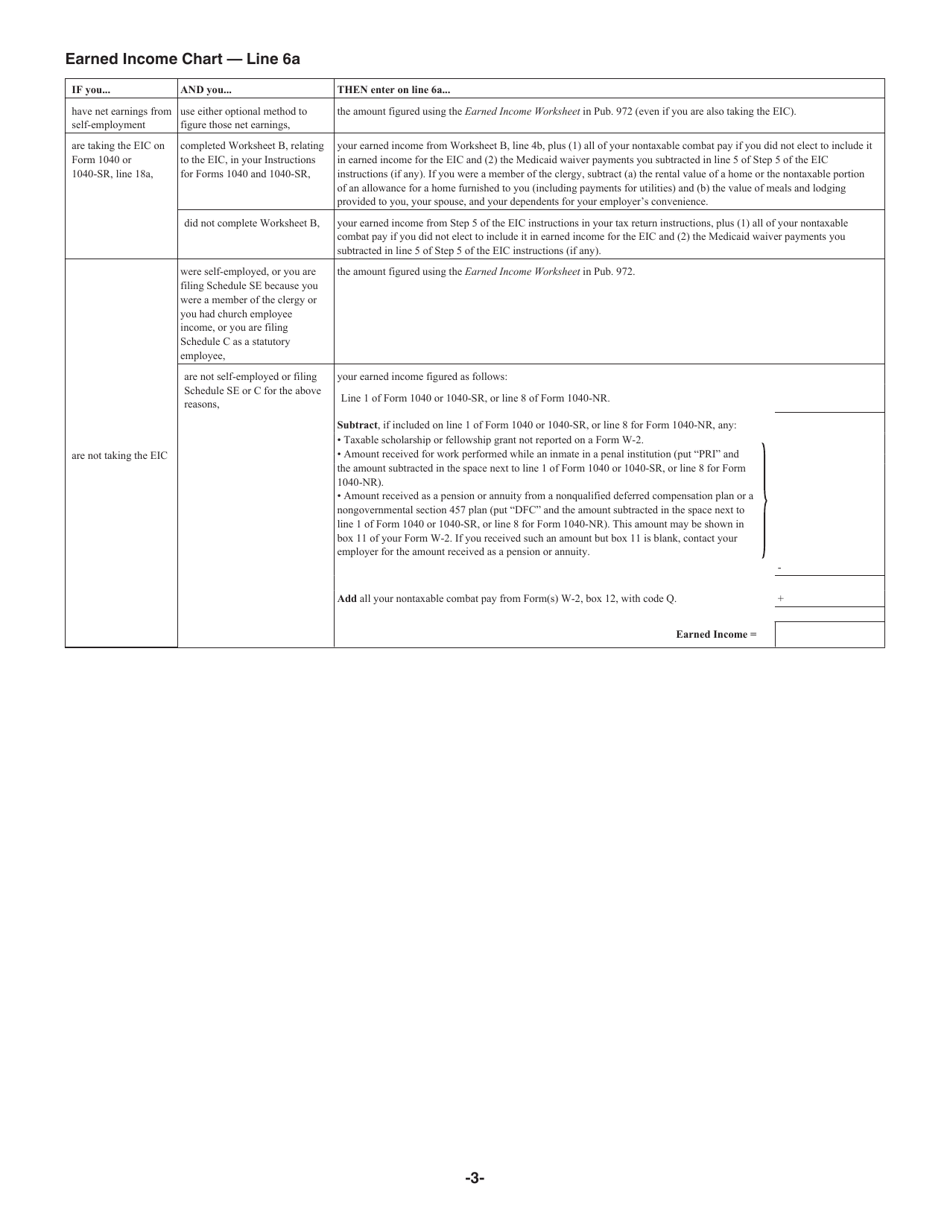

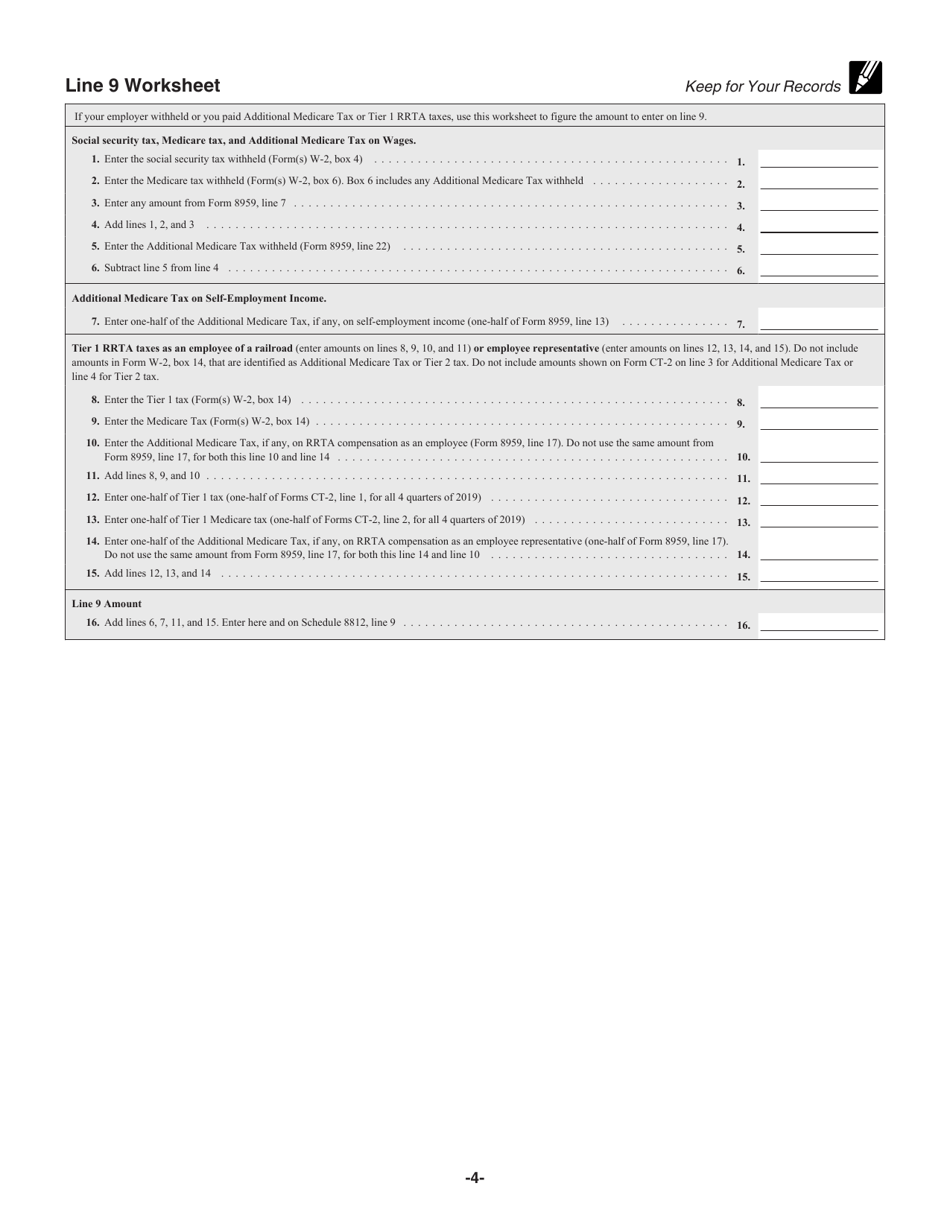

Instructions for IRS Form 1040, 1040-SR Schedule 8812 Additional Child Tax Credit

This document contains official instructions for IRS Form 1040 Schedule 8812 and IRS Form 1040-SR Schedule 8812 . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 (1040-SR) Schedule 8812 is available for download through this link.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is the standard individual income tax return form in the United States.

Q: What is IRS Form 1040-SR?

A: IRS Form 1040-SR is a simplified version of Form 1040 for taxpayers who are 65 or older.

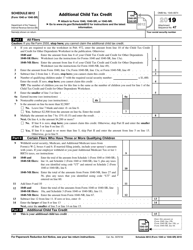

Q: What is Schedule 8812?

A: Schedule 8812 is used to claim the Additional Child Tax Credit if you have a qualifying child or children.

Q: What is the Additional Child Tax Credit?

A: The Additional Child Tax Credit is a refundable tax credit that can provide additional tax benefit for taxpayers who have qualifying children.

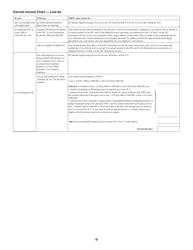

Q: How do I qualify for the Additional Child Tax Credit?

A: To qualify for the Additional Child Tax Credit, you must have a qualifying child, meet certain income requirements, and have earned income.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.