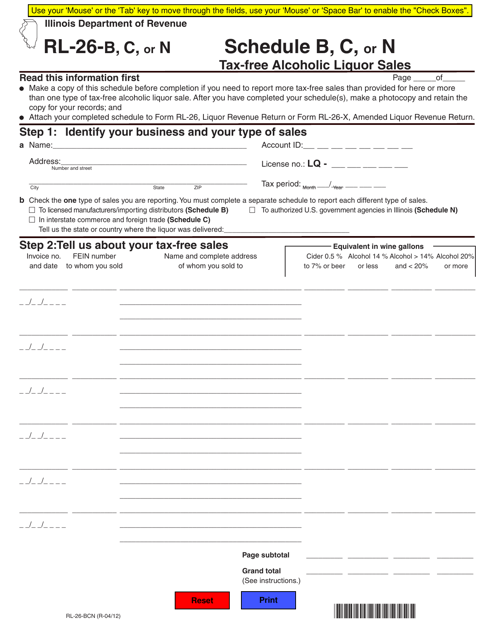

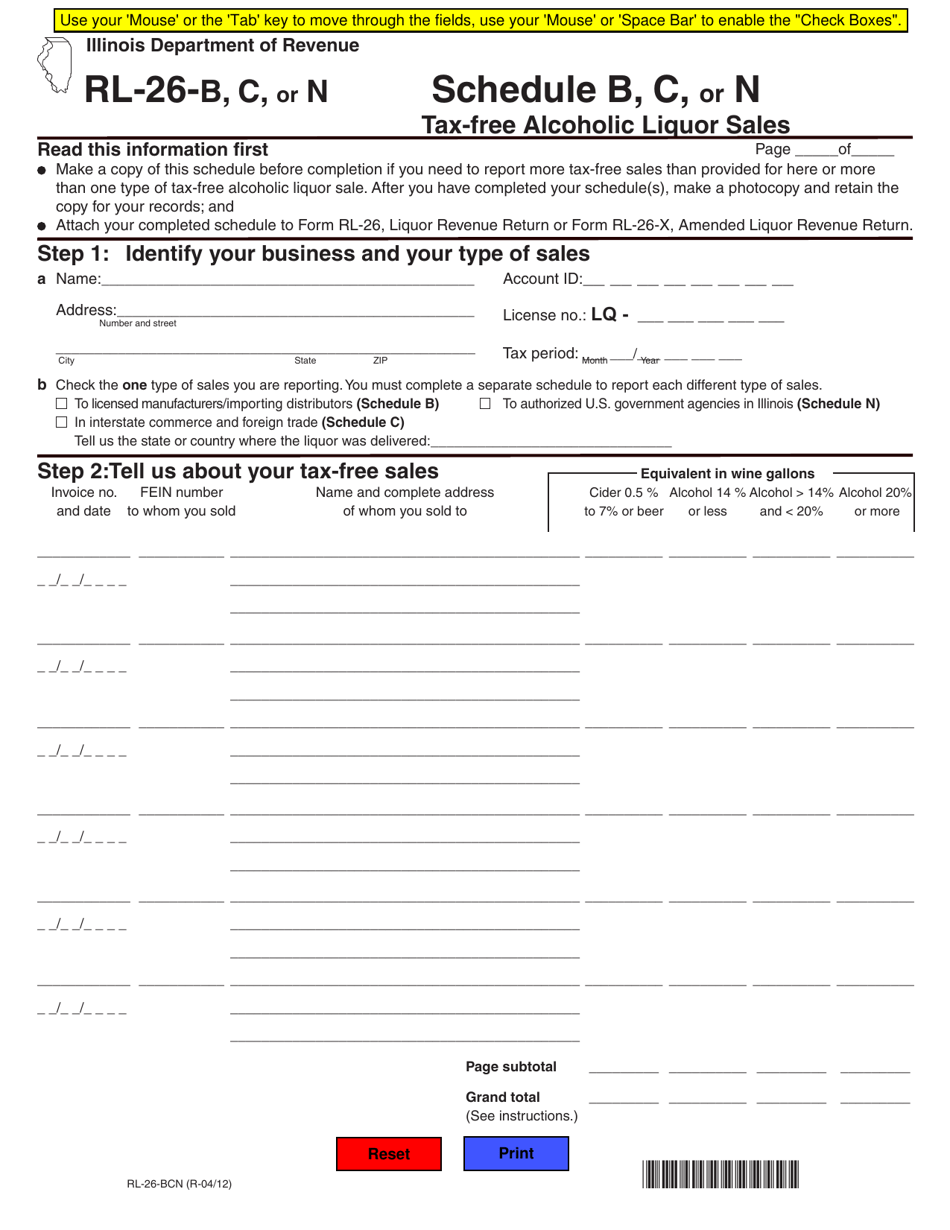

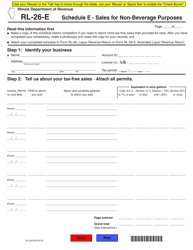

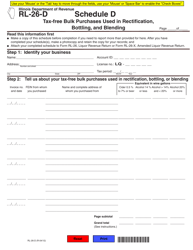

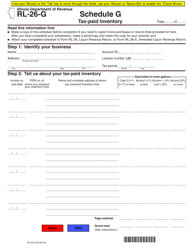

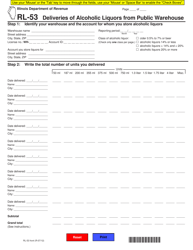

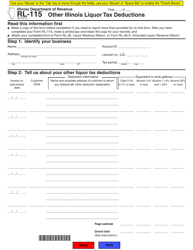

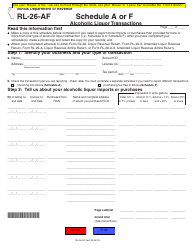

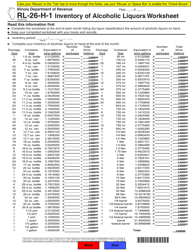

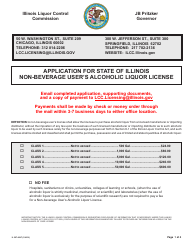

Form RL-26 Schedule B, C, N Tax-Free Alcoholic Liquor Sales - Illinois

What Is Form RL-26 Schedule B, C, N?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RL-26?

A: Form RL-26 is a tax form used in Illinois for reporting tax-free alcoholic liquor sales.

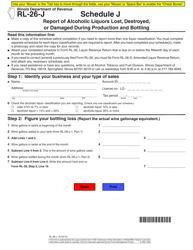

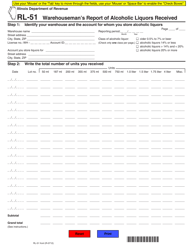

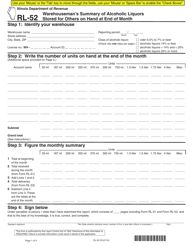

Q: What are Schedule B, C, and N on Form RL-26?

A: Schedule B, C, and N are different sections on Form RL-26 that are used to report specific information about tax-free alcoholic liquor sales.

Q: What is the purpose of Form RL-26?

A: The purpose of Form RL-26 is to report tax-free alcoholic liquor sales in Illinois.

Q: Who needs to file Form RL-26?

A: Businesses or individuals that engage in tax-free alcoholic liquor sales in Illinois are required to file Form RL-26.

Q: What information is required on Form RL-26?

A: Form RL-26 requires information such as the total amount of tax-free alcoholic liquor sales, the types of liquor sold, and the buyer's information.

Q: When is the deadline for filing Form RL-26?

A: The deadline for filing Form RL-26 depends on the reporting period, but it is generally due on a quarterly basis.

Q: Are there any penalties for not filing Form RL-26?

A: Yes, there are penalties for not filing Form RL-26 or for filing it late. It is important to comply with the filing requirements to avoid these penalties.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RL-26 Schedule B, C, N by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.