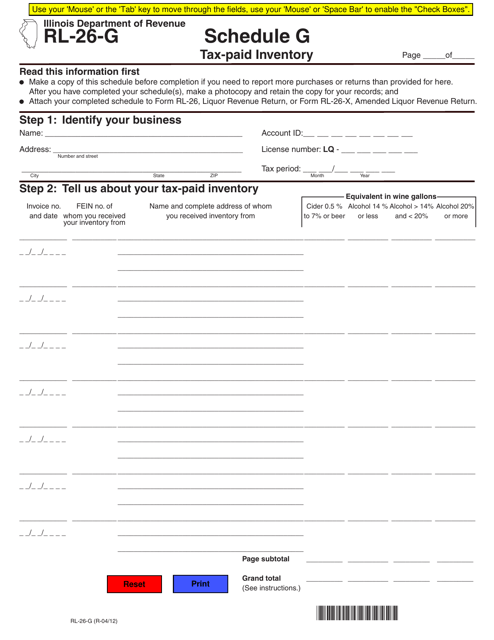

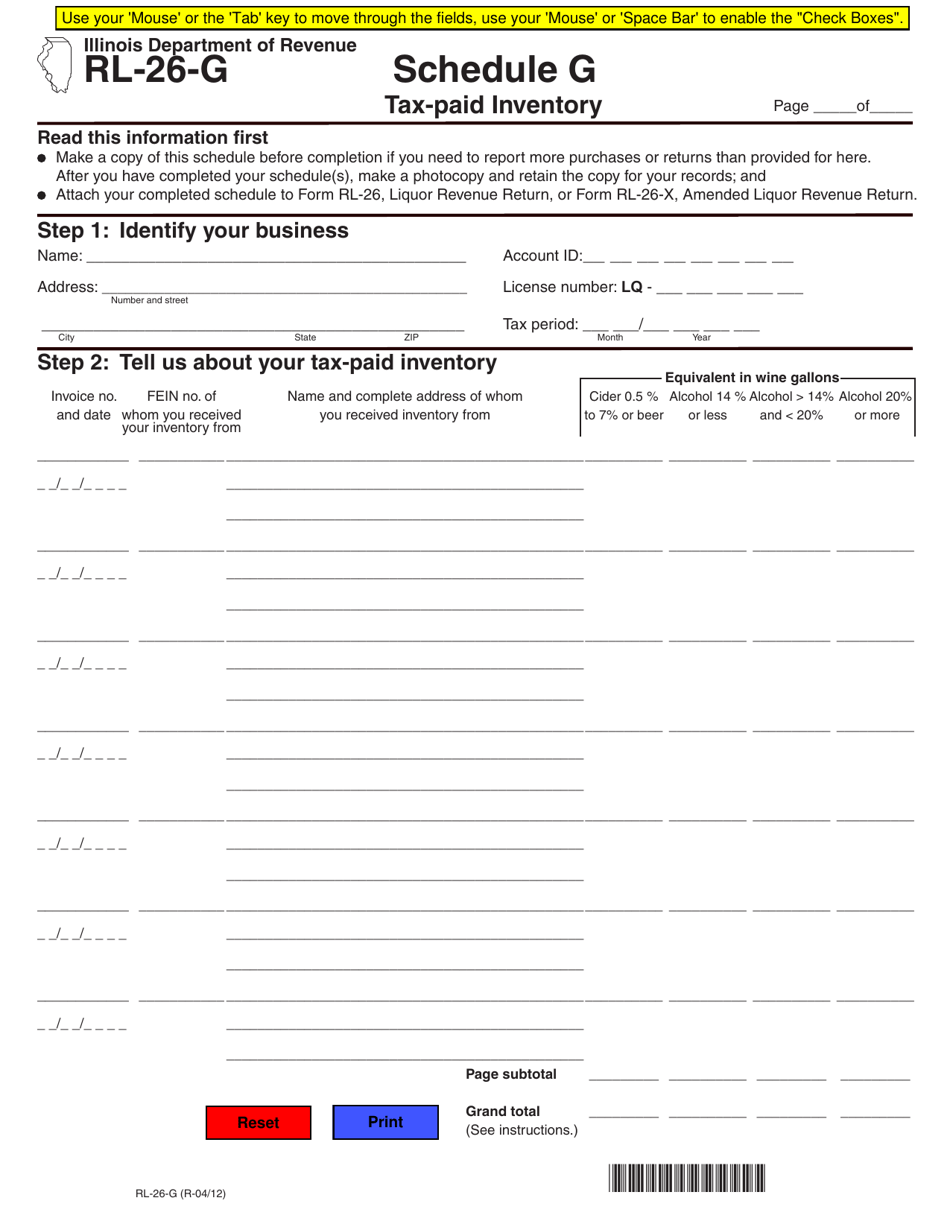

Form RL-26-G Schedule G Tax-Paid Inventory - Illinois

What Is Form RL-26-G Schedule G?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RL-26-G?

A: Form RL-26-G is a tax form used in Illinois.

Q: What is Schedule G?

A: Schedule G is a part of Form RL-26-G.

Q: What is the purpose of Form RL-26-G?

A: Form RL-26-G is used to report tax-paid inventory in Illinois.

Q: Who needs to file Form RL-26-G?

A: Businesses in Illinois that have tax-paid inventory need to file Form RL-26-G.

Q: What is tax-paid inventory?

A: Tax-paid inventory refers to inventory on which taxes have been paid.

Q: When is Form RL-26-G due?

A: Form RL-26-G is generally due on an annual basis, with the specific due date depending on the filing period.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RL-26-G Schedule G by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.