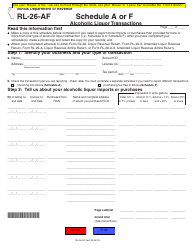

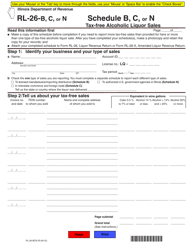

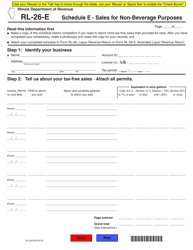

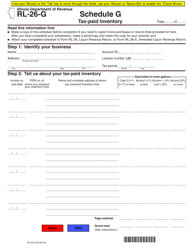

Instructions for Form RL-26-R Schedule R Report of Liquor Sales to Retailers - Illinois

This document contains official instructions for Form RL-26-R Schedule R, Report of Liquor Sales to Retailers - a form released and collected by the Illinois Department of Revenue.

FAQ

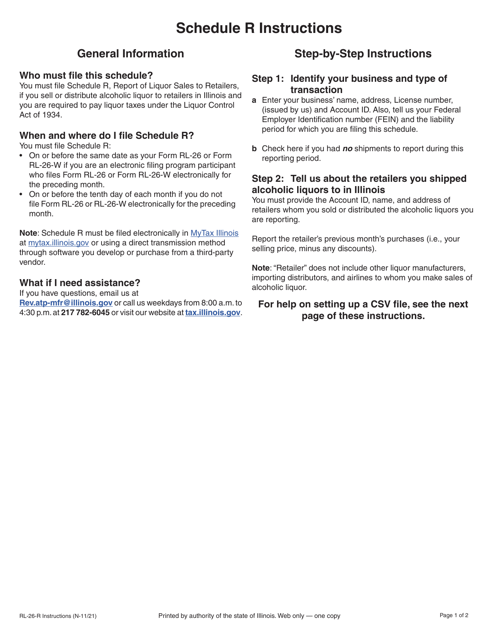

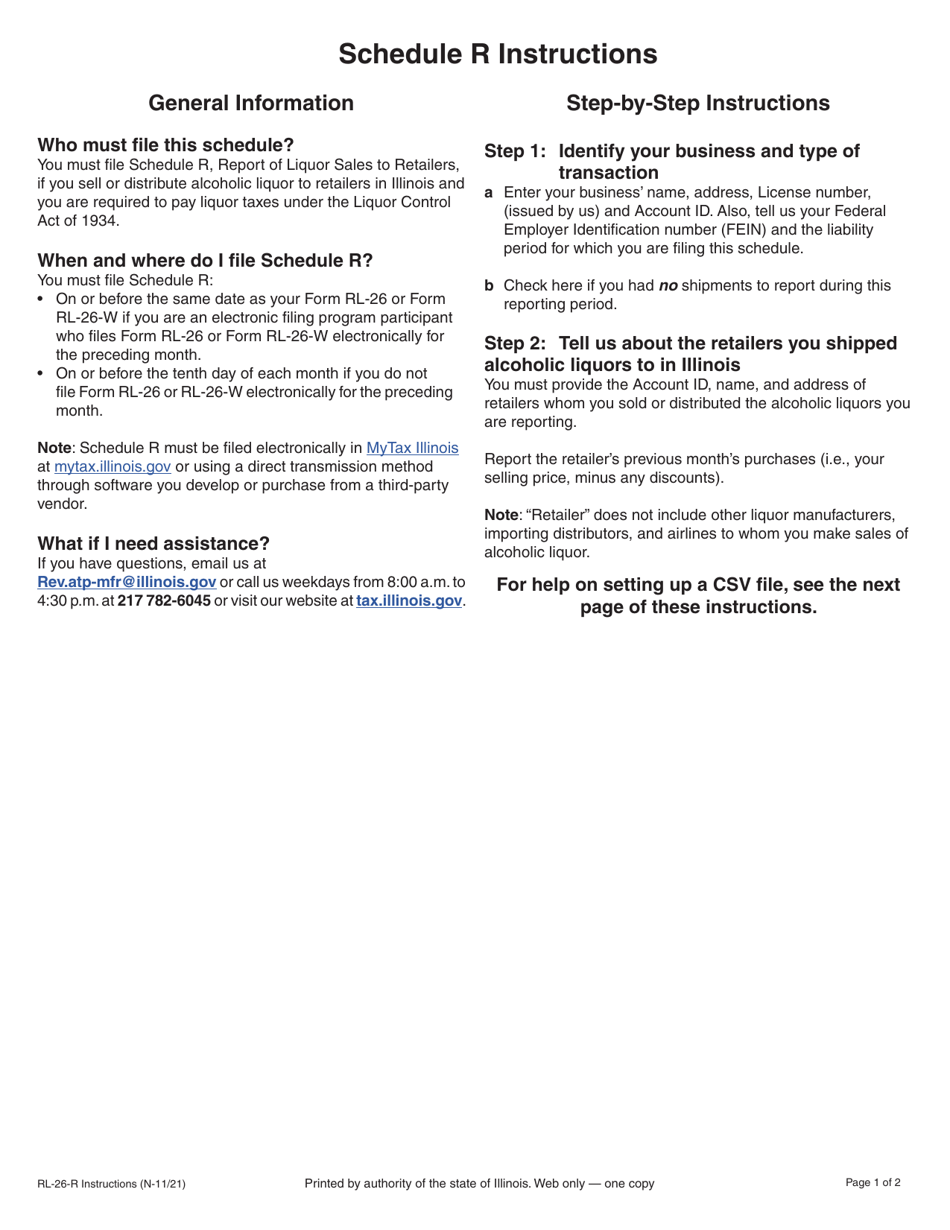

Q: What is Form RL-26-R?

A: Form RL-26-R is a report used to track and report liquor sales to retailers in the state of Illinois.

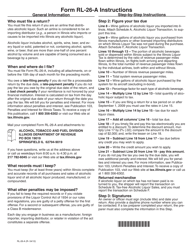

Q: Who needs to file Form RL-26-R?

A: Any business that sells liquor to retailers in Illinois needs to file Form RL-26-R.

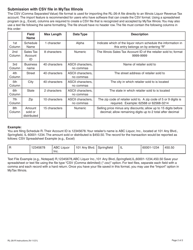

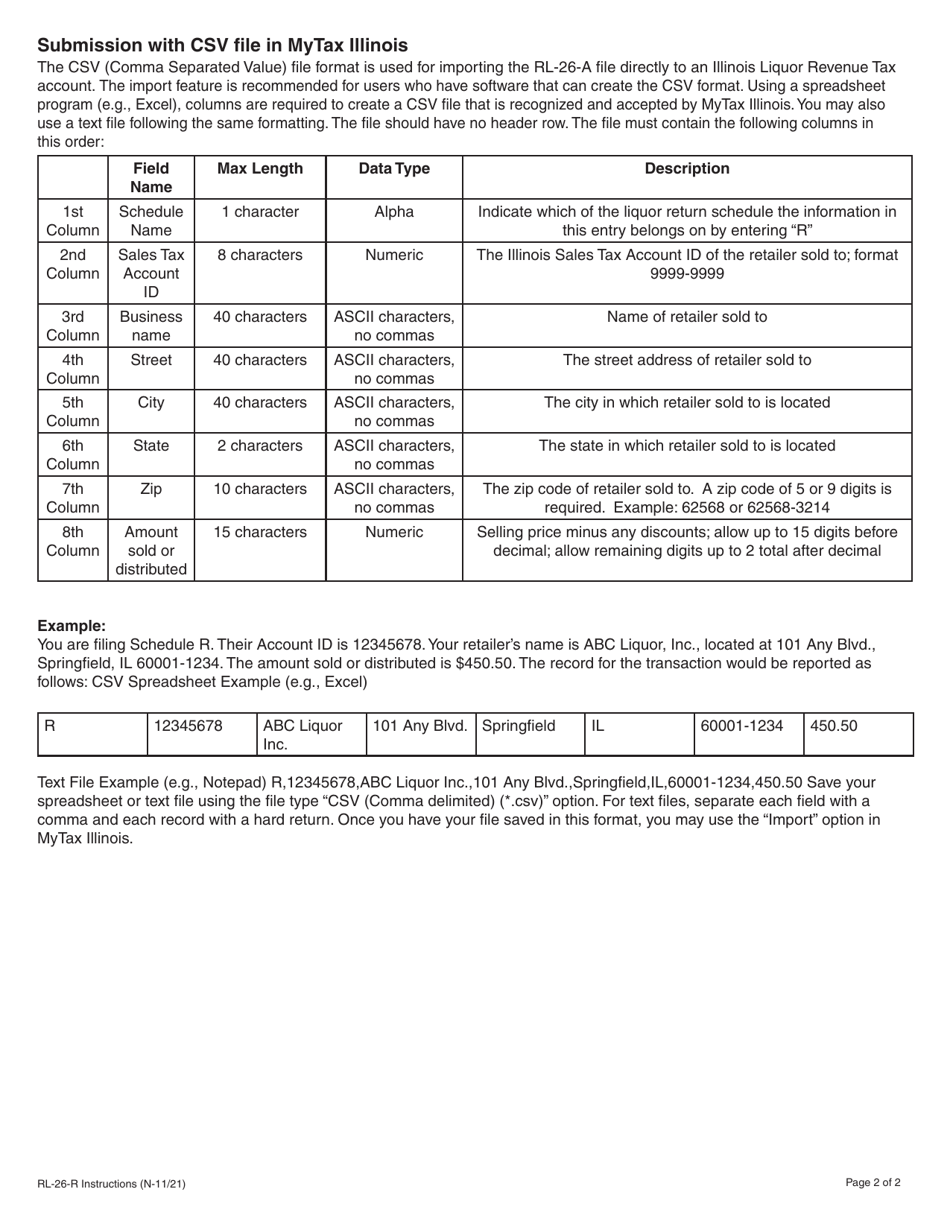

Q: What information is required on Form RL-26-R?

A: Form RL-26-R requires details about the liquor sales, such as the retailer's name and address, the types and quantities of liquor sold, and the amount of tax collected.

Q: When is the deadline for filing Form RL-26-R?

A: Form RL-26-R must be filed on a monthly basis, and the deadline is the 15th day of the month following the reporting period.

Q: Are there any penalties for not filing Form RL-26-R?

A: Yes, there are penalties for not filing Form RL-26-R or for filing it late. It is important to comply with the filing requirements to avoid these penalties.

Q: Do I need to keep records of liquor sales?

A: Yes, it is important to keep records of liquor sales in case of audit or verification purposes.

Q: Are there any exemptions from filing Form RL-26-R?

A: There may be exemptions available based on certain criteria. It is recommended to consult the Illinois Department of Revenue for specific exemption details.

Q: Can I amend a previously filed Form RL-26-R?

A: Yes, if you need to make changes to a previously filed Form RL-26-R, you can file an amended form to correct any errors or omissions.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.