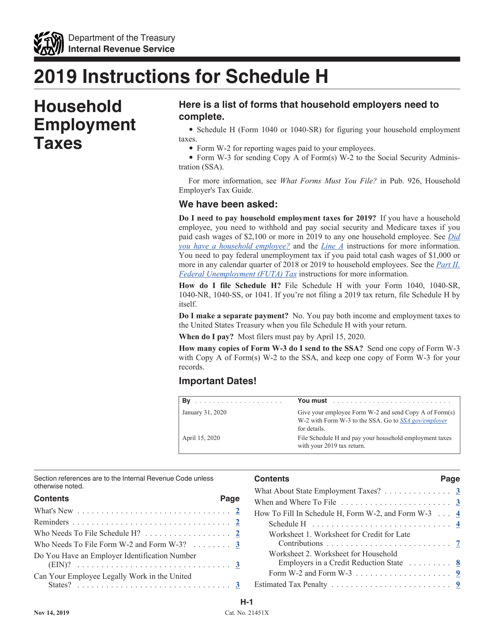

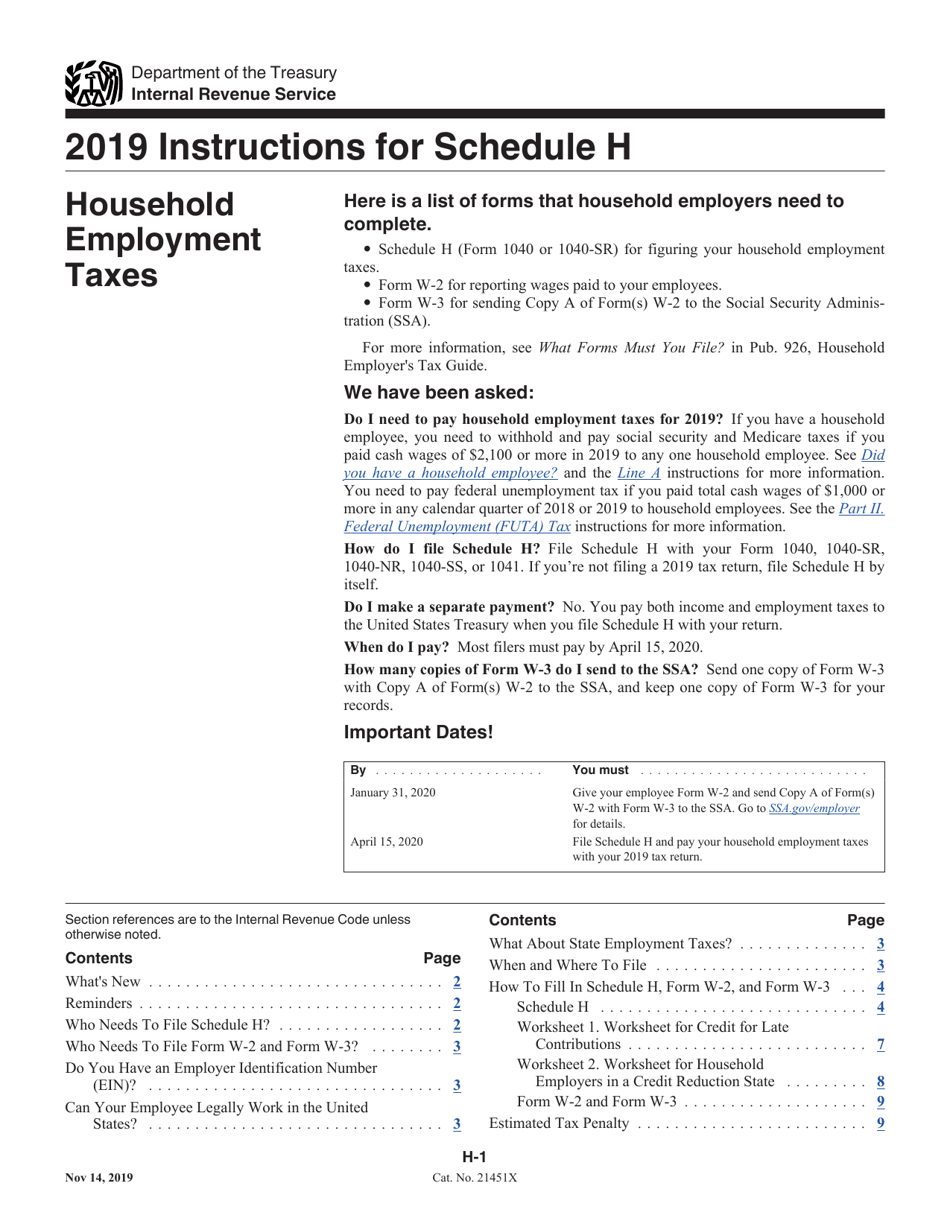

Instructions for IRS Form 1040, 1040-SR Schedule H Household Employment Taxes

This document contains official instructions for IRS Form 1040 Schedule H and IRS Form 1040-SR Schedule H . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 (1040-SR) Schedule H is available for download through this link.

FAQ

Q: What is IRS Form 1040?

A: IRS Form 1040 is the standard individual income tax return form.

Q: What is IRS Form 1040-SR?

A: IRS Form 1040-SR is a simplified version of Form 1040 for seniors (age 65 and older) with larger print and more straightforward language.

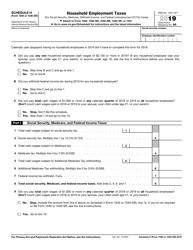

Q: What is Schedule H?

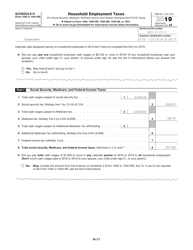

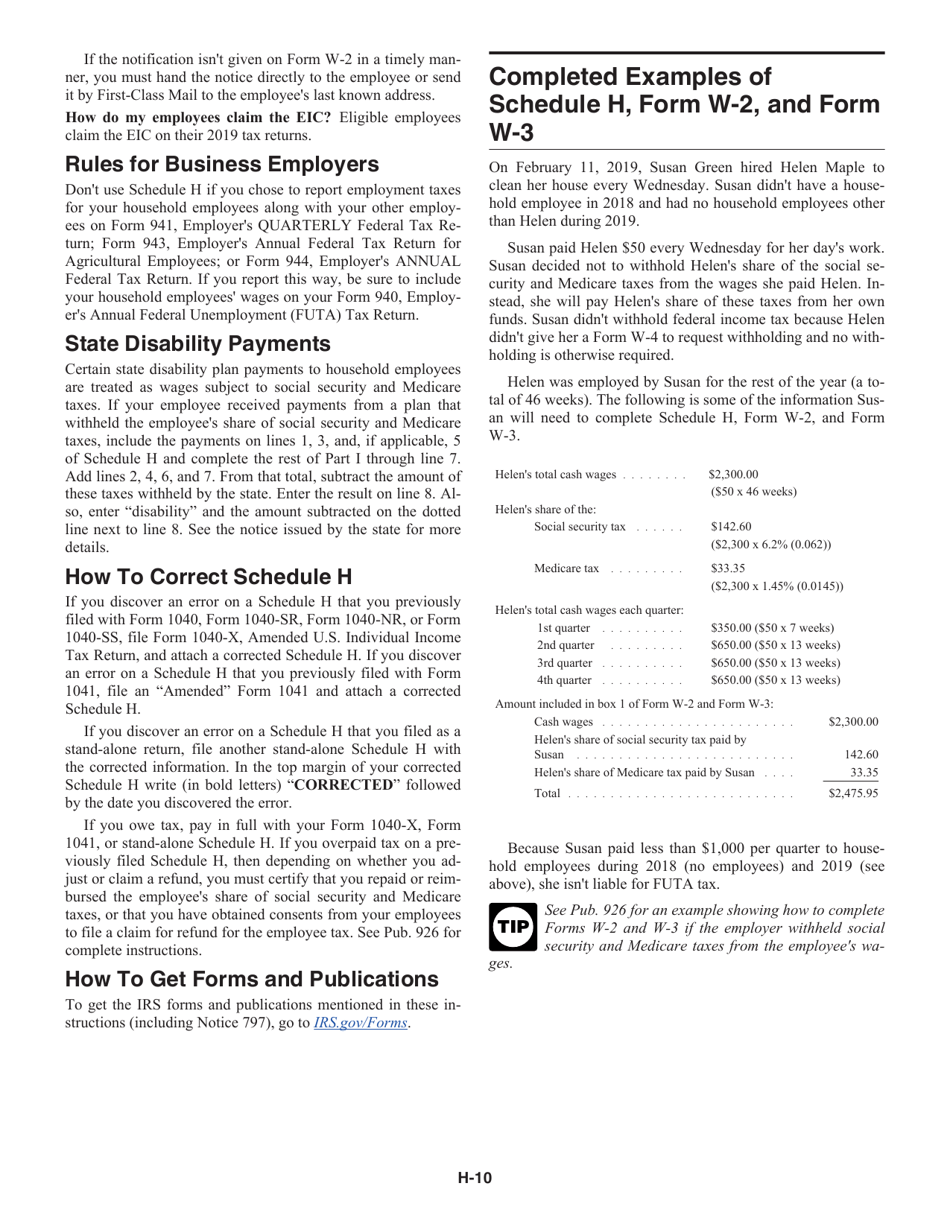

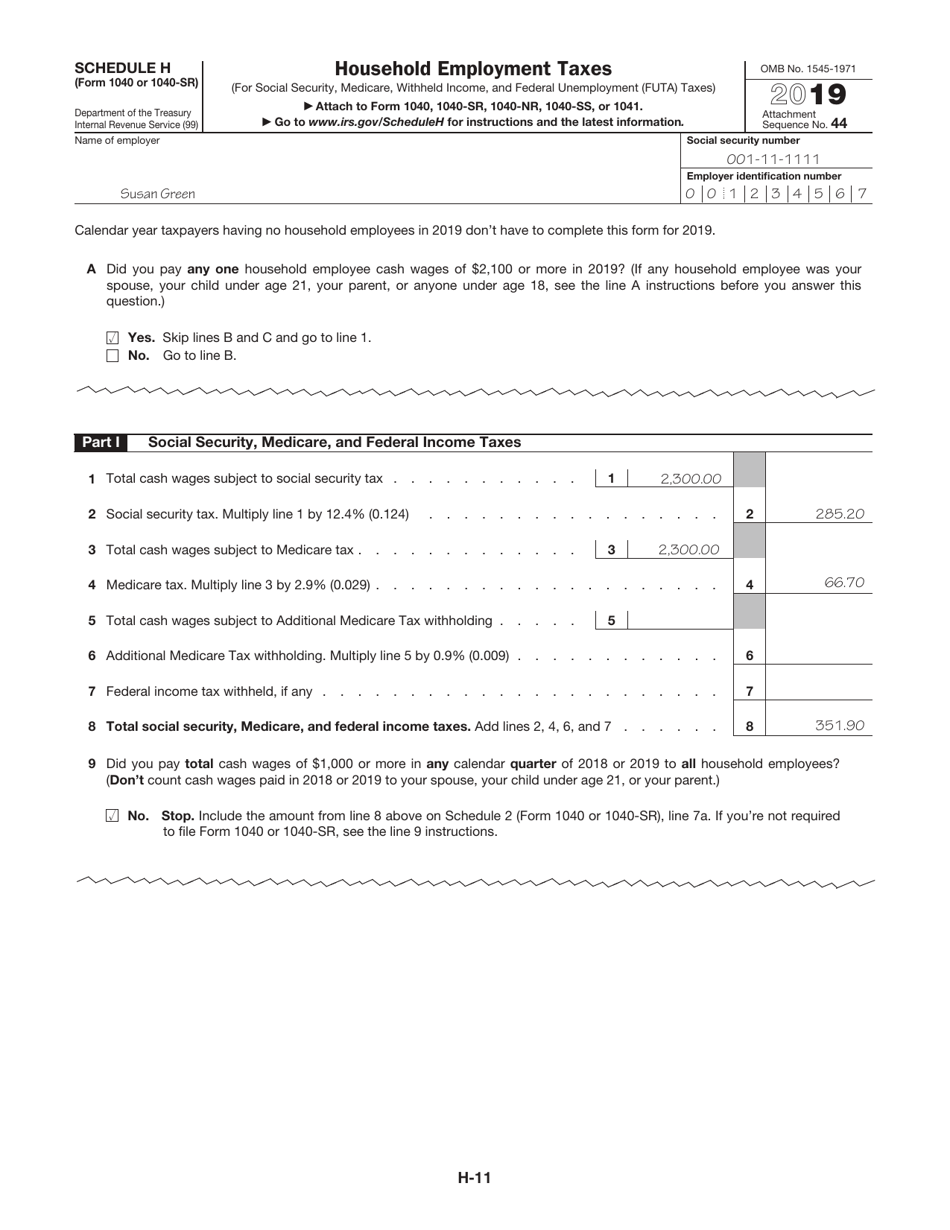

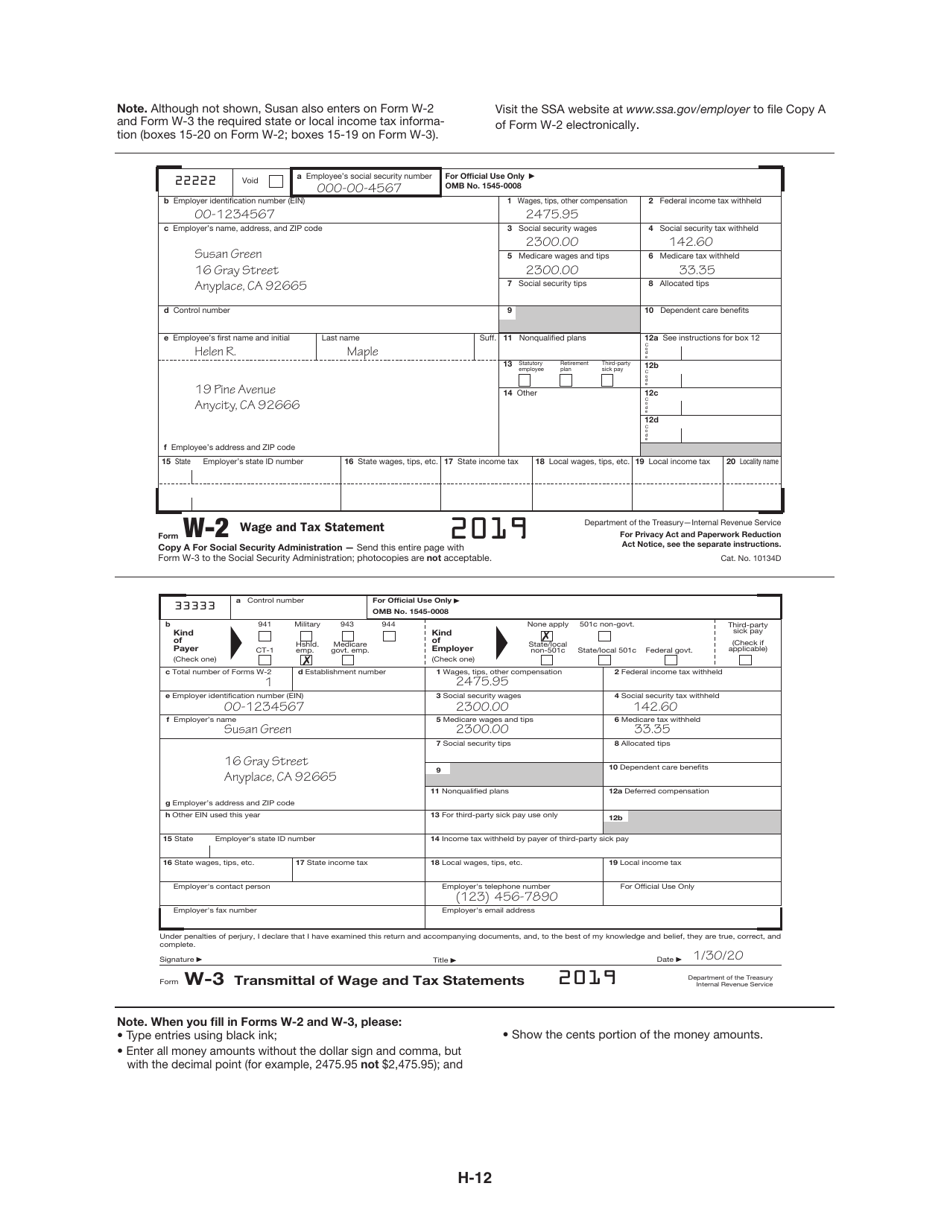

A: Schedule H is a part of Form 1040 or 1040-SR used to report household employment taxes.

Q: What are household employment taxes?

A: Household employment taxes are the taxes that need to be paid if you employ someone to work in your household, such as a nanny, caretaker, or housekeeper.

Q: What is the purpose of Schedule H?

A: The purpose of Schedule H is to calculate and report the household employment taxes you owe.

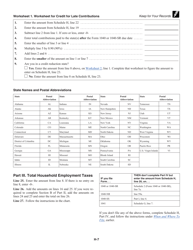

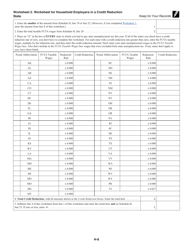

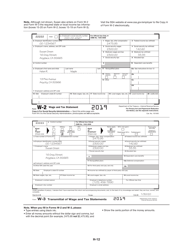

Q: What information is required on Schedule H?

A: On Schedule H, you will need to provide information about the employee, their wages, and the taxes you've withheld.

Q: When is Schedule H due?

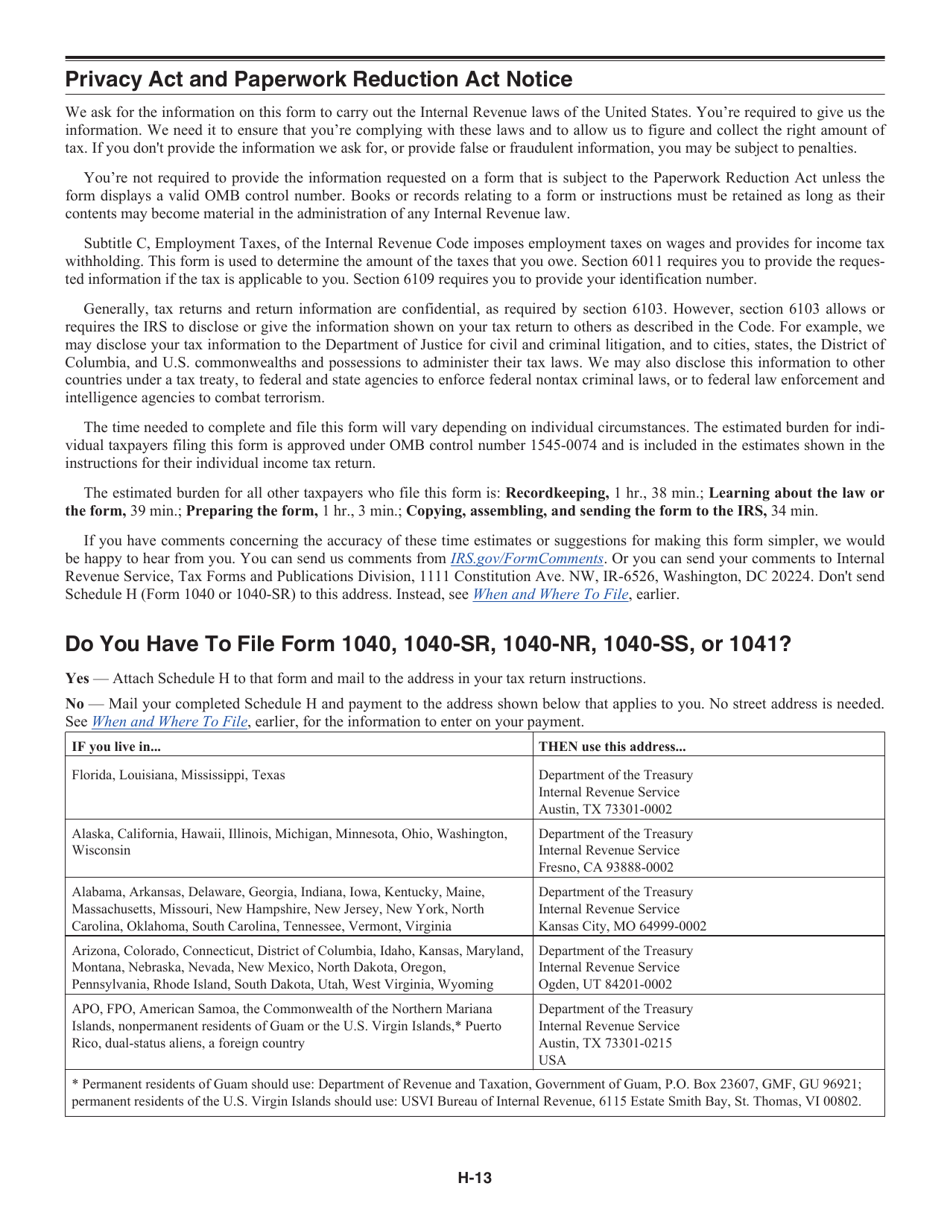

A: Schedule H is due with your annual income tax return, typically on April 15th or the following business day.

Q: Who needs to file Schedule H?

A: You need to file Schedule H if you pay a household employee more than a certain amount (the threshold changes each year).

Instruction Details:

- This 13-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.