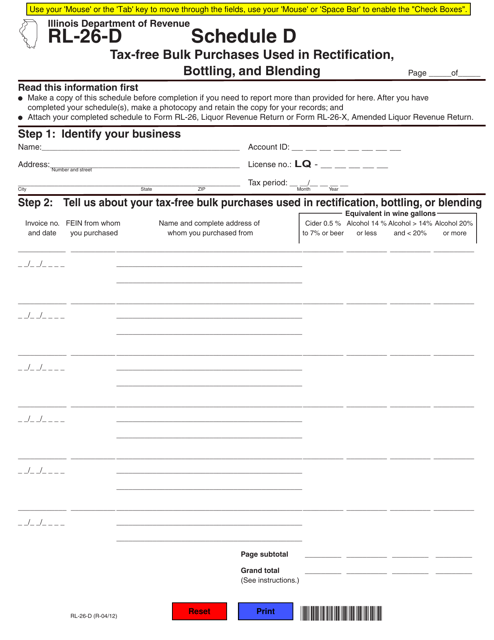

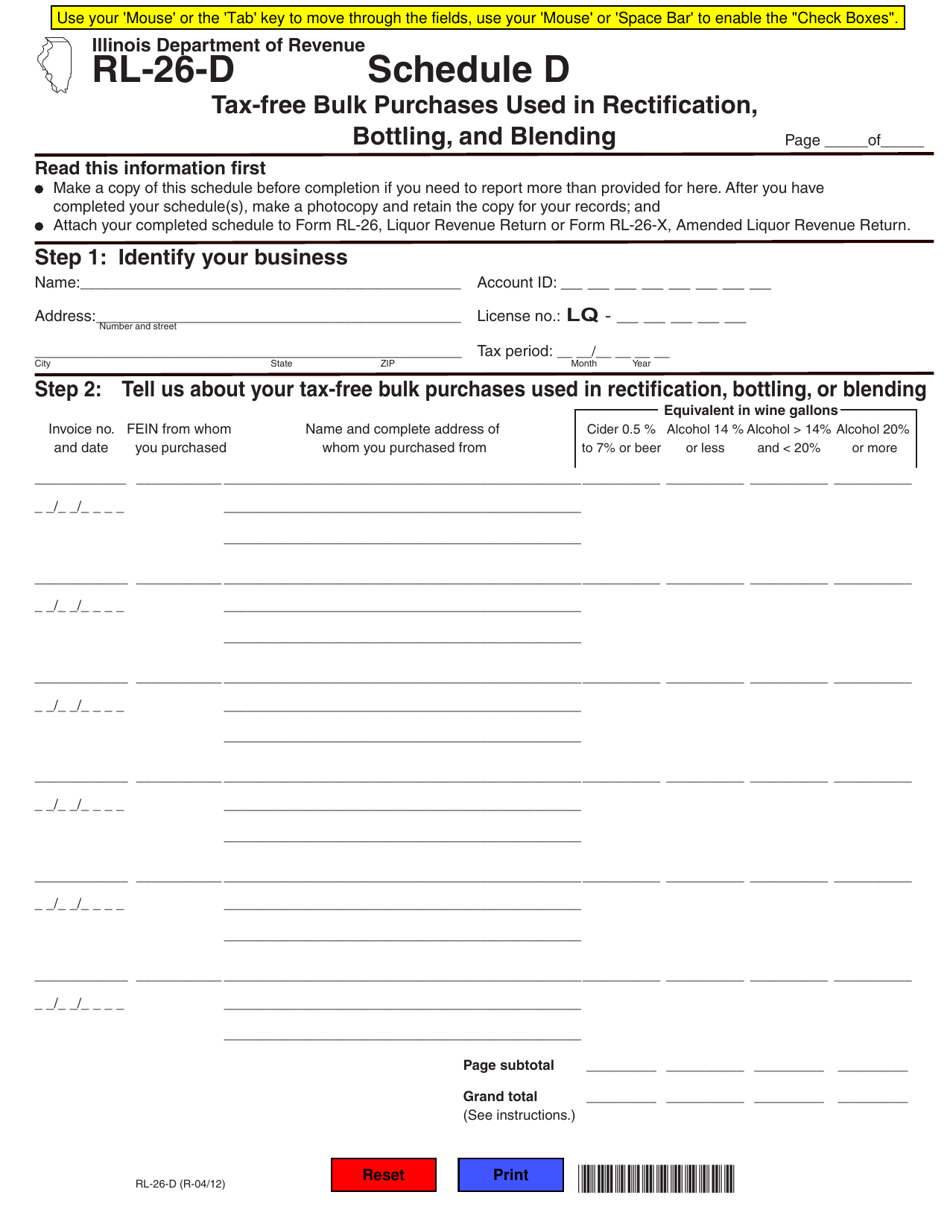

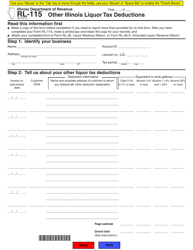

Form RL-26-D Schedule D Tax-Free Bulk Purchases Used in Rectification, Bottling, and Blending - Illinois

What Is Form RL-26-D Schedule D?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RL-26-D?

A: Form RL-26-D is a tax form used in Illinois.

Q: What is Schedule D on Form RL-26-D?

A: Schedule D on Form RL-26-D is used to report tax-free bulk purchases used in rectification, bottling, and blending.

Q: What are tax-free bulk purchases?

A: Tax-free bulk purchases are purchases made without paying taxes.

Q: What does rectification mean?

A: Rectification means the process of purifying or refining something.

Q: What does bottling mean?

A: Bottling means the process of putting liquids into bottles for sale or storage.

Q: What does blending mean?

A: Blending means mixing different substances together to create a new mixture.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RL-26-D Schedule D by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.