This version of the form is not currently in use and is provided for reference only. Download this version of

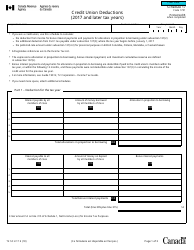

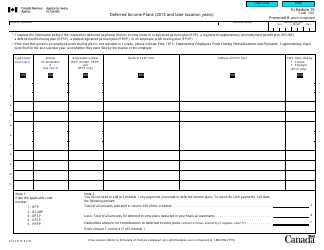

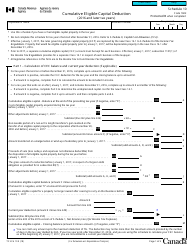

Form T2 Schedule 16

for the current year.

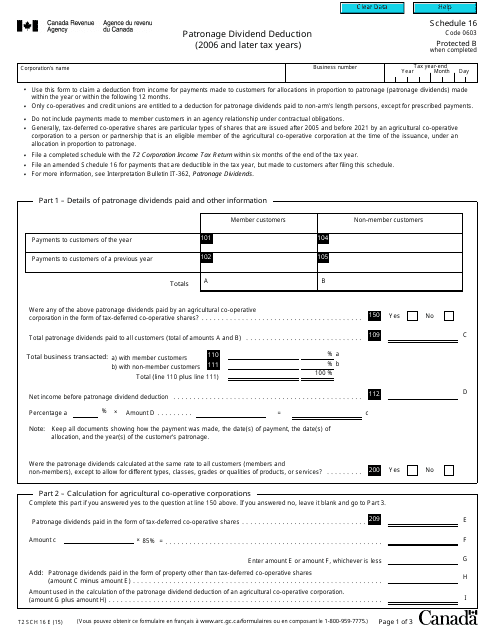

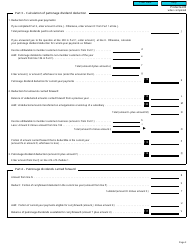

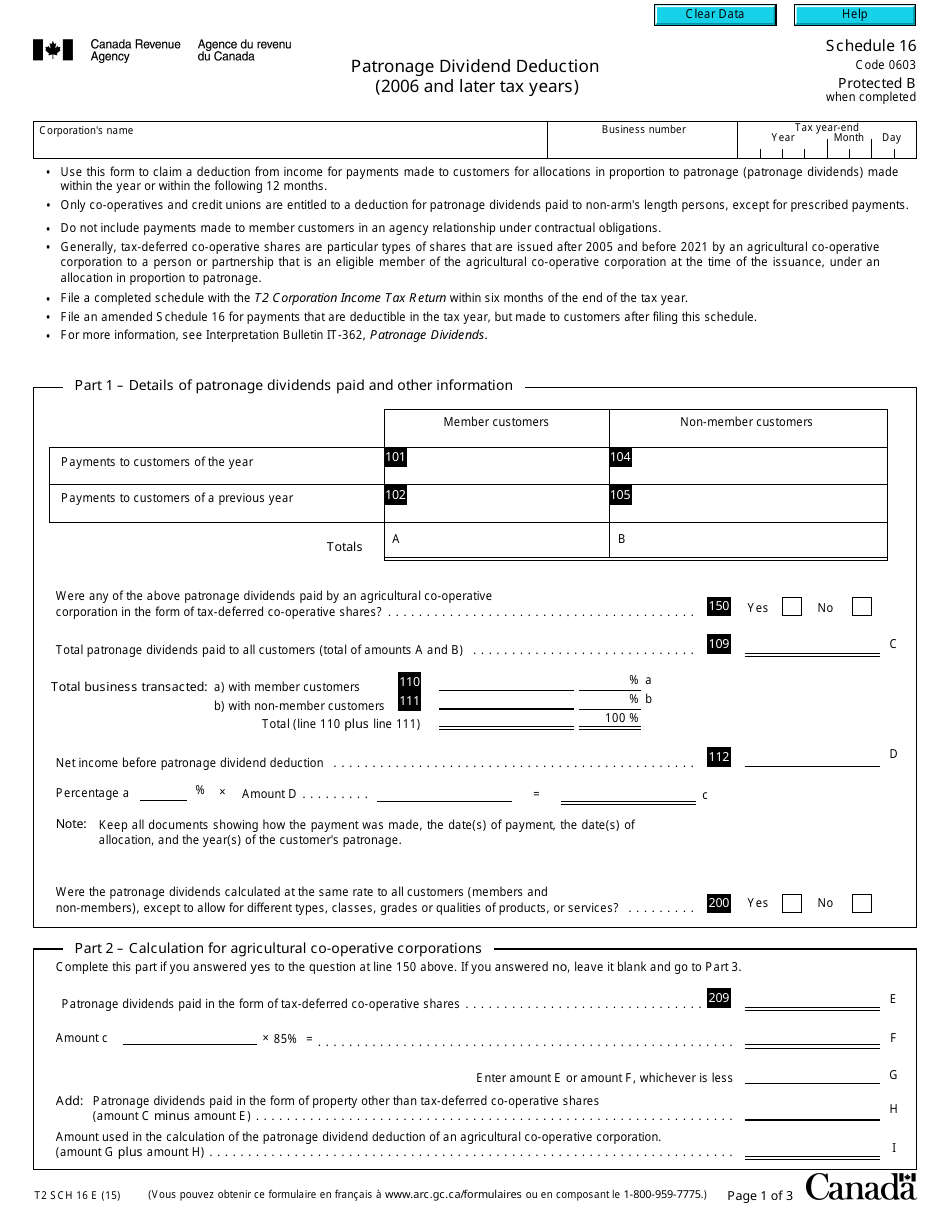

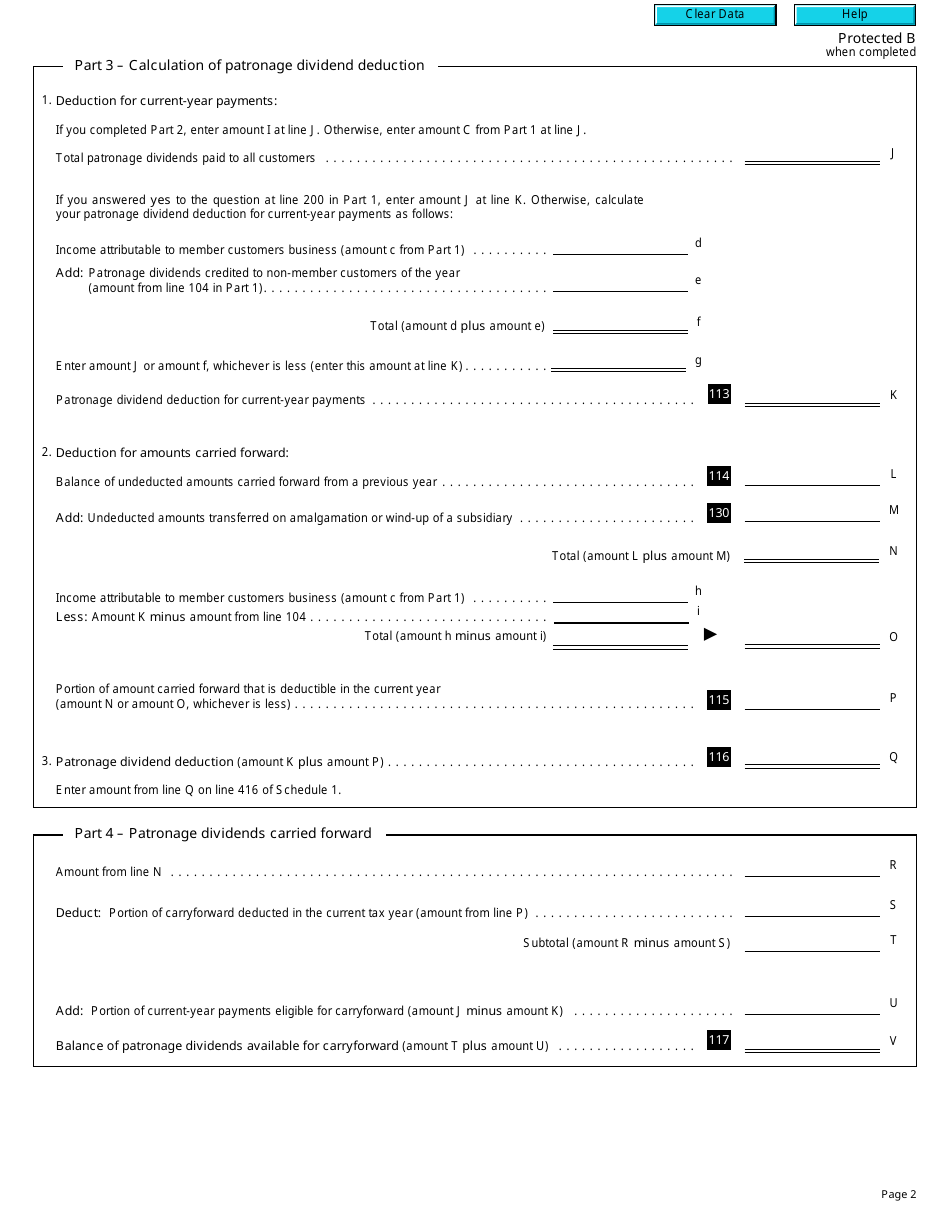

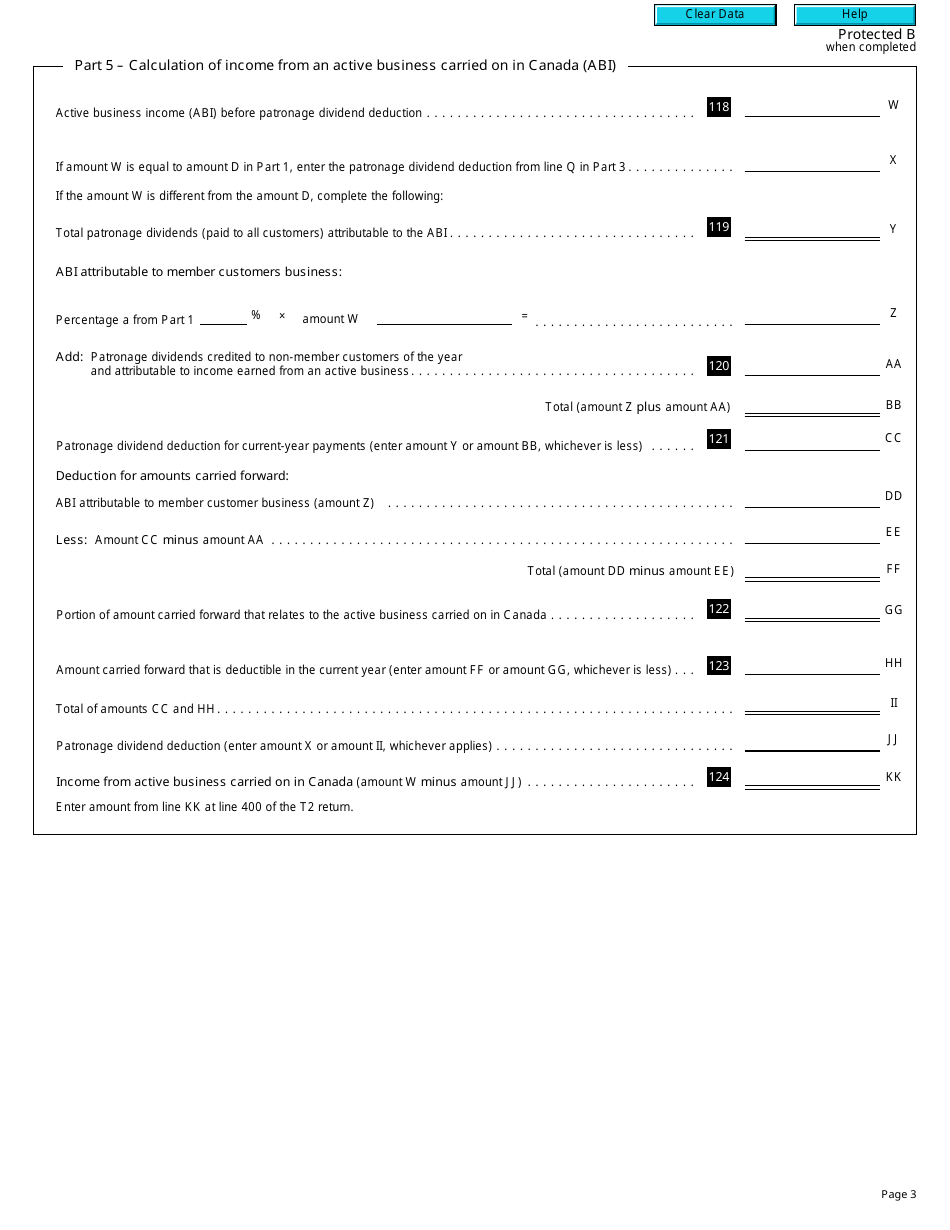

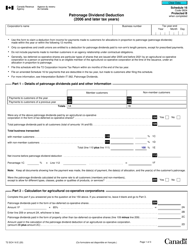

Form T2 Schedule 16 Patronage Dividend Deduction (2006 and Later Taxation Years) - Canada

Form T2 Schedule 16 Patronage Dividend Deduction (2006 and Later Taxation Years) in Canada is used by corporations to claim deductions for patronage dividends paid to members. These dividends are typically distributed by co-operative organizations.

The Form T2 Schedule 16 Patronage Dividend Deduction is filed by corporations in Canada.

FAQ

Q: What is Form T2 Schedule 16?

A: Form T2 Schedule 16 is a tax form used in Canada for claiming the Patronage Dividend Deduction.

Q: What is the Patronage Dividend Deduction?

A: The Patronage Dividend Deduction is a deduction available to certain corporations in Canada that distribute patronage dividends.

Q: Which tax years does Form T2 Schedule 16 apply to?

A: Form T2 Schedule 16 applies to the 2006 and later taxation years.

Q: Who can claim the Patronage Dividend Deduction?

A: Certain corporations that distribute patronage dividends can claim the Patronage Dividend Deduction.

Q: What is the purpose of the Patronage Dividend Deduction?

A: The Patronage Dividend Deduction is intended to encourage cooperative associations to distribute their profits to their members.

Q: Are there any eligibility requirements for claiming the Patronage Dividend Deduction?

A: Yes, there are eligibility requirements that corporations must meet in order to claim the Patronage Dividend Deduction. These requirements are outlined in the instructions for Form T2 Schedule 16.

Q: Is the Patronage Dividend Deduction refundable?

A: No, the Patronage Dividend Deduction is not refundable. It can only be used to reduce the corporation's taxable income.

Q: Can an individual taxpayer claim the Patronage Dividend Deduction?

A: No, the Patronage Dividend Deduction is only available to certain corporations.

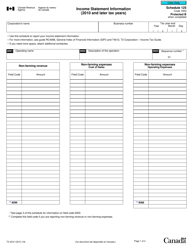

Q: What other tax forms are related to Form T2 Schedule 16?

A: Other tax forms that may be related to Form T2 Schedule 16 include Form T2 Corporation Income Tax Return and various schedules and attachments that are required to complete the corporation's tax return.