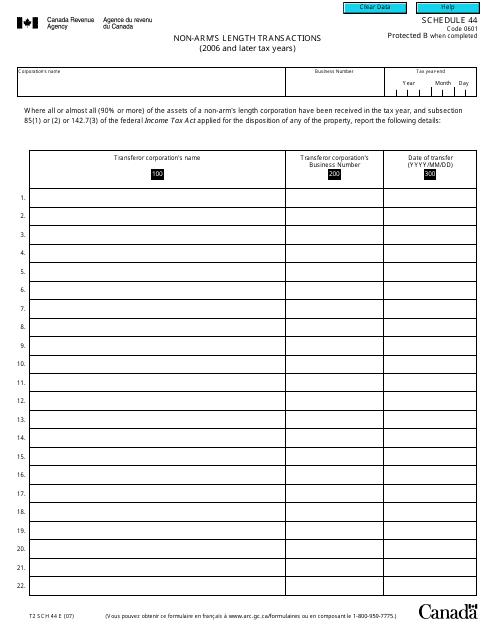

Form T2 Schedule 44 Non-arm's Length Transactions (2006 and Later Tax Years) - Canada

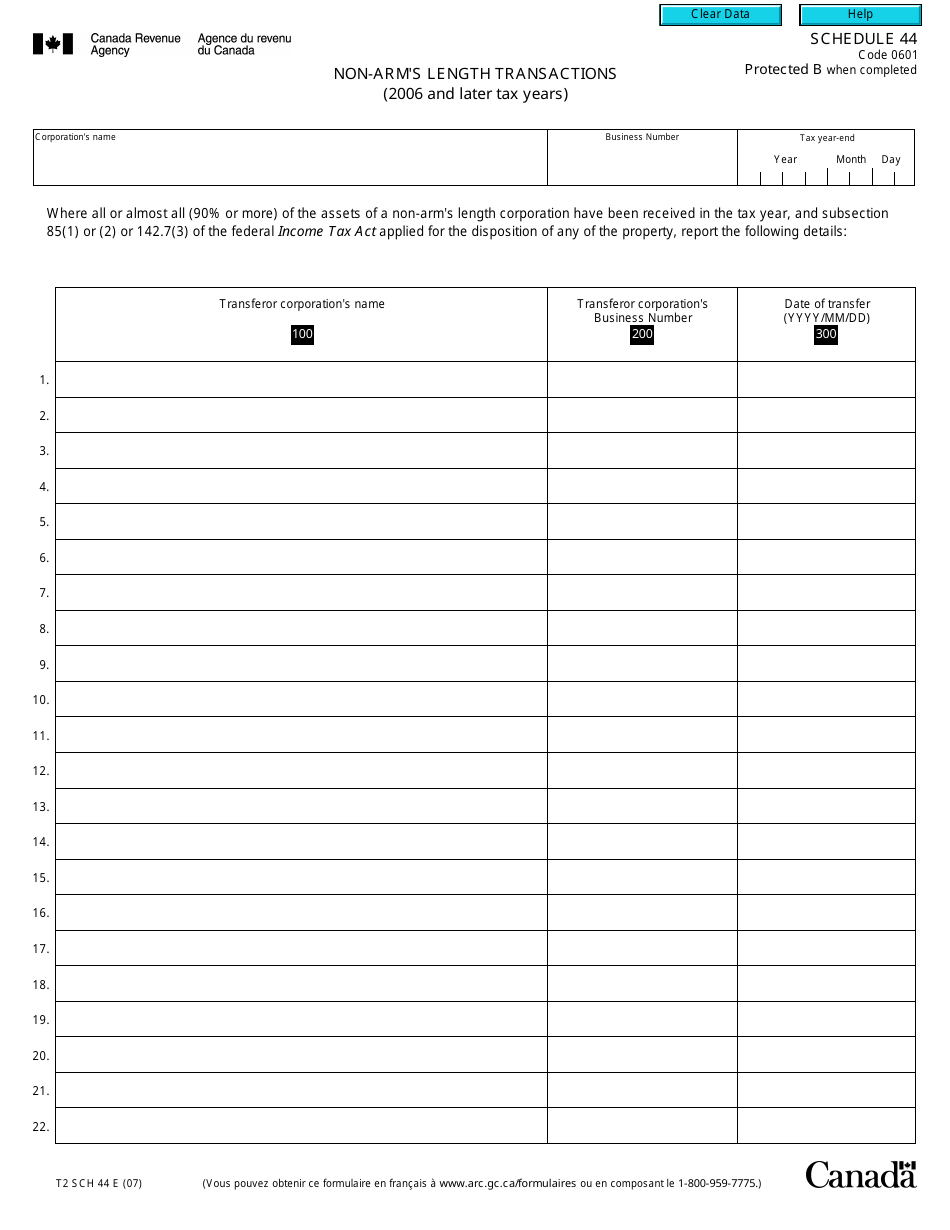

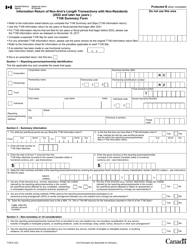

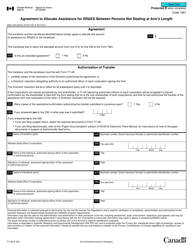

Form T2 Schedule 44, Non-arm's Length Transactions (2006 and Later Tax Years), is used in Canada for reporting transactions that occur between parties with a close personal or business relationship. The purpose is to ensure that transactions are accurately reported for tax purposes and that fair market value is used when calculating taxable income or deductions.

The form T2 Schedule 44 for non-arm's length transactions in Canada is filed by Canadian corporations for the tax years 2006 and later.

FAQ

Q: What is Form T2 Schedule 44?

A: Form T2 Schedule 44 is a tax form used in Canada to report non-arm's length transactions for the tax years 2006 and later.

Q: What are non-arm's length transactions?

A: Non-arm's length transactions are transactions between parties who are related or do not deal with each other at arm's length.

Q: Who is required to file Form T2 Schedule 44?

A: Corporations in Canada that have non-arm's length transactions during the tax years 2006 and later are required to file Form T2 Schedule 44.

Q: When should Form T2 Schedule 44 be filed?

A: Form T2 Schedule 44 must be filed with the corporation's T2 corporate income tax return by the filing due date.

Q: What information is required on Form T2 Schedule 44?

A: Form T2 Schedule 44 requires information about the non-arm's length transactions, including a description of the transaction, the amount involved, and the relationship between the parties.

Q: Are there penalties for not filing Form T2 Schedule 44?

A: Yes, there can be penalties for not filing Form T2 Schedule 44 or for providing false or misleading information on the form.