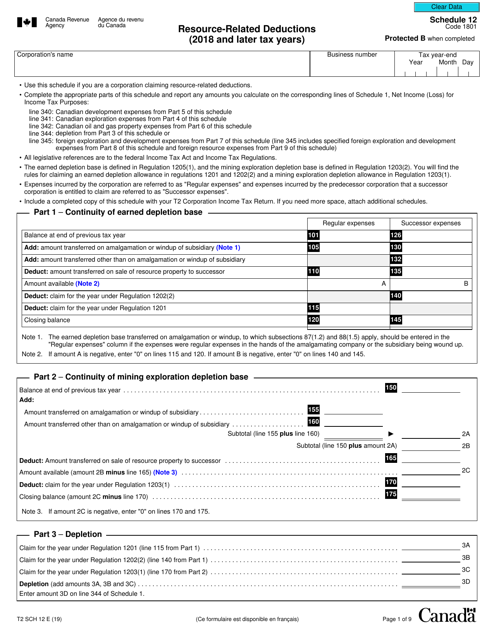

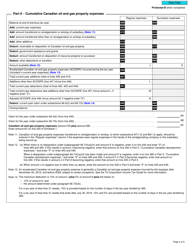

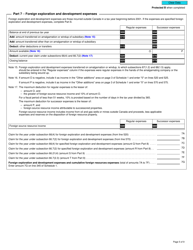

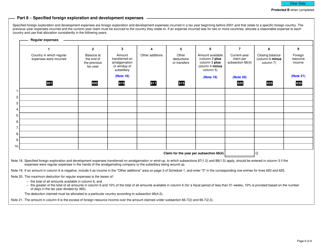

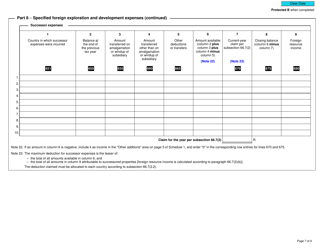

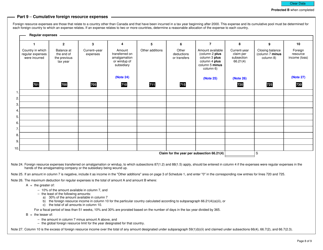

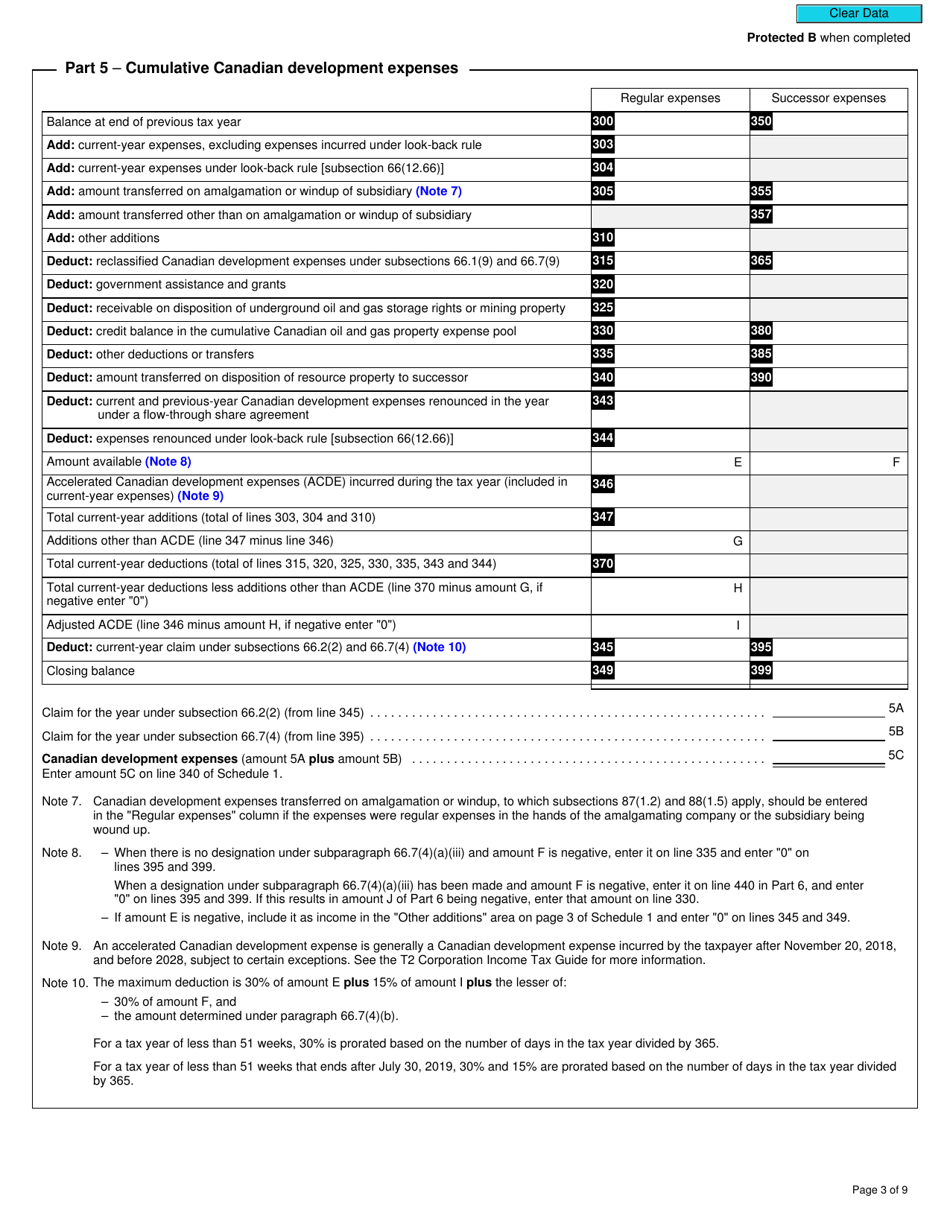

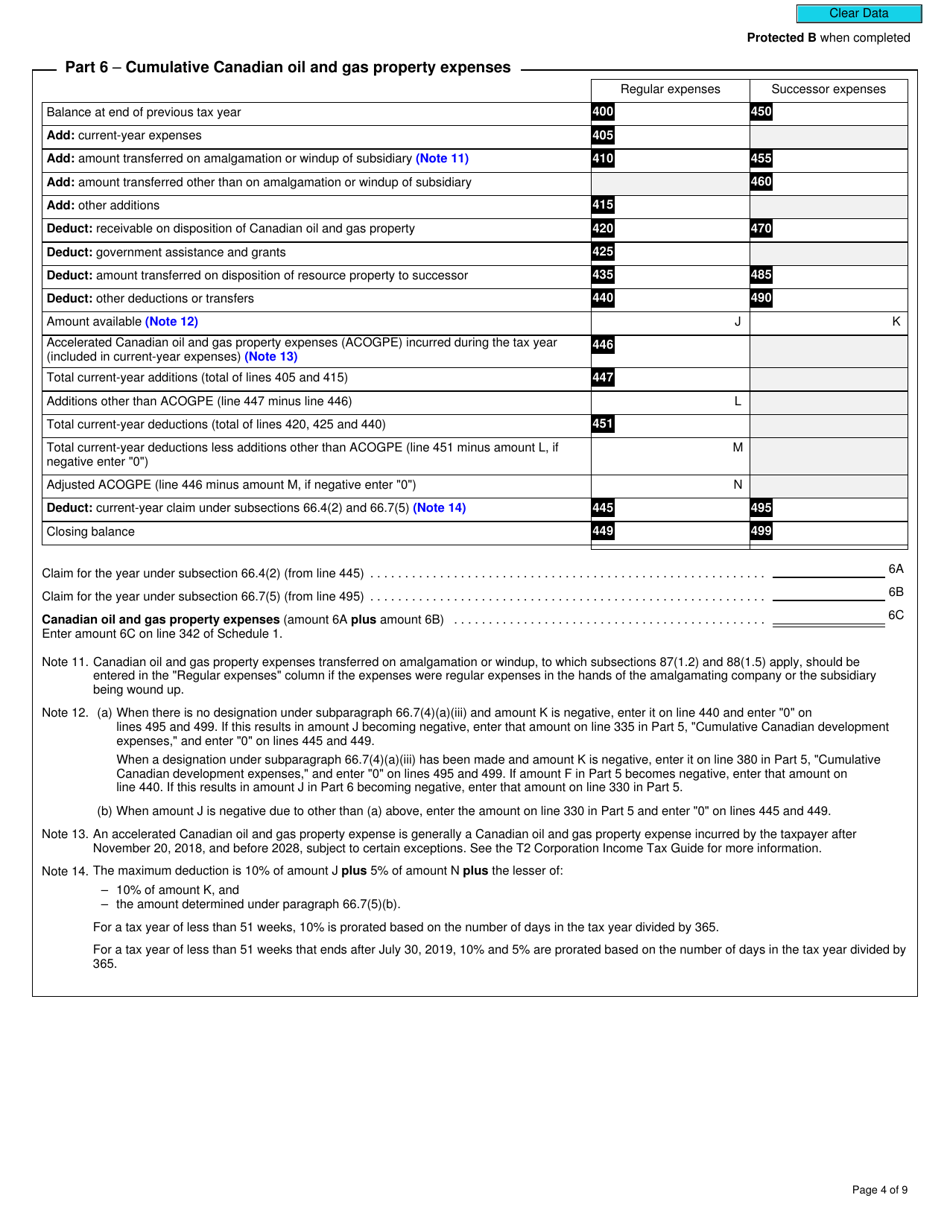

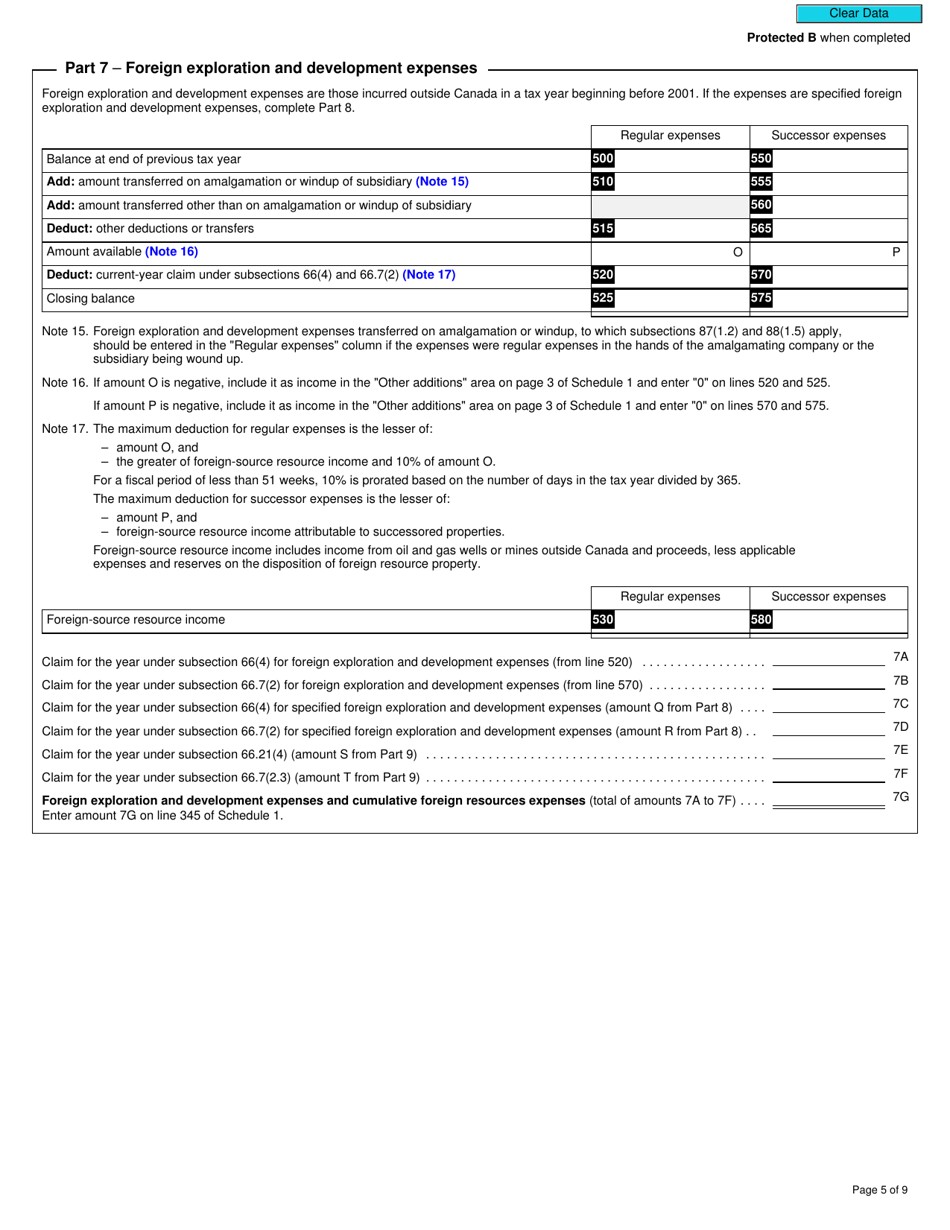

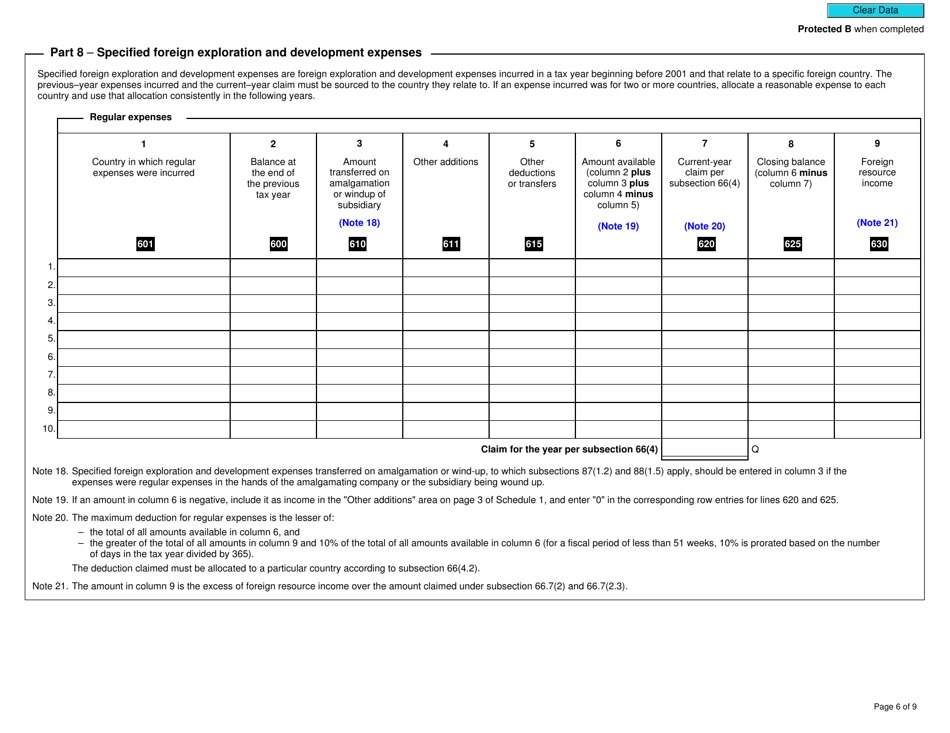

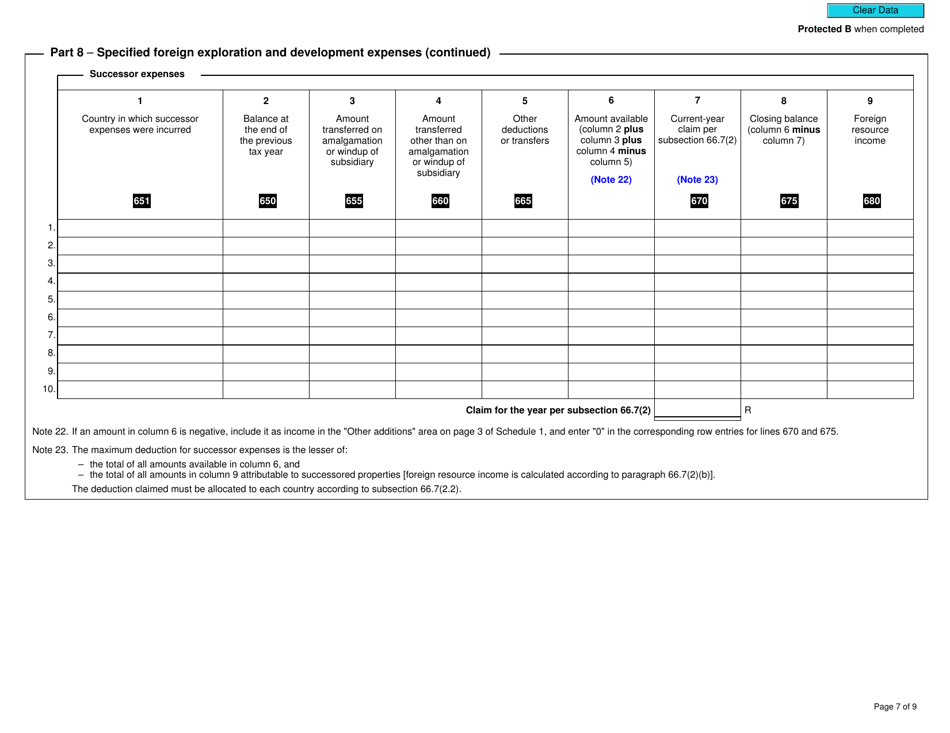

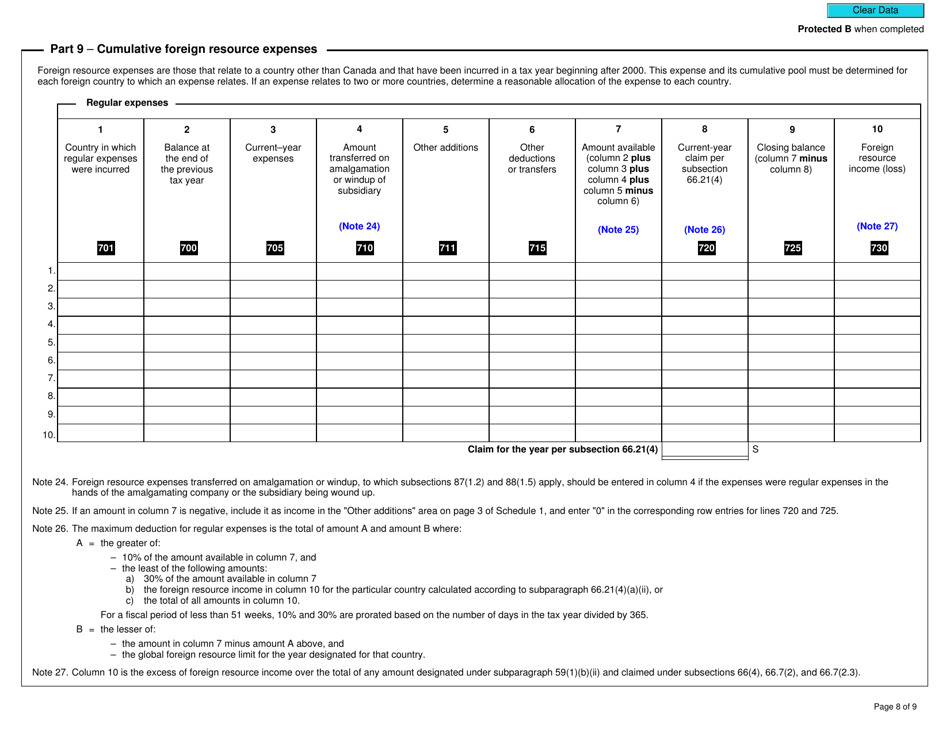

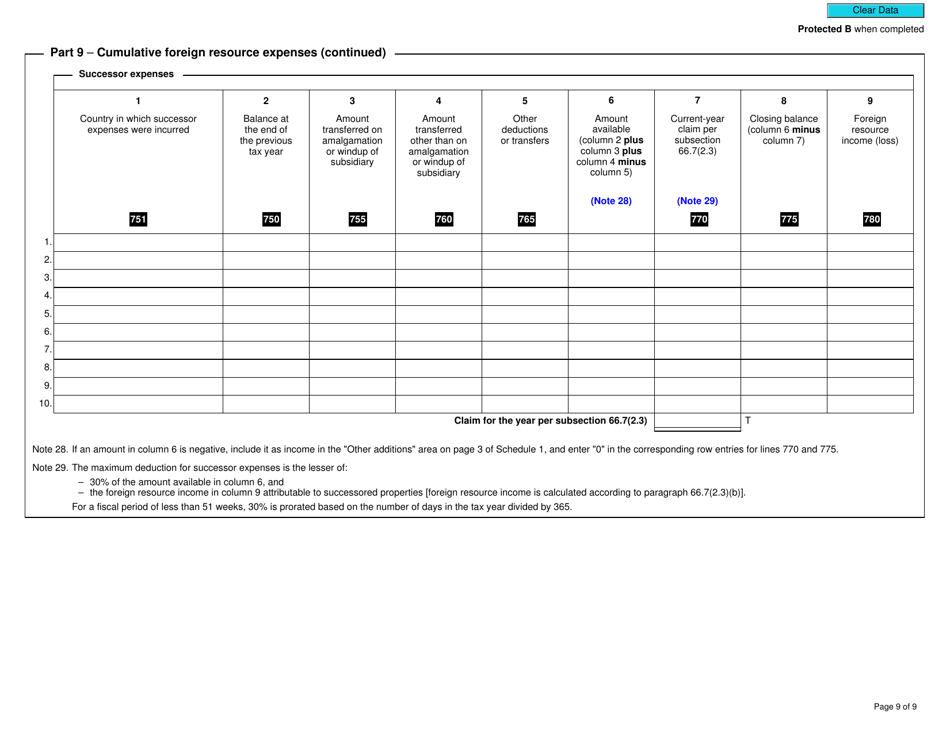

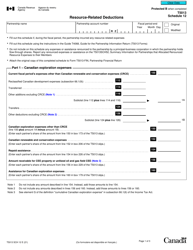

Form T2 Schedule 12 Resource-Related Deductions (2018 and Later Tax Years) - Canada

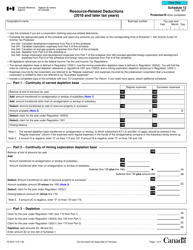

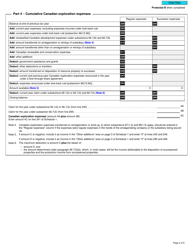

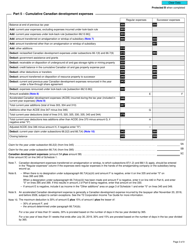

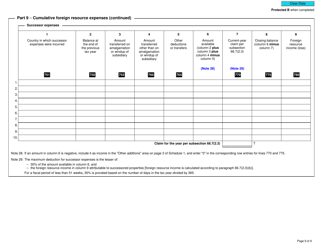

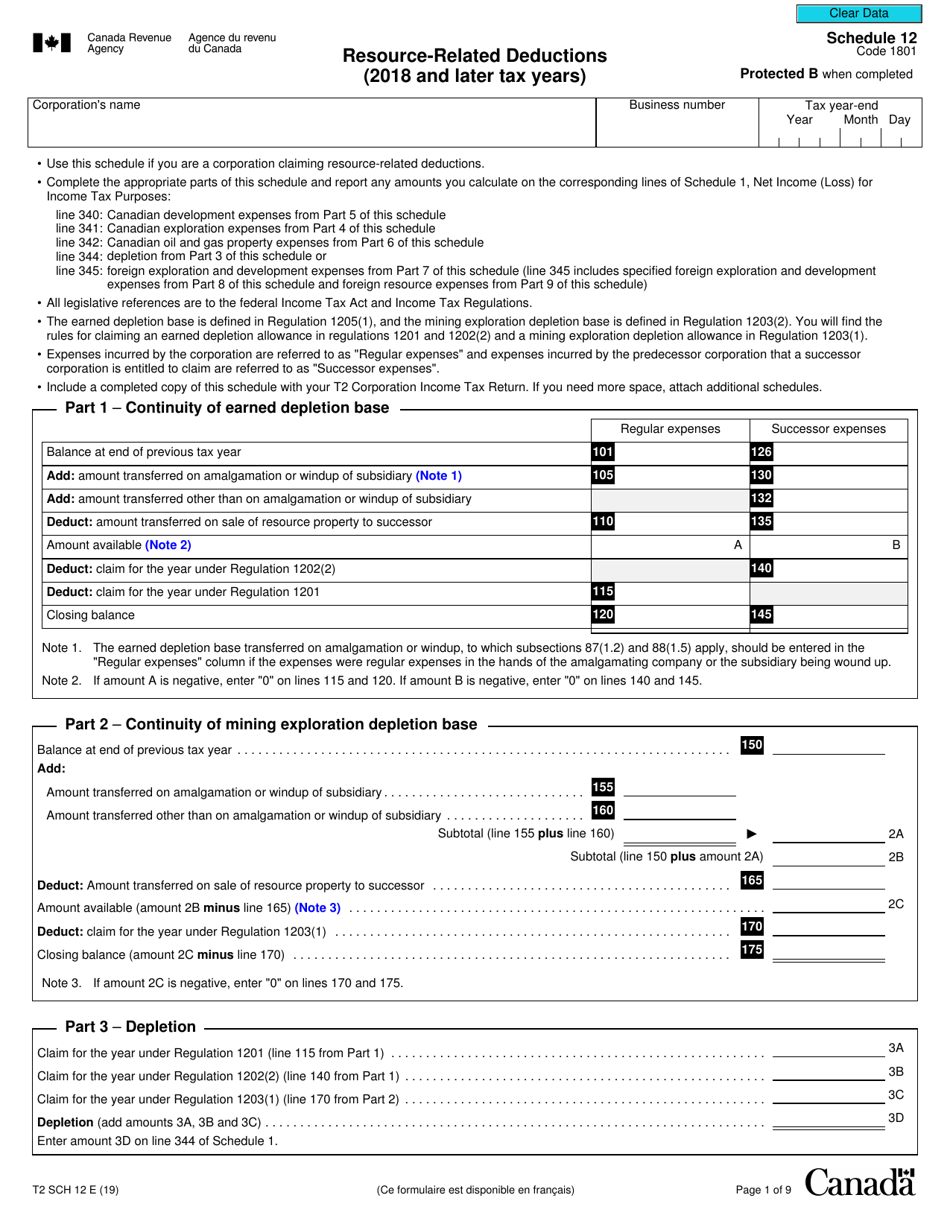

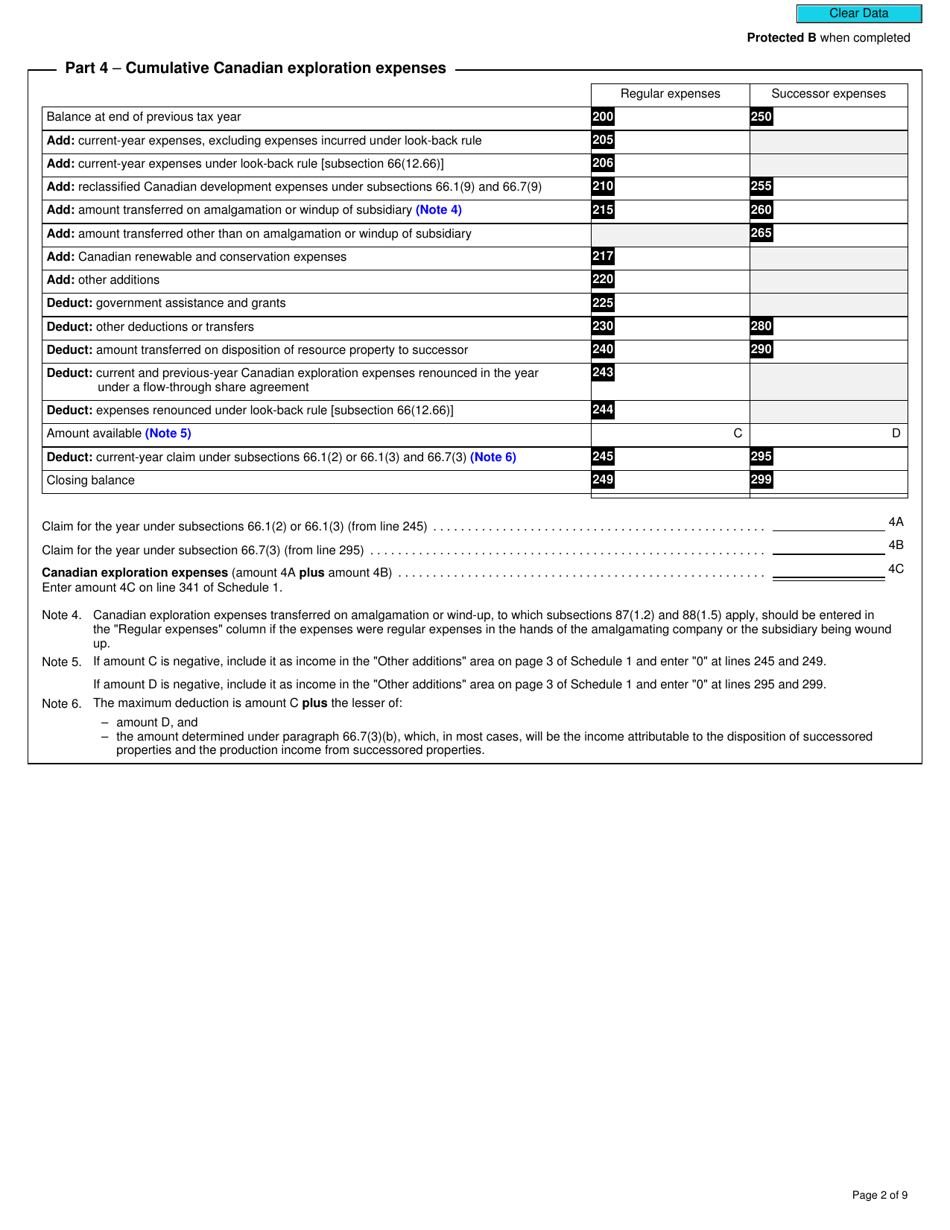

Form T2 Schedule 12 Resource-Related Deductions (2018 and Later Tax Years) in Canada is used to claim deductions related to resource-related expenses, such as exploration and development costs for mines, oil wells, and gas wells.

The Form T2 Schedule 12 Resource-Related Deductions (2018 and Later Tax Years) in Canada is filed by corporations that have resource-related expenses or deductions.

FAQ

Q: What is Form T2 Schedule 12?

A: Form T2 Schedule 12 is used in Canada for reporting resource-related deductions on corporate tax returns.

Q: What are resource-related deductions?

A: Resource-related deductions are deductions related to the exploration and development of natural resources, such as oil and gas.

Q: Who needs to file Form T2 Schedule 12?

A: Businesses engaged in resource-related activities, such as oil and gas exploration and development, are required to file Form T2 Schedule 12 with their corporate tax return.

Q: What is the purpose of Form T2 Schedule 12?

A: The purpose of Form T2 Schedule 12 is to calculate and claim resource-related deductions to reduce the taxable income of businesses involved in resource activities.

Q: What tax years can Form T2 Schedule 12 be used for?

A: Form T2 Schedule 12 can be used for tax years starting in 2018 and later.