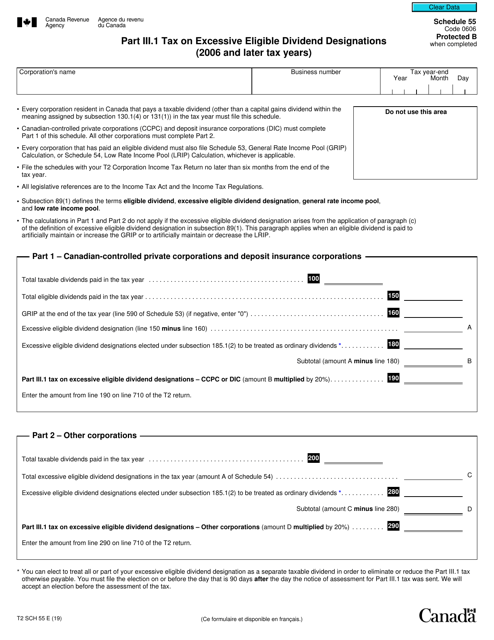

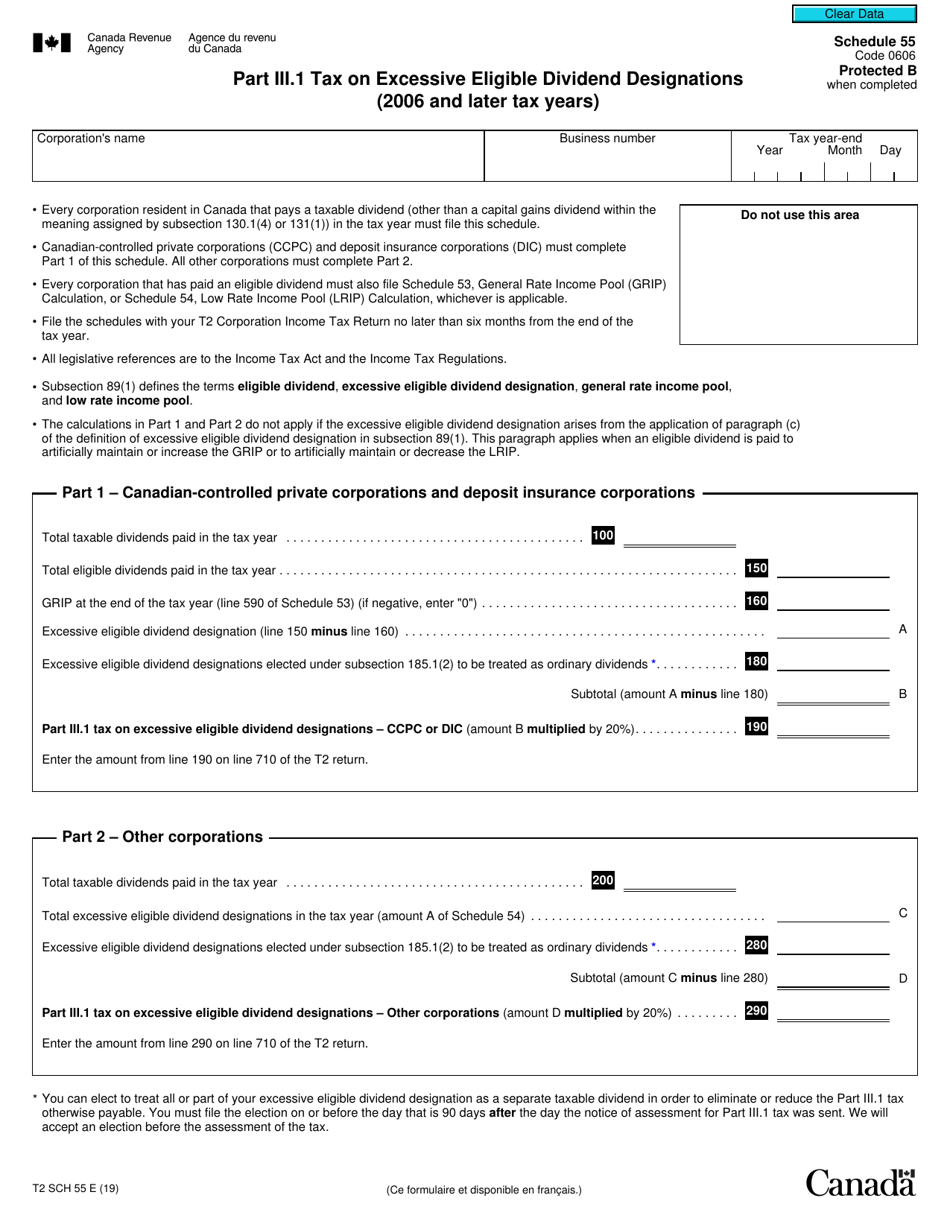

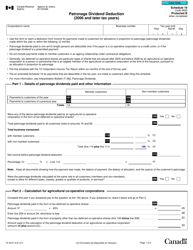

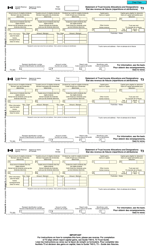

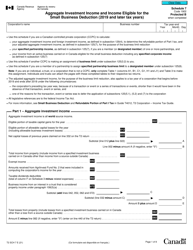

Form T2 Schedule 55 Part Iii.1 - Tax on Excessive Eligible Dividend Designations (2006 and Later Tax Years) - Canada

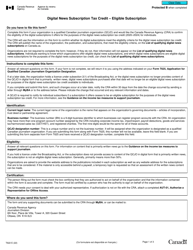

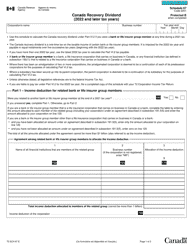

Form T2 Schedule 55 Part III.1 is used in Canada for calculating and reporting the tax on excessive eligible dividend designations for the tax years from 2006 and onwards. It is a part of the T2 Corporation Income Tax Return and helps businesses determine and pay the appropriate tax on dividends.

FAQ

Q: What is Form T2 Schedule 55 Part III.1?

A: Form T2 Schedule 55 Part III.1 is a form used by Canadian corporations to calculate the tax on excessive eligible dividend designations.

Q: When was Form T2 Schedule 55 Part III.1 introduced?

A: Form T2 Schedule 55 Part III.1 was introduced in 2006 for tax years onwards.

Q: What does the form calculate?

A: The form calculates the tax on excessive eligible dividend designations.

Q: Who needs to file Form T2 Schedule 55 Part III.1?

A: Canadian corporations that have made excessive eligible dividend designations need to file this form.

Q: Are there any specific tax years for which this form is applicable?

A: Form T2 Schedule 55 Part III.1 is applicable for tax years starting from 2006 onwards.