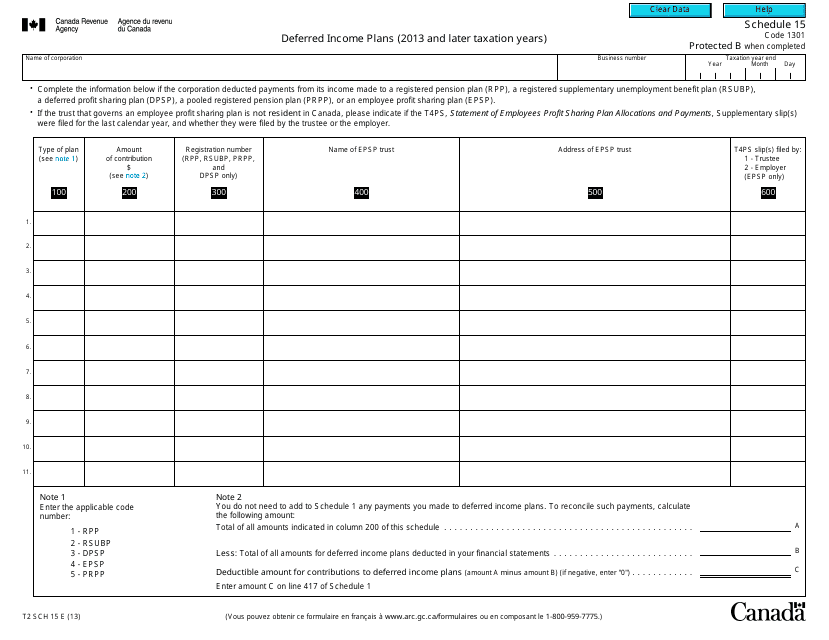

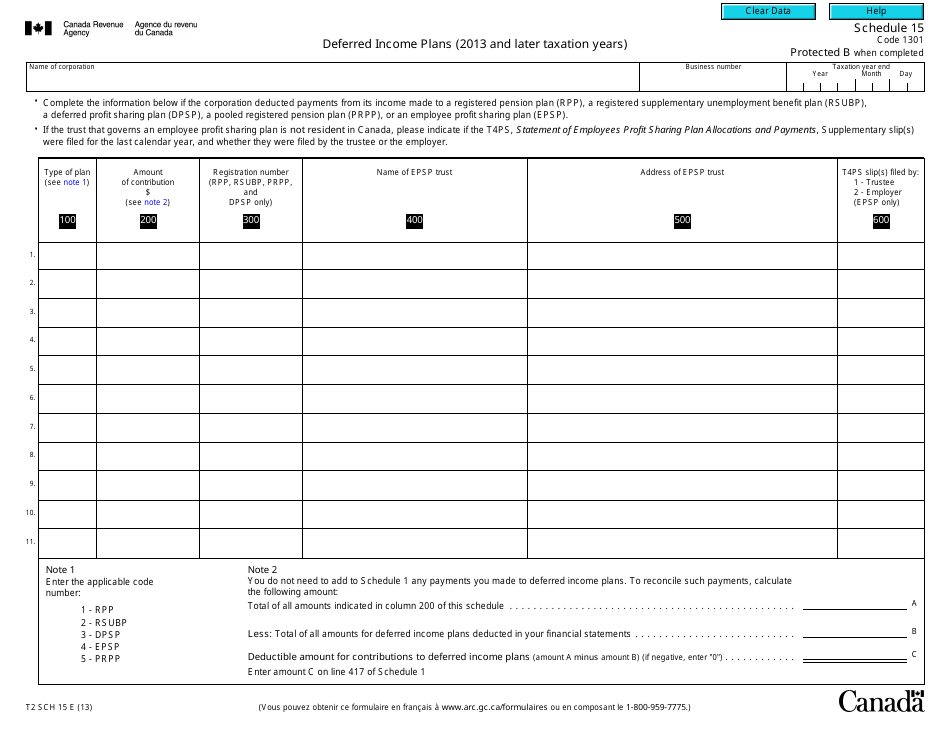

Form T2 Schedule 15 Deferred Income Plans (2013 and Later Tax Years) - Canada

Fill PDF Online

Fill out online for free

without registration or credit card

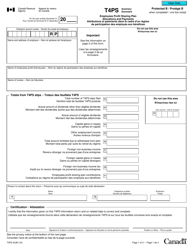

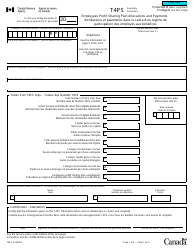

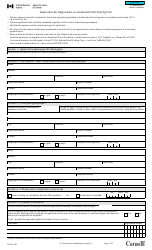

Form T2 Schedule 15 is used by Canadian corporations to report deferred income plans for tax years 2013 and later. It is used to determine the income tax treatment of these plans.

The corporation that maintains a deferred income plan would file the Form T2 Schedule 15 for tax years 2013 and later in Canada.

FAQ

Q: What is Form T2 Schedule 15?

A: Form T2 Schedule 15 is a tax form used in Canada for reporting deferred income plans.

Q: What tax years does Form T2 Schedule 15 apply to?

A: Form T2 Schedule 15 applies to tax years 2013 and later.

Q: Who should use Form T2 Schedule 15?

A: Form T2 Schedule 15 should be used by Canadian corporations with deferred income plans.