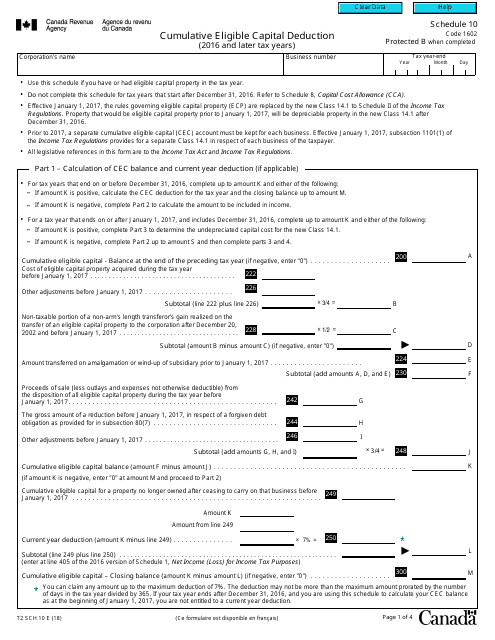

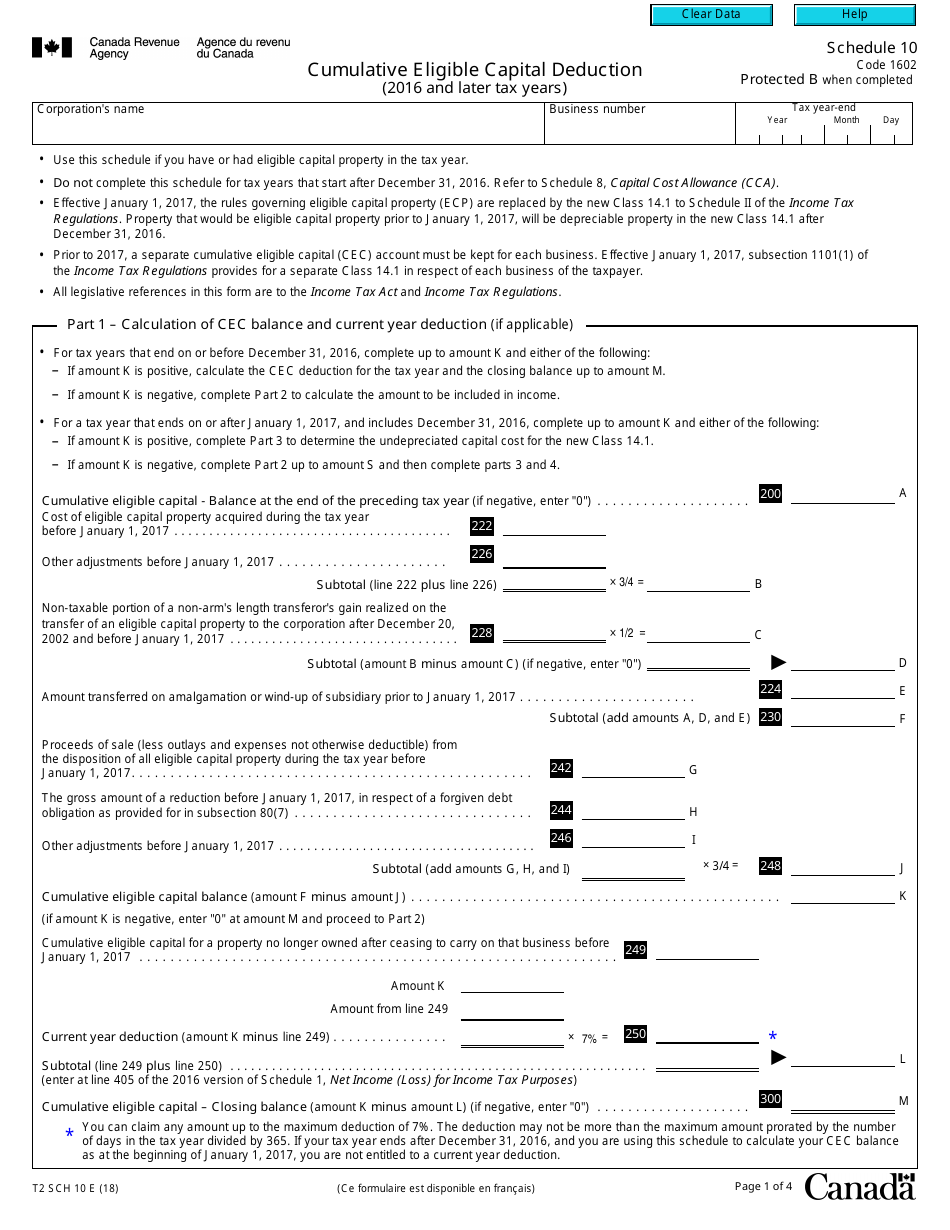

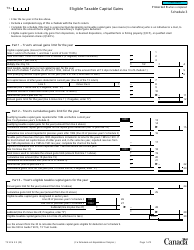

Form T2 Schedule 10 Cumulative Eligible Capital Deduction (2016 and Later Taxation Years) - Canada

Form T2 SCH 10 is a Canadian Revenue Agency form also known as the "Form T2 Sch 10 Schedule 10 "cumulative Eligible Capital Deduction (2016 And Later Taxation Years)" - Canada" . The latest edition of the form was released in January 1, 2018 and is available for digital filing.

Download an up-to-date Form T2 SCH 10 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2 Schedule 10?

A: Form T2 Schedule 10 is a tax form used in Canada for claiming the Cumulative Eligible Capital Deduction.

Q: What is the Cumulative Eligible Capital Deduction?

A: The Cumulative Eligible Capital Deduction allows businesses in Canada to deduct a portion of the eligible capital costs when calculating their taxable income.

Q: Which taxation years does Form T2 Schedule 10 apply to?

A: Form T2 Schedule 10 applies to taxation years starting in 2016 and later.