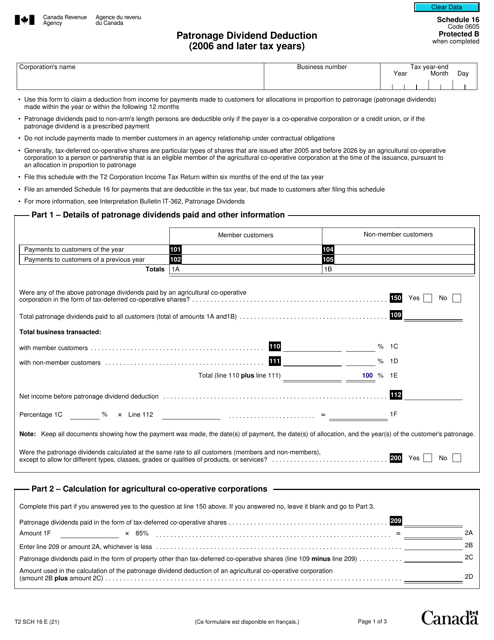

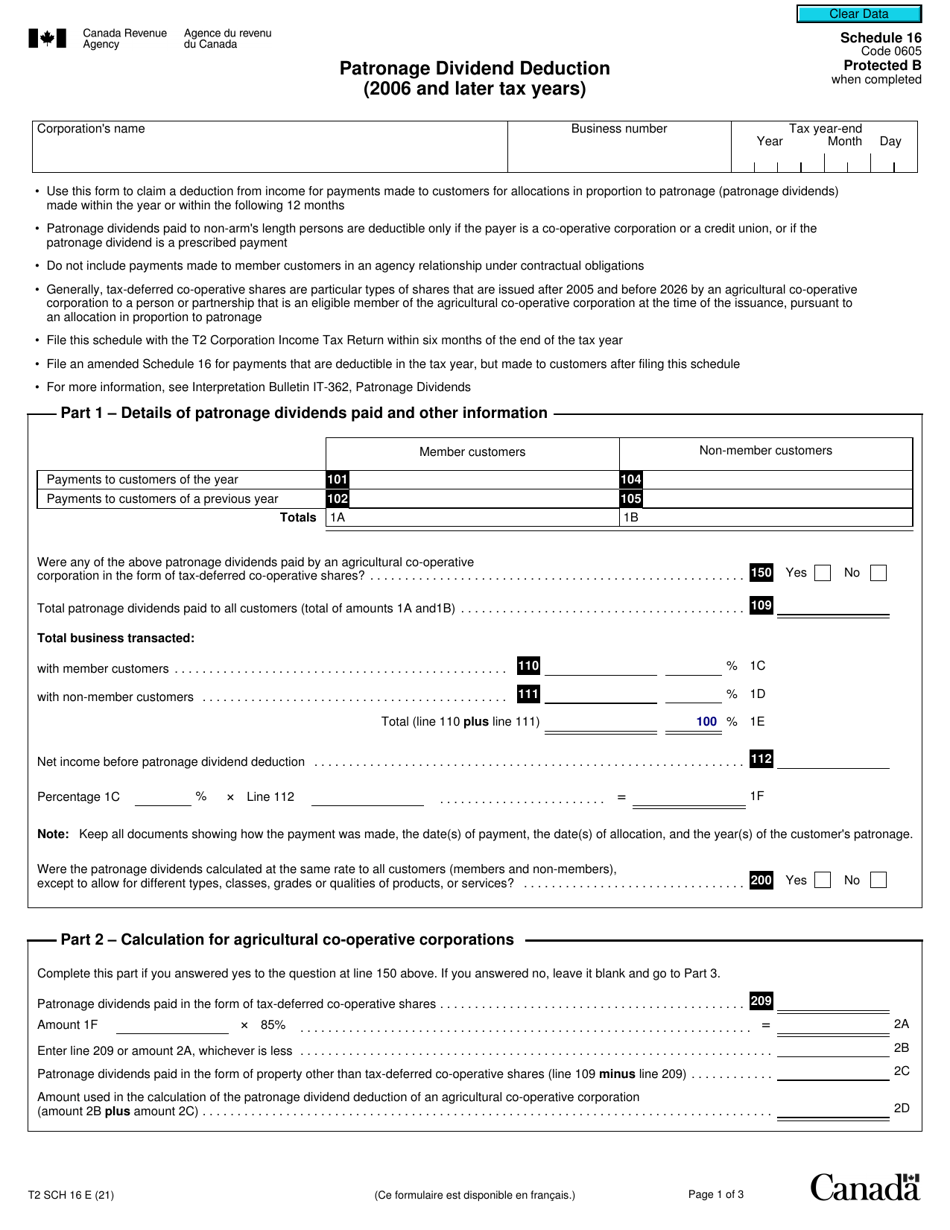

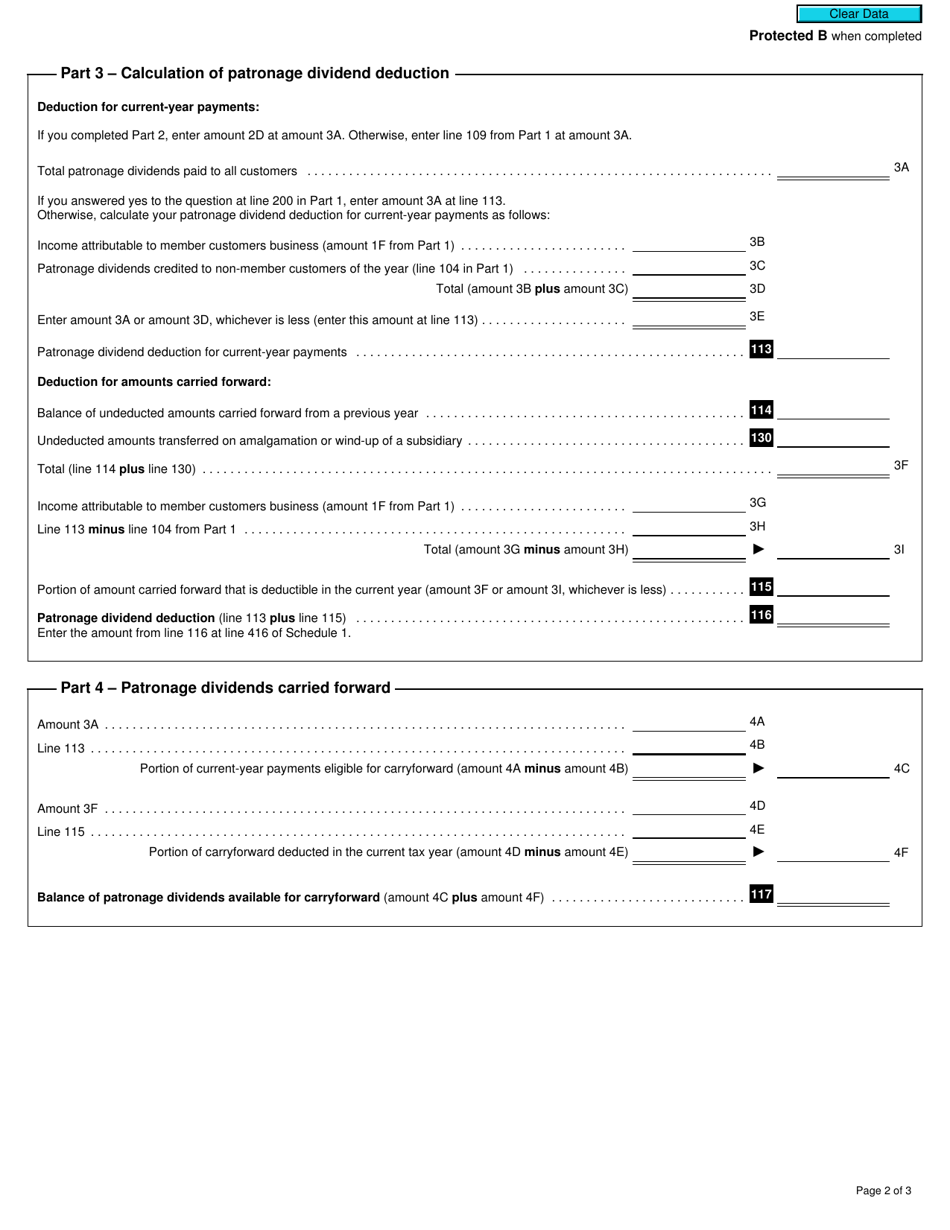

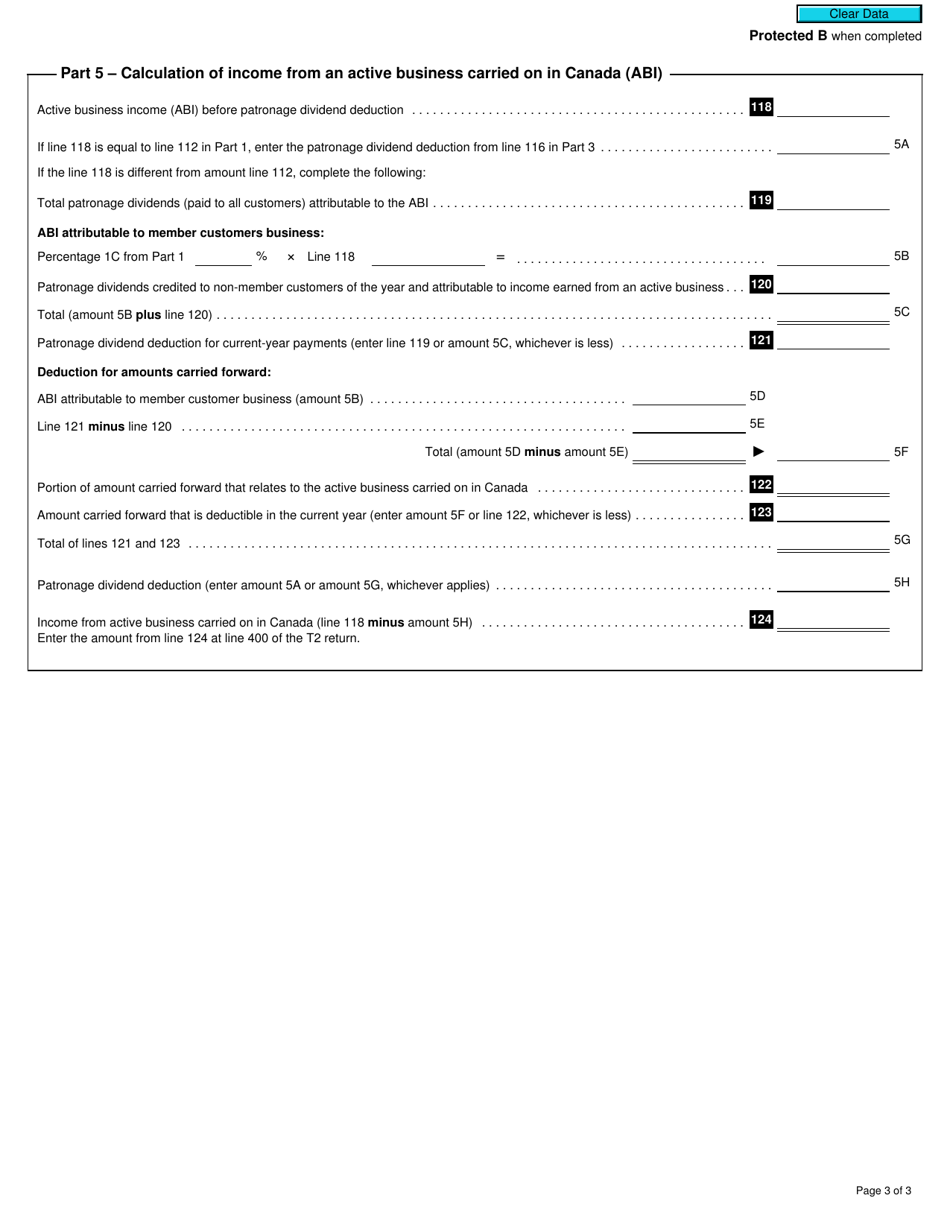

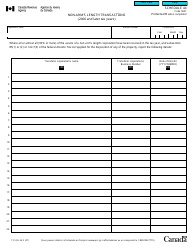

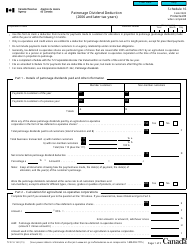

Form T2 Schedule 16 Patronage Dividend Deduction (2006 and Later Tax Years) - Canada

Form T2 Schedule 16 Patronage Dividend Deduction is used in Canada for claiming a deduction related to patronage dividends received by a corporation in the 2006 and later tax years. It allows the corporation to deduct the eligible portion of the patronage dividends from its taxable income.

The Form T2 Schedule 16 Patronage Dividend Deduction is filed by Canadian corporations.

Form T2 Schedule 16 Patronage Dividend Deduction (2006 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 16?

A: Form T2 Schedule 16 is a tax form used in Canada to claim the Patronage Dividend Deduction.

Q: What is the Patronage Dividend Deduction?

A: The Patronage Dividend Deduction is a deduction that can be claimed by certain types of organizations in Canada.

Q: Who can claim the Patronage Dividend Deduction?

A: Certain types of organizations, such as agricultural cooperatives and mutual insurance companies, can claim the Patronage Dividend Deduction.

Q: What tax years does Form T2 Schedule 16 apply to?

A: Form T2 Schedule 16 applies to tax years starting in 2006 and later.