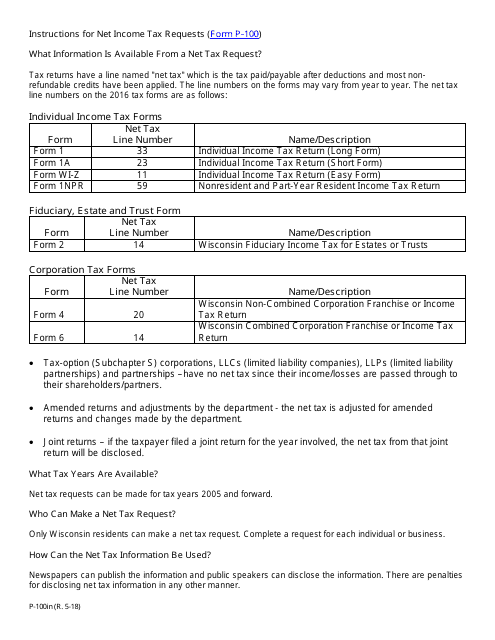

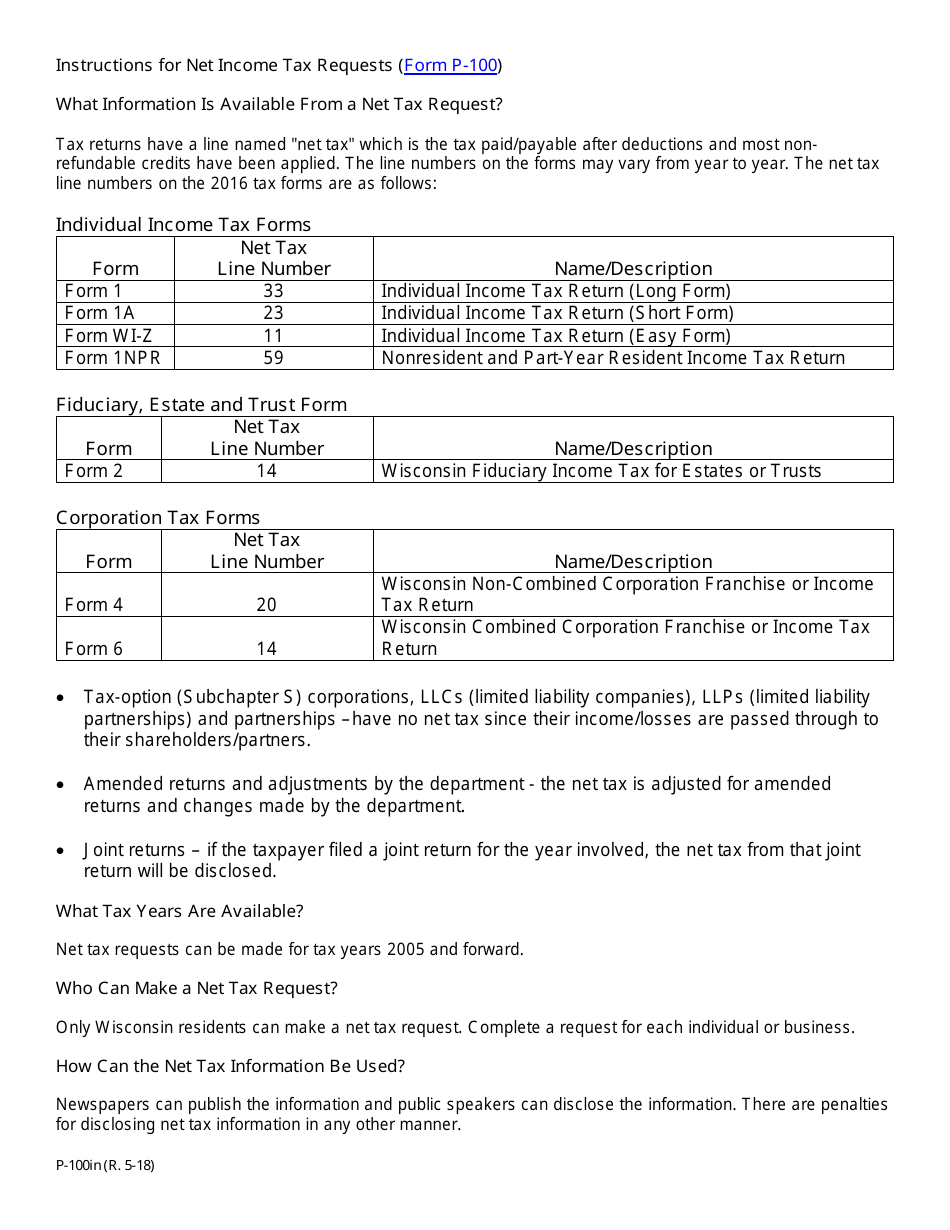

Instructions for Form P-1000 Application to Ascertain Wisconsin Net Income Tax Reported as Paid or Payable - Wisconsin

This document contains official instructions for Form P-1000 , Application to Ascertain Wisconsin Net Income Tax Reported as Paid or Payable - a form released and collected by the Wisconsin Department of Revenue.

FAQ

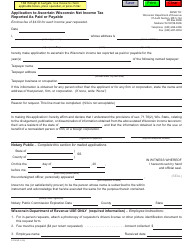

Q: What is Form P-1000?

A: Form P-1000 is an application to ascertain Wisconsin net income tax reported as paid or payable.

Q: Who needs to file Form P-1000?

A: Individuals or entities who want to determine the amount of Wisconsin net income tax reported as paid or payable.

Q: What is the purpose of Form P-1000?

A: The purpose of Form P-1000 is to calculate and certify the amount of Wisconsin net income tax that has been reported as paid or payable.

Q: When is Form P-1000 due?

A: Form P-1000 is due on or before the original due date of the Wisconsin net income tax return for the taxable year in question.

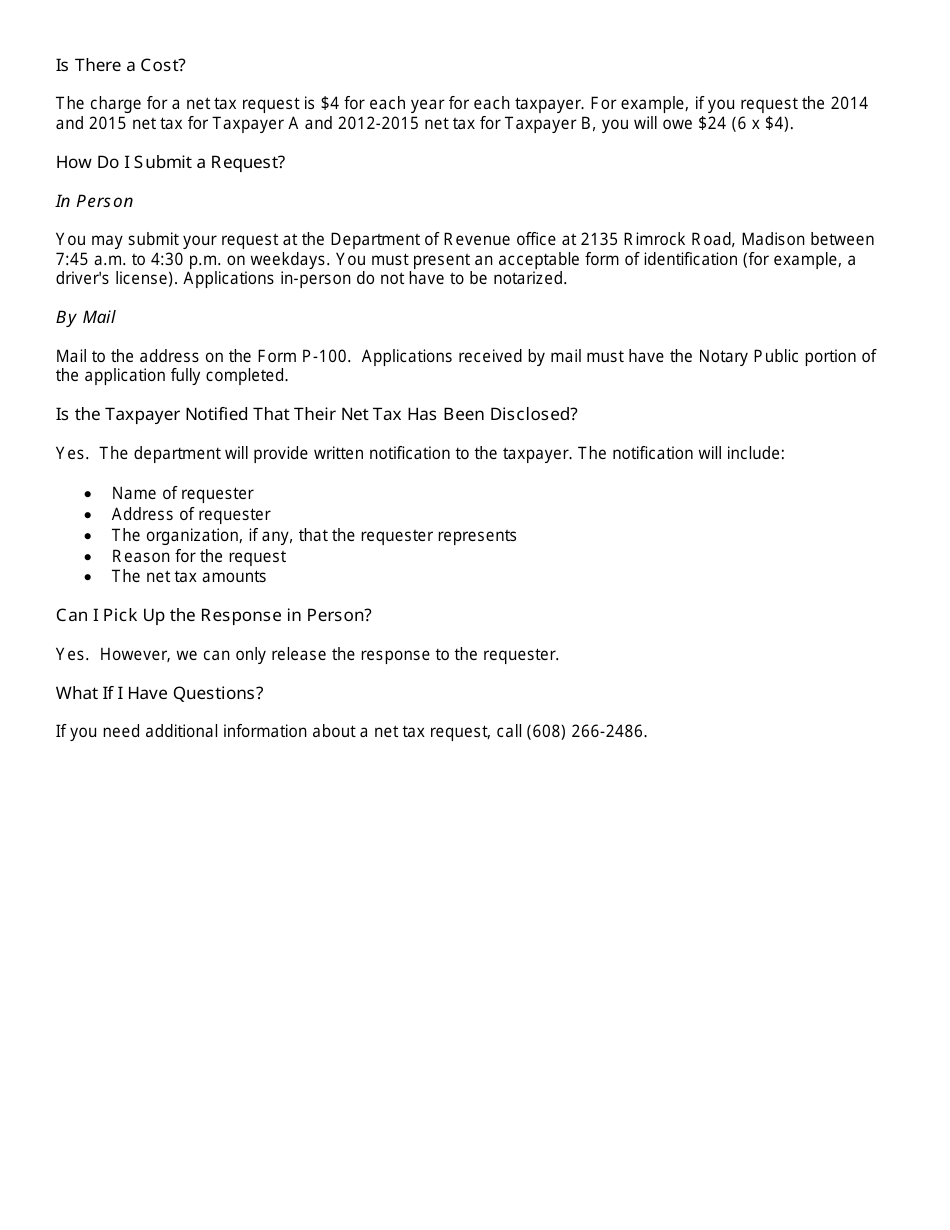

Q: Are there any fees associated with filing Form P-1000?

A: No, there are no fees associated with filing Form P-1000.

Q: Can I electronically file Form P-1000?

A: No, Form P-1000 can only be filed by mail or in person.

Q: What supporting documentation do I need to include with Form P-1000?

A: You must provide a copy of the federal income tax return for the taxable year in question and any other supporting documentation requested on the form.

Q: How long does it take to process Form P-1000?

A: The processing time for Form P-1000 can vary, but it usually takes several weeks.

Q: What happens after filing Form P-1000?

A: After filing Form P-1000, the Wisconsin Department of Revenue will review the application and determine the amount of Wisconsin net income tax reported as paid or payable.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.