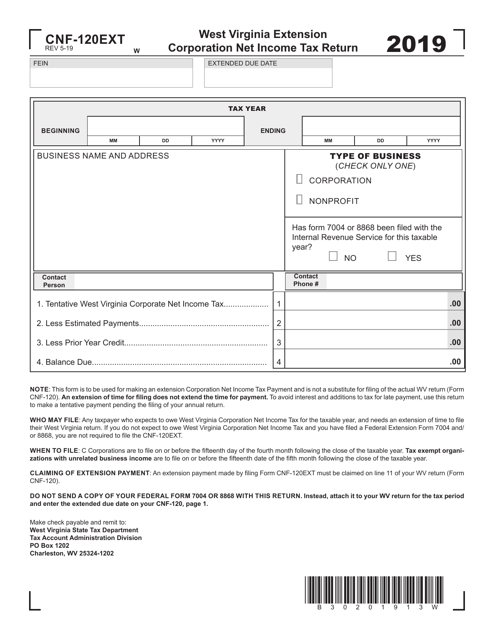

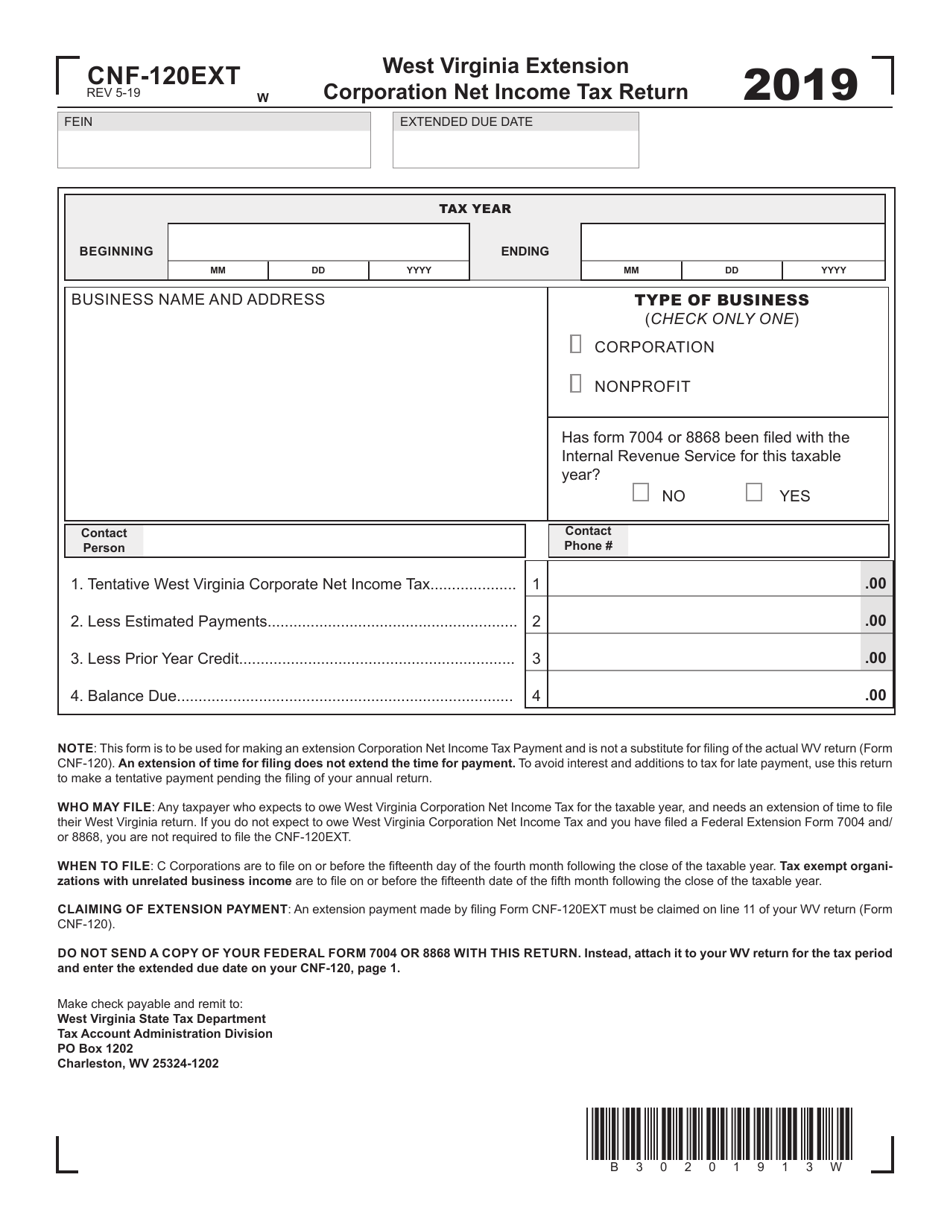

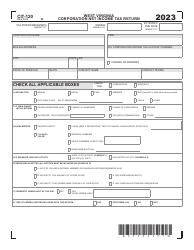

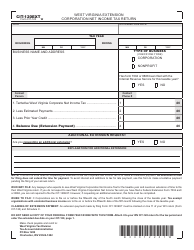

Form CNF-120EXT West Virginia Extension Corporation Net Income Tax Return - West Virginia

What Is Form CNF-120EXT?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CNF-120EXT form?

A: The CNF-120EXT is a tax form used to file a net income tax return for West Virginia Extension Corporations.

Q: Who needs to file a CNF-120EXT?

A: West Virginia Extension Corporations are required to file a CNF-120EXT form if they have net income during the tax year.

Q: What is a net income tax return?

A: A net income tax return is a form used to report the income and calculate the tax owed by a corporation.

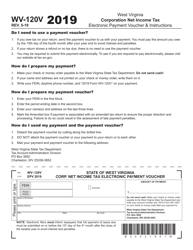

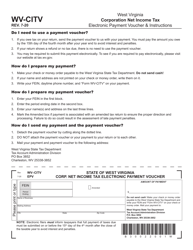

Q: What is the deadline for filing a CNF-120EXT?

A: The CNF-120EXT form must be filed on or before the 15th day of the 4th month following the close of the taxable year.

Q: Are there any penalties for late filing of the CNF-120EXT?

A: Yes, there are penalties for late filing of the CNF-120EXT form. It is important to file the form by the deadline to avoid these penalties.

Q: What should I do if I have questions about the CNF-120EXT form?

A: If you have any questions about the CNF-120EXT form, you should contact the West Virginia State Tax Department for assistance.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CNF-120EXT by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.