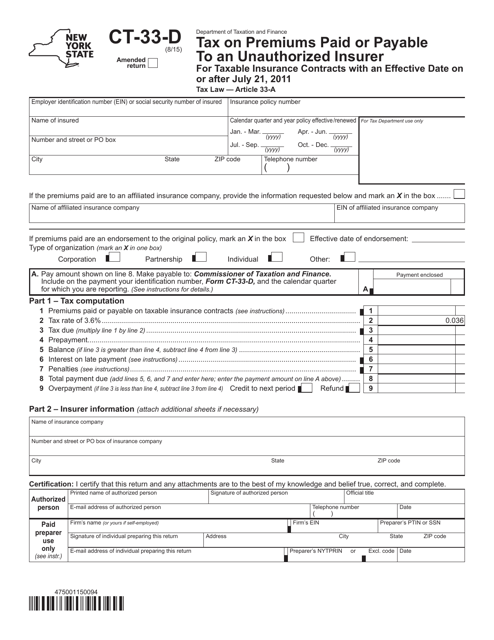

Form CT-33-D Tax on Premiums Paid or Payable to an Unauthorized Insurer - New York

What Is Form CT-33-D?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-33-D?

A: Form CT-33-D is a tax form in New York.

Q: Who needs to file Form CT-33-D?

A: This form needs to be filed by entities that pay or owe premiums to unauthorized insurers in New York.

Q: What is the purpose of Form CT-33-D?

A: The purpose of this form is to calculate and pay the tax on premiums that are paid or payable to unauthorized insurers.

Q: Are there any penalties for not filing Form CT-33-D?

A: Yes, there are penalties for failure to file or for filing a late or incomplete form.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-33-D by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.