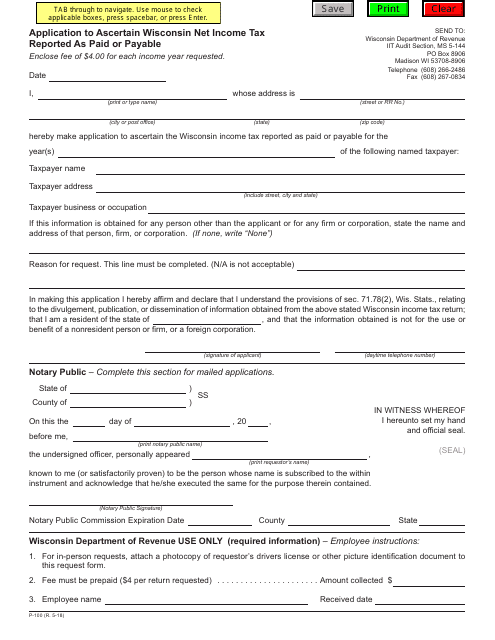

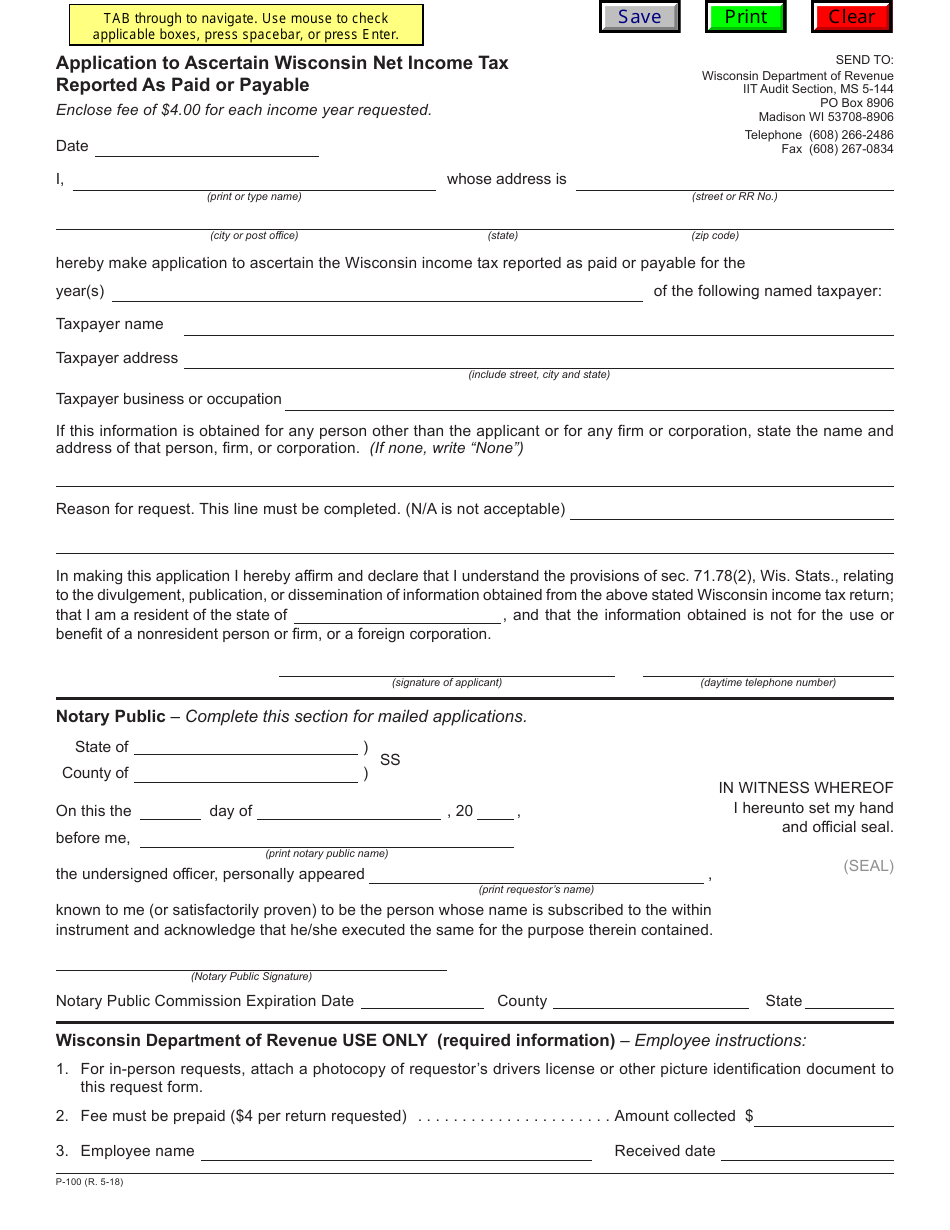

Form P-100 Application to Ascertain Wisconsin Net Income Tax Reported as Paid or Payable - Wisconsin

What Is Form P-100?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form P-100?

A: Form P-100 is an application to determine the Wisconsin net income tax reported as paid or payable.

Q: Who can use Form P-100?

A: Form P-100 can be used by individuals, corporations, and partnerships that need to ascertain their Wisconsin net income tax reported as paid or payable.

Q: What is the purpose of Form P-100?

A: The purpose of Form P-100 is to calculate and report the Wisconsin net income tax reported as paid or payable.

Q: What information is required for Form P-100?

A: Form P-100 requires detailed information about the taxpayer's income, deductions, and credits.

Q: When is the deadline for filing Form P-100?

A: The deadline for filing Form P-100 is generally April 15th, or the following business day if April 15th falls on a weekend or holiday.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form P-100 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.