Instructions for Form CT-33-D Tax on Premiums Paid or Payable to an Unauthorized Insurer for Taxable Insurance Contracts With an Effective Date on or After July 21, 2011 - New York

This document contains official instructions for Form CT-33-D , Tax on Premiums Paid or Payable to an Unauthorized Insurer for Taxable Effective Date on or After July 21, 2011 - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-33-D is available for download through this link.

FAQ

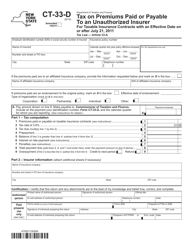

Q: What is Form CT-33-D?

A: Form CT-33-D is a tax form for reporting premiums paid or payable to an unauthorized insurer for taxable insurance contracts.

Q: When is Form CT-33-D used?

A: Form CT-33-D is used for insurance contracts with an effective date on or after July 21, 2011.

Q: What is the purpose of Form CT-33-D?

A: The purpose of Form CT-33-D is to calculate and report the tax on premiums paid or payable to an unauthorized insurer.

Q: Who needs to file Form CT-33-D?

A: Anyone who paid or is obligated to pay premiums to an unauthorized insurer for taxable insurance contracts needs to file Form CT-33-D.

Q: How often do I need to file Form CT-33-D?

A: Form CT-33-D must be filed annually by March 15th for the preceding calendar year.

Q: Are there any penalties for not filing Form CT-33-D?

A: Yes, there are penalties for failure to timely file Form CT-33-D or for filing an incomplete or inaccurate form. It is advised to file the form correctly and on time to avoid penalties.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.