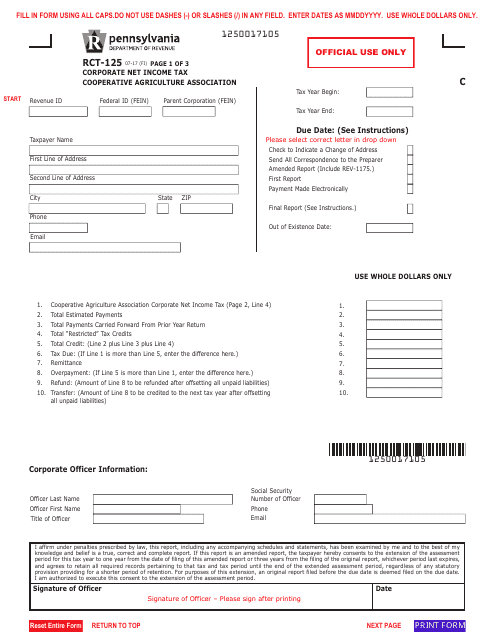

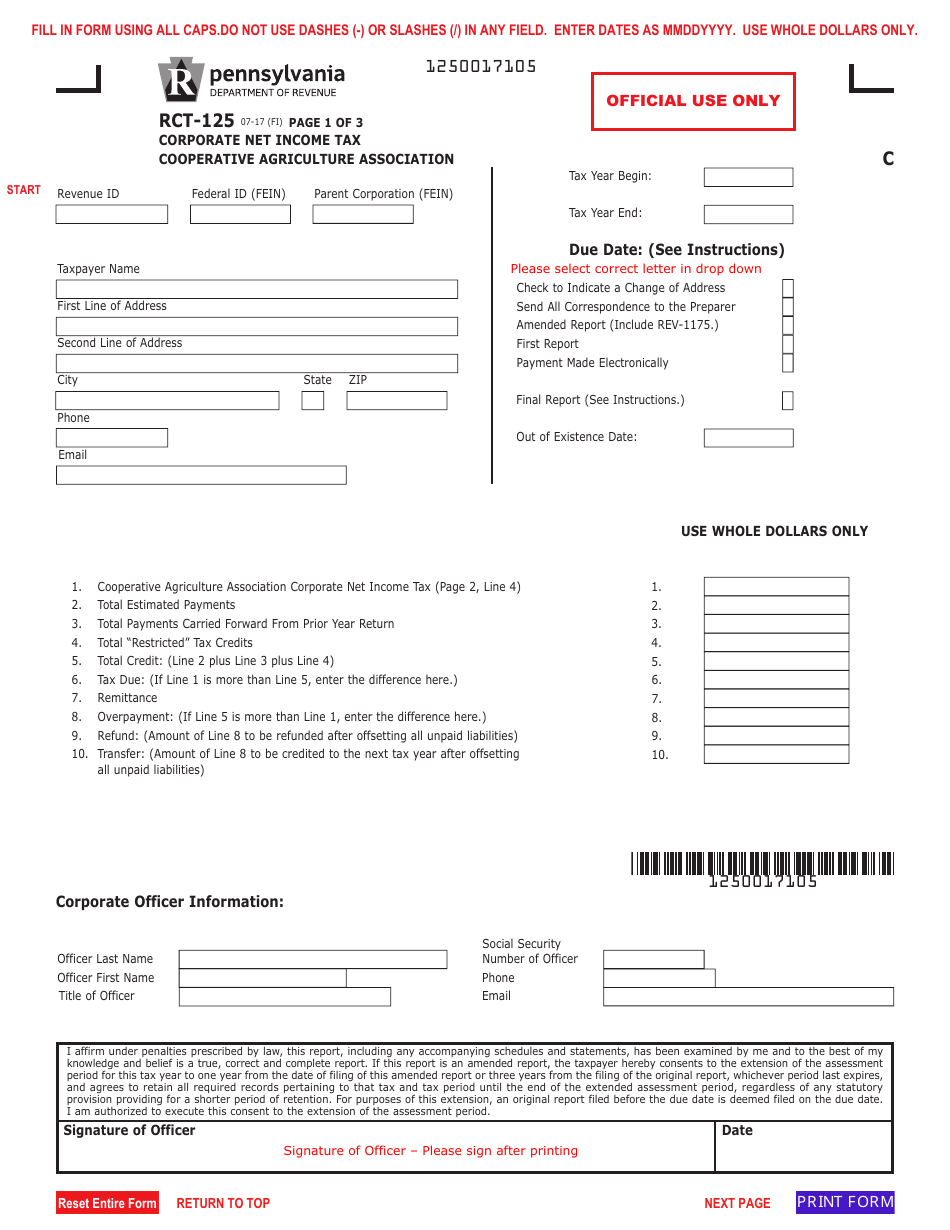

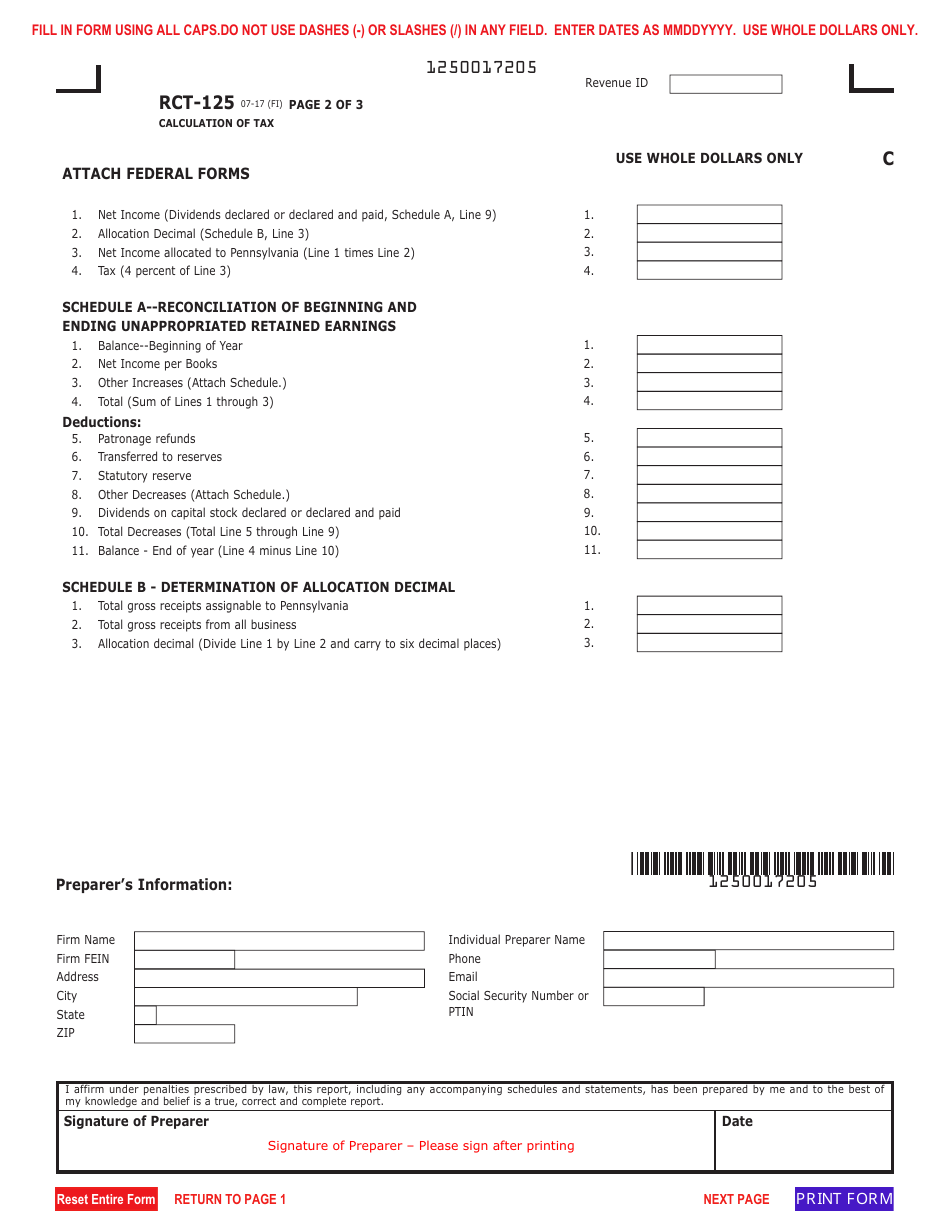

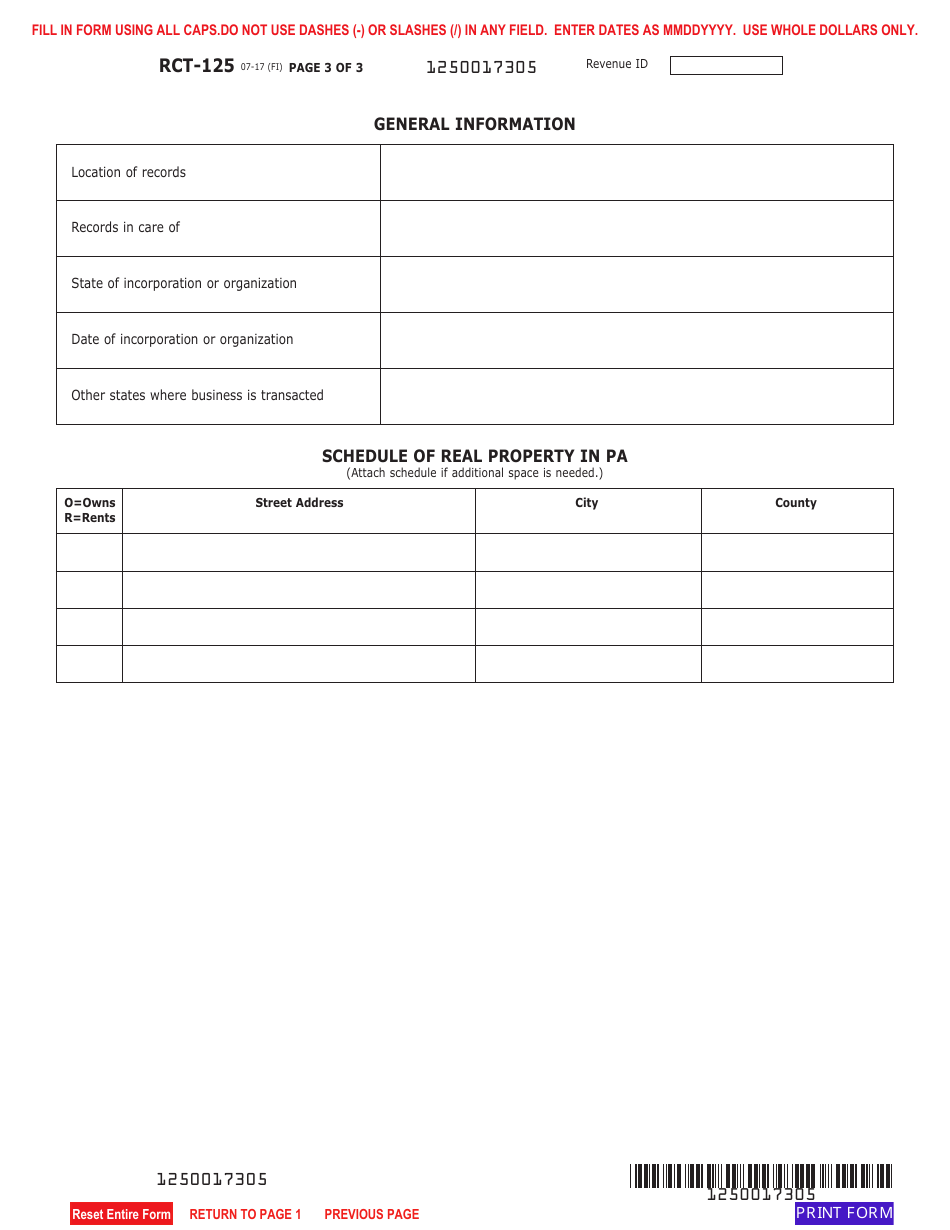

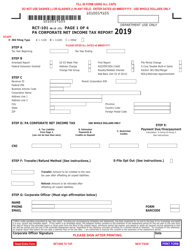

Form RCT-125 Corporate Net Income Tax Report - Cooperative Agriculture Association - Pennsylvania

What Is Form RCT-125?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RCT-125?

A: Form RCT-125 is the Corporate Net IncomeTax Report for Cooperative Agriculture Associations in Pennsylvania.

Q: What is the purpose of Form RCT-125?

A: The purpose of Form RCT-125 is to report the net income tax liability for Cooperative Agriculture Associations in Pennsylvania.

Q: Who needs to file Form RCT-125?

A: Cooperative Agriculture Associations in Pennsylvania need to file Form RCT-125.

Q: Are all Cooperative Agriculture Associations required to file Form RCT-125?

A: Yes, all Cooperative Agriculture Associations in Pennsylvania are required to file Form RCT-125.

Q: Does Form RCT-125 apply to other types of businesses or organizations?

A: No, Form RCT-125 specifically applies to Cooperative Agriculture Associations in Pennsylvania.

Form Details:

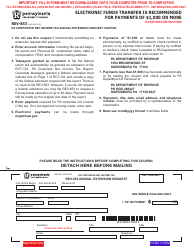

- Released on July 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-125 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.