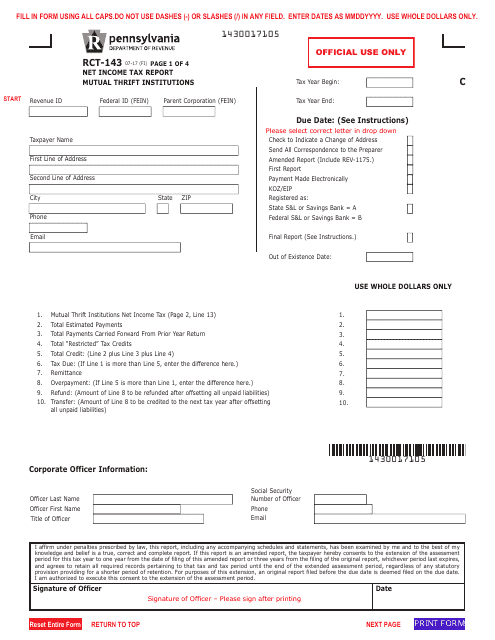

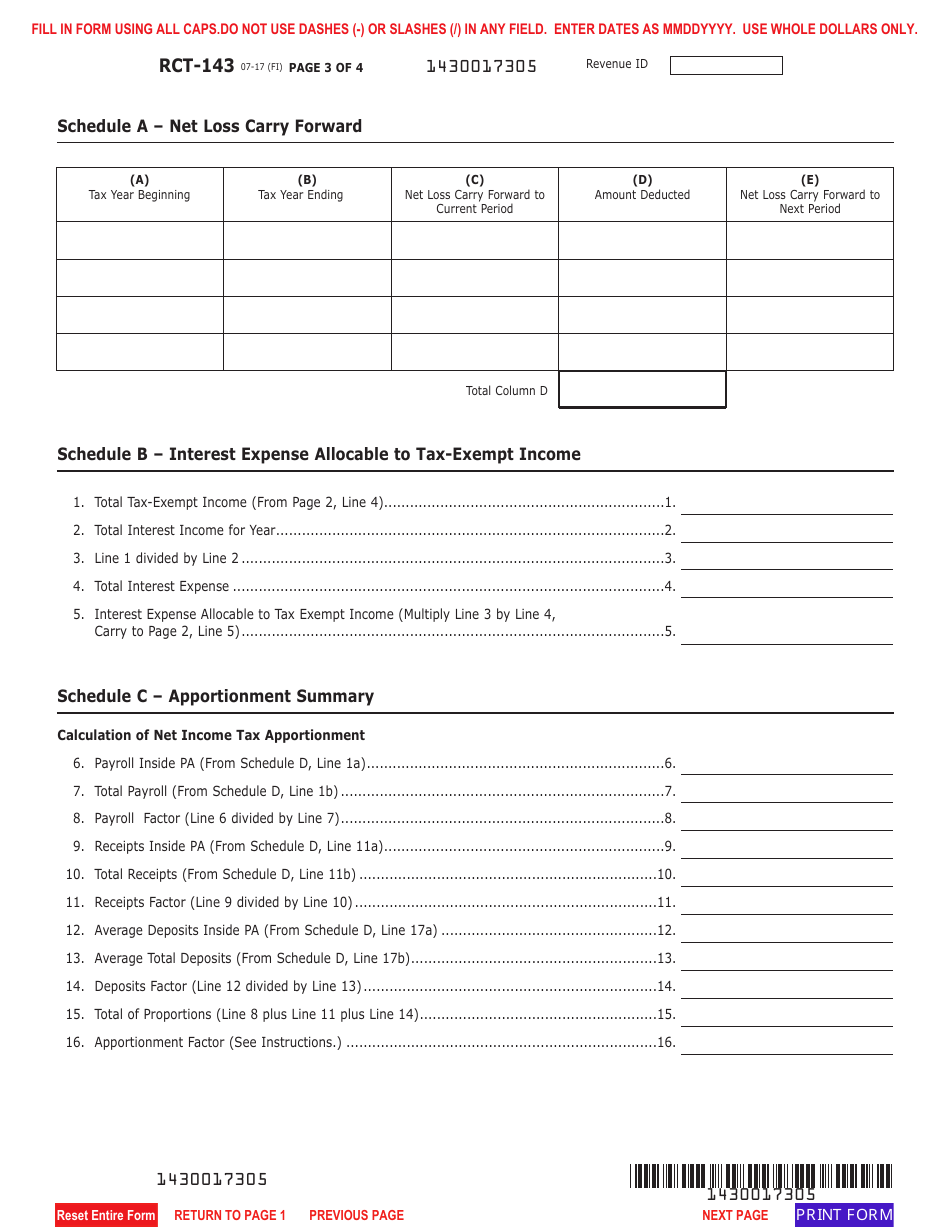

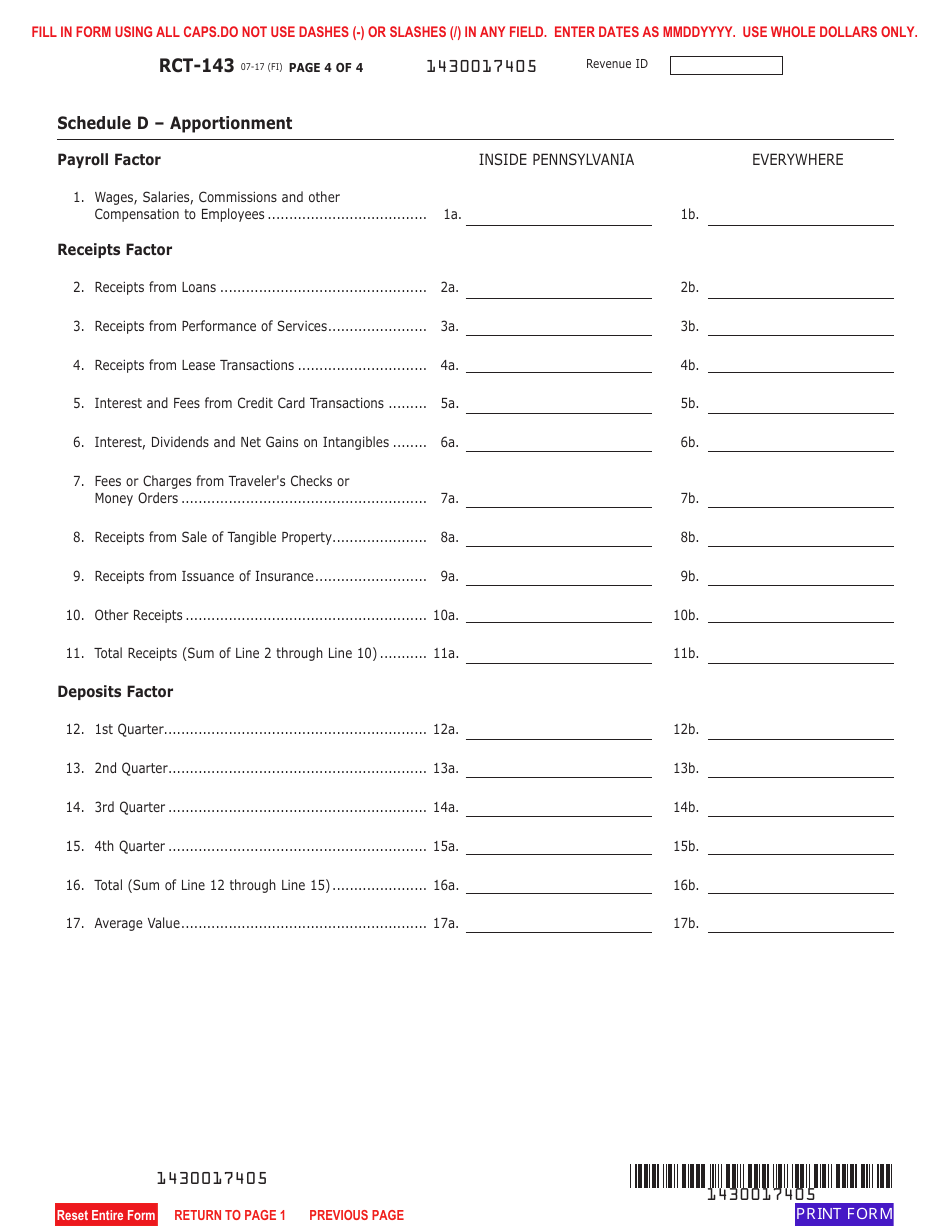

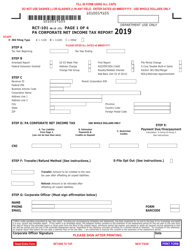

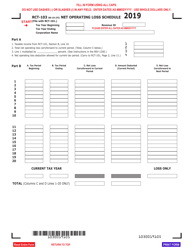

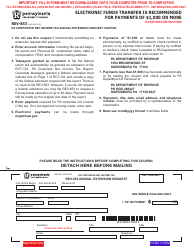

Form RCT-143 Net Income Tax Report - Mutual Thrift Institutions - Pennsylvania

What Is Form RCT-143?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RCT-143?

A: Form RCT-143 is the Net IncomeTax Report for Mutual Thrift Institutions in Pennsylvania.

Q: Who needs to file Form RCT-143?

A: Mutual thrift institutions in Pennsylvania need to file Form RCT-143.

Q: What is the purpose of Form RCT-143?

A: The purpose of Form RCT-143 is to report net income tax for mutual thrift institutions in Pennsylvania.

Q: How often should Form RCT-143 be filed?

A: Form RCT-143 should be filed annually.

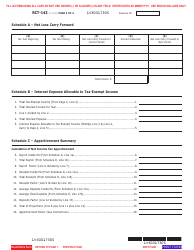

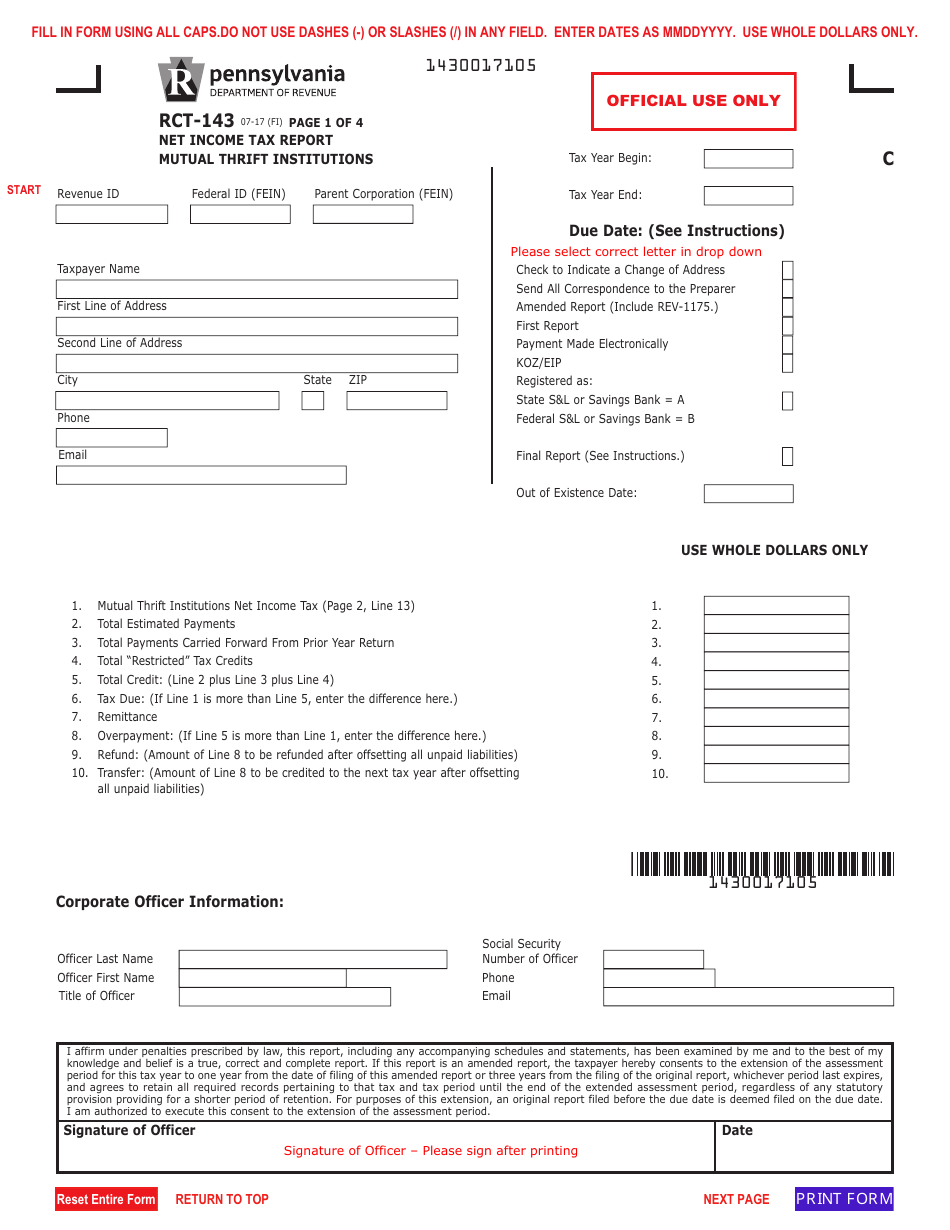

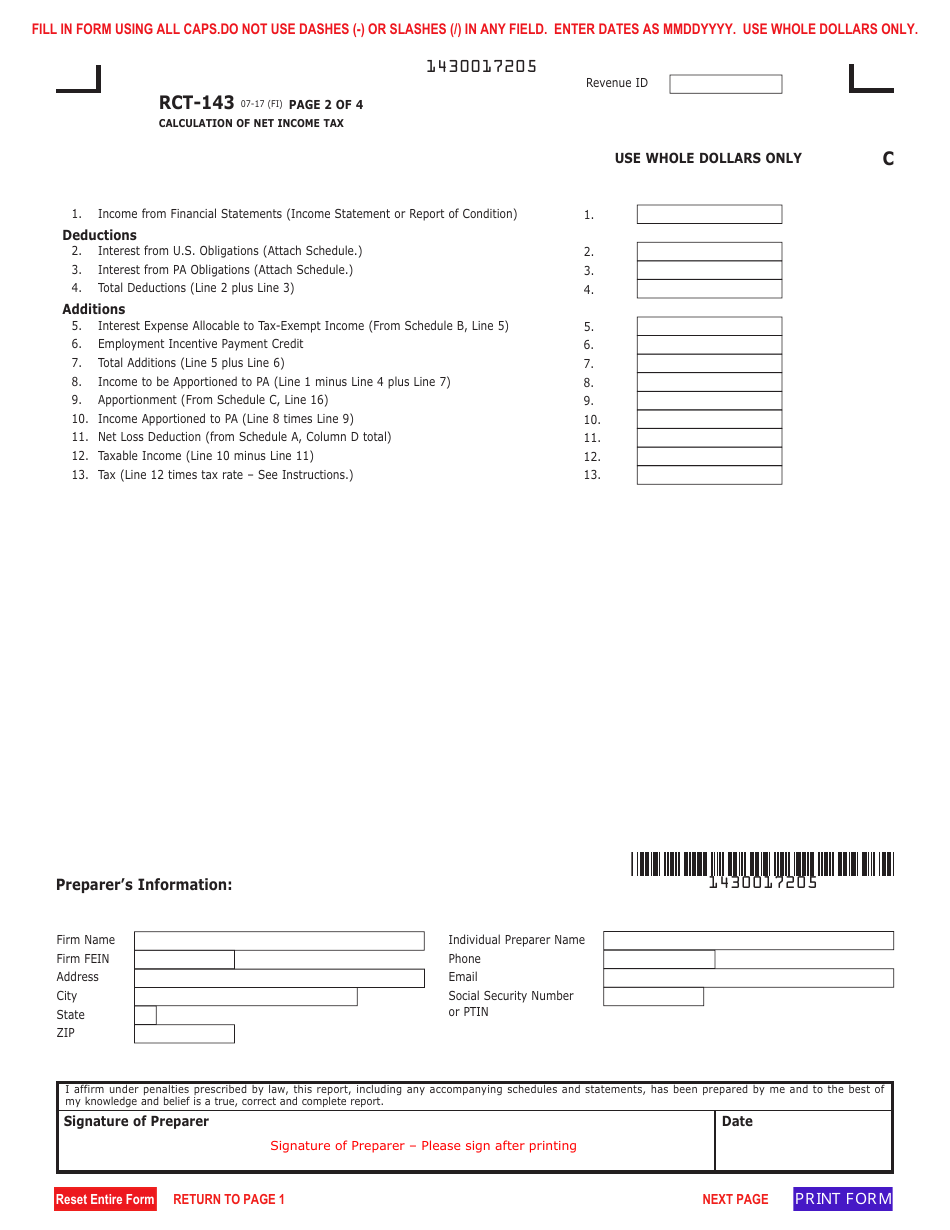

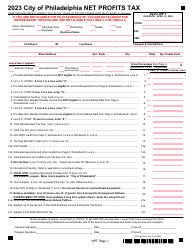

Q: What information is required to complete Form RCT-143?

A: The form requires information related to the mutual thrift institution's net income and deductions.

Q: Are there any deadlines for filing Form RCT-143?

A: Yes, the deadline for filing Form RCT-143 is typically on or before April 15th of each year.

Q: Are there any penalties for late filing of Form RCT-143?

A: Yes, there may be penalties for late filing of Form RCT-143. It is important to file the form on time to avoid penalties.

Q: Is there a fee for filing Form RCT-143?

A: No, there is no fee for filing Form RCT-143.

Q: Is there any assistance available for filling out Form RCT-143?

A: Yes, the Pennsylvania Department of Revenue provides assistance and resources to help with filling out Form RCT-143.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-143 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.