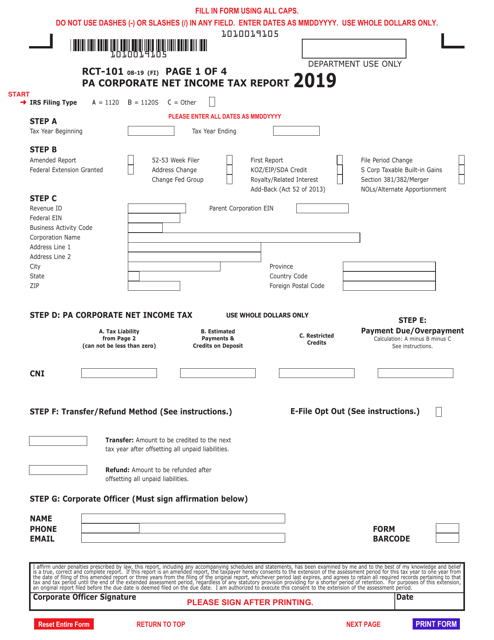

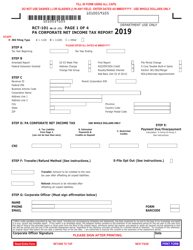

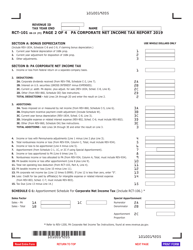

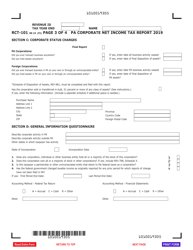

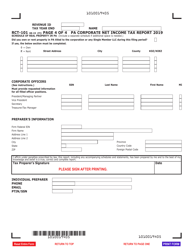

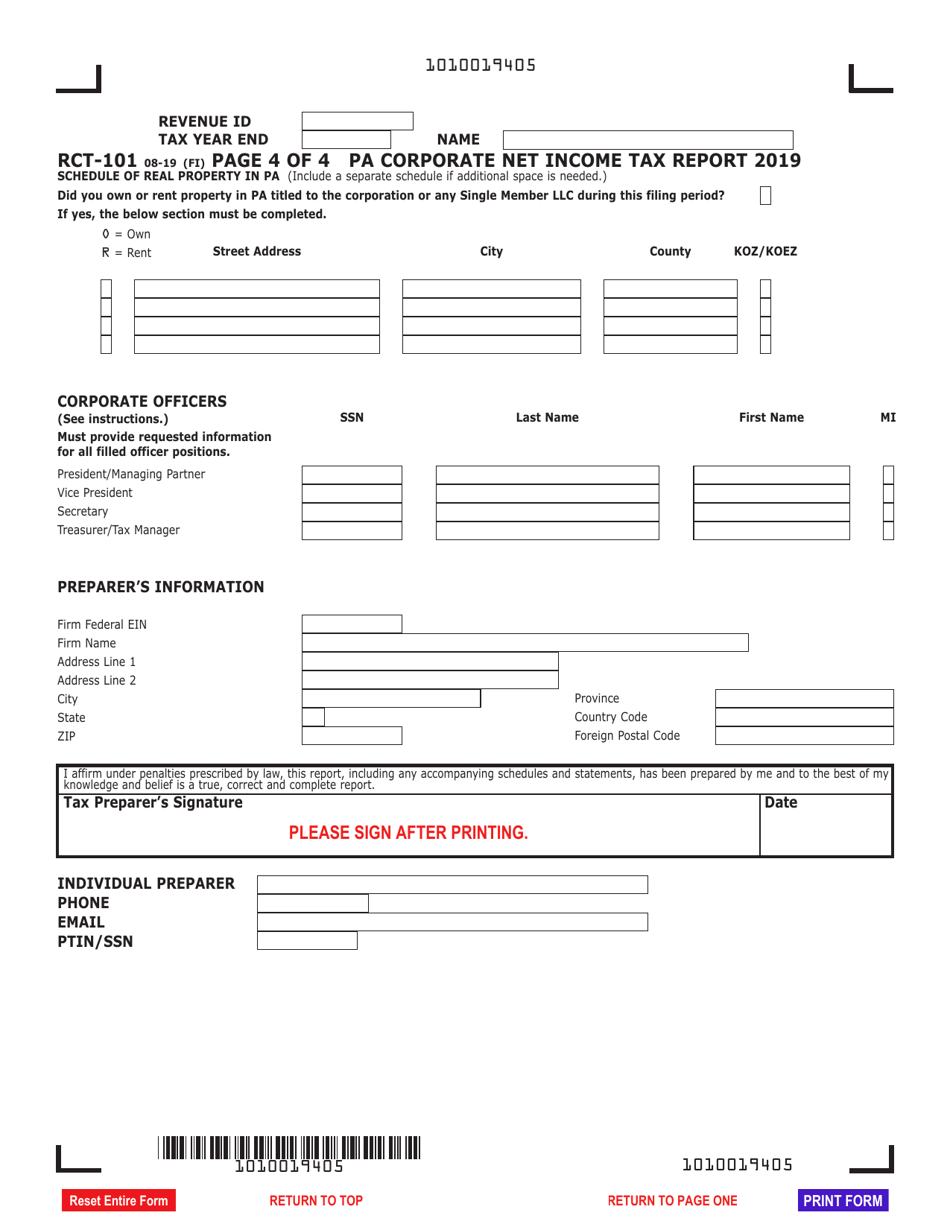

Form RCT-101 Pa Corporate Net Income Tax Report - Pennsylvania

What Is Form RCT-101?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form RCT-101?

A: Form RCT-101 is the Pennsylvania Corporate Net IncomeTax Report.

Q: Who needs to file Form RCT-101?

A: Any corporation that does business in Pennsylvania or has a filing requirement must file Form RCT-101.

Q: What is the purpose of Form RCT-101?

A: The purpose of Form RCT-101 is to report a corporation's net income earned in Pennsylvania and calculate the corresponding tax liability.

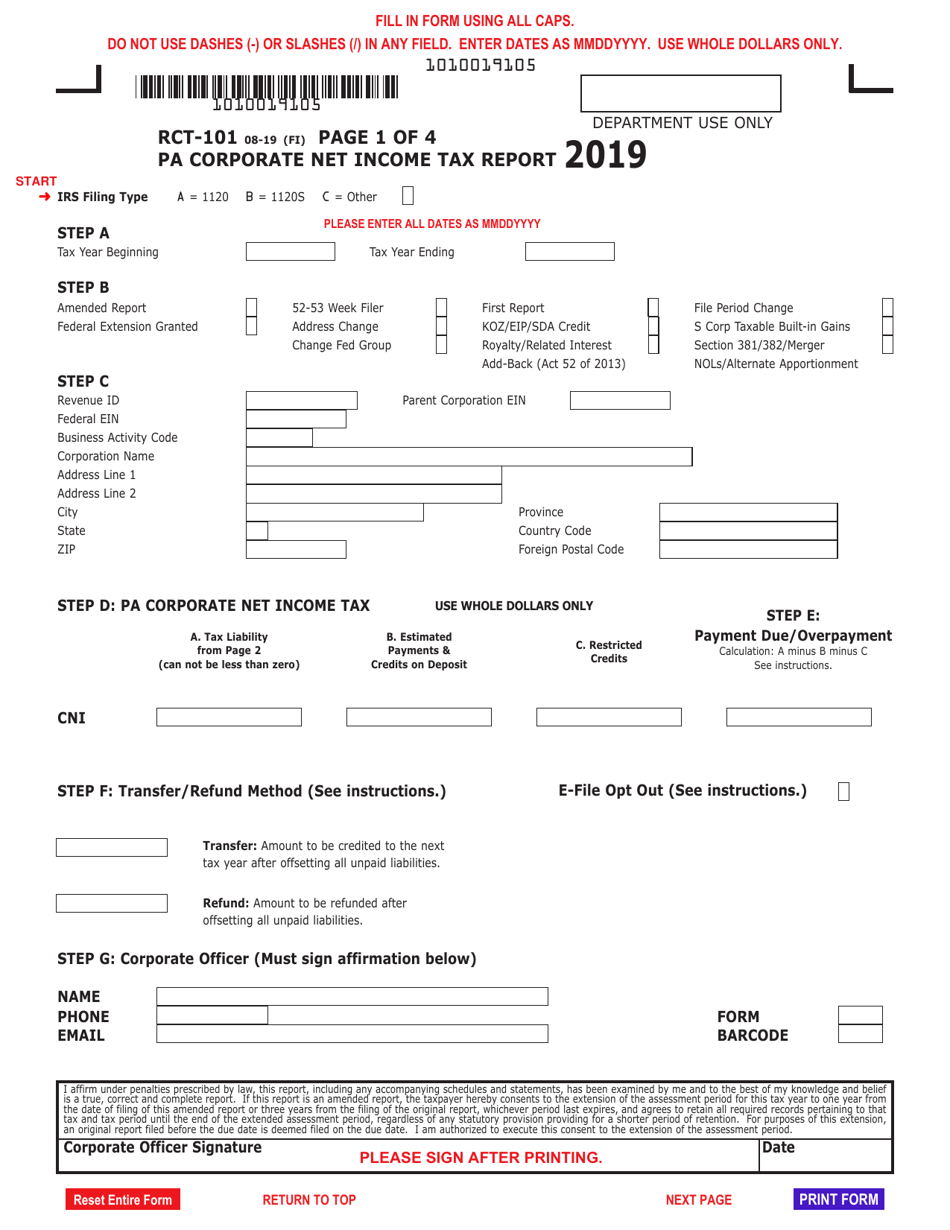

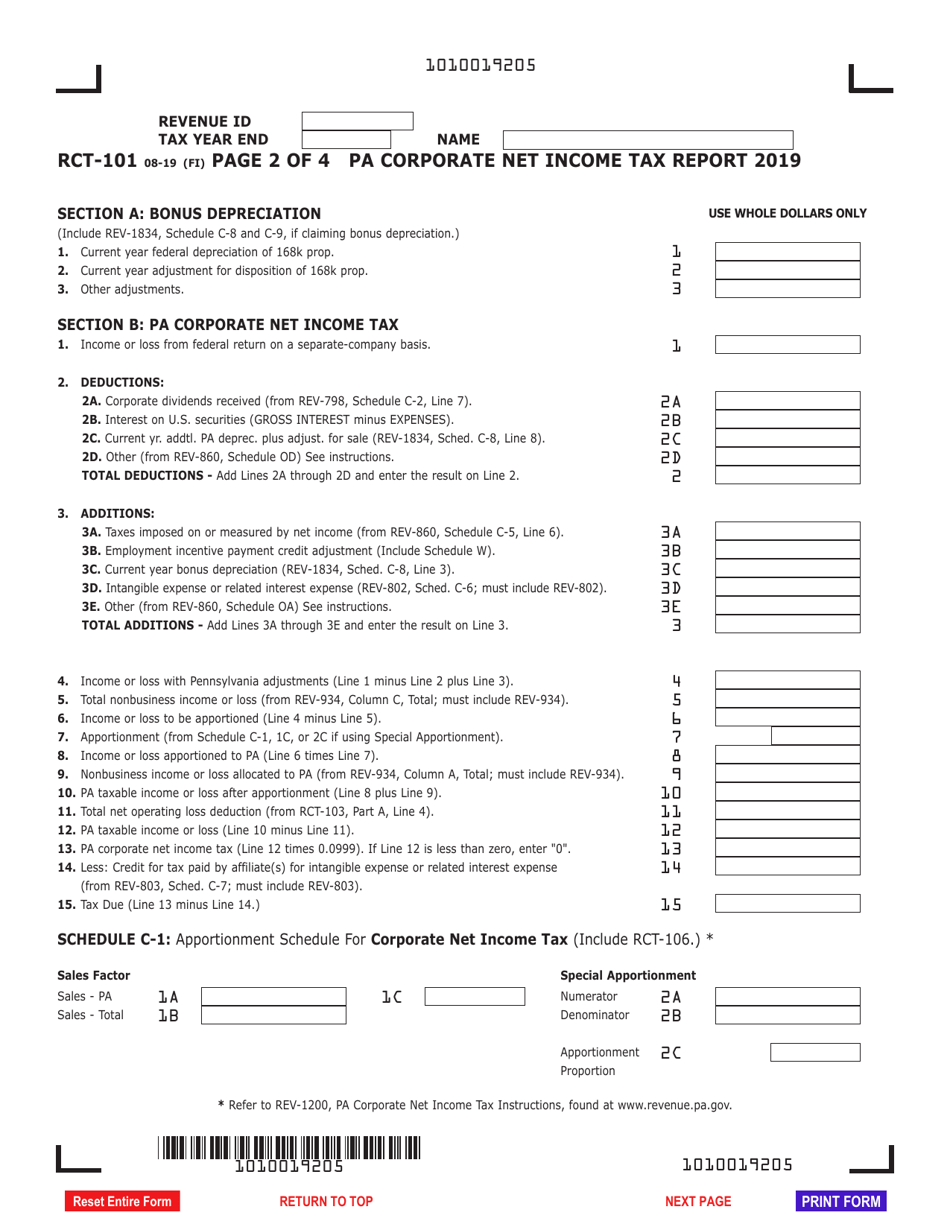

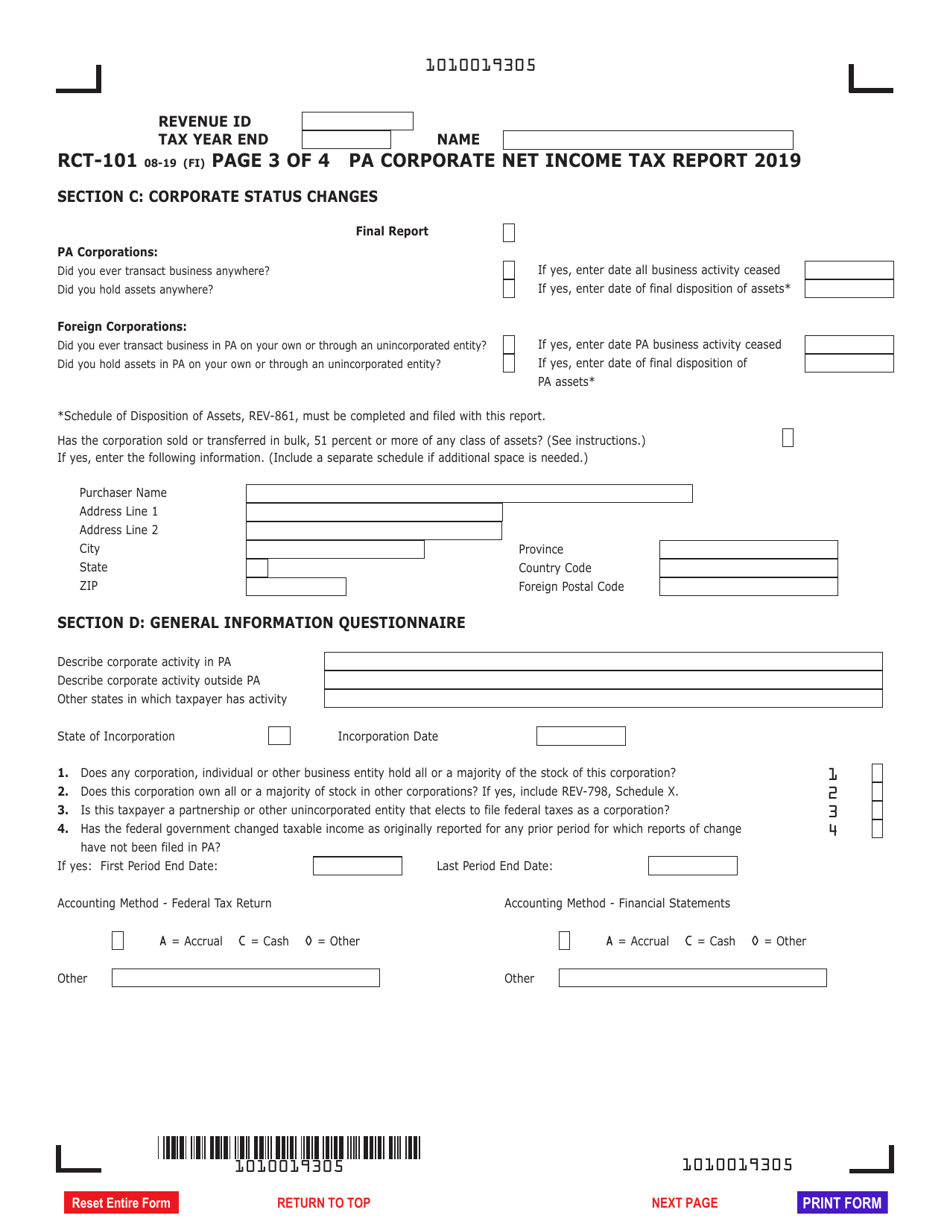

Q: What information is required on Form RCT-101?

A: Form RCT-101 requires information such as the corporation's name, address, federal employer identification number (FEIN), net income, deductions, credits, and tax due.

Q: When is Form RCT-101 due?

A: Form RCT-101 is generally due on or before the 15th day of the fourth month following the close of the corporation's tax year.

Q: Are there any penalties for late filing of Form RCT-101?

A: Yes, there are penalties for late filing of Form RCT-101. The penalties increase the longer the return is overdue.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-101 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.