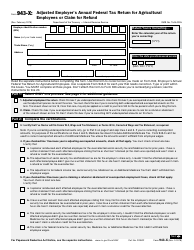

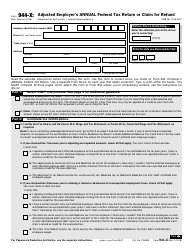

Instructions for IRS Form 945-X Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund

This document contains official instructions for IRS Form 945-X , Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is the purpose of IRS Form 945-X?

A: IRS Form 945-X is used to report adjusted annual return of withheld federal income tax or claim for refund.

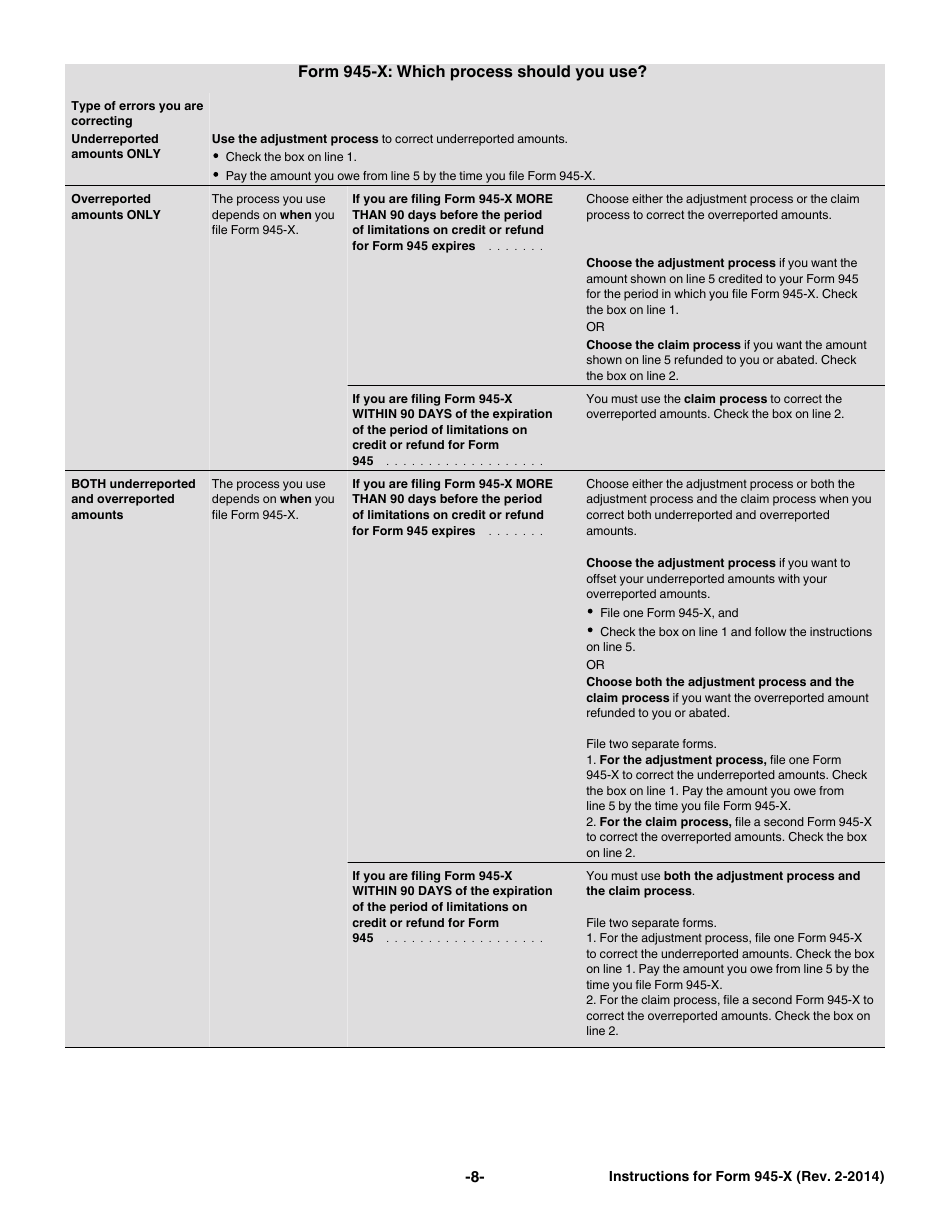

Q: When should I use IRS Form 945-X?

A: You should use Form 945-X if you need to correct errors or make adjustments to a previously filed Form 945.

Q: What information is required on IRS Form 945-X?

A: You will need to provide your employer identification number (EIN), tax period, the reason for filing Form 945-X, and the corrected amounts.

Q: Can I file IRS Form 945-X electronically?

A: No, you cannot file Form 945-X electronically. It must be filed by mail.

Q: What if I realize I made an error on my IRS Form 945-X after I submit it?

A: If you realize you made an error on your Form 945-X after submitting it, you will need to file another Form 945-X with the corrected information.

Q: How long does it take to process IRS Form 945-X?

A: The processing time for Form 945-X can vary, but it generally takes several weeks to receive a refund or notification of any adjustments.

Q: Are there any penalties for filing an incorrect Form 945-X?

A: Yes, there may be penalties for filing an incorrect Form 945-X, such as accuracy-related penalties or interest charges.

Instruction Details:

- This 8-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.