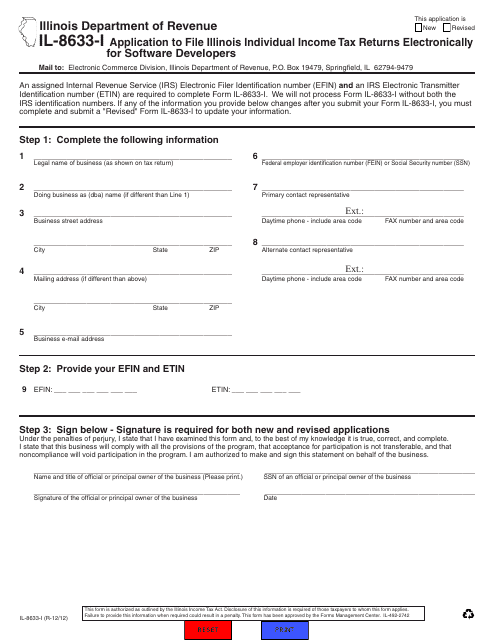

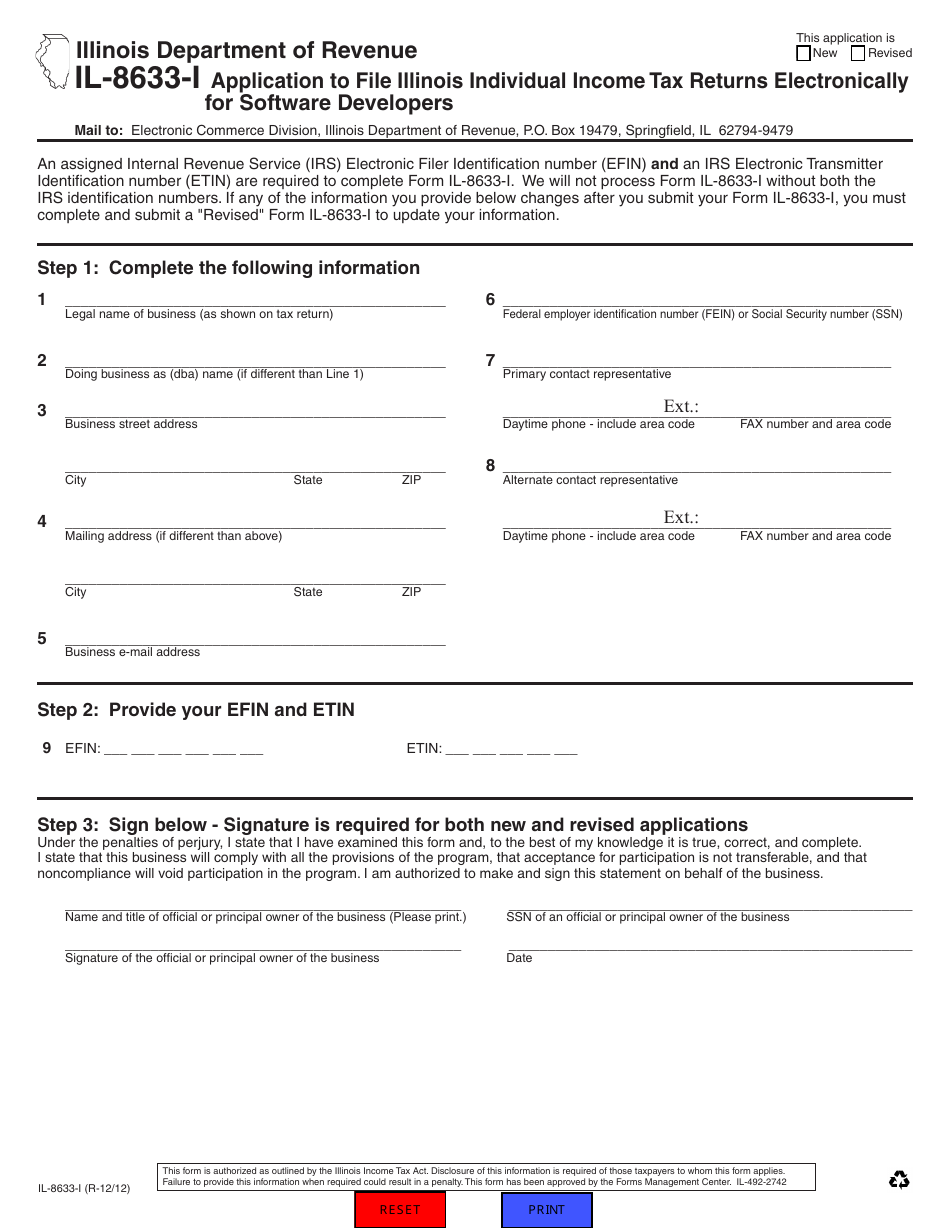

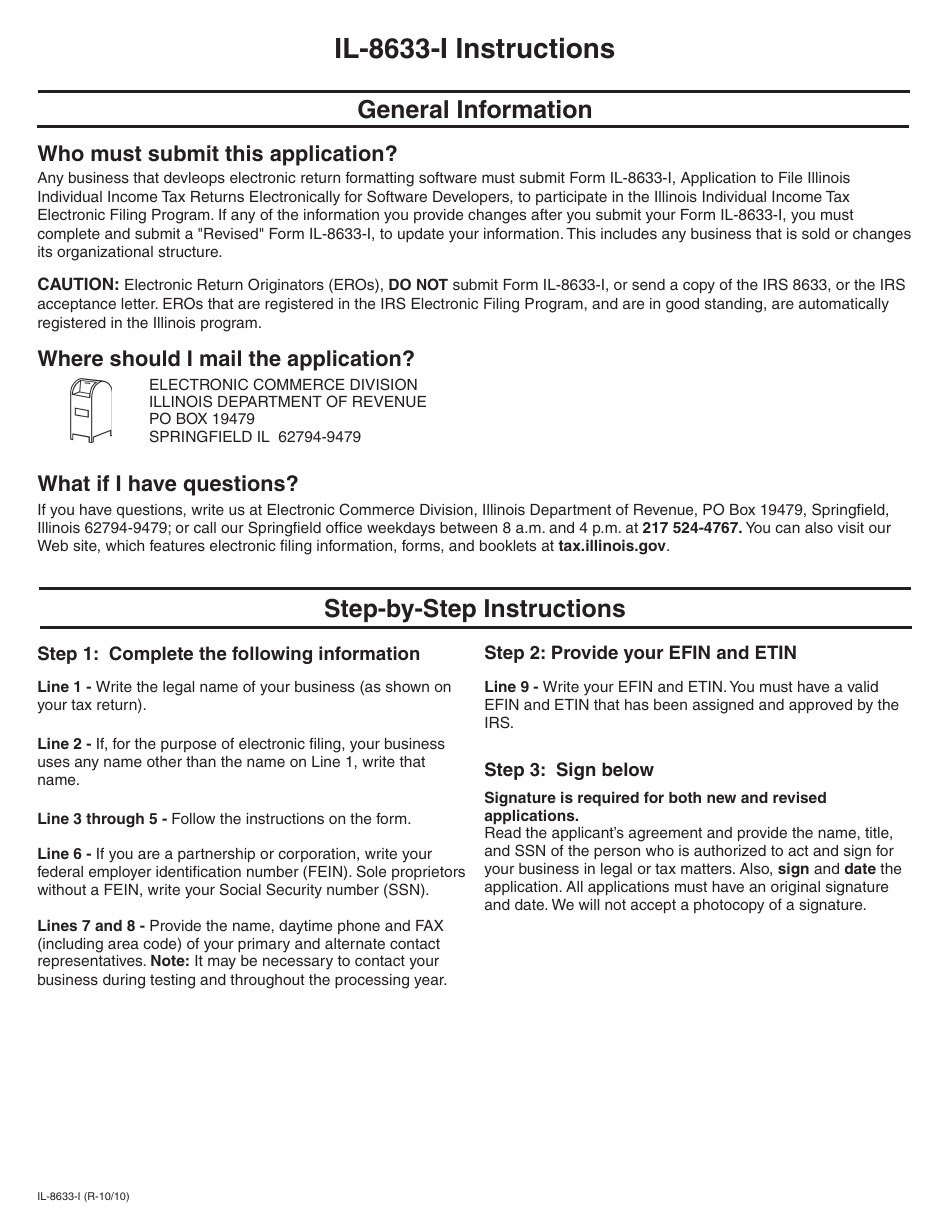

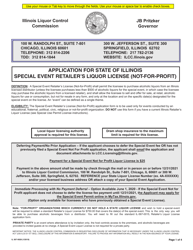

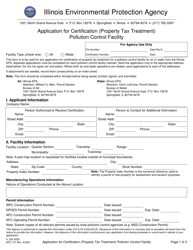

Form IL-8633-I Application to File Illinois Individual Income Tax Returns Electronically for Software Developers - Illinois

What Is Form IL-8633-I?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-8633-I?

A: Form IL-8633-I is an application to file Illinois individual income tax returns electronically for software developers.

Q: Who is eligible to use Form IL-8633-I?

A: Software developers who want to file Illinois individual income tax returns electronically are eligible to use Form IL-8633-I.

Q: Why would a software developer use Form IL-8633-I?

A: Software developers use Form IL-8633-I to electronically file Illinois individual income tax returns.

Q: Do I need to submit any additional documentation with Form IL-8633-I?

A: No, you do not need to submit any additional documentation with Form IL-8633-I.

Q: Can I electronically sign Form IL-8633-I?

A: Yes, you can electronically sign Form IL-8633-I.

Q: Are there any fees associated with filing electronically using Form IL-8633-I?

A: No, there are no fees associated with filing electronically using Form IL-8633-I.

Q: Can I e-file Illinois individual income tax returns for multiple taxpayers using Form IL-8633-I?

A: Yes, you can e-file Illinois individual income tax returns for multiple taxpayers using Form IL-8633-I.

Q: Is Form IL-8633-I only for Illinois residents?

A: No, Form IL-8633-I can be used by software developers filing Illinois individual income tax returns, regardless of residency.

Form Details:

- Released on December 1, 2012;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-8633-I by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.